#SOLPriceAnalysis 🚀

Solana (SOL) Update – Strong Fundamentals, Caution on Technicals

Solana continues to command attention in the crypto space, combining technological innovation, institutional interest, and retail enthusiasm. SOL has maintained an uptrend, approaching key resistance levels, but technical indicators signal caution for a potential short-term pullback.

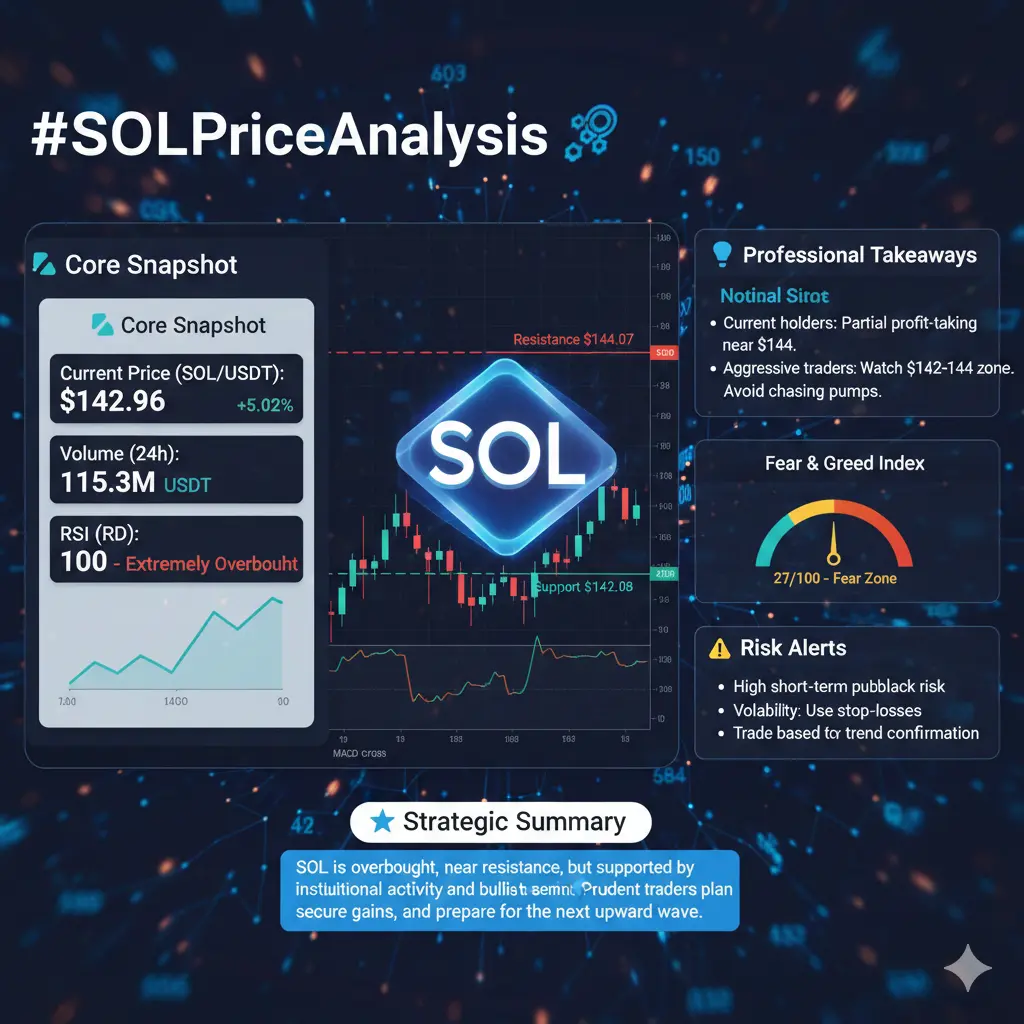

📊 Core Snapshot

Current Price (SOL/USDT): $142.96

24h Change: +5.02% (Day change: +2.33%)

Volume (24h): 824,852 SOL / 115,328,921 USDT

High–Low (24h): $144.37 – $135.88

Support/Resistance: Support at $142.08, Resistance at $144.07

RSI (1D): 100 – Extremely Overbought

MACD: Weakening momentum / dead cross on short-term charts

Fear & Greed Index: 27/100 – “Fear” zone

📈 Technical Analysis

SOL is nearing $144 USDT resistance, showing bullish momentum in short-term charts (hourly MA5/10/20/50).

