MingDragonX

No content yet

MingDragonX

#DeepCreationCamp #DeepCreationCamp The convergence of Artificial Intelligence and blockchain infrastructure is rapidly transforming the digital asset ecosystem. What began as experimental AI trading bots has evolved into autonomous, agent-driven systems interacting directly with smart contracts, DeFi protocols, NFT marketplaces, and social token economies. As Web4 matures, AI is no longer assisting users—it is becoming an active on-chain participant. At the foundation are programmable networks like Ethereum, along with scalable Layer-2 ecosystems such as Polygon and Arbitrum, enabling low-cos

- Reward

- 4

- 5

- Repost

- Share

Yunna :

:

2026 GOGOGO 👊View More

#CelebratingNewYearOnGateSquare CelebratingNewYearOnGateSquare The Evolution From Campaign Energy to Structural Ecosystem Power

As momentum builds deeper into Q1 2026, Gate.io has transformed Gate Square from a seasonal activation platform into a continuous engagement ecosystem. What began as a New Year celebration has now evolved into a permanent community intelligence and creator-driven trading layer. The Fire Horse campaign triggered participation acceleration, but the deeper transformation is occurring inside the system architecture.

Gate Square is no longer limited to red packet drops or

As momentum builds deeper into Q1 2026, Gate.io has transformed Gate Square from a seasonal activation platform into a continuous engagement ecosystem. What began as a New Year celebration has now evolved into a permanent community intelligence and creator-driven trading layer. The Fire Horse campaign triggered participation acceleration, but the deeper transformation is occurring inside the system architecture.

Gate Square is no longer limited to red packet drops or

- Reward

- 3

- 2

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#CelebratingNewYearOnGateSquare CelebratingNewYearOnGateSquare

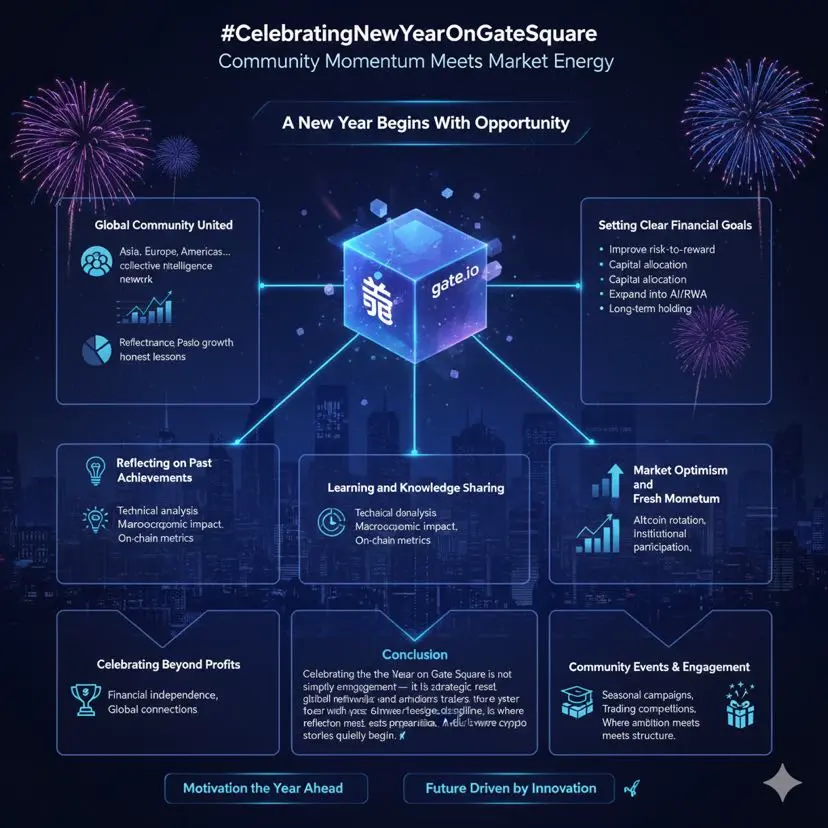

1. A New Year Begins With Opportunity

As the calendar turns, a new chapter opens for the global crypto community on Gate.io. The New Year represents more than a date change—it signals potential capital flow resets, evolving market structure, and renewed strategic positioning. On Gate Square, participants move forward with clearer trading plans, stronger risk awareness, and disciplined execution mindset. The platform becomes a launchpad for structured growth rather than simple celebration.

