Post content & earn content mining yield

placeholder

HighAmbition

#BitcoinFallsBehindGold

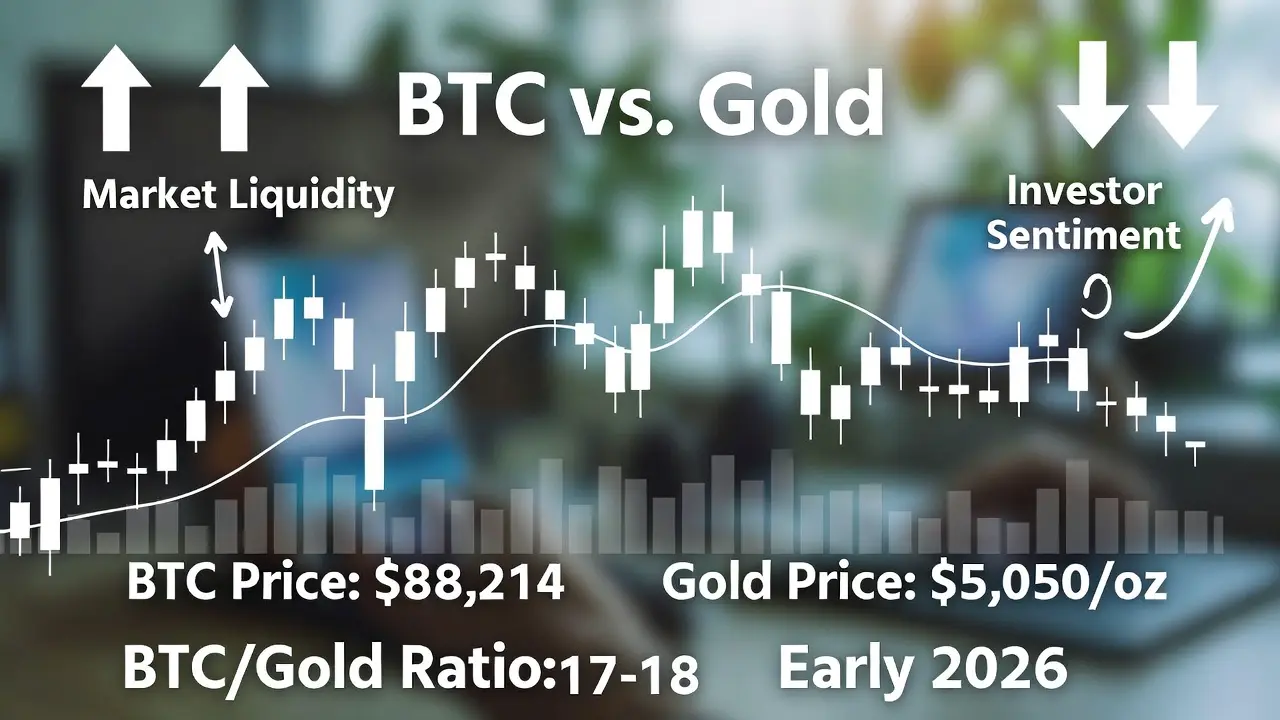

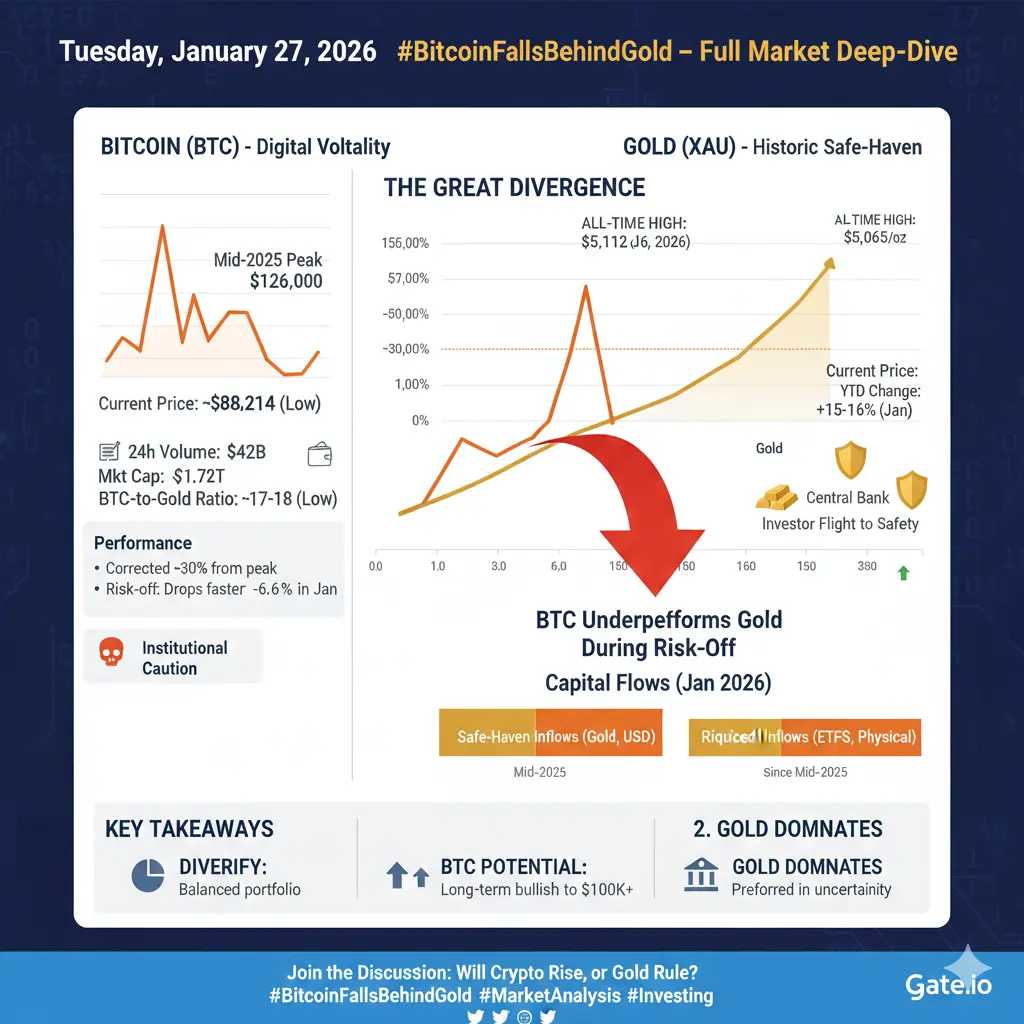

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

BTC0,94%

- Reward

- 6

- 6

- Repost

- Share

User_any :

:

2026 GOGOGO 👊View More

Brother Chuan is up. I don't know how your short positions are doing in the early morning. For those still holding, find an opportunity to close them!

We'll re-enter. I emphasized in the comment section that you might not see it.

Find an opportunity to close, wait for Brother Chuan to brush his teeth, wash his face, and start the broadcast!

View OriginalWe'll re-enter. I emphasized in the comment section that you might not see it.

Find an opportunity to close, wait for Brother Chuan to brush his teeth, wash his face, and start the broadcast!

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Who, what do you think about Pi Network??

Is the coin dying gradually or will there be more jumps?

Is the coin dying gradually or will there be more jumps?

PI-0,89%

- Reward

- 1

- 1

- Repost

- Share

SeniorBrotherKe :

:

Heading towards zero☆

飞起来

Created By@SimulatedPurchase

Subscription Progress

0.00%

MC:

$0

Create My Token

【$SPACE Signal】Short | Volume Breakout Downward

$SPACE is experiencing a volume breakout downward, with a daily decline of over 23%. Combined with high open interest, it shows typical features of long liquidation panic and main force distribution.

🎯 Direction: Short (Short)

🎯 Entry: 0.0130 - 0.0135

🛑 Stop Loss: 0.0145 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0115

🚀 Target 2: 0.0100

Price action indicates that $SPACE is experiencing a large volume decline, with market logic suggesting long liquidation or main force distribution. This volu

$SPACE is experiencing a volume breakout downward, with a daily decline of over 23%. Combined with high open interest, it shows typical features of long liquidation panic and main force distribution.

