Emilyvuong

No content yet

emilyvuong

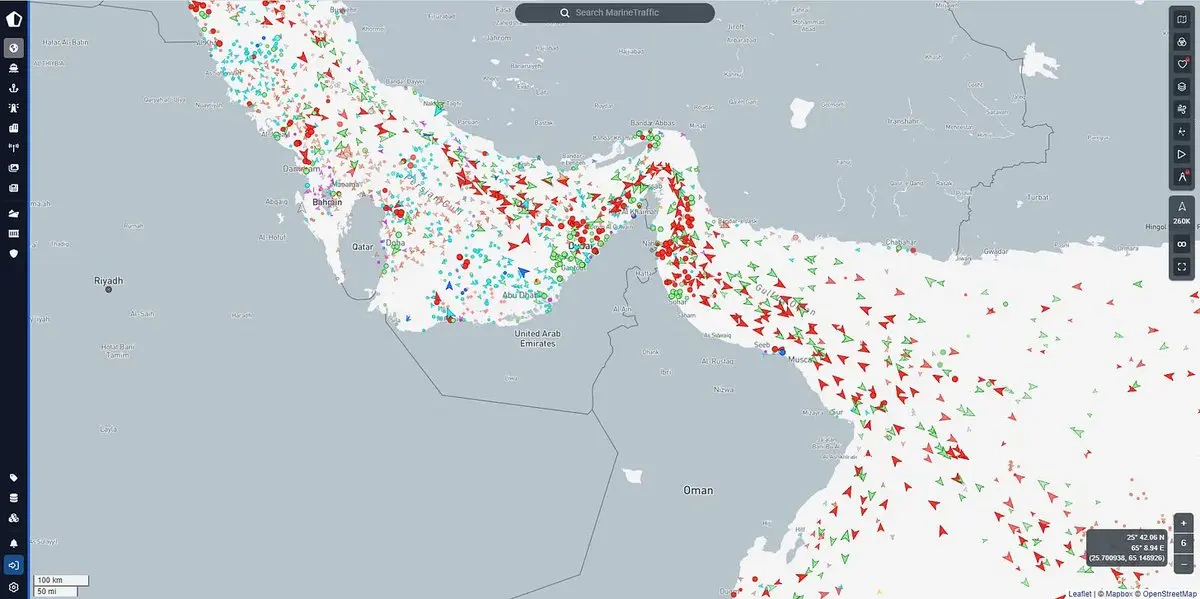

💥Current Market:

- Hormuz Strait normal

- Suez Canal reopened

- Oil price +12%

- $BTC -5% then back to the starting point

- Gold 5500 down to 5275 (tokenized)

Risk-clearing event to squeeze the market, traders chasing news and expecting WW3 are at a loss.

Of course, no one knows what will happen next week when Hezbollah just announced they are entering the conflict.

- Hormuz Strait normal

- Suez Canal reopened

- Oil price +12%

- $BTC -5% then back to the starting point

- Gold 5500 down to 5275 (tokenized)

Risk-clearing event to squeeze the market, traders chasing news and expecting WW3 are at a loss.

Of course, no one knows what will happen next week when Hezbollah just announced they are entering the conflict.

BTC1,4%

- Reward

- like

- Comment

- Repost

- Share

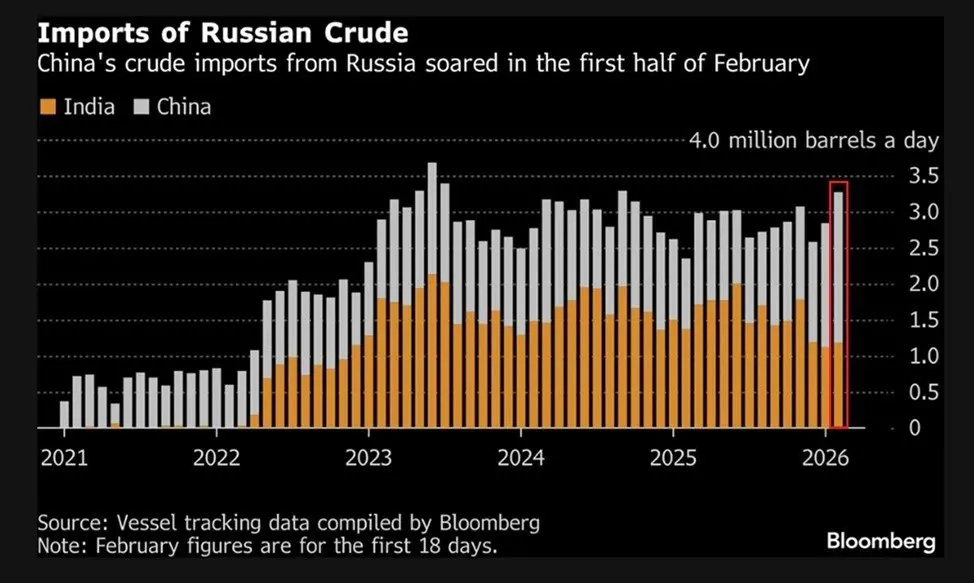

China is significantly increasing its purchases of Russian oil as India reduces imports.

