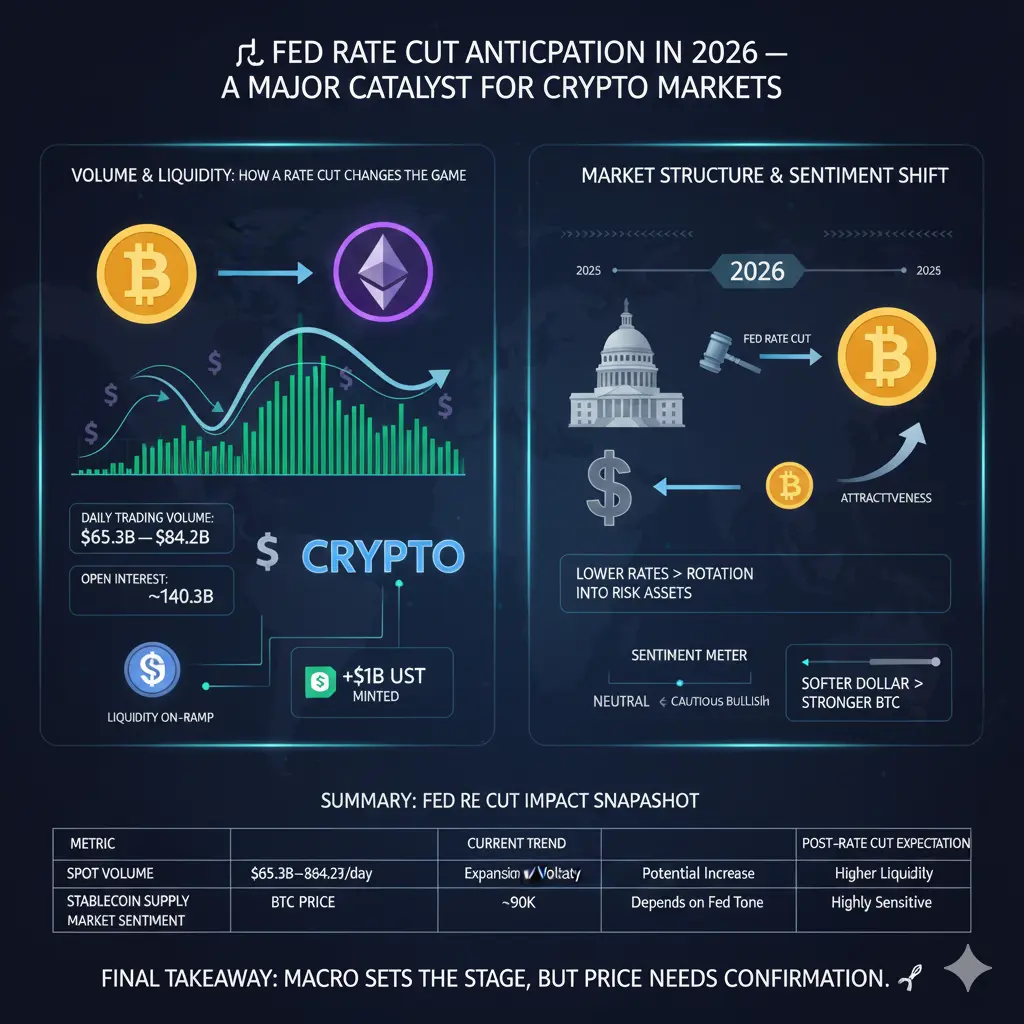

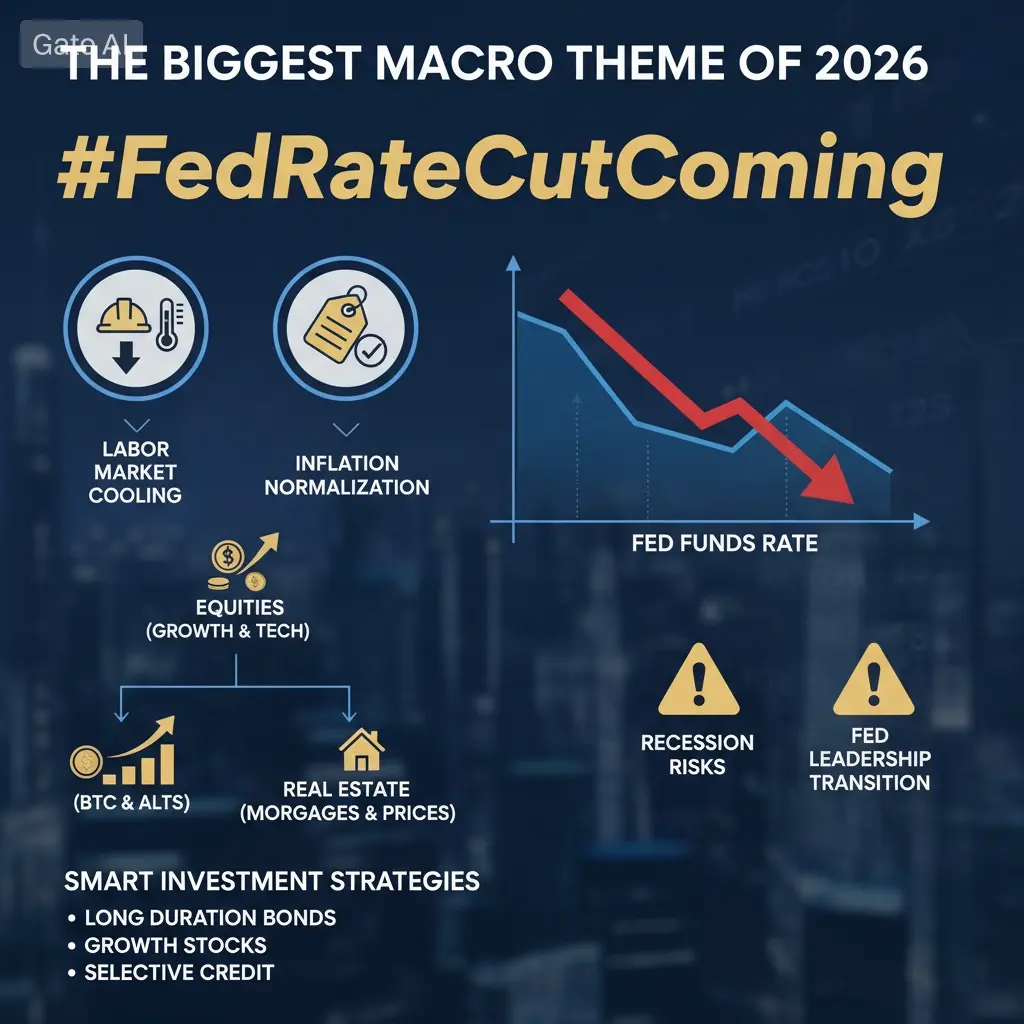

Excellent question. Forecasting the Fed's path into 2026 requires piecing together a forward-looking narrative from current data and projected trends. Here’s my synthesized outlook.