2. A Global Community United

Gate Square

1. A New Year Begins With Opportunity

As the calendar turns, a new chapter opens for the global crypto community on Gate.io. The New Year represents more than a date change—it signals potential capital flow resets, evolving market structure, and renewed strategic positioning. On Gate Square, participants move forward with clearer trading plans, stronger risk awareness, and disciplined execution mindset. The platform becomes a launchpad for structured growth rather than simple celebration.

2. A Global Community United

Gate Square

BTC-2,04%

- Reward

- 3

- 3

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

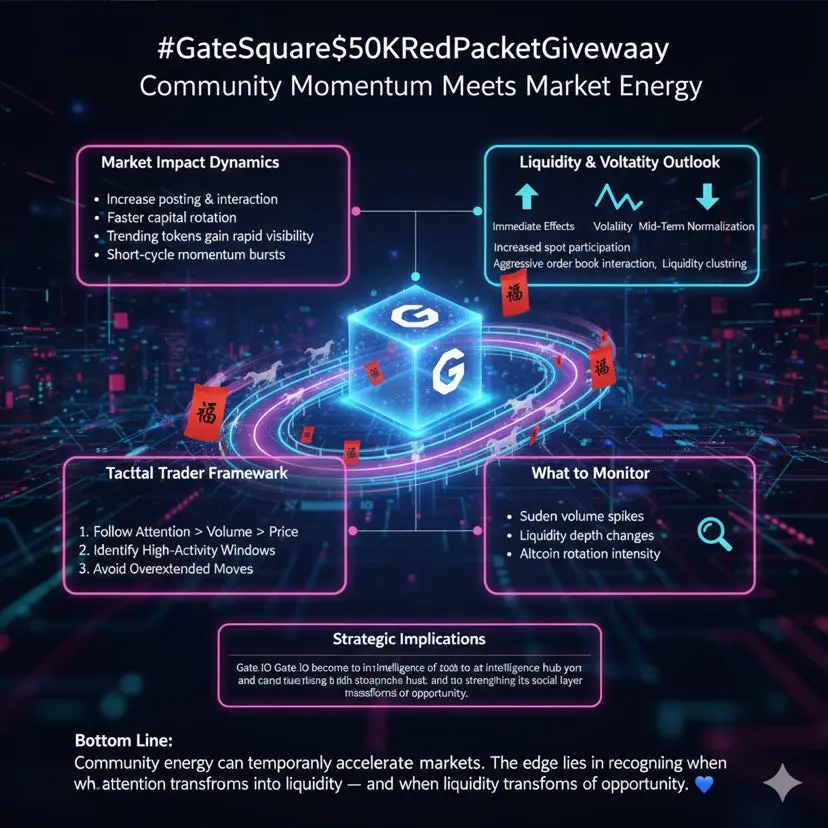

#GateSquare$50KRedPacketGiveaway Gate.io Social Intelligence Meets Engagement Economics

The #GateSquare$50KRedPacketGiveaway is more than a promotional campaign—it reflects the strategic evolution of Gate Square as a creator-driven trading ecosystem inside Gate.io. The $50,000 Red Packet initiative is designed not simply to distribute rewards, but to reinforce a behavioral model where insight, consistency, and analytical quality are prioritized over posting volume.

The campaign structure signals a shift in how modern exchange platforms operate. Trading platforms are no longer limited to execut

The #GateSquare$50KRedPacketGiveaway is more than a promotional campaign—it reflects the strategic evolution of Gate Square as a creator-driven trading ecosystem inside Gate.io. The $50,000 Red Packet initiative is designed not simply to distribute rewards, but to reinforce a behavioral model where insight, consistency, and analytical quality are prioritized over posting volume.