🎯 Direction: Short (Short)

🎯 Entry: 0.0130 - 0.0135

🛑 Stop Loss: 0.0145 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0115

🚀 Target 2: 0.0100

Price action indicates that $SPACE is experiencing a large volume decline, with market logic suggesting long liquidation or main force distribution. This volu

View Original

- Reward

- 1

- 1

- Repost

- Share

楚老魔 :

:

Good morning! 🌞 A cyclical greeting like morning sunlight spilling across the windowsill—wishing you today to be just like that, bright, repetitive, yet always fresh.

xxxtentacion

- Reward

- like

- Comment

- Repost

- Share

Entering the market is effortful.

View Original

- Reward

- like

- Comment

- Repost

- Share

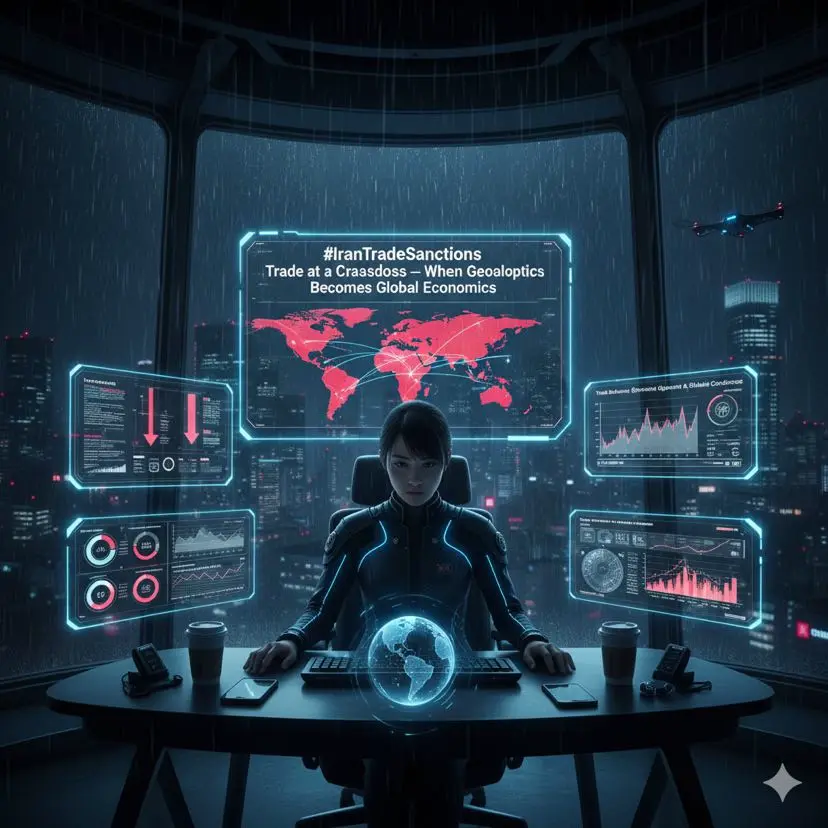

#IranTradeSanctions IranTradeSanctions In early 2026, Iran-related sanctions have evolved from a targeted geopolitical instrument into a system-wide pressure mechanism that is reshaping global trade behavior, diplomatic alignment, and market confidence, marking a critical shift where sanctions are no longer regional tools but global variables influencing interconnected economies. What once aimed to isolate Tehran now extends across capital flows, technology access, logistics networks, and financial infrastructure, affecting not only Iran but every economy linked to its trade ecosystem. This tr

- Reward

- 1

- Comment

- Repost

- Share

The Minister of Education of the Taliban terrorist regime in Afghanistan announced that Afghan women are permanently banned from enrolling in and receiving education. Surely someone will say: this can increase the birth rate.

