#CryptoRegulationNewProgress

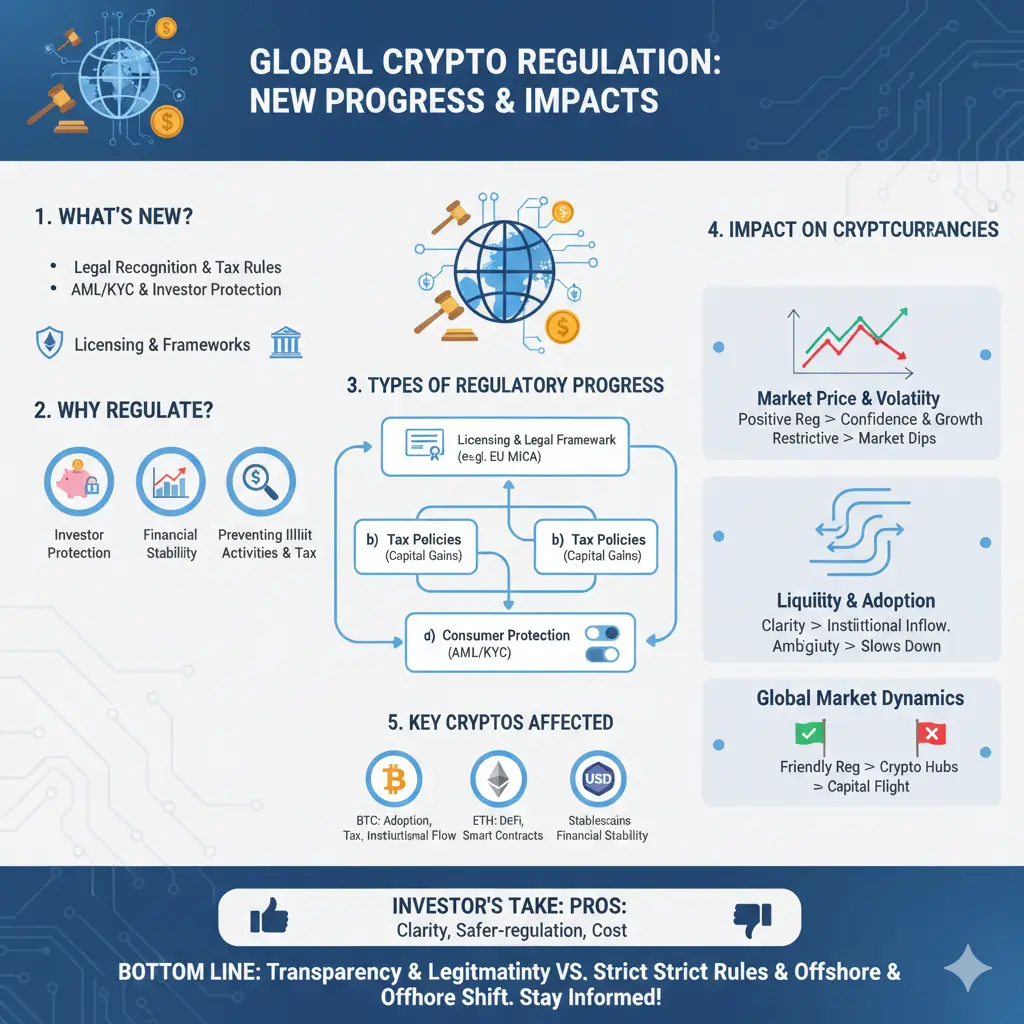

1. What “New Progress in Crypto Regulation” Means

When we say “new progress in cryptocurrency regulation,” it refers to recent steps, policies, or updates by governments, central banks, or regulatory authorities aimed at managing, monitoring, or controlling the crypto market.

These could include:

Formal legal recognition of cryptocurrencies as assets or currencies.

Implementation of taxation rules for crypto profits and transactions.

AML (Anti-Money Laundering) and KYC (Know Your Customer) policies for crypto exchanges.

Restrictions on certain crypto activities like anonymous trading or crypto derivatives.

Licensing requirements for exchanges and crypto service providers.

Essentially, it reflects how governments are trying to create a safer, more transparent, and legally compliant crypto ecosystem.

2. Why Governments Regulate Cryptocurrencies

Governments and regulators focus on crypto because:

Investor Protection – Crypto markets are highly volatile. Regulation aims to prevent fraud, scams, and market manipulation.

Financial Stability – Large-scale crypto adoption can affect traditional banking and monetary systems. Regulation helps reduce systemic risk.

