# GlobalTechSell-OffHitsRiskAssets

7.67K

HighAmbition

#GlobalTechSell-OffHitsRiskAssets

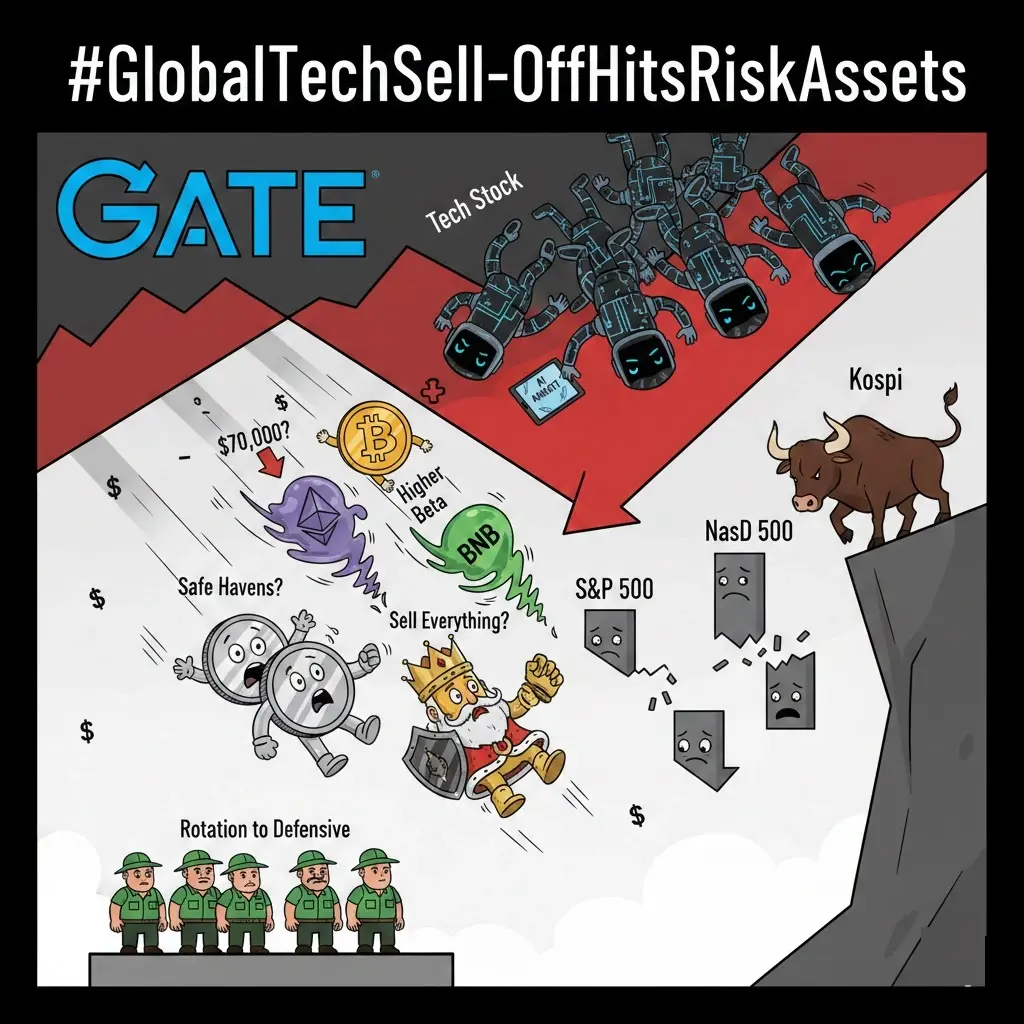

The global tech sell-off in early February 2026 has been brutal and fast-moving, hitting risk assets hard — especially crypto, which is acting like a leveraged version of Nasdaq growth stocks right now. Let's dive deeper into the details, building on the original breakdown with real-time context, exact numbers from recent sessions, and why this feels like a classic risk-off rotation.

The Tech Sector Carnage – Updated Numbers

The Nasdaq Composite has been the epicenter of the pain. From late January into early February:

It dropped sharply mid-week, closing aro

The global tech sell-off in early February 2026 has been brutal and fast-moving, hitting risk assets hard — especially crypto, which is acting like a leveraged version of Nasdaq growth stocks right now. Let's dive deeper into the details, building on the original breakdown with real-time context, exact numbers from recent sessions, and why this feels like a classic risk-off rotation.

