TimelessBeing

No content yet

TimelessBeing

$HYPE one of the more interesting charts at the moment

If price reclaim 25 VAL shes on for a bigger move within last year bracket (x marks spots of interest)

Conversely might not be the worst place to observe weakness which would be signs of a backside retest

Delicately poised structure as it stands

If price reclaim 25 VAL shes on for a bigger move within last year bracket (x marks spots of interest)

Conversely might not be the worst place to observe weakness which would be signs of a backside retest

Delicately poised structure as it stands

HYPE0,95%

- Reward

- like

- Comment

- Repost

- Share

Funny how important this 24 vwap has been

Lots of time and compression here around it

A dance in motion between buyers and sellers

Will again stress importance of maintaining price above this pivot

For now we remain in limbo with an edge to bulls at the point of putting this out

If we auction below and remain pinned next week I suspect we smash the yearly lows

Holding here opens a stairway to 75 k+ and quite quickly imo

Will see what she gives

Have a splendiferous week of trade as we run the new month

$BTC

Lots of time and compression here around it

A dance in motion between buyers and sellers

Will again stress importance of maintaining price above this pivot

For now we remain in limbo with an edge to bulls at the point of putting this out

If we auction below and remain pinned next week I suspect we smash the yearly lows

Holding here opens a stairway to 75 k+ and quite quickly imo

Will see what she gives

Have a splendiferous week of trade as we run the new month

$BTC

BTC-1,84%

- Reward

- 2

- Comment

- 1

- Share

Its my word vs no one here but fwiw i got long tuesday and pretty much bottom ticked the lows an hour prior the NY Open

Im pretty happy as I shaved a chunk at the 24 vwap at 65 but holding good chunk of risk i tagged on at the lows currently

I wouldnt be shocked if she gives a wee retest around the region but i certainly do not want to see anymore time and space below that vwap

If that happens shes cooked cunts

I hope for my sake and the industry's that these bulls can thrust us with a heavenly green dildo to the stars

I want 80s

cheers

#BTC

Im pretty happy as I shaved a chunk at the 24 vwap at 65 but holding good chunk of risk i tagged on at the lows currently

I wouldnt be shocked if she gives a wee retest around the region but i certainly do not want to see anymore time and space below that vwap

If that happens shes cooked cunts

I hope for my sake and the industry's that these bulls can thrust us with a heavenly green dildo to the stars

I want 80s

cheers

#BTC

BTC-1,84%

- Reward

- 1

- Comment

- Repost

- Share

It is hard to gage whether it is actually a function of market wide conditions, my relevence fading into the abyss or are people actually less active on here?

Is this really the worst time you have had in the crypto markets specifically? Worse than the FTX implosion? Worse than the slow dribble in 2018 that led to the 3 k collapse? Worse than the COVID Drop?

Personally I don't see it. This cycle or whatever you want to call it was different, but I don't personally share the sentinment that it is the worst period bar none?

Am I missing something or are people genuinly throwing in the towel?

Is this really the worst time you have had in the crypto markets specifically? Worse than the FTX implosion? Worse than the slow dribble in 2018 that led to the 3 k collapse? Worse than the COVID Drop?

Personally I don't see it. This cycle or whatever you want to call it was different, but I don't personally share the sentinment that it is the worst period bar none?

Am I missing something or are people genuinly throwing in the towel?

- Reward

- like

- Comment

- Repost

- Share

Can see what I mean I am not shitting these numbers out the ass

This is math

We bottomed with a 3 drive structure that chopped a lot around the top band followed by a cheeky reclaim which was a nice long to the highs

Then November put in a wick to the pubic tick

Unforuntately we have accepted within 2024 bracket

The intiial drop below the 24 vwap was followed by a really strong impulse back and instant reclaim (remember that 12%+ day recently?)

But we have spent weeks chopping in and around it (24 VWAP) with very little follow through to show

That is why it is important to have alerts set a

This is math

We bottomed with a 3 drive structure that chopped a lot around the top band followed by a cheeky reclaim which was a nice long to the highs

Then November put in a wick to the pubic tick

Unforuntately we have accepted within 2024 bracket

The intiial drop below the 24 vwap was followed by a really strong impulse back and instant reclaim (remember that 12%+ day recently?)