View Original- Reward

- like

- Comment

- Repost

- Share

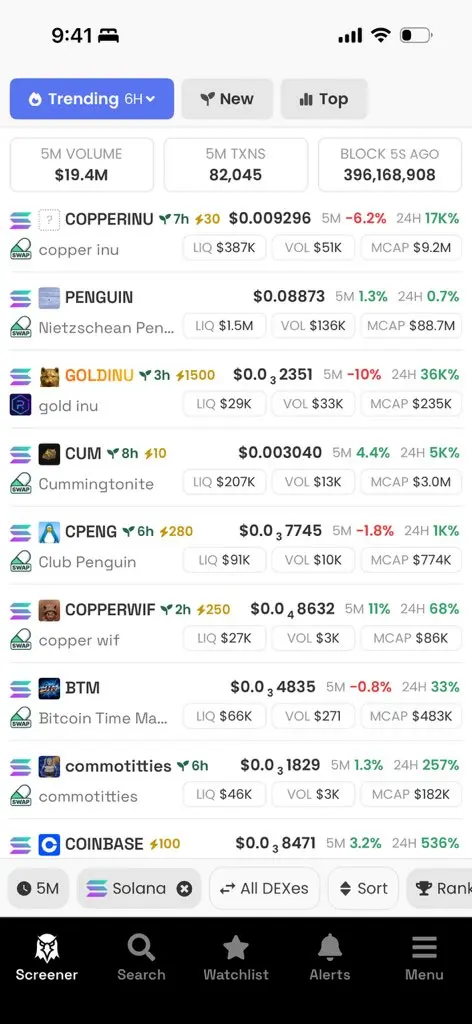

Solana: Nietzsche Culture Penguin, Dark Language Slang, Precious Metal Meme, TikTok Trends, Fake News Scams, Human Taming Claude Diary

BSC: Good-for-Nothing, Can't Fix the Mud, Rotten Alpha, Thief, Fake Airdrops, Dividend Insurance, Riding the Trend, Chinese Cultural Dross

Starting today, I am a BSC critic

View OriginalBSC: Good-for-Nothing, Can't Fix the Mud, Rotten Alpha, Thief, Fake Airdrops, Dividend Insurance, Riding the Trend, Chinese Cultural Dross

Starting today, I am a BSC critic

- Reward

- like

- Comment

- Repost

- Share

$BTC Day 65 After ATH. And Yes, This Phase Is Testing People

Bitcoin is now 65 days past the $126K ATH. That’s a long time in crypto.

From the top, price didn’t collapse. It didn’t bounce either. Instead, it dragged.

We dipped into the low $80Ks, printed a Day 65 low near $86,000, and now we’re sitting around $87K, doing… nothing.

And that “nothing” is exactly what’s frustrating most traders.

This isn’t the kind of correction that wipes accounts fast. It’s the kind that drains confidence slowly.

If you’ve traded previous cycles, this structure should feel familiar.

After major tops, Bitcoin

Bitcoin is now 65 days past the $126K ATH. That’s a long time in crypto.

From the top, price didn’t collapse. It didn’t bounce either. Instead, it dragged.

We dipped into the low $80Ks, printed a Day 65 low near $86,000, and now we’re sitting around $87K, doing… nothing.

And that “nothing” is exactly what’s frustrating most traders.

This isn’t the kind of correction that wipes accounts fast. It’s the kind that drains confidence slowly.

If you’ve traded previous cycles, this structure should feel familiar.

After major tops, Bitcoin

- Reward

- like

- Comment

- Repost

- Share

My eye infection actually brought me traffic. Evil cultivation is truly awesome.

View Original

- Reward

- like

- Comment

- Repost

- Share

Bitcoin

Bitcoin

Created By@shamim11s

Subscription Progress

0.00%

MC:

