# SOLPriceAnalysis

35.4K

SOL has rebounded strongly, gaining over 5% in a day as market sentiment improves. Whether capital continues to flow in will be key to sustaining the move. At current levels, would you chase the rally or wait for a pullback?

BitcoincomNews

Solana Price Reclaims $85, but On-Chain Data Tells a More Cautious Story

Solana's price has rebounded over 5% to retest $85 as forced selling subsides. On-chain activity hints at stabilization, but there's no confirmed bottom yet, with spot and derivatives volumes showing cooling conditions.

SOL-6,71%

- Reward

- like

- Comment

- Repost

- Share

#SOLPriceAnalysis 🚀 Solana (SOL) Rebound Continues — Bullish Pulse or Brief Bounce?

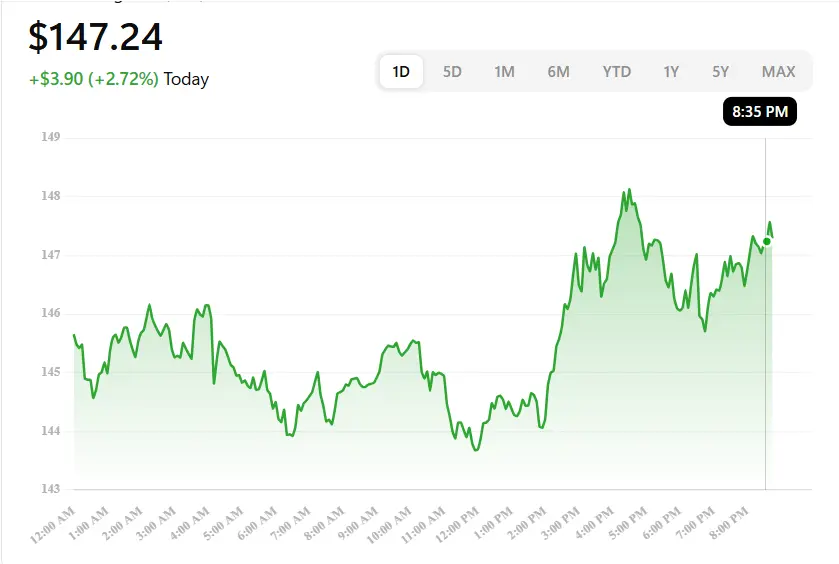

As of today, SOL is trading around ~$146–$147 USD, demonstrating renewed strength with multi‑day gains and a significant rebound after previous consolidation. This move signals improving sentiment toward high‑beta altcoins, as traders reallocate capital back into SOL following a period of sideways movement. Recent intraday swings above the $145 level indicate bulls are testing key resistance areas, while short‑term support remains between $135–$138.

This rebound is noteworthy in the context of broader market s

As of today, SOL is trading around ~$146–$147 USD, demonstrating renewed strength with multi‑day gains and a significant rebound after previous consolidation. This move signals improving sentiment toward high‑beta altcoins, as traders reallocate capital back into SOL following a period of sideways movement. Recent intraday swings above the $145 level indicate bulls are testing key resistance areas, while short‑term support remains between $135–$138.

This rebound is noteworthy in the context of broader market s

- Reward

- 25

- 22

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

SOL Price Analysis

Solana (SOL) continues to show meaningful price action and market structure development. Over recent sessions, SOL has been navigating key support zones while facing resistance at major Fibonacci levels. Bullish momentum remains intact as long as price holds above critical moving averages, signaling continued interest from both traders and long-term holders. Key levels to watch include near-term support around psychological lows and potential breakout zones above recent highs, where volume expansion could trigger accelerated upside. Always combine technical analysis with bro

Solana (SOL) continues to show meaningful price action and market structure development. Over recent sessions, SOL has been navigating key support zones while facing resistance at major Fibonacci levels. Bullish momentum remains intact as long as price holds above critical moving averages, signaling continued interest from both traders and long-term holders. Key levels to watch include near-term support around psychological lows and potential breakout zones above recent highs, where volume expansion could trigger accelerated upside. Always combine technical analysis with bro

SOL-6,71%

- Reward

- 14

- 13

- Repost

- Share

Crypto_Teacher :

:

Ape In 🚀View More

#SOLPriceAnalysis 🚀

Solana (SOL) has rebounded strongly, posting 5%+ gains as market sentiment turns more constructive. The key question now: will fresh capital continue to flow into SOL to sustain the move? 🤔

What I’m watching closely:

• Follow-through volume after the rebound – confirms if buyers are serious

• Price action around resistance zones ($145–150) – a break could trigger further upside

• Market-wide risk appetite & BTC stability – crypto moves together

Strategy Thoughts:

Chasing momentum: Catching the surge can be profitable, but risk of pullback is high. Scale in to manage risk.

