# BitcoinFallsBehindGold

22.83K

MrFlower_

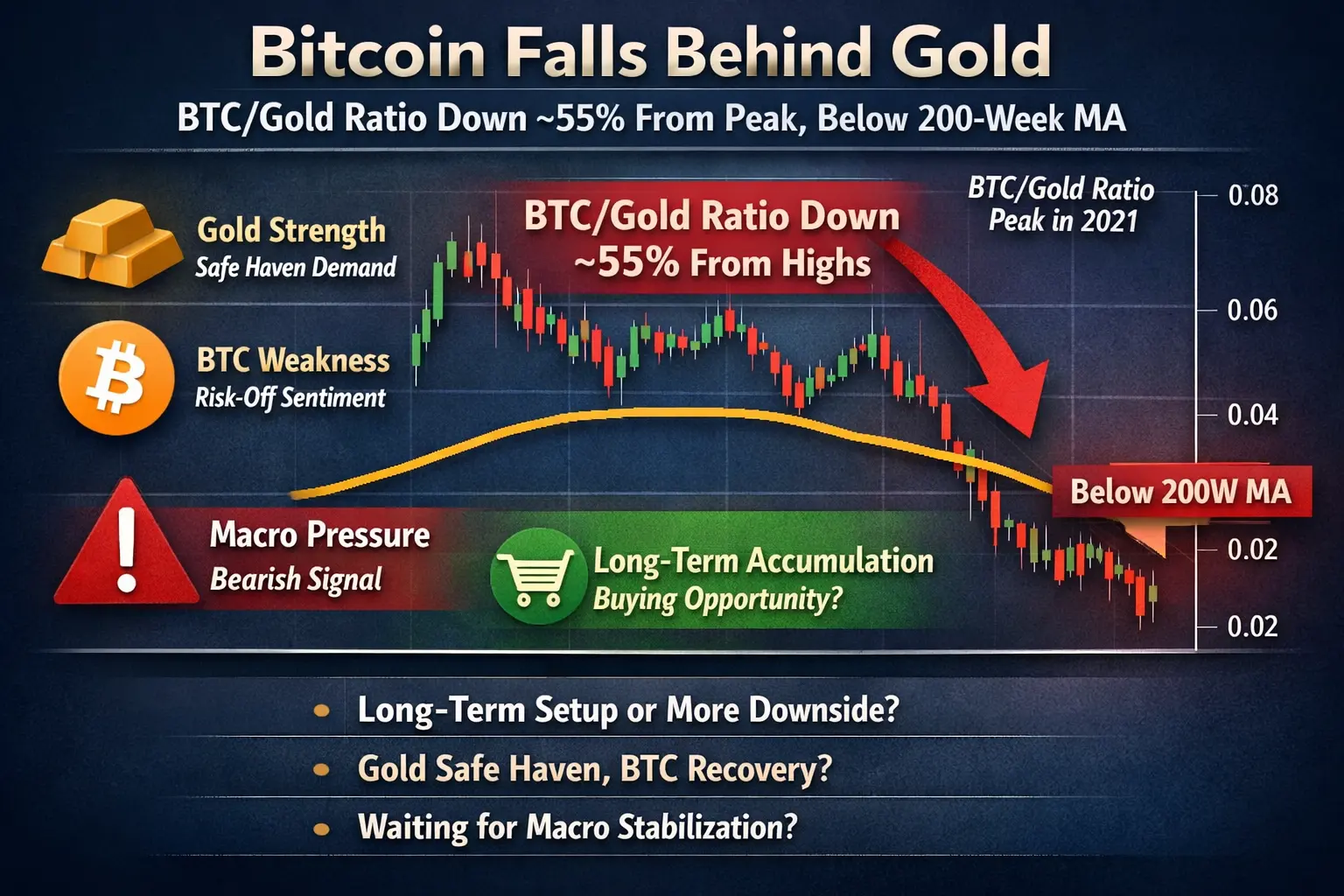

#BitcoinFallsBehindGold Global financial markets are quietly signaling a shift: the hierarchy of safe-haven assets is evolving. Recent price behavior highlights a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tensions, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

BTC-5,79%

- Reward

- 15

- 21

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

🪙 Bitcoin’s Gold Ratio Falls Below 200-Week MA — Dip-Buying Opportunity?