The Tech Sector Carnage – Updated Numbers

The Nasdaq Composite has been the epicenter of the pain. From late January into early February:

It dropped sharply mid-week, closing aro

BTC9,38%

- Reward

- 7

- 13

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GlobalTechSell-OffHitsRiskAssets — Crypto in the Crossfire

The recent global tech sell-off isn’t just Nasdaq pain. Its shockwaves are hitting all risk assets, including crypto. Understanding the dynamics is critical for strategic positioning.

📉 Drivers of the Sell-Off

1. Rising Interest Rate Pressure

Growth-oriented, leveraged tech stocks are highly sensitive to rates.

Higher bond yields → future cash flows discounted → valuations decline.

2. Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens: USD, bonds, gold.

Crypto, as a high-beta asset, experiences immediate pressur

The recent global tech sell-off isn’t just Nasdaq pain. Its shockwaves are hitting all risk assets, including crypto. Understanding the dynamics is critical for strategic positioning.

📉 Drivers of the Sell-Off

1. Rising Interest Rate Pressure

Growth-oriented, leveraged tech stocks are highly sensitive to rates.

Higher bond yields → future cash flows discounted → valuations decline.

2. Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens: USD, bonds, gold.

Crypto, as a high-beta asset, experiences immediate pressur

- Reward

- 8

- 9

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

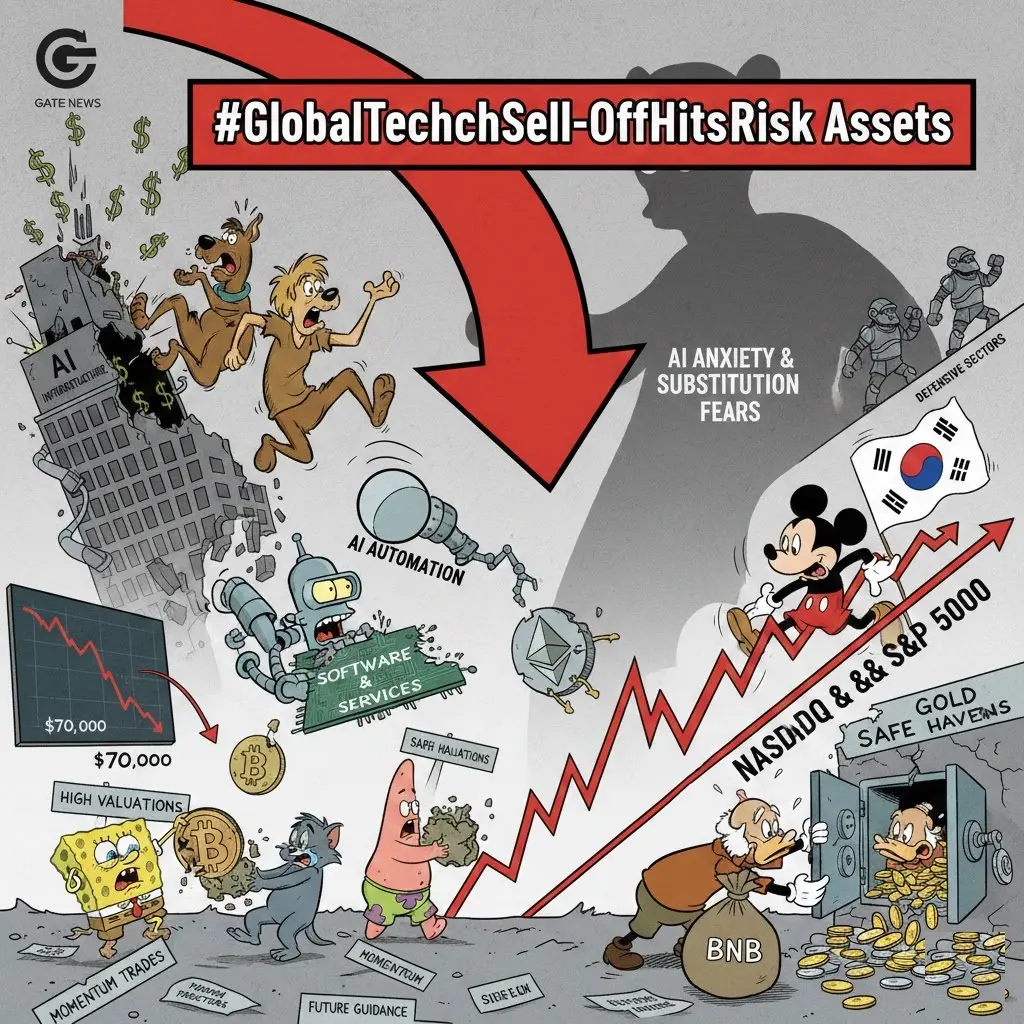

#GlobalTechSell-OffHitsRiskAssets The tech sector trembles, and risk assets bleed. Today, global markets are reeling as tech giants face unprecedented sell-offs—investors are fleeing high-multiple stocks, crypto is feeling the shockwaves, and market sentiment is tipping toward caution. Bitcoin and Ethereum dipped sharply as risk-on appetite faltered, while Nasdaq futures signal ongoing volatility.

Macro signals are screaming: inflation concerns persist, interest rates remain stubborn, and liquidity is tightening. Hedge funds and whales are repositioning aggressively, and retail investors are c

Macro signals are screaming: inflation concerns persist, interest rates remain stubborn, and liquidity is tightening. Hedge funds and whales are repositioning aggressively, and retail investors are c