Solana (SOL) has rebounded strongly, posting 5%+ gains as market sentiment turns more constructive. The key question now: will fresh capital continue to flow into SOL to sustain the move? 🤔

What I’m watching closely:

• Follow-through volume after the rebound – confirms if buyers are serious

• Price action around resistance zones ($145–150) – a break could trigger further upside

• Market-wide risk appetite & BTC stability – crypto moves together

Strategy Thoughts:

Chasing momentum: Catching the surge can be profitable, but risk of pullback is high. Scale in to manage risk.

- Reward

- 3

- 3

- Repost

- Share

BeautifulDay :

:

Happy New Year! 🤑View More

#SOLPriceAnalysis

SOL Price Recovery Update & Market Outlook Breakout or Patience?

Solana (SOL) has delivered a notable rebound, climbing more than 5% within a single session as overall market sentiment begins to stabilize. After spending time in consolidation, SOL is once again attracting attention, suggesting that capital is gradually rotating back into high-beta altcoins. The critical question now is whether this move represents the early phase of a broader trend reversal or simply a short-lived relief bounce.

At present, SOL is trading near $137.95, with intraday price action fluctuating

SOL Price Recovery Update & Market Outlook Breakout or Patience?

Solana (SOL) has delivered a notable rebound, climbing more than 5% within a single session as overall market sentiment begins to stabilize. After spending time in consolidation, SOL is once again attracting attention, suggesting that capital is gradually rotating back into high-beta altcoins. The critical question now is whether this move represents the early phase of a broader trend reversal or simply a short-lived relief bounce.

At present, SOL is trading near $137.95, with intraday price action fluctuating

- Reward

- 6

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#SOLPriceAnalysis

🚀 SOL/USDT – Market Update & Trade Insight

📌 Current Price: ≈ $147.29 (SOL live price)

SOL ne aaj strong rebound +5% dikhaya hai, market sentiment improve ho raha hai.

📈 Trade Scenarios

1️⃣ Conservative / Wait for Pullback (Recommended)

Watch for pullback to key support zones

Entry on confirmed bounce

Targets (TP):

TP1: $150

TP2: $153

TP3: $158

Stop‑Loss (SL): below recent swing low

Logic:

Momentum strong lag raha hai abhi, pullback se entry safer hoti hai.

2️⃣ Aggressive / Breakout Chase

Breakout Entry: Above $150 confirmed with volume

TP: $153 – $158

SL: Below breakout

🚀 SOL/USDT – Market Update & Trade Insight

📌 Current Price: ≈ $147.29 (SOL live price)

SOL ne aaj strong rebound +5% dikhaya hai, market sentiment improve ho raha hai.

📈 Trade Scenarios

1️⃣ Conservative / Wait for Pullback (Recommended)

Watch for pullback to key support zones

Entry on confirmed bounce

Targets (TP):

TP1: $150

TP2: $153

TP3: $158

Stop‑Loss (SL): below recent swing low

Logic:

Momentum strong lag raha hai abhi, pullback se entry safer hoti hai.

2️⃣ Aggressive / Breakout Chase

Breakout Entry: Above $150 confirmed with volume

TP: $153 – $158

SL: Below breakout

SOL-6,71%

- Reward

- 22

- 9

- Repost

- Share

ShainingMoon :

:

great post thanks for sharing informative informationView More

#SOLPriceAnalysis Current Price (Live): ~$139.43 USD (SOL) — slight dip today.

The market is in a short-term consolidation phase, showing neither strong bullish nor bearish dominance. Traders are watching key levels closely for the next breakout.

📊 Market Structure & Key Levels

🔹 Resistance (Upside Targets):

$145–$150 — immediate hurdle (recent rejection zone)

$160–$177 — mid-range resistance

$252–$295 — long-term breakout zone

ATH break above $295 → next target ~$418+ (very bullish)

🔻 Support (Downside Safety):

$133–$136 — critical short-term support

$120–$125 — historical support

$94–$105

The market is in a short-term consolidation phase, showing neither strong bullish nor bearish dominance. Traders are watching key levels closely for the next breakout.

📊 Market Structure & Key Levels

🔹 Resistance (Upside Targets):

$145–$150 — immediate hurdle (recent rejection zone)

$160–$177 — mid-range resistance

$252–$295 — long-term breakout zone

ATH break above $295 → next target ~$418+ (very bullish)

🔻 Support (Downside Safety):

$133–$136 — critical short-term support

$120–$125 — historical support

$94–$105

- Reward

- 6

- 4

- Repost

- Share

MrThanks77 :

:

2026 GOGOGO 👊View More

📊🚀 #SOLPriceAnalysis

Solana (SOL) remains in focus as market participants closely monitor its price action amid shifting crypto sentiment. Known for its high-speed network and growing ecosystem, SOL continues to attract attention from both traders and long-term observers.