The campaign structure signals a shift in how modern exchange platforms operate. Trading platforms are no longer limited to execut

- Reward

- 3

- 5

- Repost

- Share

Peacefulheart :

:

Ape In 🚀View More

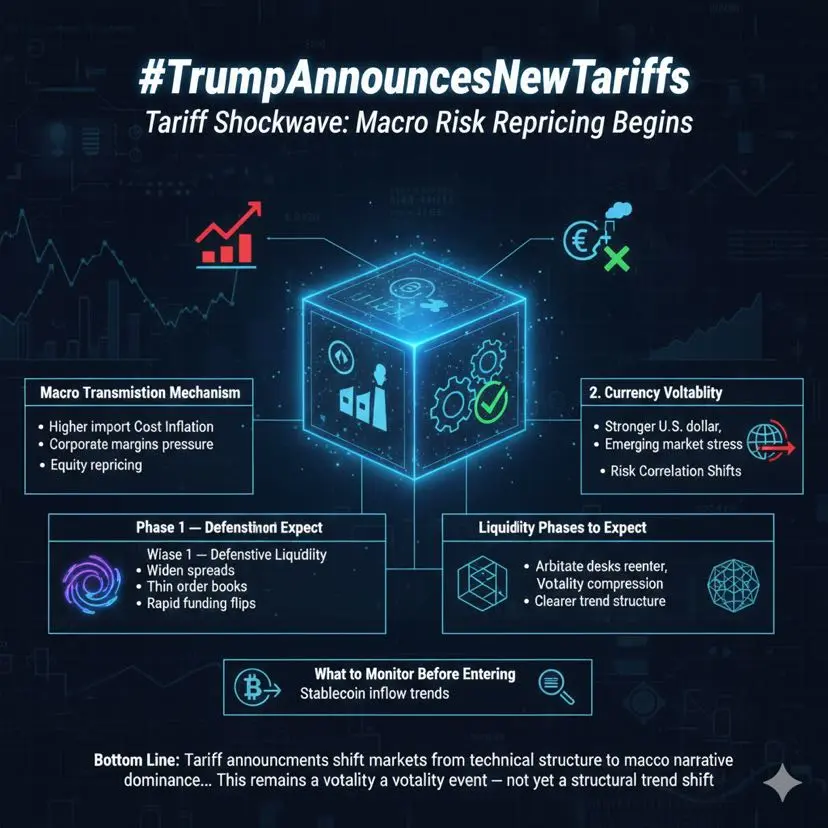

#TrumpAnnouncesNewTariffs TrumpAnnouncesNewTariffs Tariff Shockwave—Macro Risk Repricing Begins

The latest tariff announcement from Donald Trump introduces a strong macro catalyst into global markets—trade friction. While tariffs usually impact equities, commodities, and currencies first, crypto often reacts as a secondary liquidity recipient during geopolitical and economic tension. This is not merely a policy update—it is a volatility trigger.

Macro Transmission Mechanism

Tariffs impact markets through three primary channels:

1️⃣ Supply Chain Cost Inflation — higher import costs compress cor

The latest tariff announcement from Donald Trump introduces a strong macro catalyst into global markets—trade friction. While tariffs usually impact equities, commodities, and currencies first, crypto often reacts as a secondary liquidity recipient during geopolitical and economic tension. This is not merely a policy update—it is a volatility trigger.

Macro Transmission Mechanism

Tariffs impact markets through three primary channels:

1️⃣ Supply Chain Cost Inflation — higher import costs compress cor

BTC-2,04%

- Reward

- 2

- 1

- Repost

- Share

ChadwickBiu :

:

