# StrategyBitcoinPositionTurnsRed

13.59K

Major BTC-holding companies like Strategy now show unrealized losses amid recent price drops. Do you think this will change institutional accumulation strategies?

HighAmbition

#StrategyBitcoinPositionTurnsRed

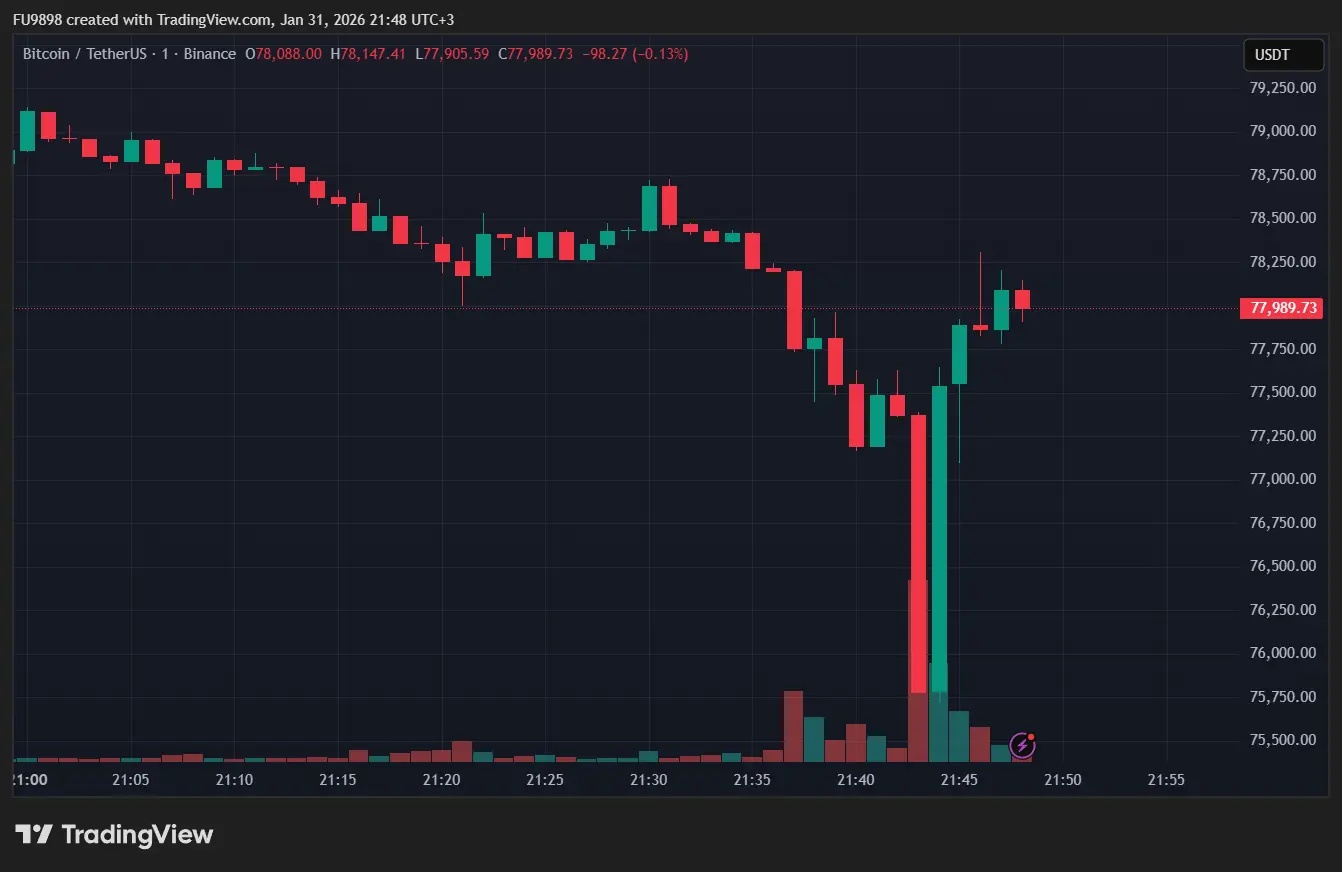

The crypto market has delivered another reality check. Bitcoin’s sharp pullback in early February briefly pushed prices below $76,000, officially turning Strategy Inc.’s massive Bitcoin position red for the first time in years.