Tax Revenue – Crypto trading and mining generate profits; governments want clear tax rules.

Preventing Illegal Activities – Cryptocurrencies can be used for money laundering, terrorist financing, or illicit trade.

Market Transparency – Regulation ensures exchanges and crypto platforms report data accurately, preventing fake volumes and wash trading.

3. Types of Regulatory Progress

Recent progress in crypto regulation can be classified as:

a) Licensing & Legal Framework

Many countries are now requiring crypto exchanges to obtain licenses to operate legally.

Examples: U.S. SEC and CFTC overseeing securities tokens; Europe’s MiCA (Markets in Crypto Assets) law providing a legal framework.

Purpose: Protect users and ensure legal accountability.

b) Tax Policies

Governments define taxable crypto income: trading profits, staking rewards, mining, or NFTs.

Some countries introduce capital gains tax for crypto trading.

Clear rules reduce legal confusion and help market legitimacy.

c) Consumer Protection

Rules for disclosure of risks to investors.

Exchanges must implement strong KYC & AML measures.

This limits fraud and scams, and encourages trust in crypto platforms.

d) Trading & Market Restrictions

Some countries ban anonymous wallets or certain derivatives (futures, options) to reduce risk.

Example: China banned crypto trading in 2021, while countries like Singapore provide controlled frameworks.

e) Innovation Encouragement

Some regulations aim to support blockchain innovation while maintaining oversight.

For example, regulatory sandboxes allow startups to test crypto solutions legally.

4. Impact on Cryptocurrencies

Regulation affects crypto in several ways:

a) Market Price and Volatility

Positive regulation → confidence & price growth (e.g., clear rules in the U.S. or Europe).

Restrictive regulation → market dips (e.g., bans or harsh restrictions in Asia).

b) Liquidity & Trading Volume

Clear regulations attract institutional investors → higher liquidity.

Uncertain or harsh regulations → lower participation, reduced volume.

c) Adoption & Technology Development

Regulatory clarity encourages more businesses, banks, and retail users to adopt crypto.

Ambiguous rules slow down blockchain projects and DeFi adoption.

d) Global Market Dynamics

Countries with friendly regulations often become crypto hubs (e.g., Switzerland, Singapore).

Countries with strict rules may see capital flight to other markets.

5. Examples of Recent Progress

U.S.:

SEC clarifying which tokens are securities.

State-level crypto licenses (e.g., NY BitLicense).

EU:

MiCA law provides Europe-wide legal clarity for crypto issuers and exchanges.

Asia:

Japan regulates crypto exchanges with strict AML/KYC rules.

Singapore allows regulated crypto activities under MAS supervision.

Global Trend:

Governments increasingly balance investor protection with innovation encouragement.

6. Cryptocurrencies Directly Affected

All major cryptocurrencies are affected by regulation, including:

Bitcoin (BTC) – often influenced by adoption, institutional investment, and tax rules.

Ethereum (ETH) – DeFi and smart contract regulations affect its ecosystem.

Stablecoins (USDT, USDC, BUSD) – regulators closely monitor them for financial stability risks.

Altcoins & Tokens – tokens issued via ICOs or DeFi projects may be classified as securities.

Market effects: Regulatory clarity generally stabilizes prices and boosts long-term adoption, while restrictive or sudden regulations can trigger short-term price drops and panic selling.

7. Investor Perspective

Pros: Legal clarity, safer trading, easier access for institutional money.

Cons: Over-regulation may limit some innovations or increase compliance costs.

Investors must track regulatory announcements closely, as they directly impact strategy, portfolio allocation, and market timing.

8. Conclusion

“New Progress in Cryptocurrency Regulation” is a major milestone in the evolution of digital assets. It brings transparency, security, and legitimacy to the crypto market, attracting more investors while reducing risks.

Positive outcome: More trust, institutional inflows, and global adoption.

Potential risk: Overly strict rules can temporarily depress markets, limit innovation, or shift activity offshore.

Investors, developers, and businesses should stay informed and adapt to regulatory updates to benefit from crypto’s long-term growth.

1. What “New Progress in Crypto Regulation” Means

When we say “new progress in cryptocurrency regulation,” it refers to recent steps, policies, or updates by governments, central banks, or regulatory authorities aimed at managing, monitoring, or controlling the crypto market.

These could include:

Formal legal recognition of cryptocurrencies as assets or currencies.

Implementation of taxation rules for crypto profits and transactions.

AML (Anti-Money Laundering) and KYC (Know Your Customer) policies for crypto exchanges.

Restrictions on certain crypto activities like anonymous trading or crypto derivatives.