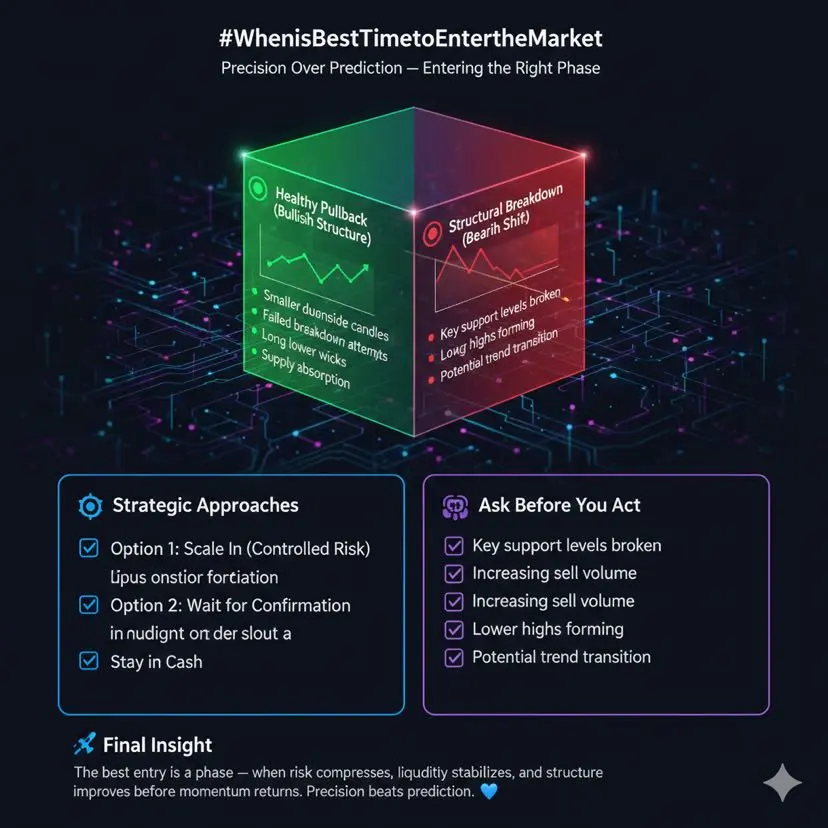

I think Trump's tariff policies could impact global trade and are worth paying attention to!#WhenisBestTimetoEntertheMarket WhenIsBestTimeToEnterTheMarket Precision Over Prediction—Entering the Right Phase

The biggest misconception in trading is believing success comes from catching the exact bottom. Sustainable performance comes from entering during the correct market phase—when liquidity transitions from distribution pressure to accumulation behavior. Markets rarely reverse when crowd sentiment expects it. Reversals usually occur when positioning becomes imbalanced and liquidity quietly shifts. In crypto markets, timing depends more on structure than prediction, especially for asse

The biggest misconception in trading is believing success comes from catching the exact bottom. Sustainable performance comes from entering during the correct market phase—when liquidity transitions from distribution pressure to accumulation behavior. Markets rarely reverse when crowd sentiment expects it. Reversals usually occur when positioning becomes imbalanced and liquidity quietly shifts. In crypto markets, timing depends more on structure than prediction, especially for asse

