Beyond Non-Farm Payrolls, what is more worth警惕的是“就业拐点”

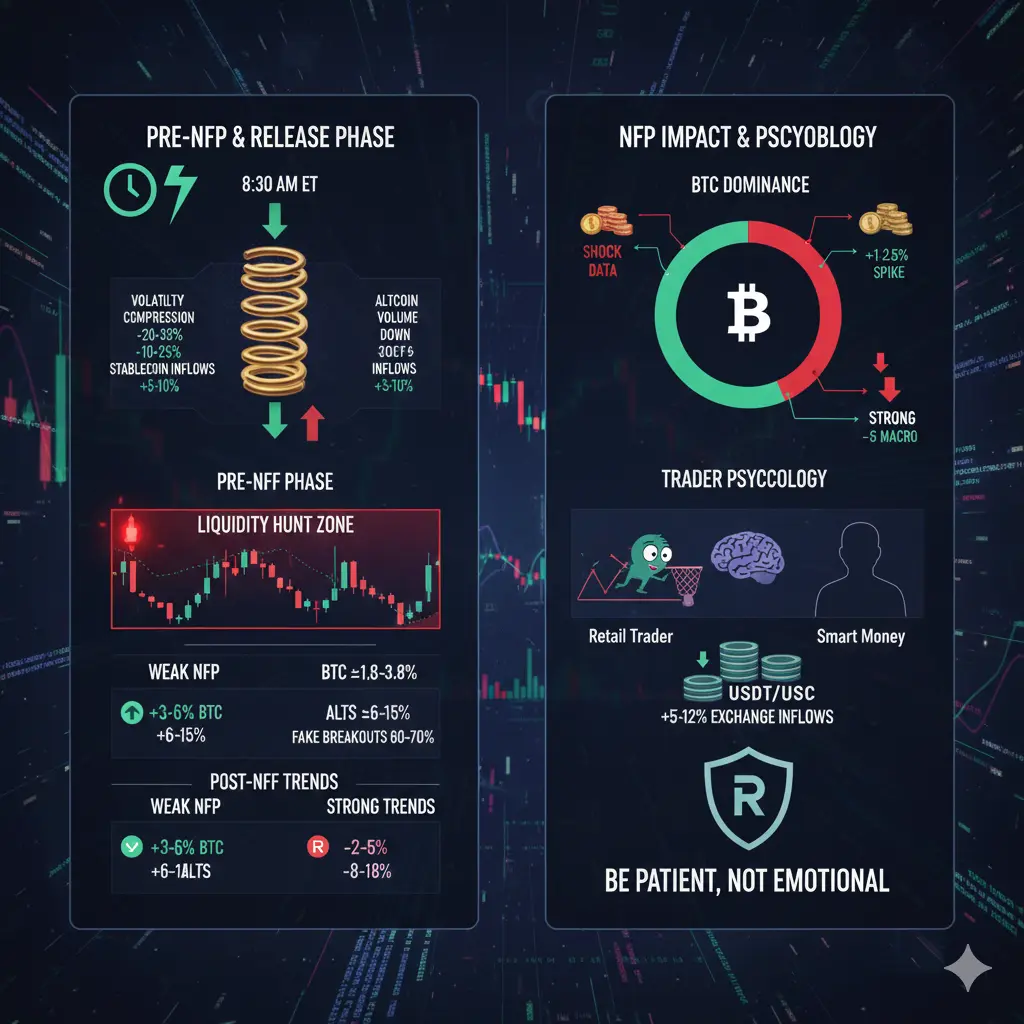

Compared to the single Non-Farm Payrolls report, what investors should be more警惕的是“就业结构性变化带来的“拐点信号”。 Historically, what truly influences the medium- to long-term market trend is not a single employment report falling significantly short of expectations, but rather sustained weakening of employment data over multiple months, accompanied by a synchronized decline in other economic indicators.

For example, when job gains continue to decline, the unemployment rate trends upward, and news of layoffs increases, it often indicates a substantial c

View OriginalCompared to the single Non-Farm Payrolls report, what investors should be more警惕的是“就业结构性变化带来的“拐点信号”。 Historically, what truly influences the medium- to long-term market trend is not a single employment report falling significantly short of expectations, but rather sustained weakening of employment data over multiple months, accompanied by a synchronized decline in other economic indicators.

For example, when job gains continue to decline, the unemployment rate trends upward, and news of layoffs increases, it often indicates a substantial c