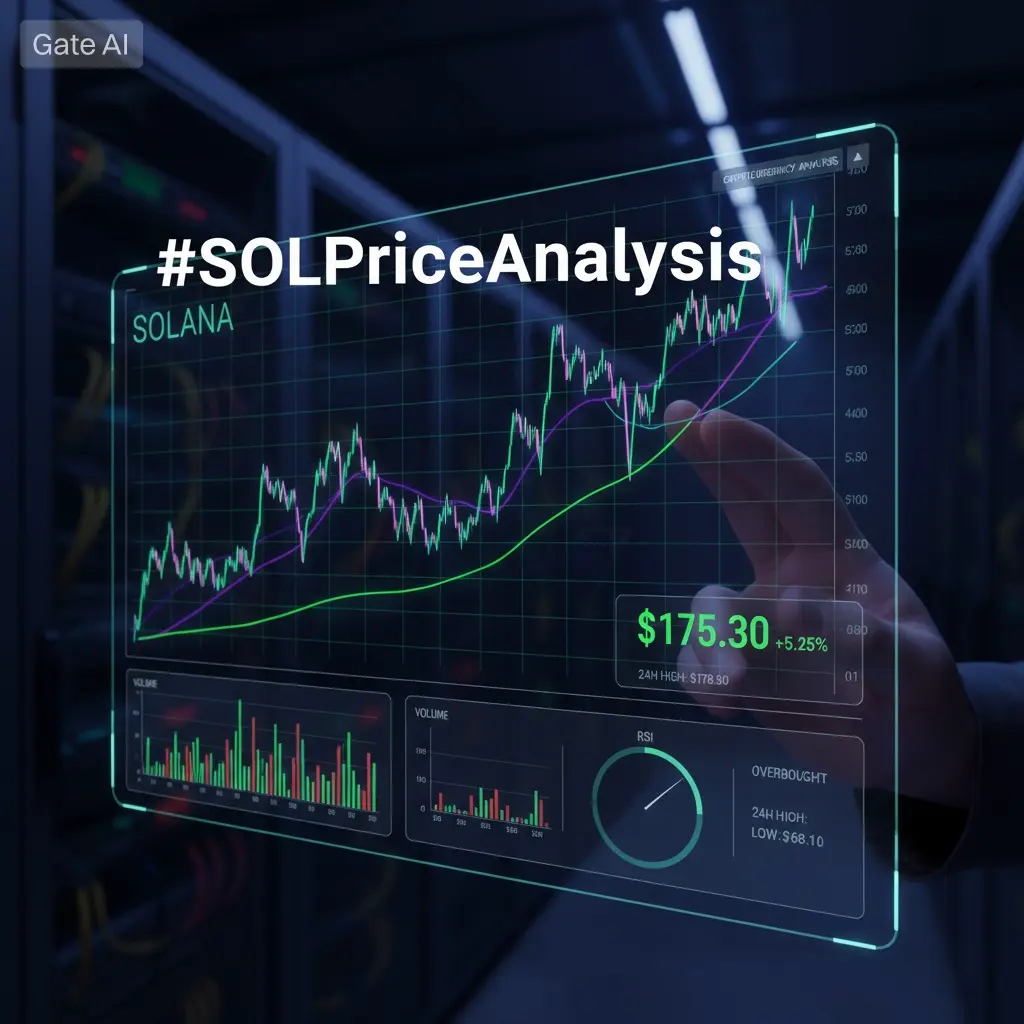

#SOLPriceAnalysis

Solana (SOL) is currently trading at $145.53 USDT, showing moderate upward movement over the past 24 hours. The price is testing key resistance zones, making this a crucial period for both traders and investors.

Heading into 2026, Solana remains a high-performance blockchain leader, driven by institutional interest (spot ETFs, large wallet accumulations) and ongoing network upgrades that enhance scalability, throughput, and developer adoption. Despite these strengths, the market is volatile, and technical indicators suggest that short-term corrections are possible.