- Reward

- 3

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

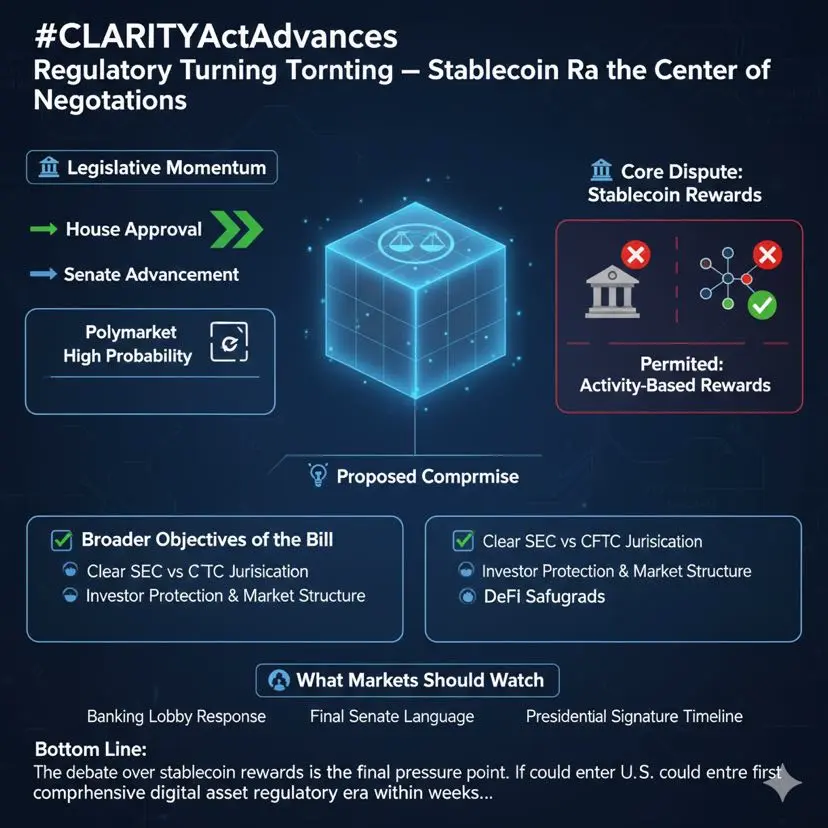

#CLARITYActAdvances CLARITY Act Advances Regulatory Turning Point — Stablecoin Reward Rules at the Center of Negotiations

Negotiations around the CLARITY Act have entered a decisive phase, with the White House acting as a mediator in the final dispute over stablecoin reward structures. As the soft March 1, 2026 target approaches, lawmakers are moving toward a compromise that could allow the bill to reach a final vote by early April 2026.

This moment represents more than legislative progress—it signals a structural transformation in U.S. digital asset governance.

🏛️ Legislative Momentum

The bi

Negotiations around the CLARITY Act have entered a decisive phase, with the White House acting as a mediator in the final dispute over stablecoin reward structures. As the soft March 1, 2026 target approaches, lawmakers are moving toward a compromise that could allow the bill to reach a final vote by early April 2026.

This moment represents more than legislative progress—it signals a structural transformation in U.S. digital asset governance.

🏛️ Legislative Momentum

The bi

- Reward

- 2

- Comment

- Repost

- Share

#GateSpringFestivalHorseRacingEvent GateSpringFestivalHorseRacingEvent Speed, Liquidity, Momentum—Tactical Volatility Window

The #GateSpringFestivalHorseRacingEvent is more than a seasonal campaign inside Gate.io—it operates as a short-term liquidity accelerator within the Gate Square ecosystem. Competitive trading environments tend to increase participation intensity. The effect is rarely macro-directional—it is behavioral. When traders compete, execution frequency rises, capital rotates faster, and short-term performance becomes the focus. That behavioral shift alone can temporarily reshape

The #GateSpringFestivalHorseRacingEvent is more than a seasonal campaign inside Gate.io—it operates as a short-term liquidity accelerator within the Gate Square ecosystem. Competitive trading environments tend to increase participation intensity. The effect is rarely macro-directional—it is behavioral. When traders compete, execution frequency rises, capital rotates faster, and short-term performance becomes the focus. That behavioral shift alone can temporarily reshape

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow? BuyTheDipOrWaitNow Discipline Over Emotion—Structured Decision Making

This is where emotional traders and disciplined traders separate. A dip alone is not information. Context is.

🔎 Step 1: Identify the Type of Dip

Not all pullbacks are equal. There are two primary structures:

🟢 Healthy Pullback (Bullish Structure)

Price remains above major moving averages. Higher highs and higher lows stay intact. Selling volume declines during the retracement. No major support breakdown occurs. These are typically liquidity resets inside an uptrend—often accumulation zones.

🔴 Structur

This is where emotional traders and disciplined traders separate. A dip alone is not information. Context is.

🔎 Step 1: Identify the Type of Dip

Not all pullbacks are equal. There are two primary structures:

🟢 Healthy Pullback (Bullish Structure)

Price remains above major moving averages. Higher highs and higher lows stay intact. Selling volume declines during the retracement. No major support breakdown occurs. These are typically liquidity resets inside an uptrend—often accumulation zones.

