#CryptoMarketWatch

As of January 2026, the cryptocurrency market is seeing a massive resurgence, with XRP, SOL, and DOGE leading the pack. Your observation about $2.30 is particularly relevant to XRP, which has recently broken through major multi-year resistance levels.

XRP Breached $2.30 Tight exchange supply, institutional ETF inflows, and regulatory clarity via the GENIUS Act.

SOL Testing ATHs Massive growth in the "Internet Bond" narrative and high-speed DeFi execution.

DOGE Social Surge On-chain data shows a 3-month high in active addresses, signaling retail "front-running" of meme cycles.

Why XRP specifically hit the $2.30 mark

XRP’s move above $2.30 is driven by a "perfect storm" of supply and demand:

Supply Crunch: XRP balances on exchanges have hit multi-year lows. When supply is tight, even moderate buying pressure from new Spot XRP ETFs causes outsized price moves.

Network Utility: The XRP Ledger is seeing daily transaction counts near 1 million, suggesting the growth isn't just speculative but rooted in actual cross-border settlement usage.

The "Plaza Feed" Strategy: Why Lists Work

You noticed that "Top" keywords and lists are performing exceptionally well. In a fast-moving market (especially in 2026), users are dealing with information overload. Lists perform high because:

Scannability: Traders want to know the "Top 3" or "Top 5" movers instantly without reading a 1,000-word technical analysis.

Comparison: Lists allow users to compare different ecosystems (like Solana vs. Ripple) in one glance.

Algorithmic Favor: Platforms like Gate Square prioritize high-engagement keywords like "Top," "Best," and "Prediction" because they have higher click-through rates (CTR) from retail investors looking for the next "moon" coin.

Key Market Drivers for January 2026

The GENIUS Act: Recent U.S. legislation has provided the clearest framework for stablecoins and exchanges in history, inviting institutional giants to move capital from "boring" assets into crypto.

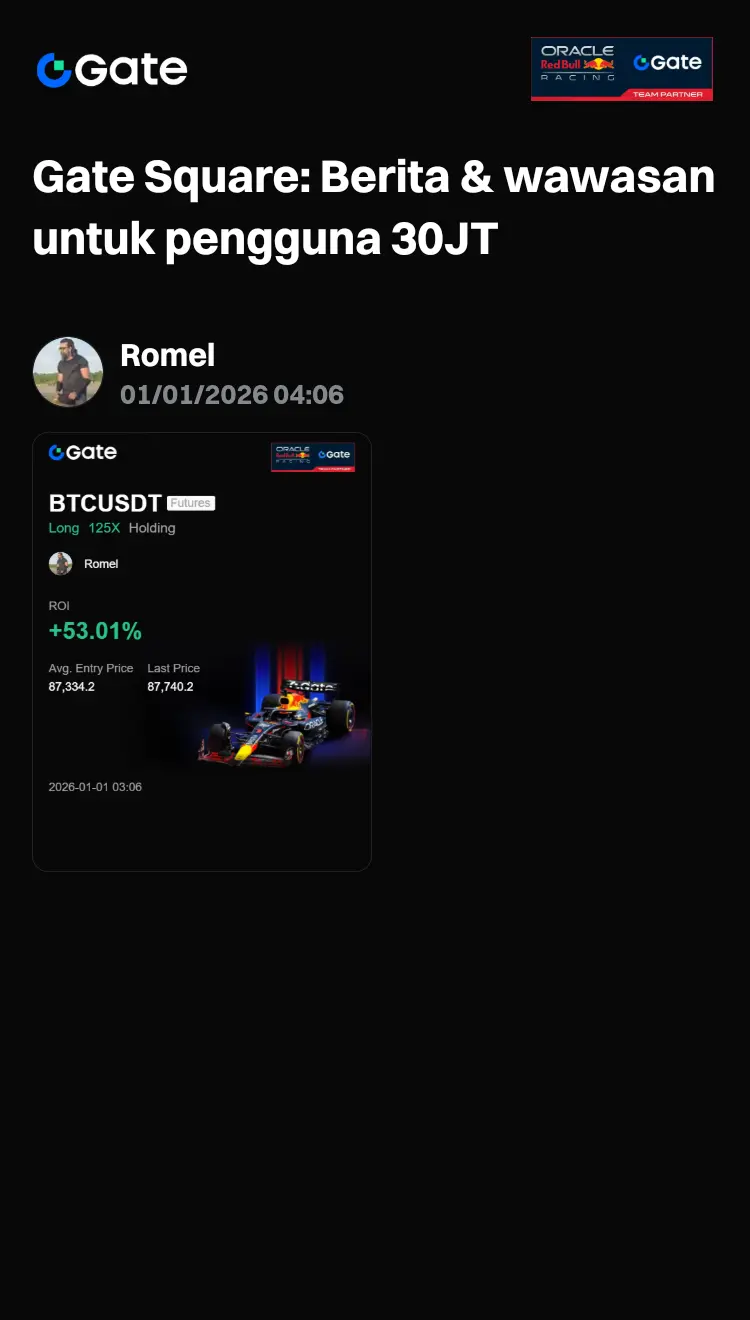

Capital Rotation: As Bitcoin stabilizes, capital is rotating into "high-conviction" alts like SOL and XRP, which now have their own regulated ETF vehicles.

As of January 2026, the cryptocurrency market is seeing a massive resurgence, with XRP, SOL, and DOGE leading the pack. Your observation about $2.30 is particularly relevant to XRP, which has recently broken through major multi-year resistance levels.

XRP Breached $2.30 Tight exchange supply, institutional ETF inflows, and regulatory clarity via the GENIUS Act.

SOL Testing ATHs Massive growth in the "Internet Bond" narrative and high-speed DeFi execution.

DOGE Social Surge On-chain data shows a 3-month high in active addresses, signaling retail "front-running" of meme cycles.

Why XRP specifically hit the $2.30 mark

XRP’s move above $2.30 is driven by a "perfect storm" of supply and demand:

Supply Crunch: XRP balances on exchanges have hit multi-year lows. When supply is tight, even moderate buying pressure from new Spot XRP ETFs causes outsized price moves.

Network Utility: The XRP Ledger is seeing daily transaction counts near 1 million, suggesting the growth isn't just speculative but rooted in actual cross-border settlement usage.

The "Plaza Feed" Strategy: Why Lists Work

You noticed that "Top" keywords and lists are performing exceptionally well. In a fast-moving market (especially in 2026), users are dealing with information overload. Lists perform high because:

Scannability: Traders want to know the "Top 3" or "Top 5" movers instantly without reading a 1,000-word technical analysis.

Comparison: Lists allow users to compare different ecosystems (like Solana vs. Ripple) in one glance.

Algorithmic Favor: Platforms like Gate Square prioritize high-engagement keywords like "Top," "Best," and "Prediction" because they have higher click-through rates (CTR) from retail investors looking for the next "moon" coin.

Key Market Drivers for January 2026

The GENIUS Act: Recent U.S. legislation has provided the clearest framework for stablecoins and exchanges in history, inviting institutional giants to move capital from "boring" assets into crypto.

Capital Rotation: As Bitcoin stabilizes, capital is rotating into "high-conviction" alts like SOL and XRP, which now have their own regulated ETF vehicles.