InvestingWithBrandon

No content yet

InvestingWithBrandon

Your HORRIBLE strike price is why you get smoked with options...

(how to fix it right now)

Most retail investors sell puts with a strike price 5% ish below the current market price to "build a margin of safety"

They usually do this with monthly contracts.

Here's the BIG problem.

5% is not a good enough margin of safety, especially with a 1 month contract where you have no tailwinds of growth behind you.

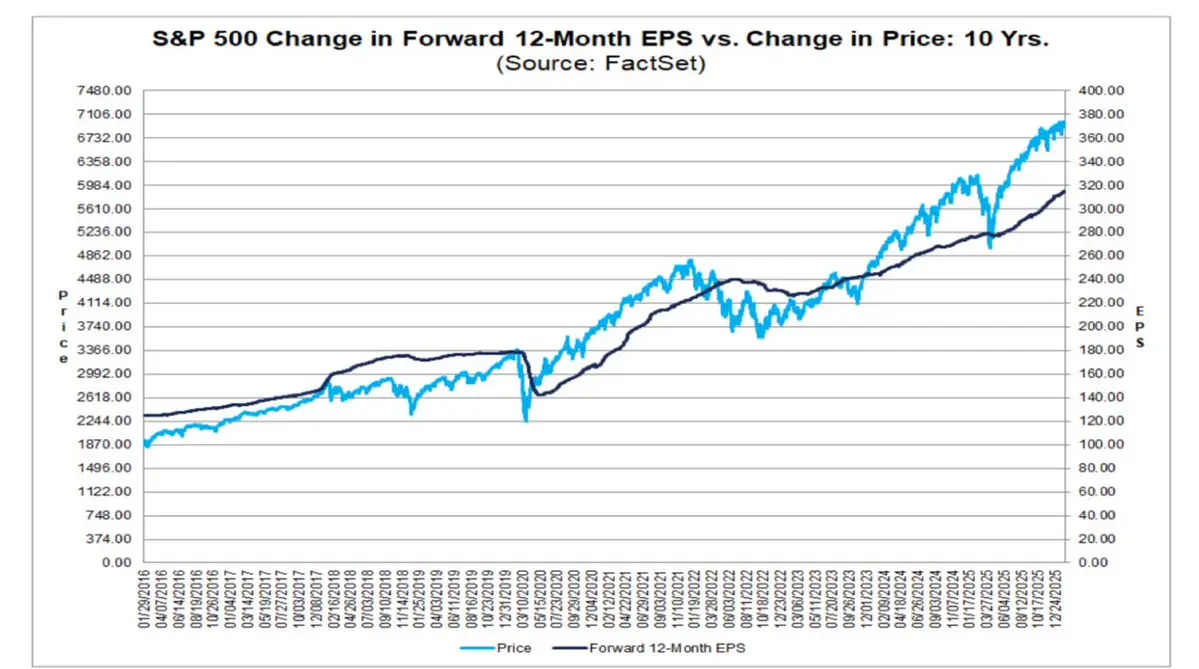

(as EPS climbs, the stock will follow that up)

The solution is to sell 1+ year puts.

You can pick a strike price 20% below the money, get great premium, build a MUCH better margin of safety, ha

(how to fix it right now)

Most retail investors sell puts with a strike price 5% ish below the current market price to "build a margin of safety"

They usually do this with monthly contracts.

Here's the BIG problem.

5% is not a good enough margin of safety, especially with a 1 month contract where you have no tailwinds of growth behind you.

(as EPS climbs, the stock will follow that up)

The solution is to sell 1+ year puts.