🔴 Structur

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

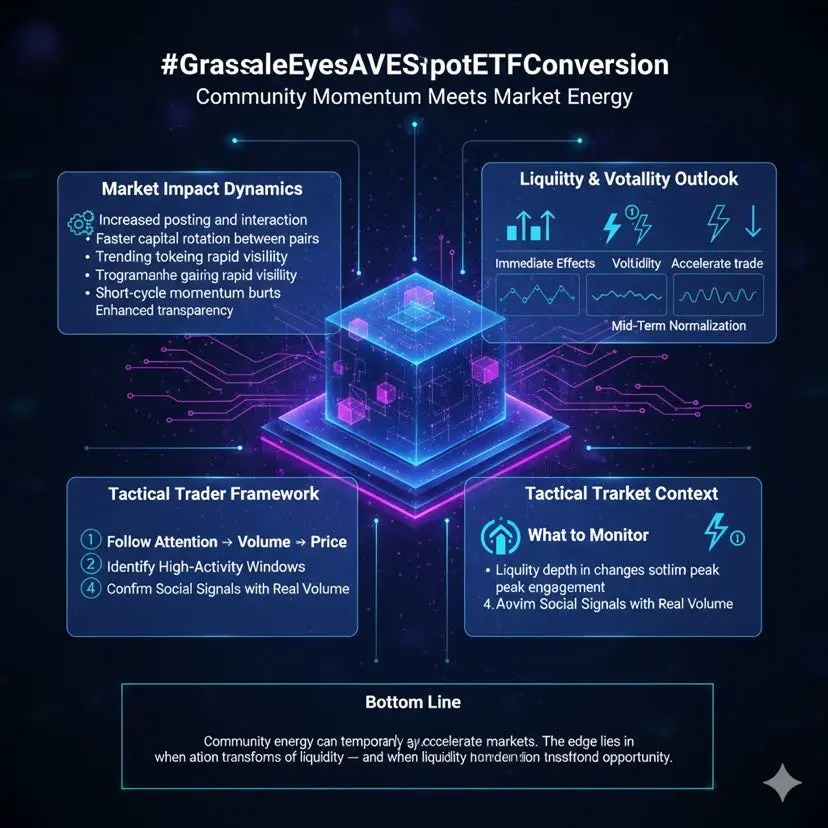

To The Moon 🌕#CelebratingNewYearOnGateSquare #CelebratingNewYearOnGateSquare Community Momentum Meets Market Energy

Seasonal campaigns inside active trading ecosystems often do more than boost engagement—they create measurable liquidity pulses. The #CelebratingNewYearOnGateSquare event on Gate.io, particularly within Gate Square, is a textbook example of how community energy can temporarily influence trading behavior. When participation rises, execution frequency often follows. In crypto markets, attention is frequently the first stage of price movement.

Market Impact Dynamics

During celebration-driven cam

Seasonal campaigns inside active trading ecosystems often do more than boost engagement—they create measurable liquidity pulses. The #CelebratingNewYearOnGateSquare event on Gate.io, particularly within Gate Square, is a textbook example of how community energy can temporarily influence trading behavior. When participation rises, execution frequency often follows. In crypto markets, attention is frequently the first stage of price movement.

Market Impact Dynamics

During celebration-driven cam

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕#GrayscaleEyesAVESpotETFConversion GrayscaleEyesAVESpotETFConversion Institutional Product Evolution Accelerates

Momentum is building around the potential conversion of Grayscale Investments products into spot ETF structures, with market focus turning toward Aave exposure. A successful spot ETF conversion would represent more than product restructuring—it would signal deeper integration of decentralized finance assets into regulated capital markets.

Spot Structure vs Trust Discount

Closed-end trust vehicles historically trade at premiums or discounts relative to net asset value. Converting to

Momentum is building around the potential conversion of Grayscale Investments products into spot ETF structures, with market focus turning toward Aave exposure. A successful spot ETF conversion would represent more than product restructuring—it would signal deeper integration of decentralized finance assets into regulated capital markets.