In the first 18 days of February, China bought up to 2.09 million barrels per day — a 50% increase in just two months.

Meanwhile, India has cut its imports by about 40% compared to the peak in June.

View OriginalIn the first 18 days of February, China bought up to 2.09 million barrels per day — a 50% increase in just two months.

Meanwhile, India has cut its imports by about 40% compared to the peak in June.

- Reward

- like

- Comment

- Repost

- Share

🟠Over 15 countries have called on their citizens to leave Iran immediately

- The United States has urged citizens to depart immediately, suggesting land travel through Armenia or Turkey.

- The UK has withdrawn diplomatic staff from Tehran and warned of a “serious risk,” advising against all travel to Iran.

- China and India have issued urgent notices, requesting their citizens to evacuate as soon as possible.

- Canada, Australia, Germany, Poland, Sweden, South Korea, Singapore, and many other European countries have also raised their alert levels to the highest.

-> This widespread evacuation

View Original- The United States has urged citizens to depart immediately, suggesting land travel through Armenia or Turkey.

- The UK has withdrawn diplomatic staff from Tehran and warned of a “serious risk,” advising against all travel to Iran.

- China and India have issued urgent notices, requesting their citizens to evacuate as soon as possible.

- Canada, Australia, Germany, Poland, Sweden, South Korea, Singapore, and many other European countries have also raised their alert levels to the highest.

-> This widespread evacuation

- Reward

- 1

- Comment

- Repost

- Share

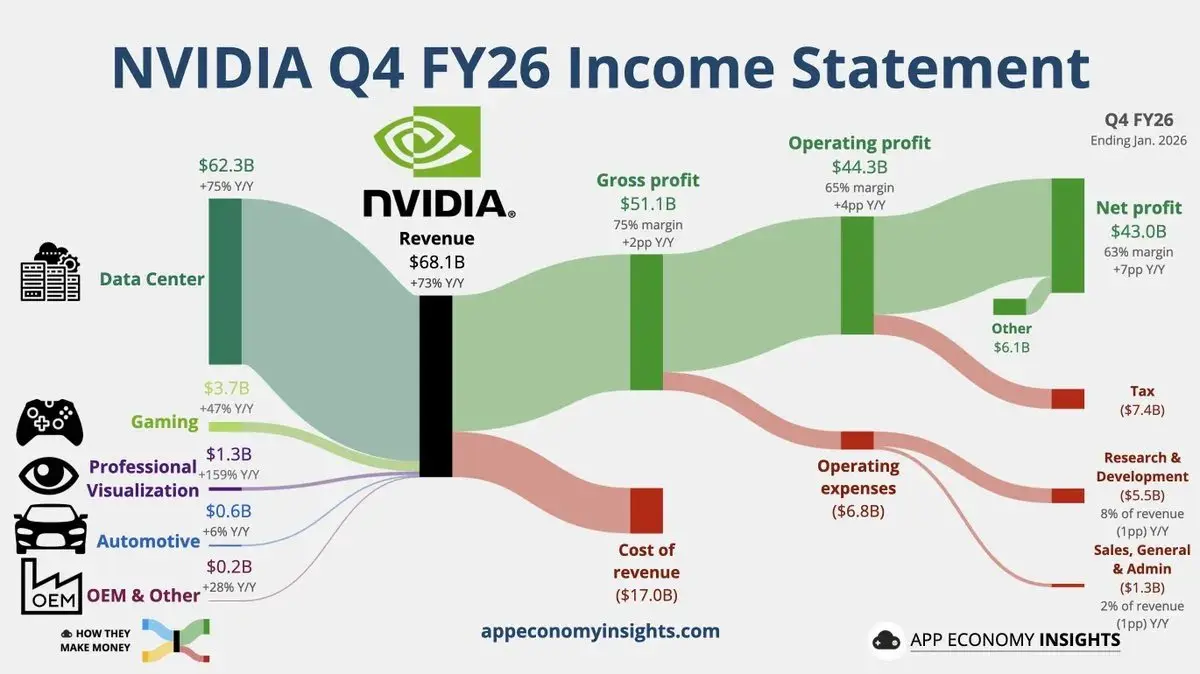

🔥 Nvidia Reports Outstanding Q4 Results, Breaking All Records

- Revenue $68.1B, surpassing expectations of ~$65.9B, up +73% YoY - a historic record.

- Data Center $62.3B, exceeding expectations of ~$60.36B, up +75% YoY - continues to be the main driver.

- EPS $1.62, beating expectations of ~$1.50.

- Gross profit margin 75.2%, higher than the previous quarter and exceeding expectations.

- Operating margin ~65%, significantly up compared to the same period last year.

- Gaming, Automotive, and Professional Visualization are no longer the focus - Data Center dominates the entire growth story.

- N

View Original- Revenue $68.1B, surpassing expectations of ~$65.9B, up +73% YoY - a historic record.

- Data Center $62.3B, exceeding expectations of ~$60.36B, up +75% YoY - continues to be the main driver.