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Buy To Earn 💎#GlobalTechSell-OffHitsRiskAssets The tech sector trembles, and risk assets bleed. Today, global markets are reeling as tech giants face unprecedented sell-offs—investors are fleeing high-multiple stocks, crypto is feeling the shockwaves, and market sentiment is tipping toward caution. Bitcoin and Ethereum dipped sharply as risk-on appetite faltered, while Nasdaq futures signal ongoing volatility.

Macro signals are screaming: inflation concerns persist, interest rates remain stubborn, and liquidity is tightening. Hedge funds and whales are repositioning aggressively, and retail investors are c

Macro signals are screaming: inflation concerns persist, interest rates remain stubborn, and liquidity is tightening. Hedge funds and whales are repositioning aggressively, and retail investors are c

- Reward

- like

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets

The recent global tech sell-off is more than just Nasdaq pain — it’s sending shockwaves through all risk assets, including crypto. Understanding the mechanics is critical for positioning.

📉 What’s Driving the Sell-Off?

Rising Interest Rate Pressure

Tech stocks, heavily leveraged and growth-oriented, are highly sensitive to rates.

Bond yields rising → future cash flows discounted → tech valuations drop.

Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens (USD, bonds, gold).

Crypto, as a high-beta risk asset, is impacted immediately.

Macro

The recent global tech sell-off is more than just Nasdaq pain — it’s sending shockwaves through all risk assets, including crypto. Understanding the mechanics is critical for positioning.

📉 What’s Driving the Sell-Off?

Rising Interest Rate Pressure

Tech stocks, heavily leveraged and growth-oriented, are highly sensitive to rates.

Bond yields rising → future cash flows discounted → tech valuations drop.

Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens (USD, bonds, gold).

Crypto, as a high-beta risk asset, is impacted immediately.

Macro

- Reward

- 4

- 5

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#GlobalTechSell-OffHitsRiskAssets