2/

Bitcoin dipped as low as $72,900–$73,000, its weakest level since November 2024. This move pushed BTC below Strategy’s average cost basis of ~$76,052 per BTC, placing the entire position underwater—at least temporarily.

3/

Bitcoin has since stabilized around $75,900–$76,000, hovering near that critical cost basis zone and trading ~3–

The crypto market has delivered another reality check. Bitcoin’s sharp pullback in early February briefly pushed prices below $76,000, officially turning Strategy Inc.’s massive Bitcoin position red for the first time in years.

2/

Bitcoin dipped as low as $72,900–$73,000, its weakest level since November 2024. This move pushed BTC below Strategy’s average cost basis of ~$76,052 per BTC, placing the entire position underwater—at least temporarily.

3/

Bitcoin has since stabilized around $75,900–$76,000, hovering near that critical cost basis zone and trading ~3–

BTC-3,24%

- Reward

- 4

- 7

- Repost

- Share

MingDragonX :

:

2026 GOGOGO 👊View More

#StrategyBitcoinPositionTurnsRed StrategyBitcoinPositionTurnsRed Institutional BTC Faces a Stress Test

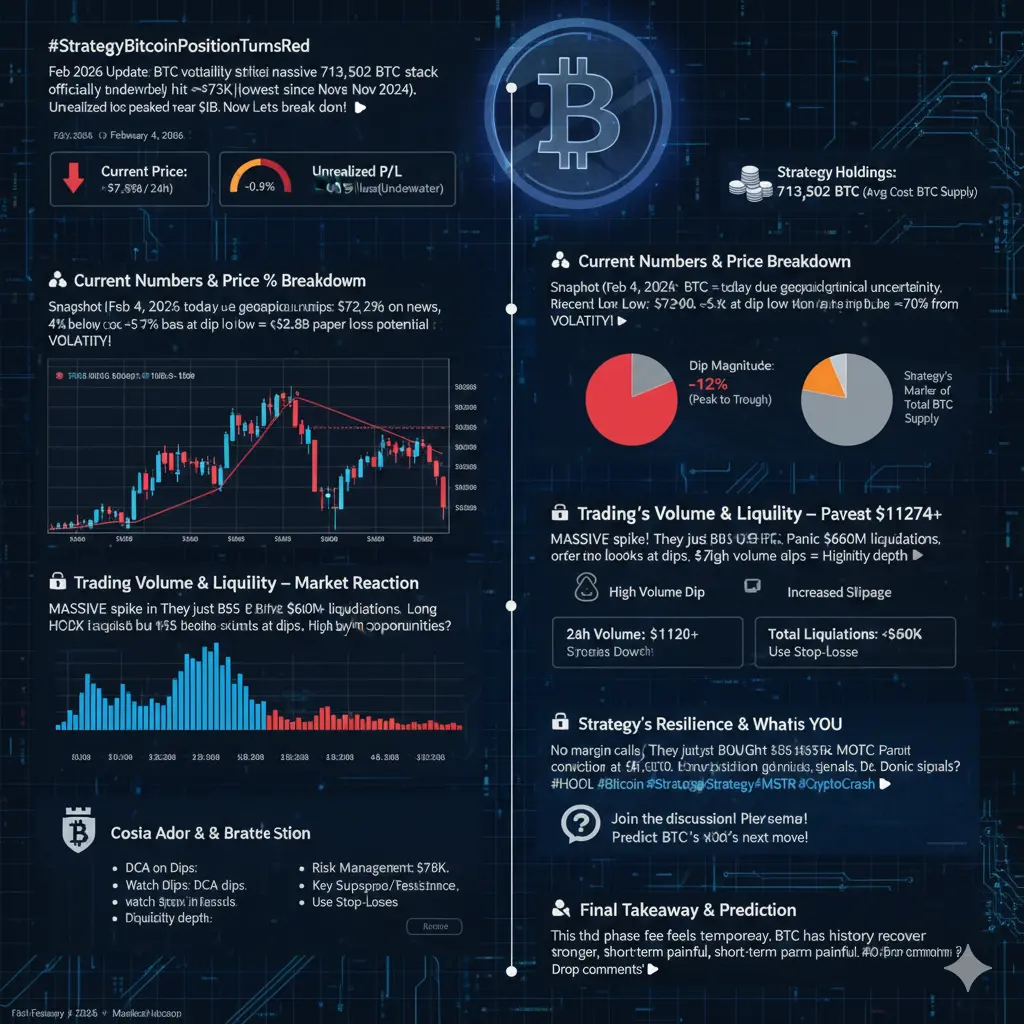

Bitcoin has slipped into a critical zone where even the strongest institutional holders are feeling pressure. With BTC trading between $74,500 and $75,500, Strategy’s average acquisition cost of $76,052 has moved the position into unrealized loss territory. Holding approximately 713,502 BTC with a total cost basis near $54.2B, the market value has now fallen below the acquisition floor, marking a notable psychological and strategic moment.

The immediate trigger behind BTC falling below Strate