$0

Create My Token

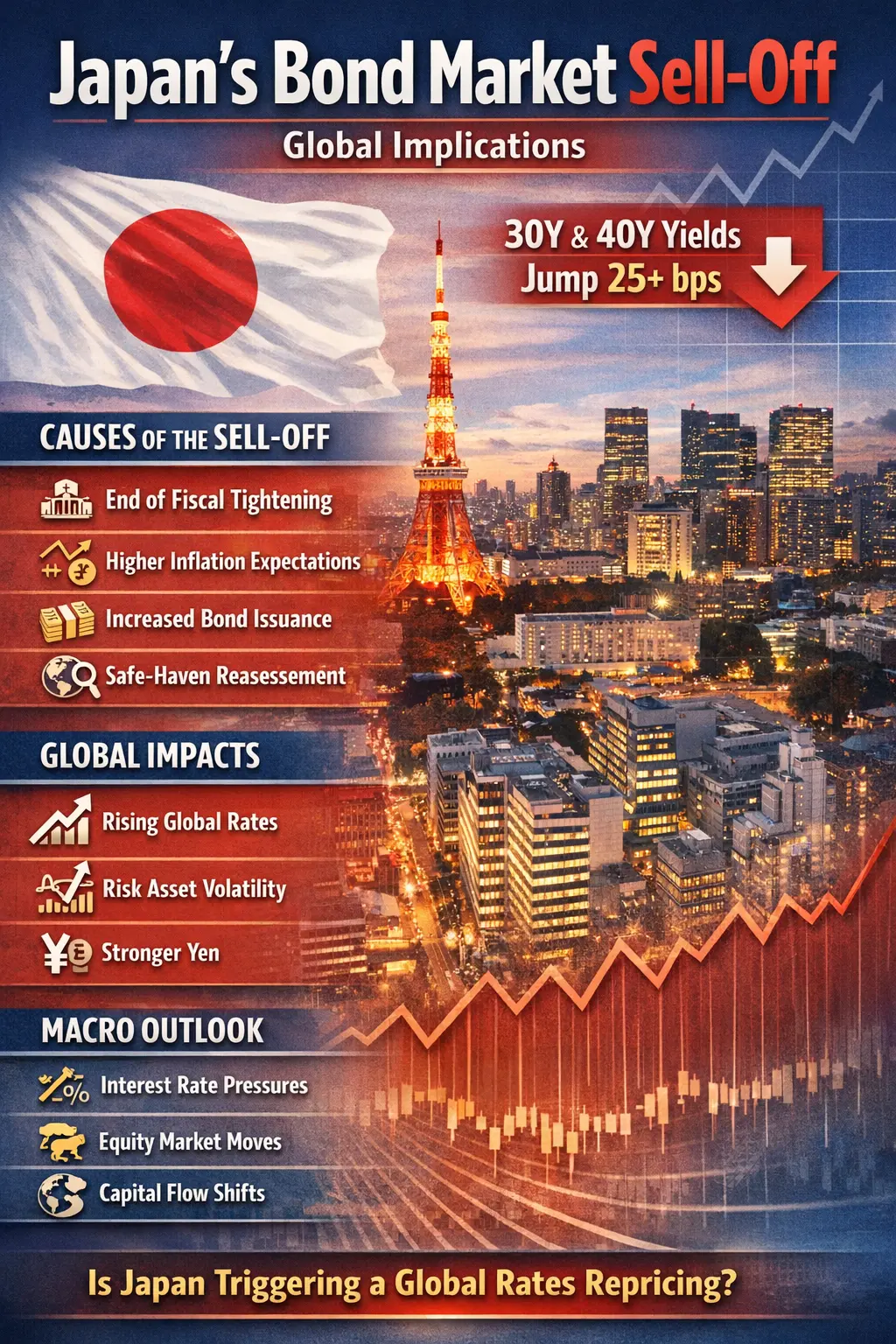

#JapanBondMarketSell-Off

Japan’s bond market experienced a dramatic sell-off this week, marking one of the most significant moves in the ultra-long end of the market in recent years. The yields on 30-year and 40-year Japanese Government Bonds (JGBs) surged by more than 25 basis points following government announcements to end fiscal tightening and increase public spending.

For decades, Japan has relied on a combination of ultra-loose monetary policy and strict yield curve control to keep long-term borrowing costs near zero, ensuring that its massive sovereign debt remains sustainable. By sig

Japan’s bond market experienced a dramatic sell-off this week, marking one of the most significant moves in the ultra-long end of the market in recent years. The yields on 30-year and 40-year Japanese Government Bonds (JGBs) surged by more than 25 basis points following government announcements to end fiscal tightening and increase public spending.