You can pick a strike price 20% below the money, get great premium, build a MUCH better margin of safety, ha

- Reward

- like

- Comment

- Repost

- Share

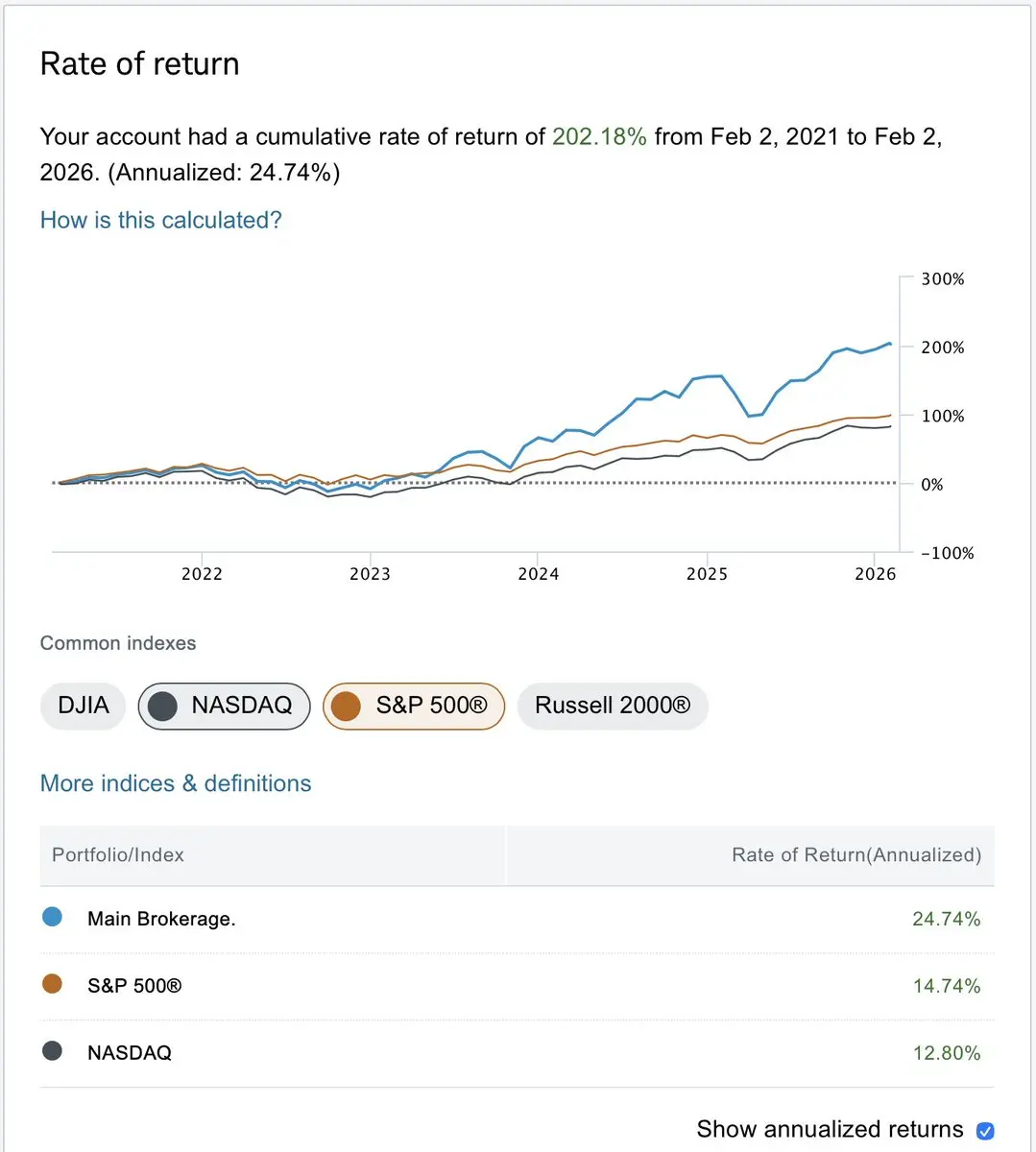

If your strategy doesn't beat the S&P500 over 5+ years, what exactly are you doing...

Most “strategies” are just:

- More screen time

- More stress

- More trades

- Worse returns than the brainless SP500

We are all here to make money right?