Bitcoin has slipped into a critical zone where even the strongest institutional holders are feeling pressure. With BTC trading between $74,500 and $75,500, Strategy’s average acquisition cost of $76,052 has moved the position into unrealized loss territory. Holding approximately 713,502 BTC with a total cost basis near $54.2B, the market value has now fallen below the acquisition floor, marking a notable psychological and strategic moment.

The immediate trigger behind BTC falling below Strate

BTC-3,24%

- Reward

- 1

- 1

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊#StrategyBitcoinPositionTurnsRed Bitcoin’s early-February pullback has quietly marked a rare moment in this cycle: Strategy Inc.’s enormous Bitcoin position briefly turning red. This is less about one company’s PnL and more about what happens when price collides with a widely known institutional cost basis. The market tends to react differently when such reference levels are tested, because psychology, liquidity, and positioning all converge in one narrow zone.

The dip below the mid-$76K area exposed how fragile short-term confidence still is. Once BTC lost that level, selling pressure acceler

The dip below the mid-$76K area exposed how fragile short-term confidence still is. Once BTC lost that level, selling pressure acceler

BTC-3,24%

- Reward

- 3

- 4

- Repost

- Share

LittleQueen :

:

Buy To Earn 💎View More

#StrategyBitcoinPositionTurnsRed

What It Really Means for Bitcoin — Beyond the Headlines

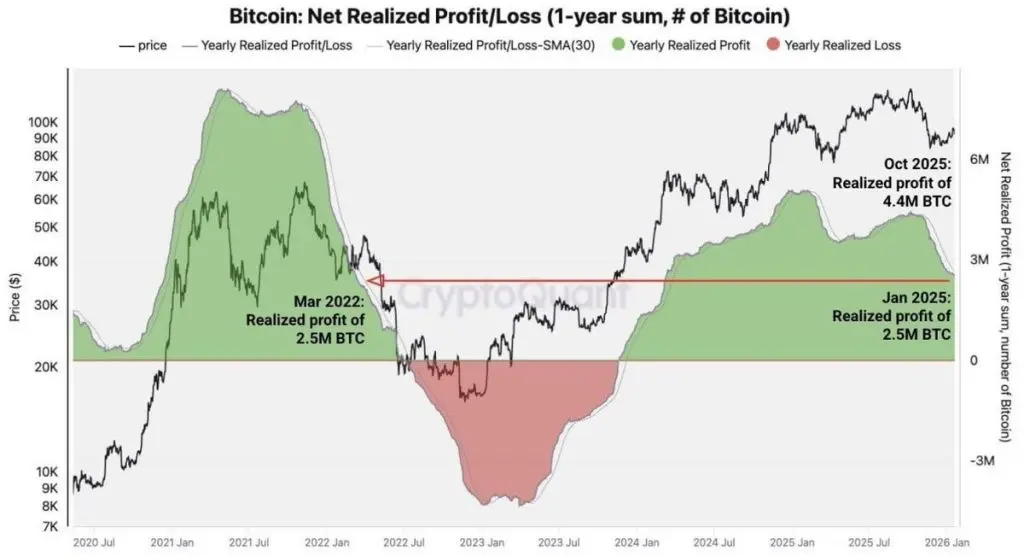

The news that Strategy’s (formerly MicroStrategy) Bitcoin position has turned “red” is being framed as bearish. In reality, this moment says more about market structure and cycle psychology than about Bitcoin’s long-term weakness.