- EPS $1.62, beating expectations of ~$1.50.

- Gross profit margin 75.2%, higher than the previous quarter and exceeding expectations.

- Operating margin ~65%, significantly up compared to the same period last year.

- Gaming, Automotive, and Professional Visualization are no longer the focus - Data Center dominates the entire growth story.

- N

- Reward

- 2

- Comment

- Repost

- Share

The number of unemployment benefit claims last week was 212,000 applications, which is lower than the forecast of 216,000. Meanwhile, the number of people continuing to receive benefits was 1.833 million, lower than the forecast of 1.858 million and also down from 1.864 million the previous week.

View Original- Reward

- 2

- Comment

- Repost

- Share

The United States is facing a rare earth shortage right before the Trump - Xi summit.

Reuters reports that the U.S. aerospace and semiconductor supply chains are critically lacking yttrium and scandium—two essential metals for defense, jet engines, lightweight alloys, and next-generation chip manufacturing.

Almost all of the supply of these two metals comes from China.

Since Beijing tightened export controls in April, yttrium exports to the U.S. have dropped to only 17 tons over 8 months, compared to 333 tons in the previous 8 months, nearly freezing the flow.

The U.S. currently has no commerc

View OriginalReuters reports that the U.S. aerospace and semiconductor supply chains are critically lacking yttrium and scandium—two essential metals for defense, jet engines, lightweight alloys, and next-generation chip manufacturing.

Almost all of the supply of these two metals comes from China.

Since Beijing tightened export controls in April, yttrium exports to the U.S. have dropped to only 17 tons over 8 months, compared to 333 tons in the previous 8 months, nearly freezing the flow.

The U.S. currently has no commerc

- Reward

- like

- Comment

- Repost

- Share

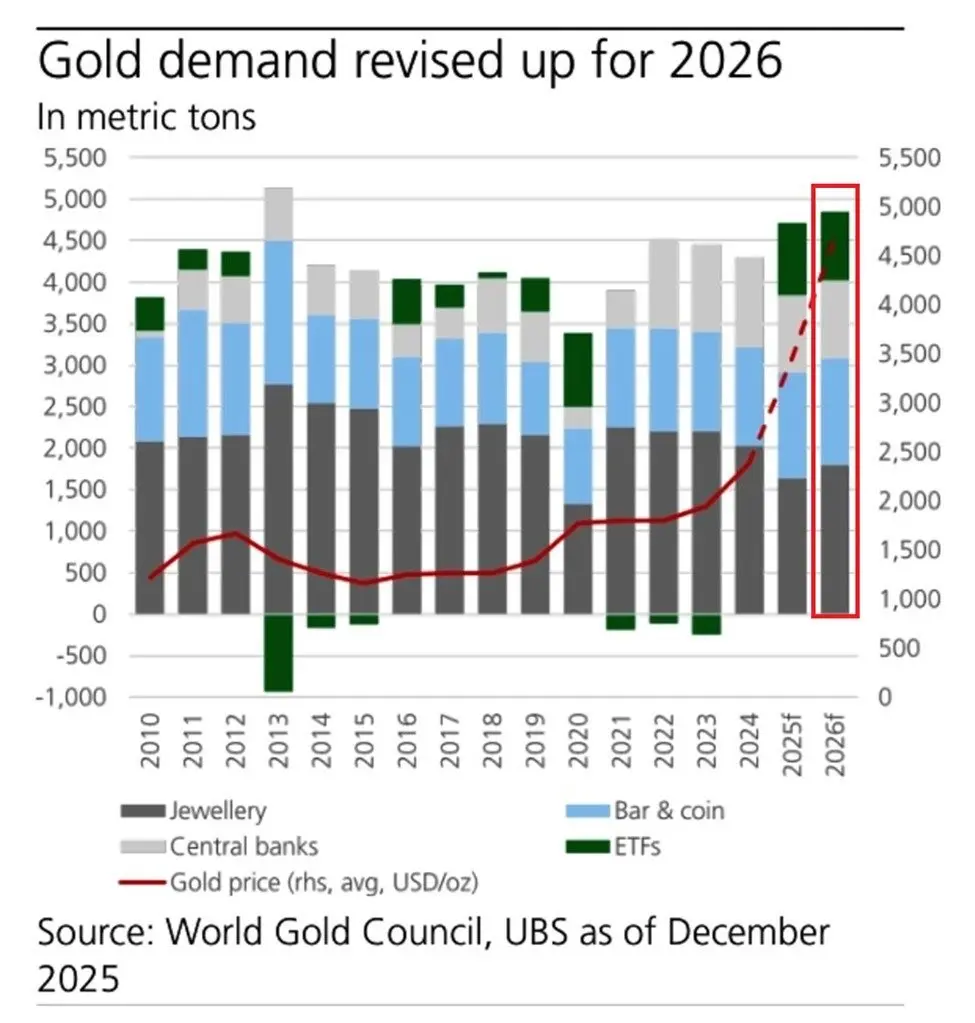

🟠Forecast for 2026, total gold demand could reach approximately 4,900 tons - a record high and the second consecutive year of growth.