📈 Key Data Points

Current Price: $145.53 USDT (SOL/USDT)

24h Range: $137.85 - $148.71 USDT

Change (24h): +4.49%

Technical Resistance: $145.00 - $147.39 USDT

RSI (Daily): 100 — heavily overbought, hinting at possible near-term pullback

Volume Trends: Price rising while volume contracts — potential buying exhaustion

Institutional Flows: Large holders, ETFs, and accumulation deals (e.g., Upexi $36M, +12% SOL)

2026 Analyst Forecasts:

Base Case: $164 - $193 USDT

Bullish: $260 - $320 USDT

Extreme Bull: ~$300 USDT

💡 Professional Analysis

Solana continues to strengthen as a go-to network for scalable DeFi, consumer apps, and high-speed settlements.

Technical Setup: Consolidation near resistance with falling volume suggests short-term exhaustion.

Fundamentals: Ongoing upgrades, ETF flows, and ecosystem growth provide medium-term stability.

Macro Factors: Fed rates, global risk appetite, and equity market performance will influence short-term price moves.

Competitive Landscape: SOL must maintain real network demand to sustain growth beyond speculation.

📊 Volume & Market Behavior

Volume Spikes: Major support/resistance zones see high trading activity.

Liquidity Clusters: Strong liquidity around $137 - $142 USDT; breaking this could trigger larger declines.

Sentiment: Institutional interest and social buzz remain moderately bullish, but can shift quickly.

🚀 Bullish & Bearish Scenarios

Bullish:

Close above $147–$150 USDT, target $160–$165, medium-term $175–$193, extreme $260–$320.

Catalysts: network upgrades, ETF flows, ecosystem adoption, favorable macro environment.

Bearish:

Fail to hold $137–$142, possible decline to $120–$125, deeper risk toward $100 USDT.

Triggers: technical weakness, macro downturns, liquidity withdrawal, competitive pressures.

🎯 Trading Strategy & Trader Mindset

Traders in SOL should align strategy with risk tolerance and timeframe. Here’s a practical approach:

1️⃣ Short-Term Traders (Day/Intraday)

Watch key resistance $145–$147; a rejection may cause a quick pullback to $137–$142.

Use tight stop-losses near support zones.

Trade breakouts only with strong volume confirmation.

Consider scalping small positions rather than all-in trades.

2️⃣ Swing Traders (Multi-Day / Weeks)

Buy near $137–$142 support zones.

Set profit targets at $148–$150 for short-term gains.

Monitor macro events (ETF flows, rate news) as they often trigger sharp swings.

Keep part of the position for medium-term upside if SOL breaks $150+.

3️⃣ Long-Term Investors

Accumulate in phases, especially near support zones.

Monitor network growth, adoption, and ecosystem expansion.

Use corrections to build positions gradually, avoid chasing highs.

Focus on fundamentals rather than short-term hype.

Trader Psychology — What Experienced Traders Are Thinking

Many are cautiously optimistic due to overbought signals.

Some are taking partial profits near resistance.

Others are positioning for dips with layered buys at support zones.

The consensus: balance patience with readiness for fast moves, given SOL’s volatility.

⚠️ Risk Advisory

Crypto markets remain highly volatile. SOL’s current price action shows:

Potential short-term downside following overbought momentum

Exposure to macro uncertainties (interest rates, regulations)

Competitive blockchain developments

Always:

Trade within risk limits

Plan entries and exits

Verify all data before making decisions

📌 Summary & Takeaways

Solana remains a prominent blockchain with strong fundamentals and high adoption potential. Short-term volatility exists, but institutional flows, network upgrades, and ecosystem growth provide medium-to-long-term bullish outlook.

Key Price Levels to Watch (2026):

Support: $137–$142 USDT

Resistance: $148–$150 USDT

Bullish Medium-Term: $164–$193 USDT

Extreme Bull: $260–$320 USDT

Trading Approach:

Short-term: monitor resistance, trade with volume confirmation

Swing: accumulate near support, take partial profits near resistance

Long-term: build positions gradually, focus on network fundamentals

SOL offers opportunities for all types of traders and investors — but careful planning, risk management, and awareness of both technical and fundamental factors are critical.