The 2026 Rate-Cut Path: Gradual, Data-Dependent Easing

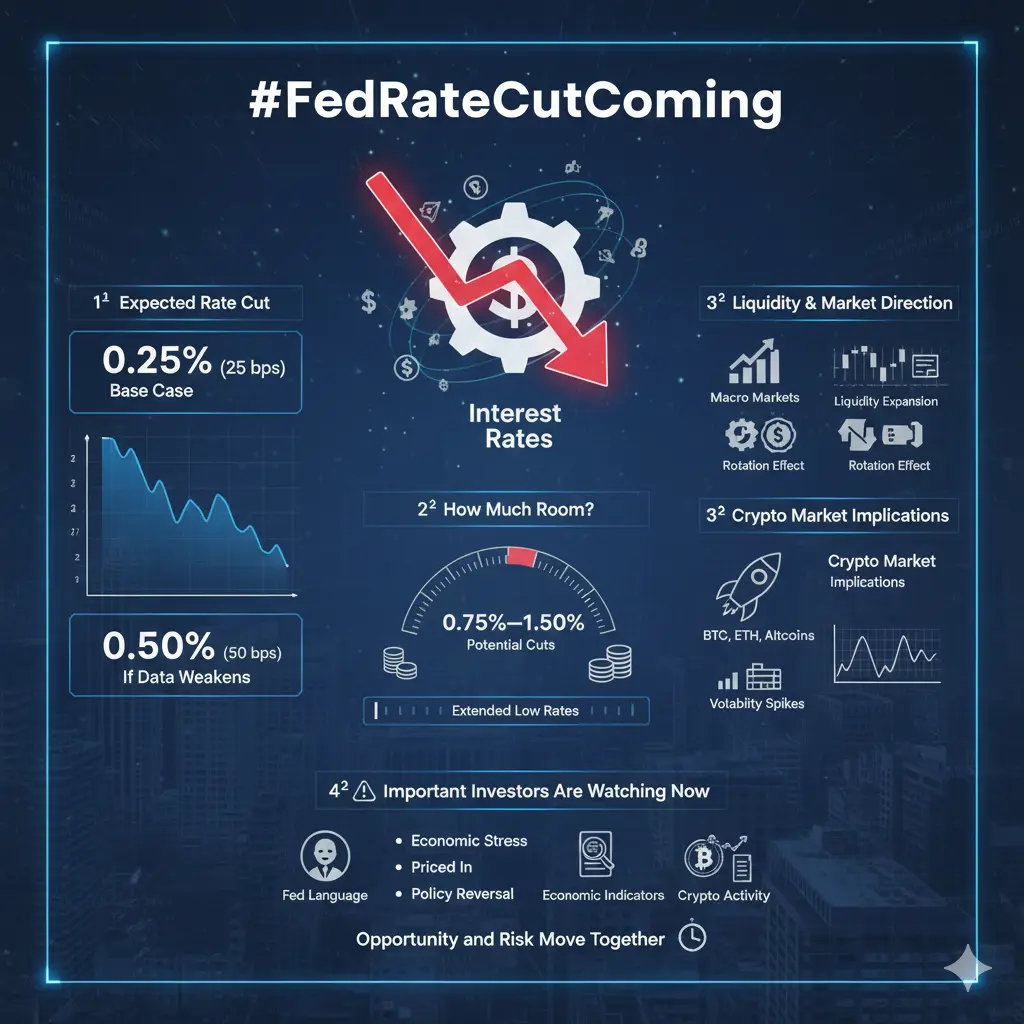

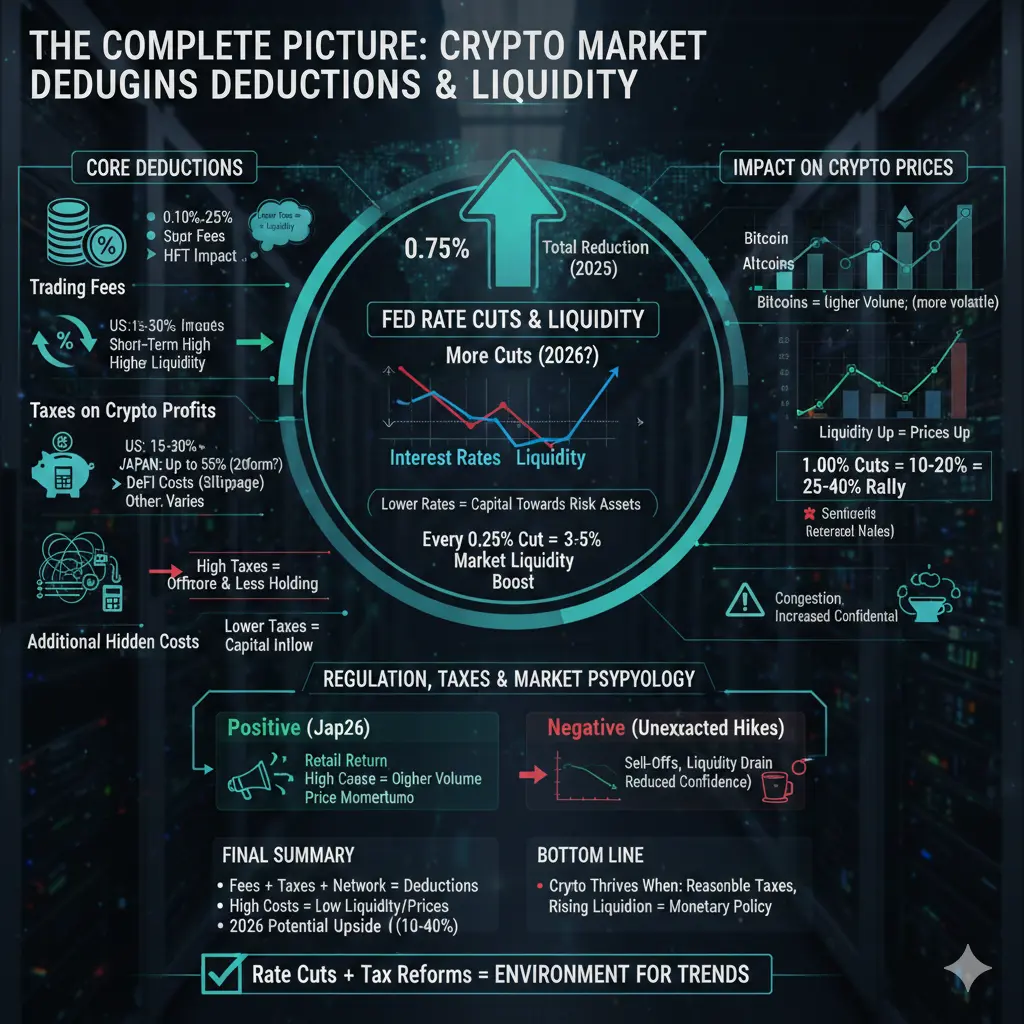

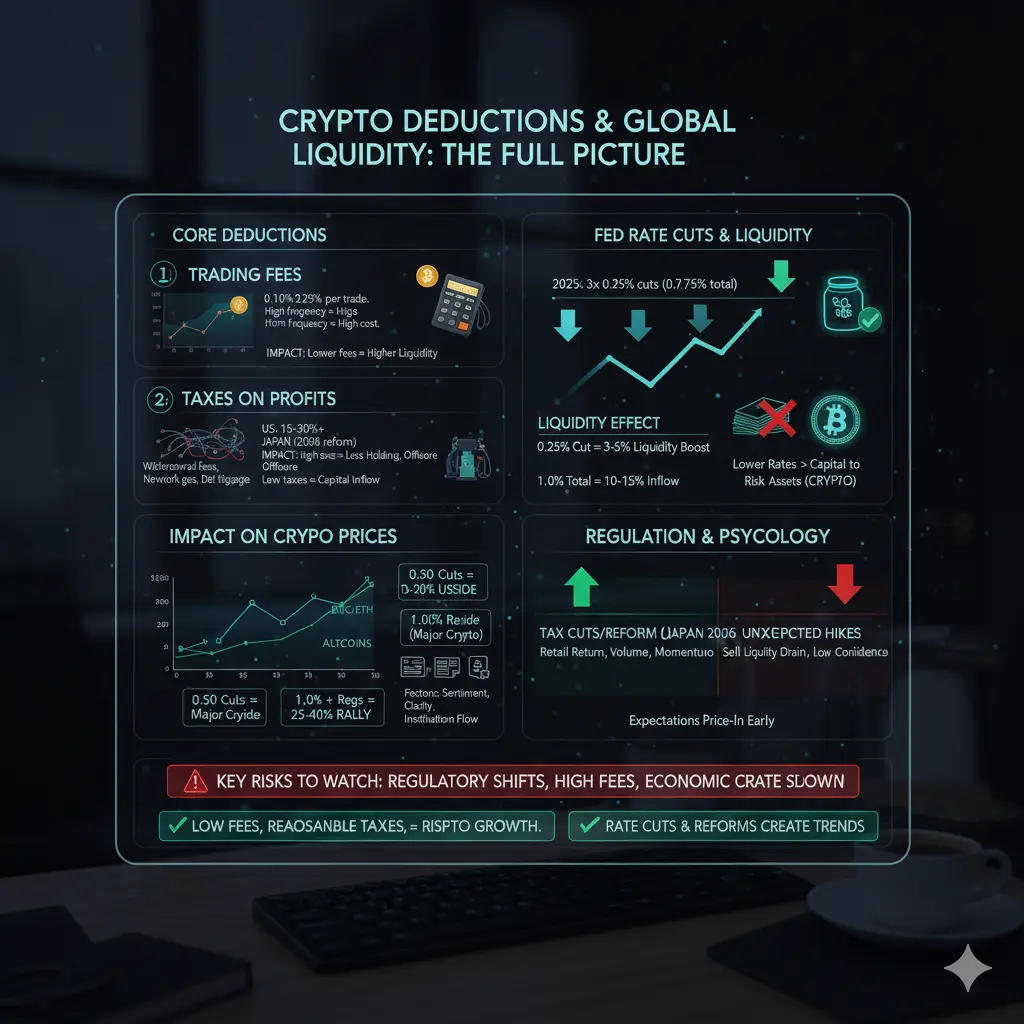

My base case for 2026 is a gradual, cautious cutting cycle, likely proceeding at a pace of 25 bps per quarter (or every other meeting), absent a severe recession. The reasoning is rooted in the interplay of key macroeconomic variables. By 2026, I expect core inflation to have settled in the 2.2%-2.8% range, stubbornly above the Fed's 2% target but within toler

The 2026 Rate-Cut Path: Gradual, Data-Dependent Easing

My base case for 2026 is a gradual, cautious cutting cycle, likely proceeding at a pace of 25 bps per quarter (or every other meeting), absent a severe recession. The reasoning is rooted in the interplay of key macroeconomic variables. By 2026, I expect core inflation to have settled in the 2.2%-2.8% range, stubbornly above the Fed's 2% target but within toler

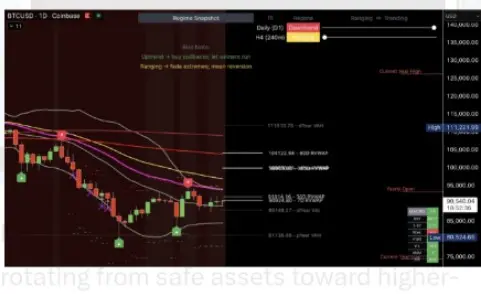

BTC1,96%