Daily RSI = 100 indicates an overbought market and high probability of a short-term pullback.

MACD on 15-min charts signals weakening buying strength.

Social sentiment remains bullish: 81 bullish vs 15 bearish, backed by whales and institutional positioning (possible Solana ETF applications).

Upcoming token unlocks: Over $16.9B in SOL and other tokens could create short-term supply pressure.

📌 Volume Insight

While prices are rising, 24h volume is slightly below average, indicating careful accumulation rather than aggressive buying.

💡 Professional Takeaways

Current holders: Consider partial profit-taking near $144 resistance.

Aggressive traders: Watch $142–$144 USDT zone for breakout or pullback entries; keep tight stop-losses.

Avoid chasing pumps in an overheated market. Let consolidation or minor corrections create safer entry points.

⚠️ Risk Alerts

High short-term pullback risk due to extreme RSI, proximity to resistance, and upcoming token unlocks.

Volatility: Use stop-losses and manage position sizes carefully.

Market sentiment in “Fear” zone – trade based on trend confirmation, not emotion.

🌟 Strategic Summary

Solana remains a top Layer-1 blockchain with strong fundamentals, growing adoption, and a highly active community. Short-term technicals call for caution, but long-term potential stays robust. Traders should balance profit-taking, risk management, and trend confirmation to navigate near-term volatility.

✨ Key Takeaway:

SOL is overbought, near resistance, but supported by institutional activity and bullish sentiment. Prudent traders can plan entries, secure gains, and prepare for the next upward wave, while respecting the high-risk short-term environment.

#SOLPriceAnalysis #SolanaUpdate #CryptoTrading #Layer1Blockchain

Solana (SOL) Update – Strong Fundamentals, Caution on Technicals

Solana continues to command attention in the crypto space, combining technological innovation, institutional interest, and retail enthusiasm. SOL has maintained an uptrend, approaching key resistance levels, but technical indicators signal caution for a potential short-term pullback.