Licensing requirements for exchanges and crypto service providers.

Essentially, it reflects how governments are trying to create a safer, more transparent, and legally compliant crypto ecosystem.

2. Why Governments Regulate Cryptocurrencies

Governments and regulators focus on crypto because:

Investor Protection – Crypto markets are highly volatile. Regulation aims to prevent fraud, scams, and market manipulation.

Financial Stability – Large-scale crypto adoption can affect traditional banking and monetary systems. Regulation helps reduce systemic risk.

Tax Revenue – Crypto trading and mining generate profits; governments want clear tax rules.

Preventing Illegal Activities – Cryptocurrencies can be used for money laundering, terrorist financing, or illicit trade.

Market Transparency – Regulation ensures exchanges and crypto platforms report data accurately, preventing fake volumes and wash trading.

3. Types of Regulatory Progress

Recent progress in crypto regulation can be classified as:

a) Licensing & Legal Framework

Many countries are now requiring crypto exchanges to obtain licenses to operate legally.

Examples: U.S. SEC and CFTC overseeing securities tokens; Europe’s MiCA (Markets in Crypto Assets) law providing a legal framework.

Purpose: Protect users and ensure legal accountability.

b) Tax Policies

Governments define taxable crypto income: trading profits, staking rewards, mining, or NFTs.

Some countries introduce capital gains tax for crypto trading.

Clear rules reduce legal confusion and help market legitimacy.

c) Consumer Protection

Rules for disclosure of risks to investors.

Exchanges must implement strong KYC & AML measures.

This limits fraud and scams, and encourages trust in crypto platforms.

d) Trading & Market Restrictions

Some countries ban anonymous wallets or certain derivatives (futures, options) to reduce risk.

Example: China banned crypto trading in 2021, while countries like Singapore provide controlled frameworks.

e) Innovation Encouragement

Some regulations aim to support blockchain innovation while maintaining oversight.

For example, regulatory sandboxes allow startups to test crypto solutions legally.

4. Impact on Cryptocurrencies

Regulation affects crypto in several ways:

a) Market Price and Volatility

Positive regulation → confidence & price growth (e.g., clear rules in the U.S. or Europe).

Restrictive regulation → market dips (e.g., bans or harsh restrictions in Asia).

b) Liquidity & Trading Volume

Clear regulations attract institutional investors → higher liquidity.

Uncertain or harsh regulations → lower participation, reduced volume.

c) Adoption & Technology Development

Regulatory clarity encourages more businesses, banks, and retail users to adopt crypto.

Ambiguous rules slow down blockchain projects and DeFi adoption.

d) Global Market Dynamics

Countries with friendly regulations often become crypto hubs (e.g., Switzerland, Singapore).

Countries with strict rules may see capital flight to other markets.

5. Examples of Recent Progress

U.S.:

SEC clarifying which tokens are securities.

State-level crypto licenses (e.g., NY BitLicense).

EU:

MiCA law provides Europe-wide legal clarity for crypto issuers and exchanges.

Asia:

Japan regulates crypto exchanges with strict AML/KYC rules.

Singapore allows regulated crypto activities under MAS supervision.

Global Trend:

Governments increasingly balance investor protection with innovation encouragement.

6. Cryptocurrencies Directly Affected

All major cryptocurrencies are affected by regulation, including:

Bitcoin (BTC) – often influenced by adoption, institutional investment, and tax rules.

Ethereum (ETH) – DeFi and smart contract regulations affect its ecosystem.

Stablecoins (USDT, USDC, BUSD) – regulators closely monitor them for financial stability risks.

Altcoins & Tokens – tokens issued via ICOs or DeFi projects may be classified as securities.

Market effects: Regulatory clarity generally stabilizes prices and boosts long-term adoption, while restrictive or sudden regulations can trigger short-term price drops and panic selling.

7. Investor Perspective

Pros: Legal clarity, safer trading, easier access for institutional money.

Cons: Over-regulation may limit some innovations or increase compliance costs.

Investors must track regulatory announcements closely, as they directly impact strategy, portfolio allocation, and market timing.

8. Conclusion

“New Progress in Cryptocurrency Regulation” is a major milestone in the evolution of digital assets. It brings transparency, security, and legitimacy to the crypto market, attracting more investors while reducing risks.

Positive outcome: More trust, institutional inflows, and global adoption.

Potential risk: Overly strict rules can temporarily depress markets, limit innovation, or shift activity offshore.

Investors, developers, and businesses should stay informed and adapt to regulatory updates to benefit from crypto’s long-term growth.