Jewelry demand is expected to increase by about 100 tons, reaching around 1,700 tons - the highest since 2024.

Central banks continue to net purchase around 1,000 tons - maintaining a historically high level.

Physical gold ETFs may attract an additional ~900 tons of net inflows - the second consecutive year of strong inflows.

Demand for gold bars and coins remains stable around ~1,300 tons.

Gold is being talked about everywhere. It’s quite amusing that the worl

View OriginalJewelry demand is expected to increase by about 100 tons, reaching around 1,700 tons - the highest since 2024.

Central banks continue to net purchase around 1,000 tons - maintaining a historically high level.

Physical gold ETFs may attract an additional ~900 tons of net inflows - the second consecutive year of strong inflows.

Demand for gold bars and coins remains stable around ~1,300 tons.

Gold is being talked about everywhere. It’s quite amusing that the worl

- Reward

- like

- Comment

- Repost

- Share

🟢Jane Street behind the start of the 2022 downtrend

Summary of the latest allegations in Terraform's lawsuit against Jane Street:

🟠 From 2018 to early 2022, Jane Street signed direct trading agreements with Terraform Labs.

- Bryce Pratt - former Terraform intern became the bridge between Jane Street and the Terra engineering team.

- Non-public data was shared under the guise of “investment discussion”.

-> Marking Jane Street as an insider.

🟠 7/5/2022 - The withdrawal before the peg broke

- 17:44 EST, Terraform quietly withdrew $150M UST from Curve 3pool.

- Less than 10 minutes later, Jane S

View OriginalSummary of the latest allegations in Terraform's lawsuit against Jane Street:

🟠 From 2018 to early 2022, Jane Street signed direct trading agreements with Terraform Labs.

- Bryce Pratt - former Terraform intern became the bridge between Jane Street and the Terra engineering team.

- Non-public data was shared under the guise of “investment discussion”.

-> Marking Jane Street as an insider.

🟠 7/5/2022 - The withdrawal before the peg broke

- 17:44 EST, Terraform quietly withdrew $150M UST from Curve 3pool.

- Less than 10 minutes later, Jane S

- Reward

- like

- Comment

- Repost

- Share

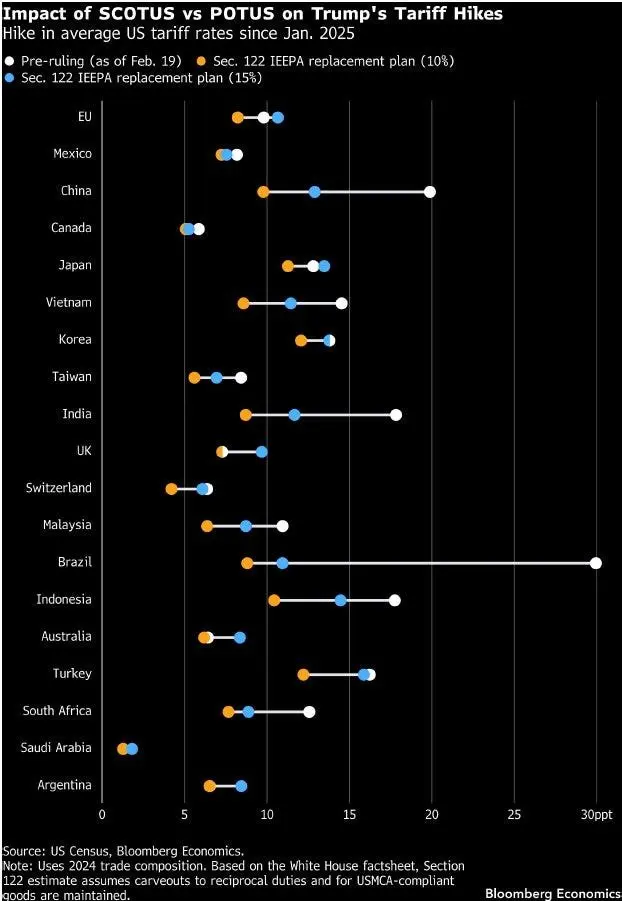

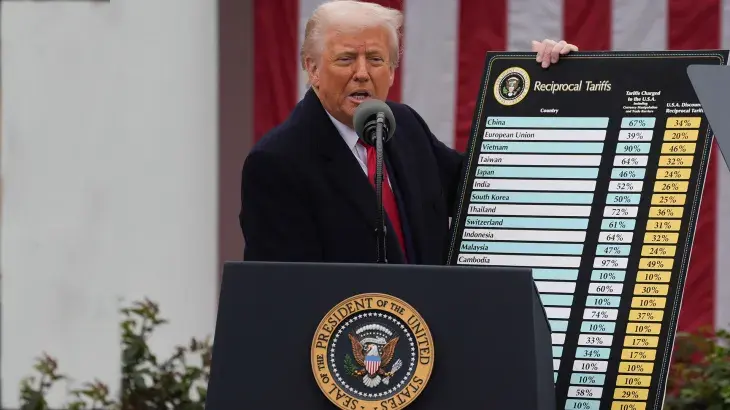

🟠 Trump raises the tariff rate from 10% to 15% under Section 122 - Trade Act of 1974.