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

BTC-5,79%

- Reward

- 16

- 22

- Repost

- Share

RightWay :

:

good post nice!View More

#BitcoinFallsBehindGold 🪙 Bitcoin vs Gold — A Long-Term Signal Most Are Ignoring

Bitcoin’s Gold Ratio is down almost 55% from the peak and has now slipped below the 200-week moving average — a level that has historically marked major accumulation zones, not tops.

📉 In previous cycles, BTC trading below this ratio didn’t mean weakness forever. It often came before strong multi-month recoveries.

That said, volatility is still high, and blind entries can be costly.

📊 Smart approach right now • Long-term players: Gradual accumulation (DCA) reduces timing risk

• Short-term traders: Expect sharp

Bitcoin’s Gold Ratio is down almost 55% from the peak and has now slipped below the 200-week moving average — a level that has historically marked major accumulation zones, not tops.

📉 In previous cycles, BTC trading below this ratio didn’t mean weakness forever. It often came before strong multi-month recoveries.

That said, volatility is still high, and blind entries can be costly.

📊 Smart approach right now • Long-term players: Gradual accumulation (DCA) reduces timing risk

• Short-term traders: Expect sharp

BTC-5,79%

- Reward

- 2

- 1

- Repost

- Share

DragonFlyOfficial :

:

Happy New Year! 🤑#BitcoinFallsBehindGold

Bitcoin Falls Behind Gold: What the BTC/Gold Breakdown Is Really Telling Us and How I’m Positioning

Bitcoin’s gold ratio is now down roughly 55% from its peak and has slipped below the 200-week moving average, a level many long-term investors treat as a key structural signal. On the surface, that looks uncomfortable especially for those who view Bitcoin as “digital gold.” But I think it’s worth slowing down and unpacking what this move actually represents before jumping to conclusions.

First, context matters. Gold has been in a powerful price-discovery phase, driven b

Bitcoin Falls Behind Gold: What the BTC/Gold Breakdown Is Really Telling Us and How I’m Positioning

Bitcoin’s gold ratio is now down roughly 55% from its peak and has slipped below the 200-week moving average, a level many long-term investors treat as a key structural signal. On the surface, that looks uncomfortable especially for those who view Bitcoin as “digital gold.” But I think it’s worth slowing down and unpacking what this move actually represents before jumping to conclusions.

First, context matters. Gold has been in a powerful price-discovery phase, driven b

- Reward

- 10

- 9

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold #BitcoinFallsBehindGold

For the first time in years, Gold is outperforming Bitcoin.

This shift marks a powerful moment in global markets one that reflects changing risk appetite, rising geopolitical uncertainty, and a renewed flight toward traditional safe-haven assets.

The digital gold narrative is being tested.

And the world is watching.

Gold Regains Its Crown

As inflation pressures persist, central banks remain cautious, and global tensions continue to rise, investors are rotating back into physical security.

Gold has surged on:

Safe-haven demand

Central bank ac

For the first time in years, Gold is outperforming Bitcoin.

This shift marks a powerful moment in global markets one that reflects changing risk appetite, rising geopolitical uncertainty, and a renewed flight toward traditional safe-haven assets.

The digital gold narrative is being tested.

And the world is watching.

Gold Regains Its Crown

As inflation pressures persist, central banks remain cautious, and global tensions continue to rise, investors are rotating back into physical security.

Gold has surged on:

Safe-haven demand

Central bank ac

BTC-5,79%

- Reward

- 6

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

🪙 Bitcoin’s Gold Ratio Falls Below 200-Week MA — Dip-Buying Opportunity?

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

BTC-5,79%

- Reward

- 9

- 11

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

Bitcoin Falls Behind Gold: Assessing the Dip, Gold Ratio Decline, and Strategic Opportunities for BTC

Bitcoin has recently shown signs of underperformance relative to gold, with its gold ratio declining approximately 55% from its all-time peak and the price falling below the 200-week moving average a level historically seen as a critical long-term support for BTC. This decline has sparked discussion among investors and traders regarding whether the current dip presents a buying opportunity or signals deeper caution. From my perspective, the interplay between Bitcoin an

Bitcoin Falls Behind Gold: Assessing the Dip, Gold Ratio Decline, and Strategic Opportunities for BTC

