Dogwifhat increases by 13% – Will the breakout scenario of the 7-month wedge pattern occur?

Memecoin is gradually regaining its appeal as the overall cryptocurrency market experiences a slight recovery. At the time of writing, dogwifhat (WIF) has surged approximately 13% within 24 hours, attracting renewed attention from investors.

However, behind this impressive rally, fundamental indicators reveal a more cautious picture: this memecoin is still “struggling” within a prolonged accumulation zone, not yet breaking out of the sideways trend that has persisted for some time.

WIF tests resistance of the wedge pattern

The daily chart of dogwifhat (WIF) depicts a relatively clear scenario. Since May last year, this memecoin has continuously oscillated within a large wedge pattern, lasting several months and indicating a persistent accumulation phase.

Although technical indicators suggest momentum is gradually improving, WIF still faces several obstacles in its attempt to break free from the correction that has lasted about 7 months. The Stochastic Momentum Index (SMI) is currently at 41, reflecting an overbought condition. Nevertheless, the signal remains positive as the SMI is above its signal line, currently around 11.8.

Source: TradingView On the money flow side, Chaikin Money Flow (CMF) shows buying pressure increasing significantly. Evidence of this is that two “whales” have accumulated over $2.5 million worth of WIF tokens within 48 hours. This development raises hopes for a breakout from the accumulation zone in the near future, although the price scenario continuing to be compressed within the wedge pattern cannot be ruled out.

Source: TradingView On the money flow side, Chaikin Money Flow (CMF) shows buying pressure increasing significantly. Evidence of this is that two “whales” have accumulated over $2.5 million worth of WIF tokens within 48 hours. This development raises hopes for a breakout from the accumulation zone in the near future, although the price scenario continuing to be compressed within the wedge pattern cannot be ruled out.

Funding rate turns positive as OI spikes

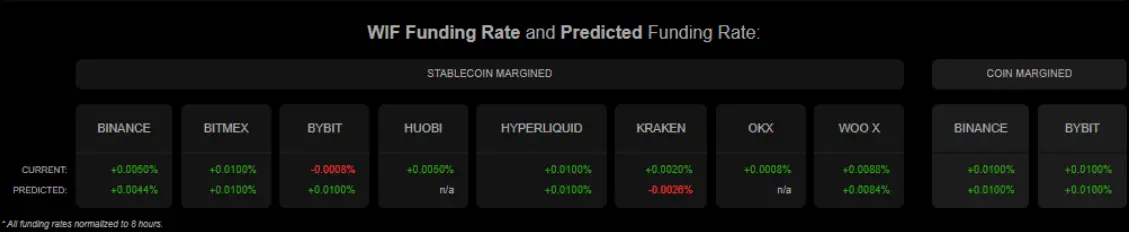

Derivatives market data are sending optimistic signals as trader sentiment using leverage improves markedly. The funding rate has turned positive on most major exchanges, reflecting a bullish bias.

Specifically, Hyperliquid, Binance, OKX, BitMEX, and WOO X all report positive funding rates, while Bybit and Kraken maintain slight negative rates, though not concerning.

Source: Coinalyze Meanwhile, open interest (OI) has surged impressively, from a low of around $55 million to nearly $100 million at the time of writing. Binance continues to lead with an OI of approximately $35 million, about $3 million ahead of Bybit.

Source: Coinalyze Meanwhile, open interest (OI) has surged impressively, from a low of around $55 million to nearly $100 million at the time of writing. Binance continues to lead with an OI of approximately $35 million, about $3 million ahead of Bybit.

All these factors collectively reinforce a positive outlook for WIF and increase expectations of a breakout. However, cautious movements from spot holders remain a variable that could hinder this bullish scenario.

Holders are selling

Although WIF’s price is rising, the underlying picture is less optimistic as on-chain signals begin to issue warnings. The number of holders has only slightly increased to about 247,849 addresses, according to data from Solscan — a modest increase compared to the current price rally.

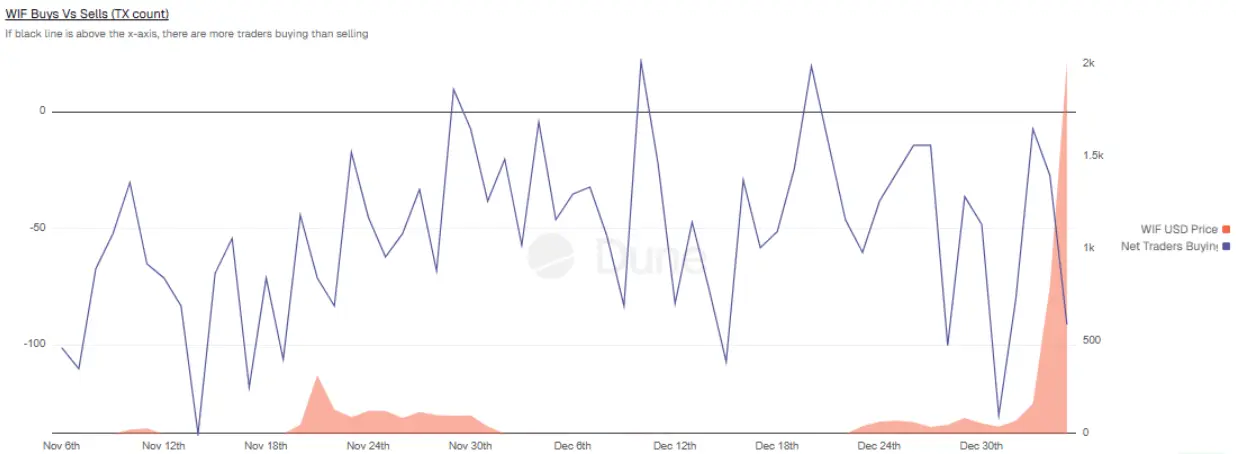

More notably, many investors seem to be taking profits. Statistics from Dune Analytics show the Buys vs. Sells (transaction count) index falling to -91, indicating selling pressure is clearly dominating the market. This development makes a strong short-term breakout for WIF less certain.

Source: Dune Analytics Overall, market sentiment remains mixed. Although optimism slightly outweighs pessimism, existing selling pressure is a significant barrier that could restrain WIF’s upward momentum in the near future.

Source: Dune Analytics Overall, market sentiment remains mixed. Although optimism slightly outweighs pessimism, existing selling pressure is a significant barrier that could restrain WIF’s upward momentum in the near future.

SN_Nour

Related Articles

Interest in "Bitcoin to 0" hits a peak on Google Trends

Kevin O’Leary Explains How Institutions Respond to Bitcoin’s Brutal Crash and Quantum Threat

Last Dip Before Liftoff? Top 5 Altcoins That Could Explode 50%–300% by Mid-2026

Pi Network (PI) falters at the critical resistance level, with selling pressure mounting.

Ethereum falls below realized price: Where are ETH's support levels and reversal points?

The tortoise and hare race of value preservation: which will win, gold or Bitcoin?