So do yourself a favor & look at your true ROI in the last 5 years and see if what you are doing even beats the SP... I bet most people reading this did not.

Me?

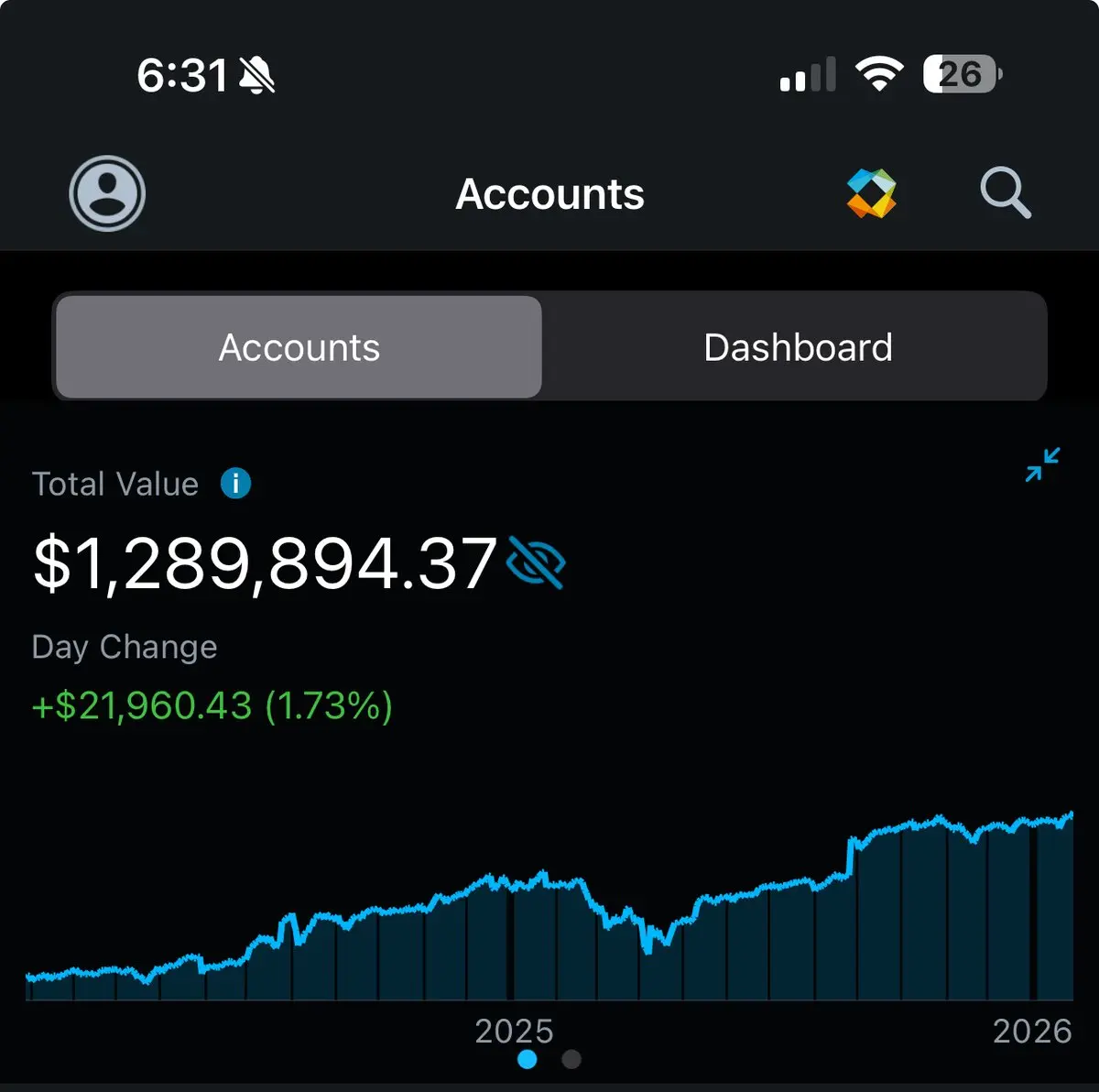

I have smoked the SP500 in the last 5 years.