Bitcoin has recently shown signs of underperformance relative to gold, with its gold ratio declining approximately 55% from its all-time peak and the price falling below the 200-week moving average a level historically seen as a critical long-term support for BTC. This decline has sparked discussion among investors and traders regarding whether the current dip presents a buying opportunity or signals deeper caution. From my perspective, the interplay between Bitcoin an

BTC-5,79%

- Reward

- 5

- 4

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Charge Charge Charge 👊View More

#BitcoinFallsBehindGold

Despite recent bullish momentum in cryptocurrencies, Bitcoin (BTC) has started to lag behind gold, highlighting a shift in investor sentiment toward traditional safe-haven assets. This trend reflects broader macroeconomic concerns, inflation hedging, and market volatility affecting digital assets.

📍 Today’s Key Prices (January 28, 2026)

• Bitcoin (BTC): ~$89,000 — showing signs of consolidation after a strong rally, underperforming compared to gold.

• Gold (XAU/USD): ~$5,210 — breaking above key resistance levels, attracting safe-haven flows.

• Ethereum (ETH): ~$3,000

Despite recent bullish momentum in cryptocurrencies, Bitcoin (BTC) has started to lag behind gold, highlighting a shift in investor sentiment toward traditional safe-haven assets. This trend reflects broader macroeconomic concerns, inflation hedging, and market volatility affecting digital assets.

📍 Today’s Key Prices (January 28, 2026)

• Bitcoin (BTC): ~$89,000 — showing signs of consolidation after a strong rally, underperforming compared to gold.

• Gold (XAU/USD): ~$5,210 — breaking above key resistance levels, attracting safe-haven flows.

• Ethereum (ETH): ~$3,000

- Reward

- 11

- 7

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#BitcoinFallsBehindGold Early 2026 has revealed a clear divergence between Bitcoin and gold, challenging the long-standing narrative of BTC as a direct replacement for physical safe havens. While spot gold has surged beyond 5,200 dollars per ounce amid rising geopolitical tension, macro uncertainty, and aggressive central bank accumulation, Bitcoin remains range-bound between 86,000 and 89,000. This contrast highlights a persistent reality: during periods of acute uncertainty, capital still prioritizes assets with centuries of proven trust over emerging digital alternatives.

The driving force

The driving force

BTC-5,79%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin Near Key Levels as Potential Liquidations Exceed $2.8 Billion

According to ChainCatcher News, citing data from Coinglass, Bitcoin (BTC) is approaching critical price thresholds that could trigger large-scale liquidations across major centralized exchanges (CEXs), significantly increasing market volatility.

If BTC breaks above $87,889, the cumulative short-position liquidation intensity on mainstream CEXs is estimated to reach approximately $2.047 billion. Such a breakout could ignite a powerful short squeeze, forcing leveraged short positions to close and potentially accelerating upwar

According to ChainCatcher News, citing data from Coinglass, Bitcoin (BTC) is approaching critical price thresholds that could trigger large-scale liquidations across major centralized exchanges (CEXs), significantly increasing market volatility.

If BTC breaks above $87,889, the cumulative short-position liquidation intensity on mainstream CEXs is estimated to reach approximately $2.047 billion. Such a breakout could ignite a powerful short squeeze, forcing leveraged short positions to close and potentially accelerating upwar

BTC-5,79%

- Reward

- 18

- 9

- Repost

- Share

xxx40xxx :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

9.59K Popularity

25.19K Popularity

352.43K Popularity

31.95K Popularity

51.74K Popularity

361 Popularity

19.2K Popularity

8.52K Popularity

82.52K Popularity

29.86K Popularity

21.1K Popularity

24.36K Popularity

8.64K Popularity

15.9K Popularity

188.04K Popularity

News

View MoreData: 20,000 SOL transferred out from Fireblocks Custody, worth approximately $2.33 million

1 m

US stock index futures slightly rebound, with S&P 500 futures down by 0.37%

22 m

The Federal Reserve is expected to cut interest rates twice this year, with traders continuously pricing in.

23 m

US Dollar Index DXY drops 10 points in the short term, with the intraday gain narrowing to 0.28%

28 m

Trump: Nominates Kevin Walsh to be Chairman of the Federal Reserve System Board of Governors

31 m

Pin