This tool allows the President to impose tariffs for up to 150 days without Congressional approval. Highly effective but with fewer political barriers. But it’s important to understand:

- Tariffs under Section 232 (on national security - steel, automobiles…) still remain.

- Tariffs under Section 301 (to punish unfair trade practices - mainly with China) remain unchanged.

-> That means 15% does not replace the entire old structure. It adds on top of the current baseline.

📊 According to Bloomberg’s estimated

View OriginalThis tool allows the President to impose tariffs for up to 150 days without Congressional approval. Highly effective but with fewer political barriers. But it’s important to understand:

- Tariffs under Section 232 (on national security - steel, automobiles…) still remain.

- Tariffs under Section 301 (to punish unfair trade practices - mainly with China) remain unchanged.

-> That means 15% does not replace the entire old structure. It adds on top of the current baseline.

📊 According to Bloomberg’s estimated

- Reward

- like

- Comment

- Repost

- Share

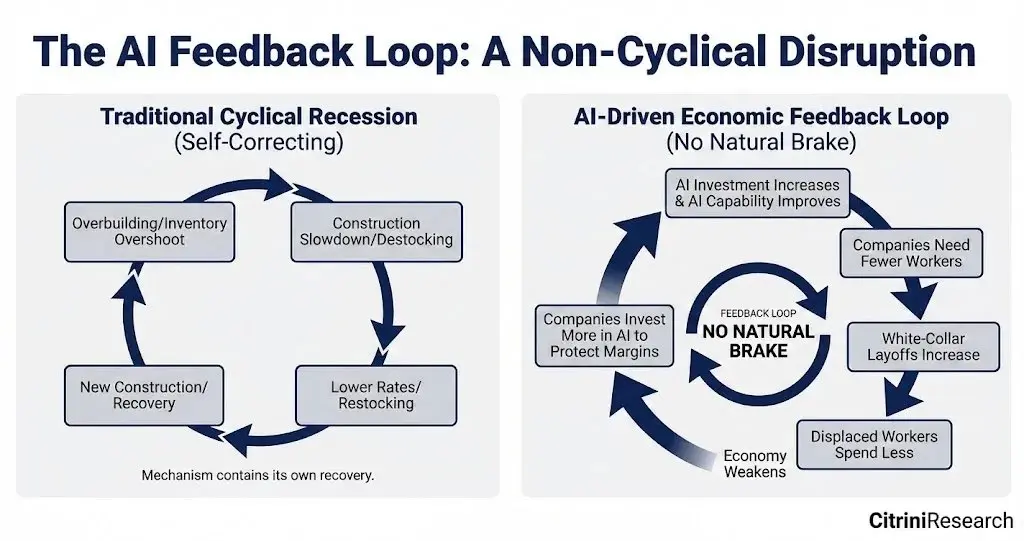

🟠 Is AI a springboard or a curse for the economy? The white-collar doom loop shock and the Ghost GDP ghost

An economy can increase productivity while becoming poorer. It’s not too far-fetched; the world witnessed this during the Industrial Revolution. Citrini Research has proposed a scenario for 2028 where accelerated technological growth driven by AI causes a breakdown in consumption.

📌 Scenario 2028: The labor market fractures as AI replaces too many jobs

- US Unemployment: 10.2%

- S&P 500: -38% from the October 2026 peak

- A shock centered on the “white collar” (knowledge workers)

- AI st

View OriginalAn economy can increase productivity while becoming poorer. It’s not too far-fetched; the world witnessed this during the Industrial Revolution. Citrini Research has proposed a scenario for 2028 where accelerated technological growth driven by AI causes a breakdown in consumption.

📌 Scenario 2028: The labor market fractures as AI replaces too many jobs

- US Unemployment: 10.2%

- S&P 500: -38% from the October 2026 peak

- A shock centered on the “white collar” (knowledge workers)

- AI st

- Reward

- like

- Comment

- Repost

- Share

🇷🇺 Russia begins gold sales

The Central Bank of Russia has sold reserve gold in January as prices are hovering near historic highs.

🔸 Gold holdings decreased by 300,000 ounces

🔸 Total reserves now at 74.5 million ounces

🔸 This is the first decline since October

Although the sales are very small compared to total reserves, there is no more reasonable explanation than "taking profits" when prices are at record highs.

View OriginalThe Central Bank of Russia has sold reserve gold in January as prices are hovering near historic highs.

🔸 Gold holdings decreased by 300,000 ounces

🔸 Total reserves now at 74.5 million ounces

🔸 This is the first decline since October

Although the sales are very small compared to total reserves, there is no more reasonable explanation than "taking profits" when prices are at record highs.

- Reward

- like

- Comment

- Repost

- Share

Bonds have become a frequently traded asset class rather than a hedge as before:

Before COVID, the stock–bond correlation was mostly negative ( below 0). This means:

- When stocks crash -> money flows into bonds

- The 60/40 portfolio commonly seen in funds becomes effective with diversification.