Let’s break it down properly.

1️⃣ What “Turns Red” Actually Means

Strategy holds Bitcoin with a high average entry price accumulated over multiple cycles. When BTC trades below that average cost:

The position shows unrealized losses

There is no forced selling

There is no liquida

What It Really Means for Bitcoin — Beyond the Headlines

The news that Strategy’s (formerly MicroStrategy) Bitcoin position has turned “red” is being framed as bearish. In reality, this moment says more about market structure and cycle psychology than about Bitcoin’s long-term weakness.

Let’s break it down properly.

1️⃣ What “Turns Red” Actually Means

Strategy holds Bitcoin with a high average entry price accumulated over multiple cycles. When BTC trades below that average cost:

The position shows unrealized losses

There is no forced selling

There is no liquida

BTC-3,24%

- Reward

- 4

- 5

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#StrategyBitcoinPositionTurnsRed

Strategy Bitcoin Position Turns Red: A Defining Moment for Institutional Crypto Playbooks

The recent decline in Bitcoin has pushed several of the largest corporate holders into unrealized losses, marking one of the most important stress tests for institutional crypto adoption to date. For years, companies such as Strategy (formerly MicroStrategy) became symbols of conviction, promoting Bitcoin as a superior treasury reserve asset and accumulating aggressively regardless of short-term volatility. Now, with market prices sitting well below many of their average

Strategy Bitcoin Position Turns Red: A Defining Moment for Institutional Crypto Playbooks

The recent decline in Bitcoin has pushed several of the largest corporate holders into unrealized losses, marking one of the most important stress tests for institutional crypto adoption to date. For years, companies such as Strategy (formerly MicroStrategy) became symbols of conviction, promoting Bitcoin as a superior treasury reserve asset and accumulating aggressively regardless of short-term volatility. Now, with market prices sitting well below many of their average

BTC-3,24%

- Reward

- 1

- 5

- Repost

- Share

Yusfirah :

:

HODL Tight 💪View More

#StrategyBitcoinPositionTurnsRed Institutional BTC Moves, Market Sentiment & Opportunities (Feb 3, 2026)

Strategy Inc.’s temporary red position in Bitcoin is more than just a headline—it’s a psychological and structural milestone in the evolution of institutional crypto investing. The brief unrealized losses reminded markets of the volatility inherent in large BTC holdings, even for corporates with strong conviction. While the position lasted only days, the event triggered sentiment swings, retail chatter, and renewed focus on leverage and positioning.

The trigger was straightforward: BTC brie

Strategy Inc.’s temporary red position in Bitcoin is more than just a headline—it’s a psychological and structural milestone in the evolution of institutional crypto investing. The brief unrealized losses reminded markets of the volatility inherent in large BTC holdings, even for corporates with strong conviction. While the position lasted only days, the event triggered sentiment swings, retail chatter, and renewed focus on leverage and positioning.

The trigger was straightforward: BTC brie

BTC-3,24%

- Reward

- like

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed #StrategyBitcoinPositionTurnsRed

Let’s kill a dangerous lie first:

A red Bitcoin position is not failure.

Staying red because you refused to decide is.

When BTC turns against you, there are only three professional responses — everything else is emotional gambling.

1️⃣ Cut fast if the thesis breaks

If your entry was based on structure and that structure is gone, staying in is stupidity dressed as patience.

Markets don’t reward loyalty — they reward accuracy.

2️⃣ Hold only if invalidation is untouched

Red PnL doesn’t matter.

Broken logic does.

If your invalidatio

Let’s kill a dangerous lie first:

A red Bitcoin position is not failure.

Staying red because you refused to decide is.

When BTC turns against you, there are only three professional responses — everything else is emotional gambling.

1️⃣ Cut fast if the thesis breaks

If your entry was based on structure and that structure is gone, staying in is stupidity dressed as patience.

Markets don’t reward loyalty — they reward accuracy.

2️⃣ Hold only if invalidation is untouched

Red PnL doesn’t matter.

Broken logic does.