#SOLAnalysis #SolanaPrice #CryptoTrading

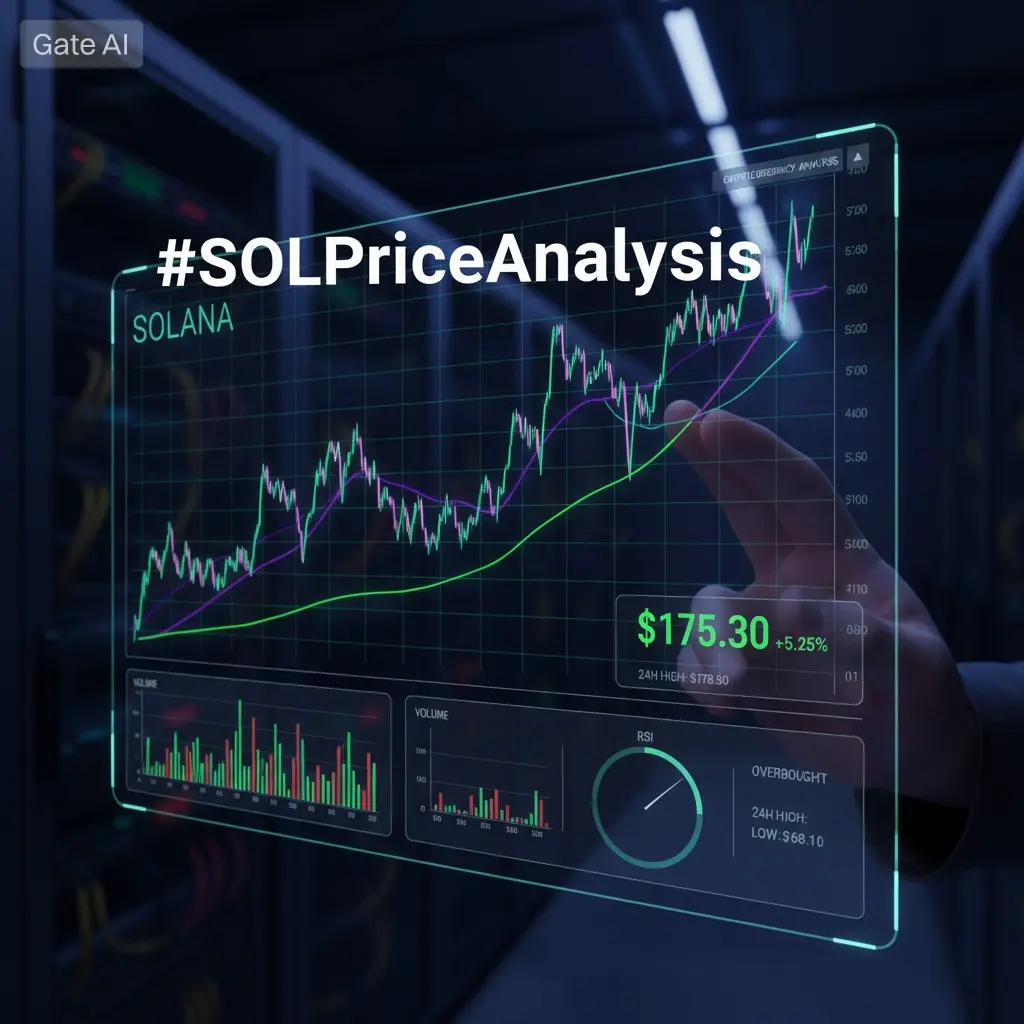

Solana (SOL) is currently trading at $145.53 USDT, showing moderate upward movement over the past 24 hours. The price is testing key resistance zones, making this a crucial period for both traders and investors.

Heading into 2026, Solana remains a high-performance blockchain leader, driven by institutional interest (spot ETFs, large wallet accumulations) and ongoing network upgrades that enhance scalability, throughput, and developer adoption. Despite these strengths, the market is volatile, and technical indicators suggest that short-term corrections are possible.