Since COVID, a “post-2020 structural shift” has emerged according to the IMF. Stocks and bonds tend to move in the same direction -> traditional portfolios of funds are no longer effective.

Monetary policy and inflation have made bonds no longer a safe haven. Risk parity and diversified 60/40 funds hav

View OriginalBefore COVID, the stock–bond correlation was mostly negative ( below 0). This means:

- When stocks crash -> money flows into bonds

- The 60/40 portfolio commonly seen in funds becomes effective with diversification.

Since COVID, a “post-2020 structural shift” has emerged according to the IMF. Stocks and bonds tend to move in the same direction -> traditional portfolios of funds are no longer effective.

Monetary policy and inflation have made bonds no longer a safe haven. Risk parity and diversified 60/40 funds hav

- Reward

- 1

- Comment

- Repost

- Share

📍 Since the all-time high in October, the spot Bitcoin ETF has experienced the largest capital outflow ever.

The total BTC holdings in spot ETFs have decreased by approximately ~100.3K BTC compared to the ATH level.

This is the largest drawdown recorded since the emergence of #Bitcoin ETFs.

The total BTC holdings in spot ETFs have decreased by approximately ~100.3K BTC compared to the ATH level.

This is the largest drawdown recorded since the emergence of #Bitcoin ETFs.

BTC1,4%

- Reward

- 1

- Comment

- Repost

- Share

📍 $17B First day trading volume - $IQMM has surpassed all ETF issuance records

ProShares GENIUS Money Market ETF - ticker $IQMM - just recorded $17B trading volume on its first day. This figure far exceeds any ETF record:

📌 $IBIT (BlackRock Bitcoin ETF): ~$1B first day

📌 BlackRock ESG ETF (backed by retirement funds): ~$2B

📌 IQMM is currently being mentioned at about 8x compared to previous large precedents

$IQMM is not a crypto ETF. This is ProShares GENIUS Money Market ETF - a money market ETF designed to hold ultra-short-term assets, mainly:

- US Treasury Bills

- High-quality Commercial

View OriginalProShares GENIUS Money Market ETF - ticker $IQMM - just recorded $17B trading volume on its first day. This figure far exceeds any ETF record:

📌 $IBIT (BlackRock Bitcoin ETF): ~$1B first day

📌 BlackRock ESG ETF (backed by retirement funds): ~$2B

📌 IQMM is currently being mentioned at about 8x compared to previous large precedents

$IQMM is not a crypto ETF. This is ProShares GENIUS Money Market ETF - a money market ETF designed to hold ultra-short-term assets, mainly:

- US Treasury Bills

- High-quality Commercial

- Reward

- 1

- Comment

- Repost

- Share

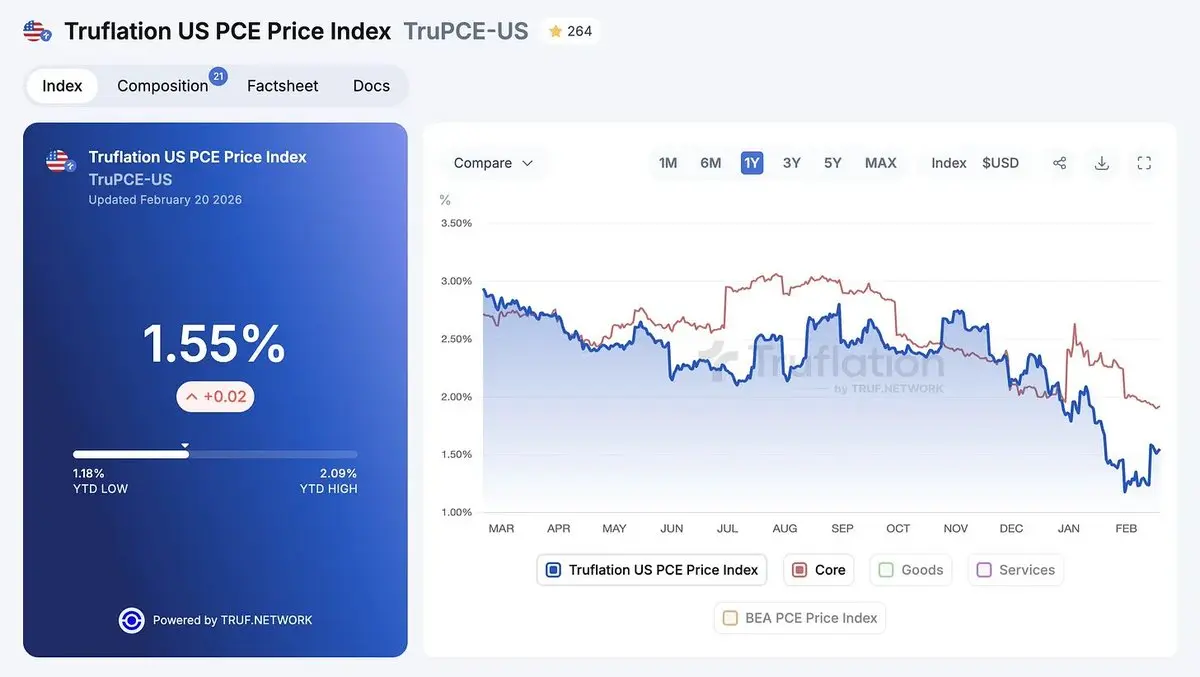

📍 December PCE unexpectedly exceeds forecasts: The story of inflation cooling down faces obstacles