Spot Structure vs Trust Discount

Closed-end trust vehicles historically trade at premiums or discounts relative to net asset value. Converting to

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕#RussiaStudiesNationalStablecoin SovereignDigitalLiquidity The Next Phase of Monetary Strategy

The digitization of national currencies is no longer experimental—it is strategic. As major economies evaluate sovereign stablecoins and programmable settlement systems, digital currency is evolving from a market innovation into a state-level policy instrument. The next phase will not be defined by speculation, but by infrastructure design and monetary positioning.

1️⃣ From Currency to Settlement Layer

Future sovereign digital tokens may function less as retail payment tools and more as high-efficien

The digitization of national currencies is no longer experimental—it is strategic. As major economies evaluate sovereign stablecoins and programmable settlement systems, digital currency is evolving from a market innovation into a state-level policy instrument. The next phase will not be defined by speculation, but by infrastructure design and monetary positioning.

1️⃣ From Currency to Settlement Layer

Future sovereign digital tokens may function less as retail payment tools and more as high-efficien

- Reward

- 1

- 3

- Repost

- Share

Discovery :

:

LFG 🔥View More

#USSECPushesCryptoReform DigitalAssetFramework2026 The Institutional Convergence Phase

U.S. digital asset regulation is no longer defined by uncertainty — it is entering a phase of structural alignment between regulators, lawmakers, and institutional capital. What began as fragmented enforcement cycles is evolving into coordinated rulemaking and balance sheet integration. The transition is gradual, but the direction is increasingly clear.

1️⃣ Capital Recognition of On-Chain Assets

Regulators are beginning to treat select digital assets not as speculative anomalies but as instruments requiring

U.S. digital asset regulation is no longer defined by uncertainty — it is entering a phase of structural alignment between regulators, lawmakers, and institutional capital. What began as fragmented enforcement cycles is evolving into coordinated rulemaking and balance sheet integration. The transition is gradual, but the direction is increasingly clear.

1️⃣ Capital Recognition of On-Chain Assets

Regulators are beginning to treat select digital assets not as speculative anomalies but as instruments requiring

- Reward

- 1

- Comment

- Repost

- Share

#GrayscaleEyesAVESpotETFConversion GateSquare2026 SocialFi Performance Arena Enters a New Phase

A powerful evolution is unfolding inside Gate.io as Gate Square transitions from a seasonal campaign hub into a structured SocialFi performance arena. In 2026, the Lunar New Year activation is no longer centered solely on celebration — it is engineered to convert insight, analytical depth, and consistency into measurable on-platform value.

In the Year of the Horse, execution speed and content precision define leadership. Gate Square now operates as a performance-driven content engine where research

A powerful evolution is unfolding inside Gate.io as Gate Square transitions from a seasonal campaign hub into a structured SocialFi performance arena. In 2026, the Lunar New Year activation is no longer centered solely on celebration — it is engineered to convert insight, analytical depth, and consistency into measurable on-platform value.

In the Year of the Horse, execution speed and content precision define leadership. Gate Square now operates as a performance-driven content engine where research

GT-2,86%

- Reward

- 4

- 13

- Repost

- Share

Peacefulheart :

:

Diamond Hands 💎View More

#ApollotoBuy90MMORPHOin4Years TradFiMeetsDeFi Institutional Capital Embeds Into On-Chain Credit

A structural shift is unfolding as institutional capital moves from observing decentralized finance to embedding directly within protocol architecture. Under #ApollotoBuy90MMORPHOin4Years, Apollo Global Management has committed to acquiring 90 million MORPHO tokens over a 48-month horizon — a move that signals long-term alignment rather than tactical exposure. With approximately $1 trillion in managed assets, Apollo’s scale introduces governance-relevant participation inside a decentralized lending

A structural shift is unfolding as institutional capital moves from observing decentralized finance to embedding directly within protocol architecture. Under #ApollotoBuy90MMORPHOin4Years, Apollo Global Management has committed to acquiring 90 million MORPHO tokens over a 48-month horizon — a move that signals long-term alignment rather than tactical exposure. With approximately $1 trillion in managed assets, Apollo’s scale introduces governance-relevant participation inside a decentralized lending

- Reward

- 5

- 11

- Repost

- Share

Peacefulheart :

:

Buy To Earn 💰️View More

#RussiaStudiesNationalStablecoin RussiaDigitalSettlementStrategy Sovereign Stablecoin Signals Strategic Shift

When reports suggest that Russia is studying a national stablecoin model, the development reflects more than crypto experimentation — it signals potential evolution in monetary and trade infrastructure strategy. The discussion sits at the intersection of geopolitics, sanctions resilience, and blockchain-based settlement systems rather than retail speculation.