📈 Key Data Points

Current Price: $145.53 USDT (SOL/USDT)

24h Range: $137.85 - $148.71 USDT

Change (24h): +4.49%

Technical Resistance: $145.00 - $147.39 USDT

RSI (Daily): 100 — heavily overbought, hinting at possible near-term pullback

Volume Trends: Price rising while volume contracts — potential buying exhaustion

Institutional Flows: Large holders, ETFs, and accumulation deals (e.g., Upexi $36M, +12% SOL)

2026 Analyst Forecasts:

Base Case: $164 - $193 USDT

Bullish: $260 - $320 USDT

Extreme Bull: ~$300 USDT

💡 Professional Analysis

Solana continues to strengthen as a go-to network for scalable DeFi, consumer apps, and high-speed settlements.

Technical Setup: Consolidation near resistance with falling volume suggests short-term exhaustion.

Fundamentals: Ongoing upgrades, ETF flows, and ecosystem growth provide medium-term stability.

Macro Factors: Fed rates, global risk appetite, and equity market performance will influence short-term price moves.

Competitive Landscape: SOL must maintain real network demand to sustain growth beyond speculation.

📊 Volume & Market Behavior

Volume Spikes: Major support/resistance zones see high trading activity.

Liquidity Clusters: Strong liquidity around $137 - $142 USDT; breaking this could trigger larger declines.

Sentiment: Institutional interest and social buzz remain moderately bullish, but can shift quickly.

🚀 Bullish & Bearish Scenarios

Bullish:

Close above $147–$150 USDT, target $160–$165, medium-term $175–$193, extreme $260–$320.

Catalysts: network upgrades, ETF flows, ecosystem adoption, favorable macro environment.

Bearish:

Fail to hold $137–$142, possible decline to $120–$125, deeper risk toward $100 USDT.

Triggers: technical weakness, macro downturns, liquidity withdrawal, competitive pressures.

🎯 Trading Strategy & Trader Mindset

Traders in SOL should align strategy with risk tolerance and timeframe. Here’s a practical approach:

1️⃣ Short-Term Traders (Day/Intraday)

Watch key resistance $145–$147; a rejection may cause a quick pullback to $137–$142.

Use tight stop-losses near support zones.

Trade breakouts only with strong volume confirmation.

Consider scalping small positions rather than all-in trades.

2️⃣ Swing Traders (Multi-Day / Weeks)

Buy near $137–$142 support zones.

Set profit targets at $148–$150 for short-term gains.

Monitor macro events (ETF flows, rate news) as they often trigger sharp swings.

Keep part of the position for medium-term upside if SOL breaks $150+.

3️⃣ Long-Term Investors

Accumulate in phases, especially near support zones.

Monitor network growth, adoption, and ecosystem expansion.

Use corrections to build positions gradually, avoid chasing highs.

Focus on fundamentals rather than short-term hype.

Trader Psychology — What Experienced Traders Are Thinking

Many are cautiously optimistic due to overbought signals.

Some are taking partial profits near resistance.

Others are positioning for dips with layered buys at support zones.

The consensus: balance patience with readiness for fast moves, given SOL’s volatility.

⚠️ Risk Advisory

Crypto markets remain highly volatile. SOL’s current price action shows:

Potential short-term downside following overbought momentum

Exposure to macro uncertainties (interest rates, regulations)

Competitive blockchain developments

Always:

Trade within risk limits

Plan entries and exits

Verify all data before making decisions

📌 Summary & Takeaways

Solana remains a prominent blockchain with strong fundamentals and high adoption potential. Short-term volatility exists, but institutional flows, network upgrades, and ecosystem growth provide medium-to-long-term bullish outlook.

Key Price Levels to Watch (2026):

Support: $137–$142 USDT

Resistance: $148–$150 USDT

Bullish Medium-Term: $164–$193 USDT

Extreme Bull: $260–$320 USDT

Trading Approach:

Short-term: monitor resistance, trade with volume confirmation

Swing: accumulate near support, take partial profits near resistance

Long-term: build positions gradually, focus on network fundamentals

SOL offers opportunities for all types of traders and investors — but careful planning, risk management, and awareness of both technical and fundamental factors are critical.

#SOLAnalysis #SolanaPrice #CryptoTrading