📌 Headline PCE (YoY): +2.9% (higher than +2.8% forecast, same as last month)

📌 Core PCE (YoY): +3.0% (higher than +2.9% forecast, up from +2.8% in November)

📌 Monthly (MoM) figures are also hotter than expected:

- Headline: +0.4% (+0.3% forecast, +0.2% last month)

- Core: +0.4% (+0.3% forecast, +0.2% last month)

-> MoM increase doubles the previous month. Inflation momentum is returning.

📌 Data in the report:

- Personal income: +0.3% MoM

- Nominal spending: +0.4% MoM

- But real spending only

View Original📌 Headline PCE (YoY): +2.9% (higher than +2.8% forecast, same as last month)

📌 Core PCE (YoY): +3.0% (higher than +2.9% forecast, up from +2.8% in November)

📌 Monthly (MoM) figures are also hotter than expected:

- Headline: +0.4% (+0.3% forecast, +0.2% last month)

- Core: +0.4% (+0.3% forecast, +0.2% last month)

-> MoM increase doubles the previous month. Inflation momentum is returning.

📌 Data in the report:

- Personal income: +0.3% MoM

- Nominal spending: +0.4% MoM

- But real spending only

- Reward

- 1

- Comment

- Repost

- Share

The U.S. Supreme Court has officially ruled that President Trump's tariffs are illegal, with a 6-3 vote.

The U.S. is now facing a potential tax refund of over $150B. The market immediately experienced significant volatility following the news.

View OriginalThe U.S. is now facing a potential tax refund of over $150B. The market immediately experienced significant volatility following the news.