1️⃣ Strategic Context: Financial Sovereignty

In recent years, Russia has reduced reliance on U.S.-denominated trade channels, pa

When reports suggest that Russia is studying a national stablecoin model, the development reflects more than crypto experimentation — it signals potential evolution in monetary and trade infrastructure strategy. The discussion sits at the intersection of geopolitics, sanctions resilience, and blockchain-based settlement systems rather than retail speculation.

1️⃣ Strategic Context: Financial Sovereignty

In recent years, Russia has reduced reliance on U.S.-denominated trade channels, pa

- Reward

- 5

- 12

- Repost

- Share

Peacefulheart :

:

Diamond Hands 💎View More

#USSECPushesCryptoReform USDigitalAssetReform Structured Shift Toward Regulatory Clarity

The regulatory narrative in the United States continues to evolve as the U.S. Securities and Exchange Commission advances its digital-asset reform agenda. This is not a sudden policy reversal, but part of a broader modernization effort aimed at clarifying how cryptocurrencies integrate within existing securities law frameworks rather than operating in prolonged legal gray areas.

At the center of the reform push are three pillars: classification, compliance, and market structure. Regulators are working to d

The regulatory narrative in the United States continues to evolve as the U.S. Securities and Exchange Commission advances its digital-asset reform agenda. This is not a sudden policy reversal, but part of a broader modernization effort aimed at clarifying how cryptocurrencies integrate within existing securities law frameworks rather than operating in prolonged legal gray areas.

At the center of the reform push are three pillars: classification, compliance, and market structure. Regulators are working to d

- Reward

- 4

- 11

- Repost

- Share

Peacefulheart :

:

Diamond Hands 💎View More

#HongKongPlansNewVAGuidelines HongKongVAGuidelineExpansion Strengthening Asia’s Regulated Digital Asset Hub

The introduction of updated Virtual Asset guidelines in Hong Kong represents a strategic effort to reinforce its position as a leading global digital finance center. The framework reflects a calibrated approach that advances blockchain innovation while maintaining strict standards for investor protection, operational discipline, and market integrity. Rather than restricting industry development, policymakers are shaping growth within a transparent and structured regulatory architecture.

The introduction of updated Virtual Asset guidelines in Hong Kong represents a strategic effort to reinforce its position as a leading global digital finance center. The framework reflects a calibrated approach that advances blockchain innovation while maintaining strict standards for investor protection, operational discipline, and market integrity. Rather than restricting industry development, policymakers are shaping growth within a transparent and structured regulatory architecture.

- Reward

- 4

- 11

- Repost

- Share

Peacefulheart :

:

Diamond Hands 💎View More

#HongKongPlansNewVAGuidelines HongKongVAFutureFramework Strategic Regulatory Expansion in Digital Finance

The announcement of updated Virtual Asset guidelines in Hong Kong signals a calculated move to reinforce its standing as a global digital finance hub. The framework reflects a dual-track objective: enabling blockchain-driven innovation while strengthening investor safeguards, operational security, and overall market integrity. Rather than limiting development, authorities are channeling growth into a transparent and structured regulatory environment.

Oversight is being advanced under the s

The announcement of updated Virtual Asset guidelines in Hong Kong signals a calculated move to reinforce its standing as a global digital finance hub. The framework reflects a dual-track objective: enabling blockchain-driven innovation while strengthening investor safeguards, operational security, and overall market integrity. Rather than limiting development, authorities are channeling growth into a transparent and structured regulatory environment.

Oversight is being advanced under the s

- Reward

- 5

- 9

- Repost

- Share

Peacefulheart :

:

Diamond Hands 💎View More