But we have spent weeks chopping in and around it (24 VWAP) with very little follow through to show

That is why it is important to have alerts set a

BTC-1,84%

- Reward

- like

- Comment

- Repost

- Share

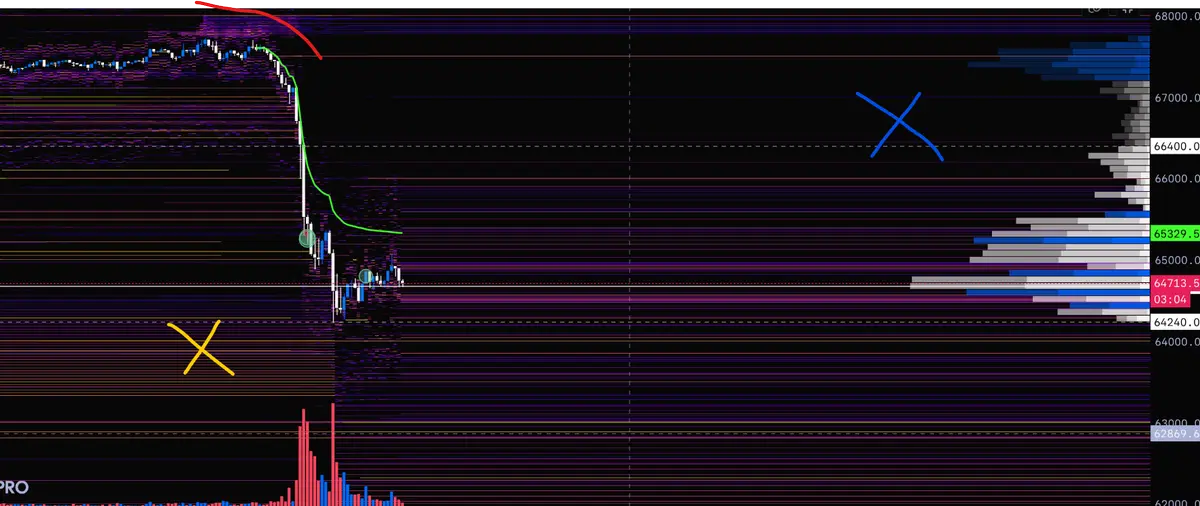

As mentioned this 2024 vwap is big big zone

The only thing stopping price from traversing entire plane of value is a strong reaction at the POC (the 2024 vwap in this case)

To me this is a pretty limp dick reaction thus far

We have compressed above it but being pinned down by developing yearly value which in this case is the Qaurterly view overlaid as evidenced by the downward sloping resistance

No bueno tbh. It needs to reclaim the 2024 vwap today or we going to take the lows and need to be on guard for a full value flush which would be 50 k even. Yes, 50 k even per Auction Market Theory

HO

The only thing stopping price from traversing entire plane of value is a strong reaction at the POC (the 2024 vwap in this case)

To me this is a pretty limp dick reaction thus far

We have compressed above it but being pinned down by developing yearly value which in this case is the Qaurterly view overlaid as evidenced by the downward sloping resistance

No bueno tbh. It needs to reclaim the 2024 vwap today or we going to take the lows and need to be on guard for a full value flush which would be 50 k even. Yes, 50 k even per Auction Market Theory

HO

BTC-1,84%

- Reward

- like

- Comment

- Repost

- Share

You can sit there and watch your stops and liquidations hit and then find 99 reasons in the world to explain why you lost

Or you can sit there, watch the sun rise, sun the balls, take a breath, look up to the heavens and thank the universe for another day on this beautiful pale blue rock

The choice is yours

Attitude is everything in this buisness

Keep clicking

And click with gratitude

#BTC

Or you can sit there, watch the sun rise, sun the balls, take a breath, look up to the heavens and thank the universe for another day on this beautiful pale blue rock

The choice is yours

Attitude is everything in this buisness

Keep clicking

And click with gratitude

#BTC

BTC-1,84%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Early move with suppresion at weekly open