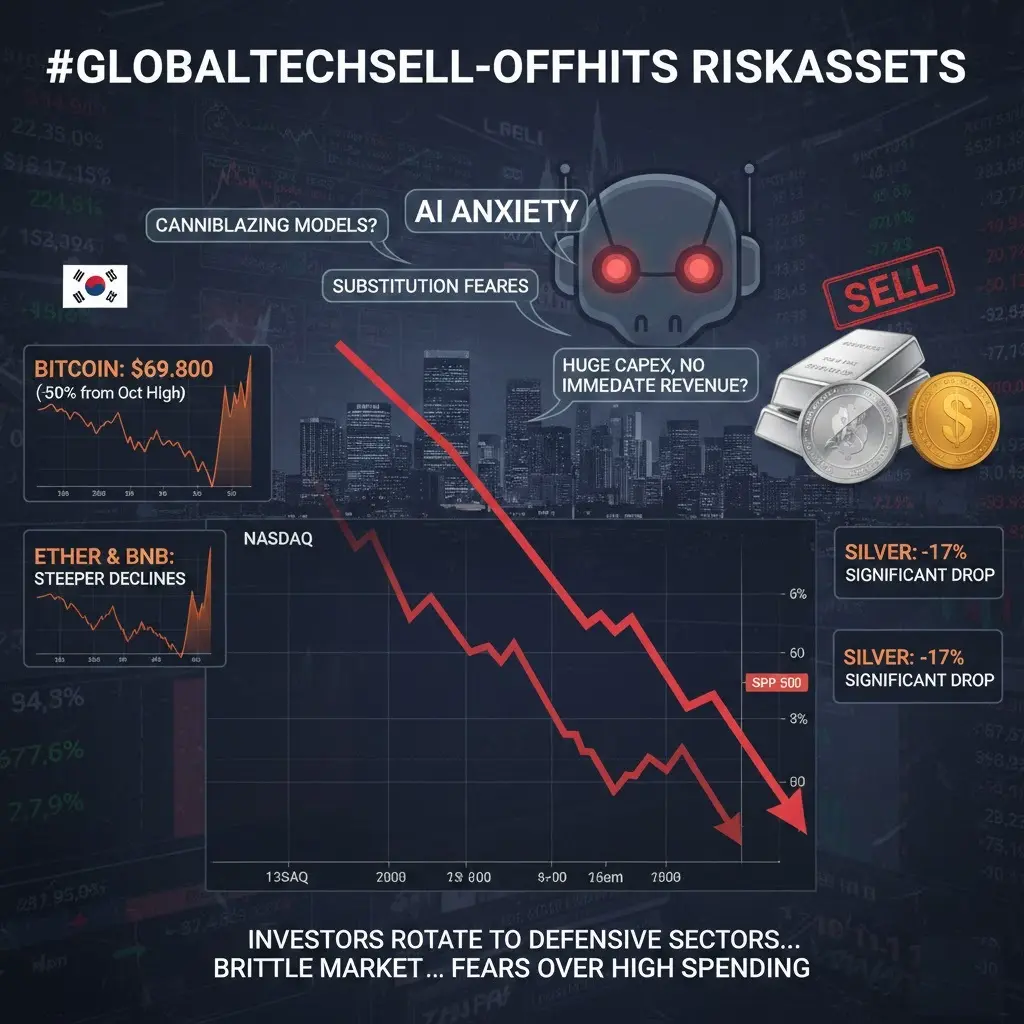

Global markets entered February with a sharp retreat led by technology giants. As investors increasingly question whether the "AI bubble" is reaching its limit, the flight from risky assets has caused deep tremors not only in stock markets but also across the crypto world and commodity markets.

Capex and Spending Concerns Among Tech Titans

At the heart of this turbulence lies the fact that the massive capital expenditures (capex) by giants like Microsoft, Alphabet, and Amazon for AI infrastructure are now perceived as a "risk" by investors. Despite billions o

Global markets entered February with a sharp retreat led by technology giants. As investors increasingly question whether the "AI bubble" is reaching its limit, the flight from risky assets has caused deep tremors not only in stock markets but also across the crypto world and commodity markets.

Capex and Spending Concerns Among Tech Titans

At the heart of this turbulence lies the fact that the massive capital expenditures (capex) by giants like Microsoft, Alphabet, and Amazon for AI infrastructure are now perceived as a "risk" by investors. Despite billions o

- Reward

- 5

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#GlobalTechSell-OffHitsRiskAssets GlobalTechSell-OffHitsRiskAssets—CryptoInTheCrossfire

The recent global tech sell-off isn’t just Nasdaq pain its shockwaves are hitting all risk assets including crypto understanding these dynamics is critical for strategic positioning

📉DriversOfTheSell-Off rising interest rate pressure growth-oriented and leveraged tech stocks are highly sensitive to rates higher bond yields lead to heavier discounting of future cash flows pushing valuations lower risk-off sentiment spreads as investors rotate from equities into safe havens like USD bonds and gold crypto as

The recent global tech sell-off isn’t just Nasdaq pain its shockwaves are hitting all risk assets including crypto understanding these dynamics is critical for strategic positioning

📉DriversOfTheSell-Off rising interest rate pressure growth-oriented and leveraged tech stocks are highly sensitive to rates higher bond yields lead to heavier discounting of future cash flows pushing valuations lower risk-off sentiment spreads as investors rotate from equities into safe havens like USD bonds and gold crypto as

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊#GlobalTechSell-OffHitsRiskAssets

Global markets are experiencing a broad risk-off event, driven by a sell-off in major technology sectors. When tech stocks correct sharply, it often triggers capital flight from risk assets, including crypto. This macro pressure has led to increased volatility, rapid price swings, and stress tests across markets.