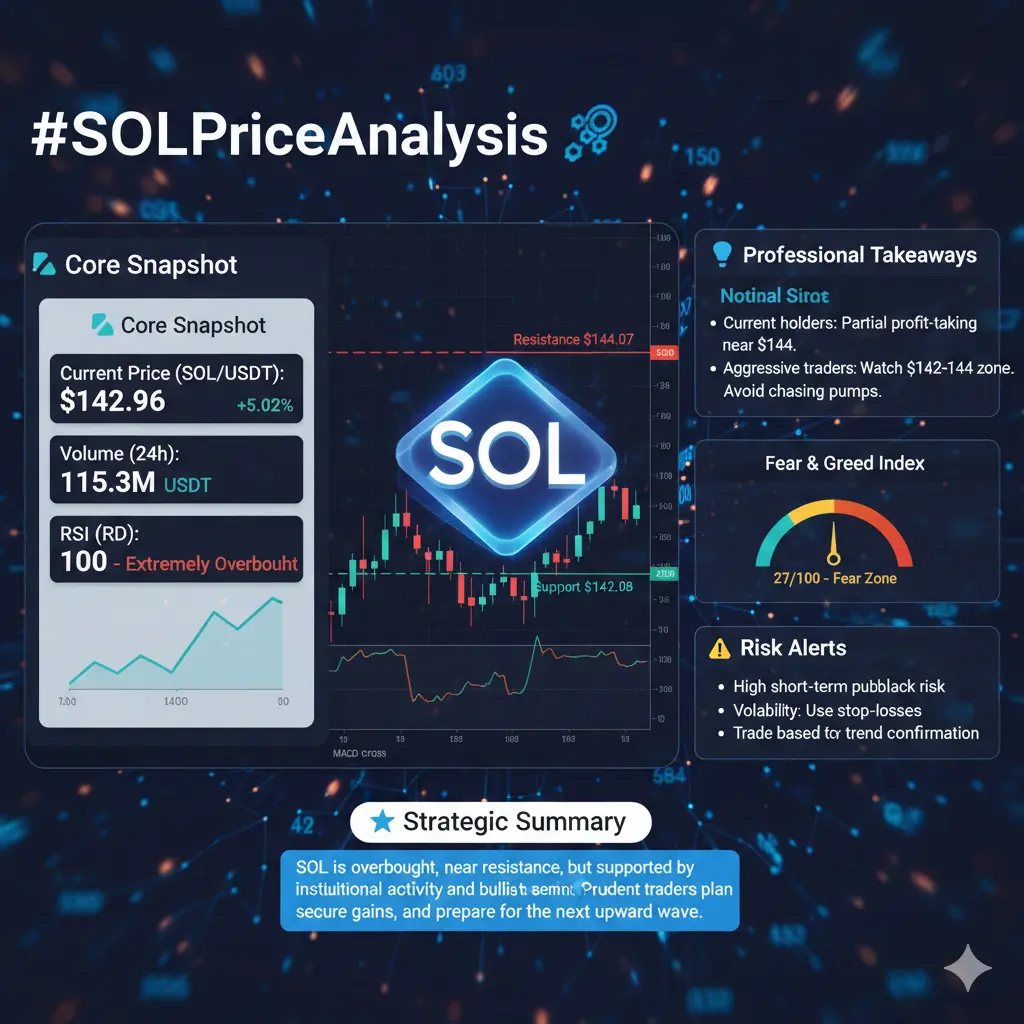

📊 Core Snapshot

Current Price (SOL/USDT): $142.96

24h Change: +5.02% (Day change: +2.33%)

Volume (24h): 824,852 SOL / 115,328,921 USDT

High–Low (24h): $144.37 – $135.88

Support/Resistance: Support at $142.08, Resistance at $144.07

RSI (1D): 100 – Extremely Overbought

MACD: Weakening momentum / dead cross on short-term charts

Fear & Greed Index: 27/100 – “Fear” zone

📈 Technical Analysis

SOL is nearing $144 USDT resistance, showing bullish momentum in short-term charts (hourly MA5/10/20/50).

Daily RSI = 100 indicates an overbought market and high probability of a short-term pullback.

MACD on 15-min charts signals weakening buying strength.

Social sentiment remains bullish: 81 bullish vs 15 bearish, backed by whales and institutional positioning (possible Solana ETF applications).

Upcoming token unlocks: Over $16.9B in SOL and other tokens could create short-term supply pressure.

📌 Volume Insight

While prices are rising, 24h volume is slightly below average, indicating careful accumulation rather than aggressive buying.

💡 Professional Takeaways

Current holders: Consider partial profit-taking near $144 resistance.

Aggressive traders: Watch $142–$144 USDT zone for breakout or pullback entries; keep tight stop-losses.

Avoid chasing pumps in an overheated market. Let consolidation or minor corrections create safer entry points.

⚠️ Risk Alerts

High short-term pullback risk due to extreme RSI, proximity to resistance, and upcoming token unlocks.

Volatility: Use stop-losses and manage position sizes carefully.

Market sentiment in “Fear” zone – trade based on trend confirmation, not emotion.

🌟 Strategic Summary

Solana remains a top Layer-1 blockchain with strong fundamentals, growing adoption, and a highly active community. Short-term technicals call for caution, but long-term potential stays robust. Traders should balance profit-taking, risk management, and trend confirmation to navigate near-term volatility.

✨ Key Takeaway:

SOL is overbought, near resistance, but supported by institutional activity and bullish sentiment. Prudent traders can plan entries, secure gains, and prepare for the next upward wave, while respecting the high-risk short-term environment.

#SOLPriceAnalysis #SolanaUpdate #CryptoTrading #Layer1Blockchain