Bid has been pulled

Some cunts got taken to the cleaners

Thin book

Little conviction

A skittish market

#BTC

Bid has been pulled

Some cunts got taken to the cleaners

Thin book

Little conviction

A skittish market

#BTC

BTC-1,84%

- Reward

- 2

- Comment

- Repost

- Share

Everyone has their strategy but procuring a decent set of heuristics around execution is a completely different kettle of fish

You can always refine and do better

Anyways, this environment is such if you actually pay attention there are subtle clues and signs on who stands to lose

Pretty clean soak and rinse here

#BTC

You can always refine and do better

Anyways, this environment is such if you actually pay attention there are subtle clues and signs on who stands to lose

Pretty clean soak and rinse here

#BTC

BTC-1,84%

- Reward

- like

- Comment

- Repost

- Share

Low volatility is synoynmous with low volume (active participation)

but remember this environment is always a prelude to an outsized violent rotation

You can't have one without the other

You can gage this regime simply using PA

But understanding when the "move" is outside of expected norms is where many leave dollars on the penny

but remember this environment is always a prelude to an outsized violent rotation

You can't have one without the other

You can gage this regime simply using PA

But understanding when the "move" is outside of expected norms is where many leave dollars on the penny

- Reward

- 2

- Comment

- Repost

- Share

We've had a few weeks of value built since the "blow off top event"

I am willing to donate my left testicle to charity if we do not hit that green box of destiny before the months end

Yes to charity

My only crown jewel left

You can thank me in advance when you refinance your mortgages on this trade

Cheers

Send it $SLV

I am willing to donate my left testicle to charity if we do not hit that green box of destiny before the months end