Here’s a thorough breakdown of what’s happening, why it matters, and how I’m approaching it as a Gate user — Repanzal.

Recent Market Reality Check

In recent sessions:

Equities, especially tech stocks, have pulled back significantly, leading to wider

Global markets are experiencing a broad risk-off event, driven by a sell-off in major technology sectors. When tech stocks correct sharply, it often triggers capital flight from risk assets, including crypto. This macro pressure has led to increased volatility, rapid price swings, and stress tests across markets.

Here’s a thorough breakdown of what’s happening, why it matters, and how I’m approaching it as a Gate user — Repanzal.

Recent Market Reality Check

In recent sessions:

Equities, especially tech stocks, have pulled back significantly, leading to wider

- Reward

- 6

- 8

- Repost

- Share

Yusfirah :

:

HODL Tight 💪View More

#GlobalTechSell-OffHitsRiskAssets

#GlobalTechSell-OffHitsRiskAssets

describes a broad market downturn in which technology shares, cryptocurrencies like Bitcoin, and other risk-oriented assets have sold off sharply — reflecting investor fears and macroeconomic risk aversion.

The sell-off has been global and synchronized, impacting markets across the United States, Europe, Asia, and crypto exchanges. Major equity indexes such as the S&P 500, Nasdaq, and global MSCI benchmarks have slid as investors cut positions in high-growth tech names. This weakness has also spilled over into risk assets li

#GlobalTechSell-OffHitsRiskAssets

describes a broad market downturn in which technology shares, cryptocurrencies like Bitcoin, and other risk-oriented assets have sold off sharply — reflecting investor fears and macroeconomic risk aversion.

The sell-off has been global and synchronized, impacting markets across the United States, Europe, Asia, and crypto exchanges. Major equity indexes such as the S&P 500, Nasdaq, and global MSCI benchmarks have slid as investors cut positions in high-growth tech names. This weakness has also spilled over into risk assets li

BTC9,38%

- Reward

- 5

- 4

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Stay strong and HODL💎View More

#GlobalTechSell-OffHitsRiskAssets

The markets are currently experiencing a significant "risk-off" environment. What started as a focused correction in high-flying technology stocks has snowballed into a broader retreat from risk assets—including cryptocurrencies and commodities—as we move through the first week of February 2026.

AI Anxiety & "Substitution" Fears

The primary trigger for this week’s rout was a sharp repricing of the AI narrative.

Market sentiment shifted following the release of new AI automation tools. Investors are no longer viewing AI solely as a "productivity booster" but a

The markets are currently experiencing a significant "risk-off" environment. What started as a focused correction in high-flying technology stocks has snowballed into a broader retreat from risk assets—including cryptocurrencies and commodities—as we move through the first week of February 2026.

AI Anxiety & "Substitution" Fears

The primary trigger for this week’s rout was a sharp repricing of the AI narrative.

Market sentiment shifted following the release of new AI automation tools. Investors are no longer viewing AI solely as a "productivity booster" but a

- Reward

- 3

- 2

- Repost

- Share

ybaser :

:

Watching Closely 🔍️Happy New Year! 🤑 2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

120.39K Popularity

23.25K Popularity

389.4K Popularity

9.49K Popularity

7.67K Popularity

7K Popularity

5.91K Popularity

6.56K Popularity

4.44K Popularity

3.23K Popularity

15.29K Popularity

9.35K Popularity

21.86K Popularity

29.75K Popularity

24.59K Popularity

News

View MoreGate DEX launches Meme Go weekly trading challenge on BNB Chain, with trading sharing prize of 20,000 USDT

6 m

Overview of the popular cryptocurrencies on February 7, 2026, with the top three in popularity being: WAR, API3, and WEN.

11 m

a16z Partner: Still committed to long-termism in crypto investments, believing that after the widespread adoption of blockchain finance, other categories of apps will emerge.

24 m

Two Major Ethereum Bulls Share Same CEX Deposit Address Despite Heavy Losses

32 m

Data: In the past 24 hours, the entire network has liquidated $649 million, with long positions liquidated at $179 million and short positions at $470 million.

41 m

Pin