The screenshot is proof the system I use through bull markets & bear markets does smoke the SP500.

Anyone can get amazing ROIs in bull markets (I do too,

Most “strategies” are just:

- More screen time

- More stress

- More trades

- Worse returns than the brainless SP500

We are all here to make money right?

So do yourself a favor & look at your true ROI in the last 5 years and see if what you are doing even beats the SP... I bet most people reading this did not.

Me?

I have smoked the SP500 in the last 5 years.

The screenshot is proof the system I use through bull markets & bear markets does smoke the SP500.

Anyone can get amazing ROIs in bull markets (I do too,

- Reward

- like

- Comment

- Repost

- Share

If you get value from my posts, you'll love my 10 Day Stock & Options Transformation Training.

Over the course of 10 days of training, you'll learn exactly how you can scale your portfolio to millions with Stocks & Options in a low risk way & get access to my mastermind Discord community.

This is the exact same system I have used for the last decade & scaled to millions with tens of thousands in monthly cash flow.

No day trading.

No BS.

Just straight up investing the right way.

Get set up here:

Over the course of 10 days of training, you'll learn exactly how you can scale your portfolio to millions with Stocks & Options in a low risk way & get access to my mastermind Discord community.

This is the exact same system I have used for the last decade & scaled to millions with tens of thousands in monthly cash flow.

No day trading.

No BS.

Just straight up investing the right way.

Get set up here:

- Reward

- like

- Comment

- Repost

- Share

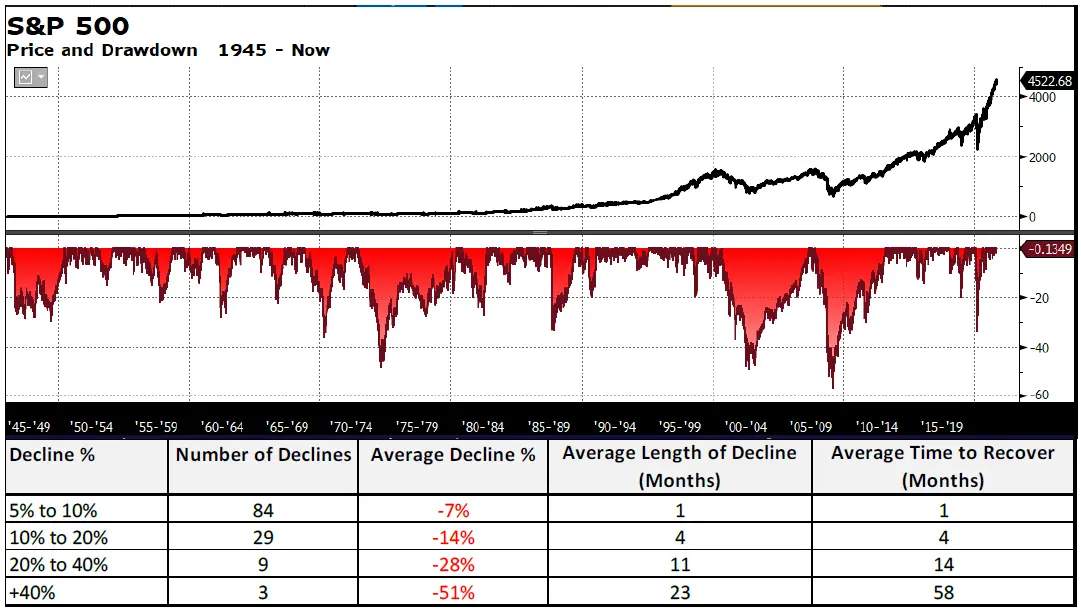

MARKETS DO NOT NEED TO CRASH JUST BECAUSE THEY LOOK A LITTLE HOT.