🔍 Key points to watch:

🔹 📈 Short-term price momentum and key resistance levels

🔹 🧭 Support zones shaping near-term direction

🔹 🌐 Network activity and ecosystem developments

With volatility creating both risks and opportunities, staying informed is essential. Use reliable tools, real-time charts, and market insights t

Solana (SOL) remains in focus as market participants closely monitor its price action amid shifting crypto sentiment. Known for its high-speed network and growing ecosystem, SOL continues to attract attention from both traders and long-term observers.

🔍 Key points to watch:

🔹 📈 Short-term price momentum and key resistance levels

🔹 🧭 Support zones shaping near-term direction

🔹 🌐 Network activity and ecosystem developments

With volatility creating both risks and opportunities, staying informed is essential. Use reliable tools, real-time charts, and market insights t

- Reward

- 8

- 7

- Repost

- Share

GorgeousQueen :

:

DYOR 🤓View More

🚀 #SOLPriceAnalysis – January 15, 2026

Current Price: $XXX.XX

1m Candle Overview: SOL recently moved between $XXX and $XXX, showing an immediate volatility spike.

Support Levels: $XXX, $XXX

Resistance Levels: $XXX, $XXX

Trend: Short-term bullish/bearish

Market Sentiment: Excitement is building in the community, especially with recent layer-1 upgrades and ecosystem developments. Rapid fluctuations are visible on 1m candles.

Key Tips for Traders:

1️⃣ Consider quick entries on dips near support levels.

2️⃣ Monitor resistance for potential breakouts.

3️⃣ Apply strict risk management due to high v

Current Price: $XXX.XX

1m Candle Overview: SOL recently moved between $XXX and $XXX, showing an immediate volatility spike.

Support Levels: $XXX, $XXX

Resistance Levels: $XXX, $XXX

Trend: Short-term bullish/bearish

Market Sentiment: Excitement is building in the community, especially with recent layer-1 upgrades and ecosystem developments. Rapid fluctuations are visible on 1m candles.

Key Tips for Traders:

1️⃣ Consider quick entries on dips near support levels.

2️⃣ Monitor resistance for potential breakouts.

3️⃣ Apply strict risk management due to high v

SOL-6,71%

- Reward

- 8

- 8

- Repost

- Share

QueenOfTheDay :

:

Happy New Year! 🤑View More

#SOLPriceAnalysis

🚀 SOL/USDT – Market Update & Trade Insight

📌 Current Price: ≈ $147.29 (SOL live price)

SOL ne aaj strong rebound +5% dikhaya hai, market sentiment improve ho raha hai.

📈 Trade Scenarios

1️⃣ Conservative / Wait for Pullback (Recommended)

Watch for pullback to key support zones

Entry on confirmed bounce

Targets (TP):

TP1: $150

TP2: $153

TP3: $158

Stop‑Loss (SL): below recent swing low

Logic:

Momentum strong lag raha hai abhi, pullback se entry safer hoti hai.

2️⃣ Aggressive / Breakout Chase

Breakout Entry: Above $150 confirmed with volume

TP: $153 – $158

SL: Below breakout

🚀 SOL/USDT – Market Update & Trade Insight

📌 Current Price: ≈ $147.29 (SOL live price)

SOL ne aaj strong rebound +5% dikhaya hai, market sentiment improve ho raha hai.

📈 Trade Scenarios

1️⃣ Conservative / Wait for Pullback (Recommended)

Watch for pullback to key support zones

Entry on confirmed bounce

Targets (TP):

TP1: $150

TP2: $153

TP3: $158

Stop‑Loss (SL): below recent swing low

Logic:

Momentum strong lag raha hai abhi, pullback se entry safer hoti hai.

2️⃣ Aggressive / Breakout Chase

Breakout Entry: Above $150 confirmed with volume

TP: $153 – $158

SL: Below breakout

SOL-6,71%

- Reward

- 3

- 5

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

36.3K Popularity

146.68K Popularity

85.16K Popularity

1.66M Popularity

483.82K Popularity

7.42K Popularity

6.52K Popularity

19.62K Popularity

3.53K Popularity

362.37K Popularity

44.27K Popularity

100.25K Popularity

16.51K Popularity

69.57K Popularity

5.9K Popularity

News

View MorePolygon network stablecoin holdings reach $3.28 billion, hitting a record high

9 m

February crypto startups raised $883 million, down 13% year-over-year

11 m

Japan's Financial Services Agency supports cryptocurrency anti-money laundering pilot programs, with the participation of several well-known companies

36 m

Japanese established publicly listed company "Daito Co., Ltd." has decided to allocate up to 1 billion yen to purchase Bitcoin to hedge against inflation.

50 m

Hong Kong's Financial Services and the Treasury Bureau plans to hire additional personnel responsible for AI and virtual asset regulation, aiming to investigate companies involved in virtual asset trading.

50 m

Pin