Yes to charity

My only crown jewel left

You can thank me in advance when you refinance your mortgages on this trade

Cheers

Send it $SLV

- Reward

- 1

- Comment

- Repost

- Share

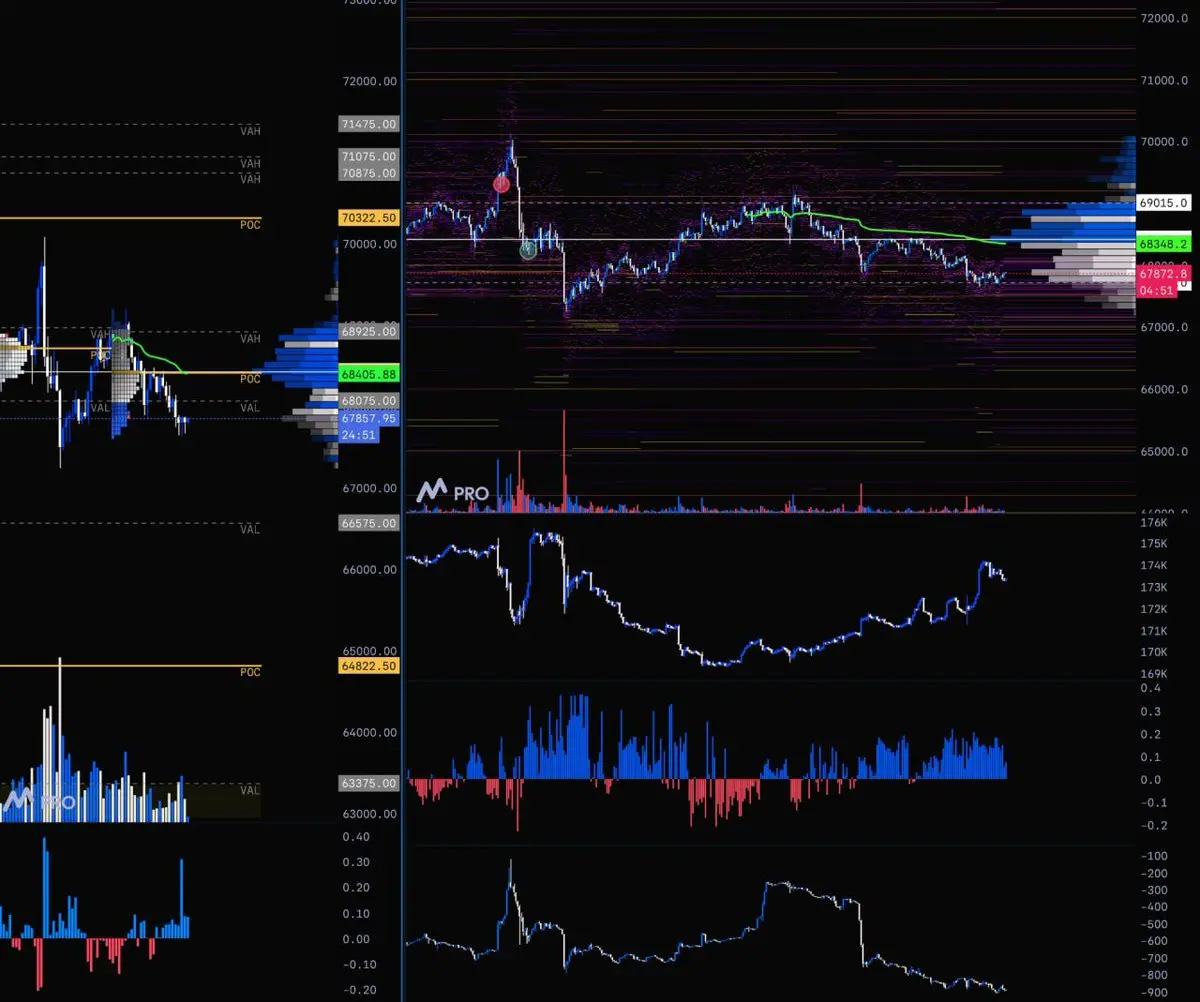

I like the qaurter view to get a hollistic contextual breakdown of price

The developing Q VAL is super important for upward bias

If we can reclaim that 68750 and put in some time and space there, then I reckon we smash the 30 day rolling in due course and likely sets up for a larger extension rally into the mid 80s

Invalidation would be sustained pa Below the 65 k pivot (2024 vwap)

Anything below that would likely lead to a range low retest into the low 60s and high 58s or so

Anyways, to me I think #BTC is putting in a bottom base here and regardless of what happens in the macro landscape w

The developing Q VAL is super important for upward bias

If we can reclaim that 68750 and put in some time and space there, then I reckon we smash the 30 day rolling in due course and likely sets up for a larger extension rally into the mid 80s

Invalidation would be sustained pa Below the 65 k pivot (2024 vwap)

Anything below that would likely lead to a range low retest into the low 60s and high 58s or so

Anyways, to me I think #BTC is putting in a bottom base here and regardless of what happens in the macro landscape w

BTC-1,84%

- Reward

- 1

- Comment

- Repost

- Share

Yeah this was a very choppy week

Range is compressing even more

Importantly 67 k is holding as support, but don't want to see us accept below 65 k (2024 yearly vwap) otherwise im expecting a swift dump towards the 60 k even level

So far holding here not a bad look

Last 2 Fridays have been green

What will she give today?!

#BTC

Range is compressing even more

Importantly 67 k is holding as support, but don't want to see us accept below 65 k (2024 yearly vwap) otherwise im expecting a swift dump towards the 60 k even level

So far holding here not a bad look

Last 2 Fridays have been green

What will she give today?!

#BTC

BTC-1,84%

- Reward

- 1

- Comment

- Repost

- Share

Decent early week dispersion here

Would love to see some of these short sellers run over

72s potentially next

Must reclaim previous weekly vwap (per previous post)

#BTC

Would love to see some of these short sellers run over

72s potentially next

Must reclaim previous weekly vwap (per previous post)

#BTC

BTC-1,84%

- Reward

- like

- Comment

- Repost

- Share

10 out of 10 cycle

10 out of 10 market

10 out of 10 start to 2026

10 out of 10 tell a friend

10 out of 10 market

10 out of 10 start to 2026

10 out of 10 tell a friend

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Genuinly can feel the good vibes here

Everyone on feed is nothing but a burning beam of optimism

If you are here and enjoying the market - you are a real one

Congrats bro

Everyone on feed is nothing but a burning beam of optimism

If you are here and enjoying the market - you are a real one

Congrats bro

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share