- Reward

- 1

- Comment

- Repost

- Share

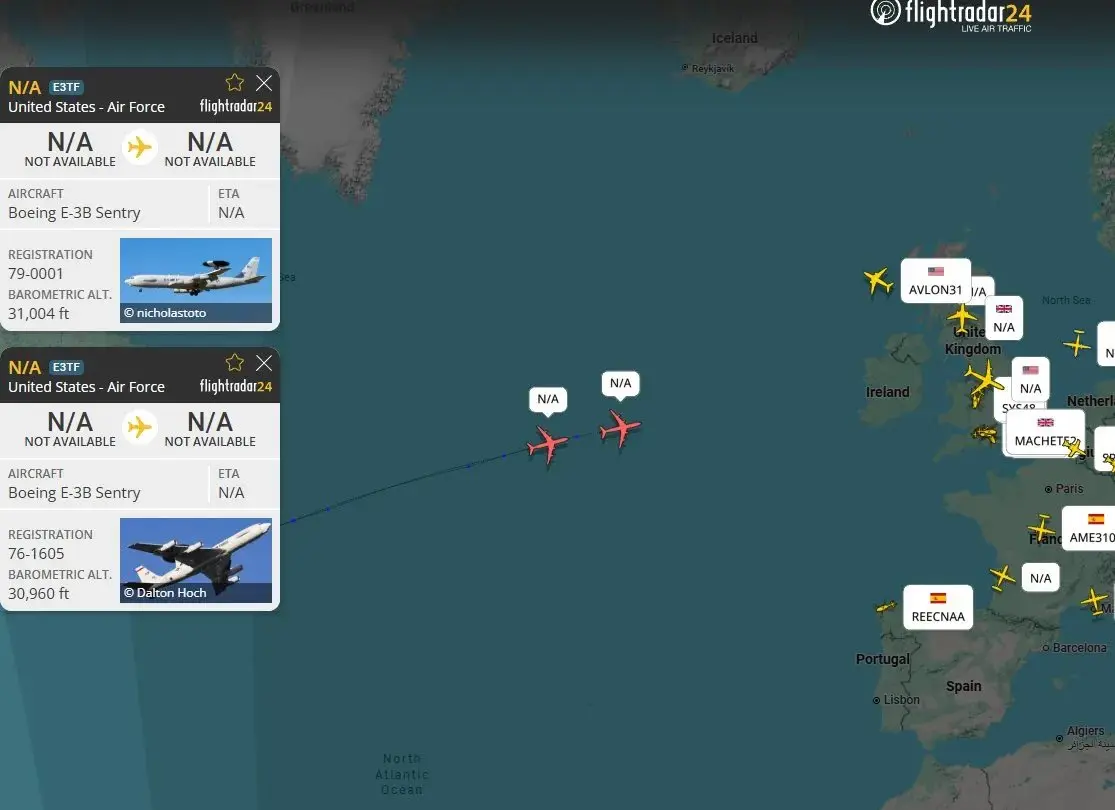

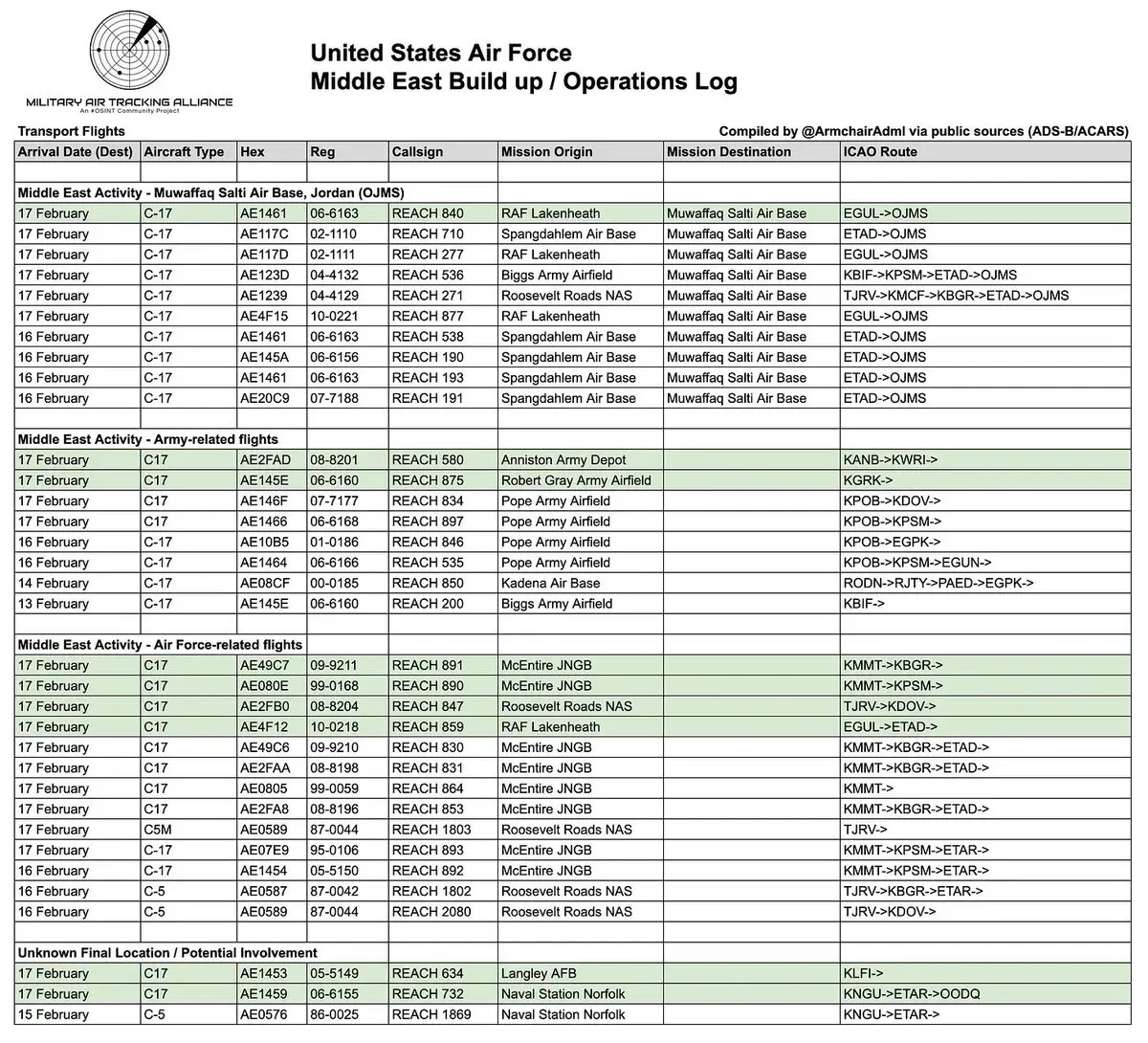

📍 USA - Iran: War imminent?

📌 U.S. Side

- 25 strategic refueling aircraft have been deployed to the Middle East. Tankers are not offensive weapons, but are essential for maintaining long-range airstrikes.

- 6 E-3 AWACS are present in the (U.S. region, which only has a total of 16 aircraft but has deployed 6 to the area — representing up to 40% of air control capacity).

- 2 U-2 reconnaissance aircraft have appeared with uplink node missions — connecting signals and consolidating data from an altitude of ~40,000 feet.

-> The scale is so large that flight data has been publicly disclo

View Original📌 U.S. Side

- 25 strategic refueling aircraft have been deployed to the Middle East. Tankers are not offensive weapons, but are essential for maintaining long-range airstrikes.

- 6 E-3 AWACS are present in the (U.S. region, which only has a total of 16 aircraft but has deployed 6 to the area — representing up to 40% of air control capacity).

- 2 U-2 reconnaissance aircraft have appeared with uplink node missions — connecting signals and consolidating data from an altitude of ~40,000 feet.

-> The scale is so large that flight data has been publicly disclo

- Reward

- 1

- Comment

- Repost

- Share