People hear “valuations are elevated” & instantly jump to “bear market is coming, head for the hills.”

I do think valuations are hot now, but I am not calling for a MAJOR crash (possible though).

The market can trade sideways for a long time while earnings catch up. It does not have to drop 15% just because fair value might be 15% lower. Short term price action is irrational more often than not.

Here is the part most investors miss.

Waiting for the "perfect" crash usually destroys more wealth than volatility ever will. You mig

People hear “valuations are elevated” & instantly jump to “bear market is coming, head for the hills.”

I do think valuations are hot now, but I am not calling for a MAJOR crash (possible though).

The market can trade sideways for a long time while earnings catch up. It does not have to drop 15% just because fair value might be 15% lower. Short term price action is irrational more often than not.

Here is the part most investors miss.

Waiting for the "perfect" crash usually destroys more wealth than volatility ever will. You mig

- Reward

- like

- Comment

- Repost

- Share

The market falls 5% last week & many people are nervous...

This chart shows you the odds of the "big one"

Please ensure you can not only survive the crashes, but capitalize in them too.

This chart shows you the odds of the "big one"

Please ensure you can not only survive the crashes, but capitalize in them too.

- Reward

- like

- Comment

- Repost

- Share

Don’t let a bear market scare you out of investing.

The best opportunities often pop up when prices are low and fear dominates.

GET READY

The best opportunities often pop up when prices are low and fear dominates.

GET READY

- Reward

- 1

- Comment

- Repost

- Share

Stop day trading/swing

You’ll prob never make it like you see online.

Literally it’s a 1 in a 50,000 chance you strike gold with that.

Prob even worse.

You’ll prob never make it like you see online.

Literally it’s a 1 in a 50,000 chance you strike gold with that.

Prob even worse.

- Reward

- like

- Comment

- Repost

- Share

"Investing is risky"

"Taxes will kill you"

"Only the rich make it"

"The stock market is rigged"

"Regular people never make it"

The phrases from people that accepted being average is all they will ever amount to in life...

What other BS excuses have you heard?

"Taxes will kill you"

"Only the rich make it"

"The stock market is rigged"

"Regular people never make it"

The phrases from people that accepted being average is all they will ever amount to in life...

What other BS excuses have you heard?

- Reward

- like

- Comment

- Repost

- Share

The day job is a means to an end.We all started out trading time for moneyBUT Eventually you will realize you are losing money working the day job vs investing and building your business.Opportunity cost!

- Reward

- like

- Comment

- Repost

- Share

If you’re serious about building wealth, don’t ask what car someone drives or how big their house is. Ask how they manage RISK. Ask how they INVEST. Ask how they THINK. Everybody wants the lifestyle, but few want the discipline that creates it.

- Reward

- like

- Comment

- Repost

- Share

Making money with money is the ultimate life hackYou’re taught to trade your time for money and then trade your money for materials.But you could trade your money for more money instead

- Reward

- like

- Comment

- Repost

- Share

When will retail learn?Prob never.Unfortunately…

- Reward

- 1

- 1

- Repost

- Share

Wetik :

:

Hold tight 💪The biggest issue I see a lot of people when they start making more money, or come into money suddenly is.Celebrating too earlyUpgrading their lifestyle too quicklyInstead of using that new income as a tool to keep you earning and growingDon’t celebrate too early, but still find the balance to live life.

- Reward

- like

- Comment

- Repost

- Share

Stocks always revert to the mean. Always.Never forget that.Valuations don’t matter… till they do. As I always say, capitalize on upside, but always be prepared for significant downside, especially when valuations are hot.

- Reward

- like

- Comment

- Repost

- Share

Valuations don\'t matter. UNTIL THEY DO.Retail investors forget this.

- Reward

- like

- Comment

- Repost

- Share