For decades, Japan has relied on a combination of ultra-loose monetary policy and strict yield curve control to keep long-term borrowing costs near zero, ensuring that its massive sovereign debt remains sustainable. By sig

- Reward

- 3

- 3

- Repost

- Share

LittleGodOfWealthPlutus :

:

2026 Prosperity Prosperity😘View More

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

#BitcoinFallsBehindGold Safe-Haven Hierarchy Shifts in 2026

Global financial markets are quietly signaling a major shift in the hierarchy of safe-haven assets. Recent price behavior across major asset classes shows a growing divergence between Bitcoin and Gold, reflecting a decisive change in investor priorities.

As geopolitical tensions escalate, monetary uncertainty persists, and macroeconomic instability intensifies, capital is no longer chasing innovation. Instead, it is seeking protection, reliability, and long-term credibility.

Gold’s advance is neither emotional nor accidental. Its move

Global financial markets are quietly signaling a major shift in the hierarchy of safe-haven assets. Recent price behavior across major asset classes shows a growing divergence between Bitcoin and Gold, reflecting a decisive change in investor priorities.

As geopolitical tensions escalate, monetary uncertainty persists, and macroeconomic instability intensifies, capital is no longer chasing innovation. Instead, it is seeking protection, reliability, and long-term credibility.

Gold’s advance is neither emotional nor accidental. Its move

BTC0,94%

- Reward

- 3

- 1

- Repost

- Share

楚老魔 :

:

Good morning! ✨ These continuous morning blessings are like a string of crisp wind chimes—may they bring you a day filled with clarity, lightness, and endless echoes of good times.#JapanBondMarketSell-Off #JapanBondMarketSellOff

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

BTC0,94%

- Reward

- 2

- Comment

- Repost

- Share

The two-basket strategy remains clear: use the rebound as an opportunity, with a bearish trend as the main line.

Driven by last night's US stock market sentiment, prices quickly surged to around 2950 during the session, but the upward momentum failed to continue, and then retreated to around 2885. During the early morning hours, bulls and bears repeatedly tugged, and currently, the price has returned above 2920 for consolidation.

From the 4-hour structure, the previous dip found effective support at around 2785, triggering a short-term bullish rebound, with the price returning above the midlin

Driven by last night's US stock market sentiment, prices quickly surged to around 2950 during the session, but the upward momentum failed to continue, and then retreated to around 2885. During the early morning hours, bulls and bears repeatedly tugged, and currently, the price has returned above 2920 for consolidation.

From the 4-hour structure, the previous dip found effective support at around 2785, triggering a short-term bullish rebound, with the price returning above the midlin

ETH2,07%

- Reward

- 1

- Comment

- Repost

- Share

Good morning, I am Daidai. @TermMaxFi's true moat—the "structural correctness." In the DeFi world, the competitiveness of many protocols often manifests in two dimensions: higher yields or stronger incentives. But both have a common problem—they are short-term variables. Today’s higher returns can be copied, surpassed, or diluted tomorrow. Protocols that can truly exist long-term are often not because they "earn the most," but because their underlying structure is sufficiently correct and difficult to replace. From this perspective, @TermMaxFi, you'll find that its moat doesn't come from APY b

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.95K Popularity

102.08K Popularity

71.89K Popularity

18.26K Popularity

40.28K Popularity

Hot Gate Fun

View More- MC:$3.44KHolders:20.04%

- MC:$3.41KHolders:20.00%

- MC:$3.39KHolders:10.00%

- MC:$3.4KHolders:10.00%

- MC:$3.5KHolders:20.33%

News

View MoreHYPE (Hyperliquid) up 16.25% in the past 24 hours

1 m

Sentient announces Franklin Templeton has become its strategic investor

7 m

"DASH's largest short seller" continues to increase short positions, with a floating profit of $1.35 million.

7 m

North Korean hackers use AI deepfake video calls to attack crypto professionals

10 m

PI (Pi) decreased by 0.79% in the past 24 hours

12 m

Pin