If your invalidatio

BTC-3,24%

- Reward

- 1

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

Strategy Bitcoin Position Turns Red – Comprehensive Market Analysis (Feb 3, 2026)

The recent event of Strategy Inc. (formerly MicroStrategy, ticker: MSTR) temporarily seeing its massive BTC holdings move into unrealized losses (“red” on paper) has become a significant milestone in the Bitcoin and institutional investing landscape. Led by Executive Chairman Michael Saylor, this occurrence triggered sharp sentiment swings, debates, and FUD across crypto communities, X, finance forums, and trading desks.

1️⃣ Exact Trigger & Current Status

BTC Holdings: 713,502 BT

Strategy Bitcoin Position Turns Red – Comprehensive Market Analysis (Feb 3, 2026)

The recent event of Strategy Inc. (formerly MicroStrategy, ticker: MSTR) temporarily seeing its massive BTC holdings move into unrealized losses (“red” on paper) has become a significant milestone in the Bitcoin and institutional investing landscape. Led by Executive Chairman Michael Saylor, this occurrence triggered sharp sentiment swings, debates, and FUD across crypto communities, X, finance forums, and trading desks.

1️⃣ Exact Trigger & Current Status

BTC Holdings: 713,502 BT

BTC-3,24%

- Reward

- 1

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

Strategy Bitcoin Position Turns Red – Comprehensive Market Analysis (Feb 3, 2026)

The recent event of Strategy Inc. (formerly MicroStrategy, ticker: MSTR) temporarily seeing its massive BTC holdings move into unrealized losses (“red” on paper) has become a significant milestone in the Bitcoin and institutional investing landscape. Led by Executive Chairman Michael Saylor, this occurrence triggered sharp sentiment swings, debates, and FUD across crypto communities, X, finance forums, and trading desks.

1️⃣ Exact Trigger & Current Status

BTC Holdings: 713,502 BT

Strategy Bitcoin Position Turns Red – Comprehensive Market Analysis (Feb 3, 2026)

The recent event of Strategy Inc. (formerly MicroStrategy, ticker: MSTR) temporarily seeing its massive BTC holdings move into unrealized losses (“red” on paper) has become a significant milestone in the Bitcoin and institutional investing landscape. Led by Executive Chairman Michael Saylor, this occurrence triggered sharp sentiment swings, debates, and FUD across crypto communities, X, finance forums, and trading desks.

1️⃣ Exact Trigger & Current Status

BTC Holdings: 713,502 BT

BTC-3,24%

- Reward

- 1

- Comment

- Repost

- Share

#StrategyBitcoinPositionTurnsRed

#StrategyBitcoinPositionTurnsRed

Bitcoin’s recent price action has triggered a significant shift in trader sentiment, with many strategies now showing red positions. After holding support around $77,000–$78,000 for several weeks, BTC experienced a pullback that tested critical demand zones. This move has exposed vulnerabilities in both short-term momentum trades and leveraged positions, signaling that traders may need to reassess their risk and positioning strategies.

The immediate support for Bitcoin currently sits around $74,000–$75,000. This zone has histor

#StrategyBitcoinPositionTurnsRed

Bitcoin’s recent price action has triggered a significant shift in trader sentiment, with many strategies now showing red positions. After holding support around $77,000–$78,000 for several weeks, BTC experienced a pullback that tested critical demand zones. This move has exposed vulnerabilities in both short-term momentum trades and leveraged positions, signaling that traders may need to reassess their risk and positioning strategies.

The immediate support for Bitcoin currently sits around $74,000–$75,000. This zone has histor

BTC-3,24%

- Reward

- 7

- 8

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

20.94K Popularity

13.59K Popularity

6.89K Popularity

998 Popularity

5.56K Popularity

6.82K Popularity

19.39K Popularity

16.21K Popularity

13.88K Popularity

15.61K Popularity

12.34K Popularity

2.92K Popularity

1.24K Popularity

31.13K Popularity

225.61K Popularity

News

View More"Strategy Opponent" whale increases position to open long, ETH long position valued at $52 million

3 m

Matrixdock releases 2026 Outlook, outlining the development path of the Reserve Layer

4 m

OG (OG Fan Token) increased by 23.53% in the past 24 hours

6 m

Data: 241.08 BTC transferred from an anonymous address, then routed through intermediaries before flowing into FalconX.

9 m

CHESS (Tranchess) 24-hour increase of 25.09%

15 m

Pin