IntoTheBlock

No content yet

IntoTheBlock

We’ll be diving into risk curation in our webinar this Wednesday.

Register below to make sure you don’t miss it👇

Register below to make sure you don’t miss it👇

- Reward

- like

- Comment

- Repost

- Share

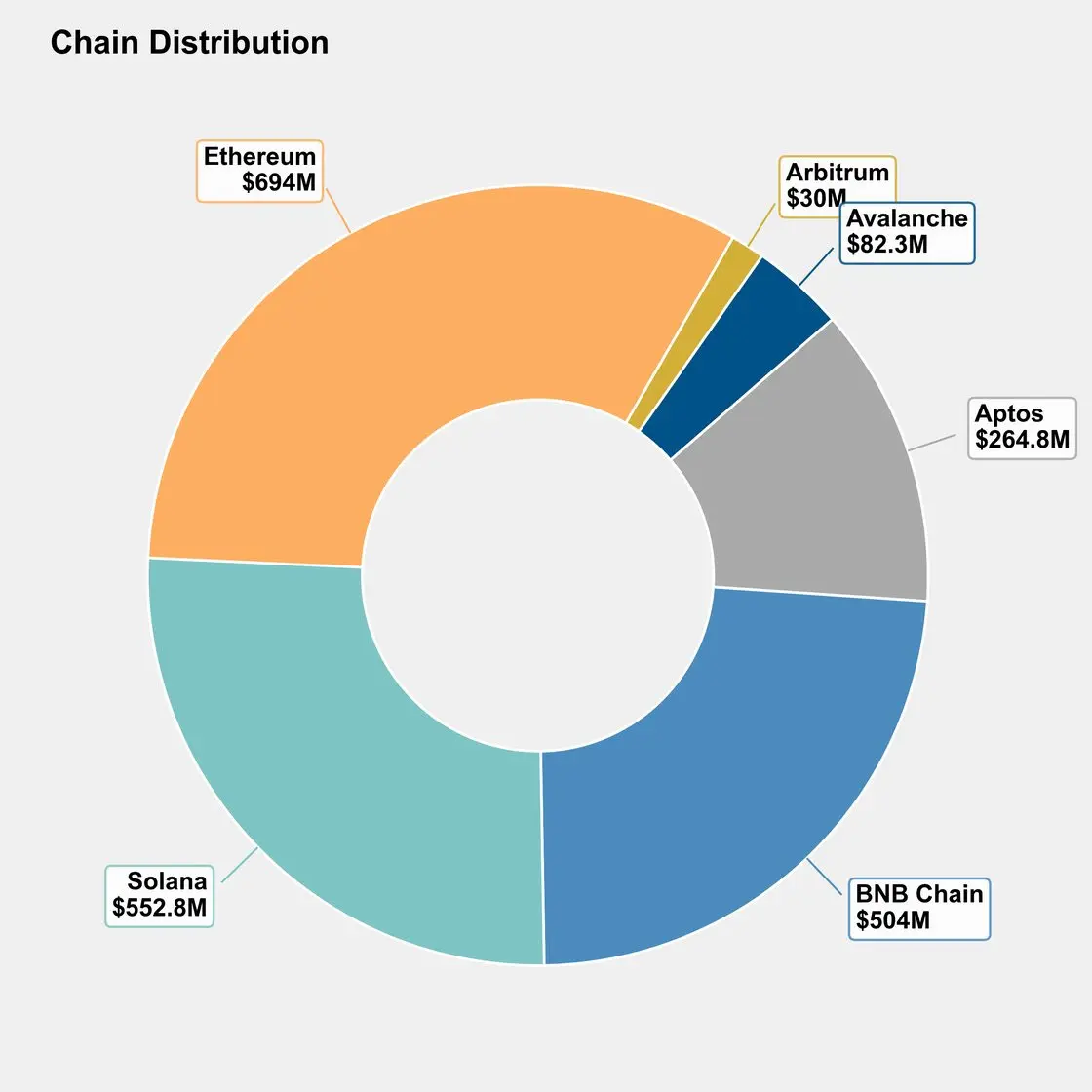

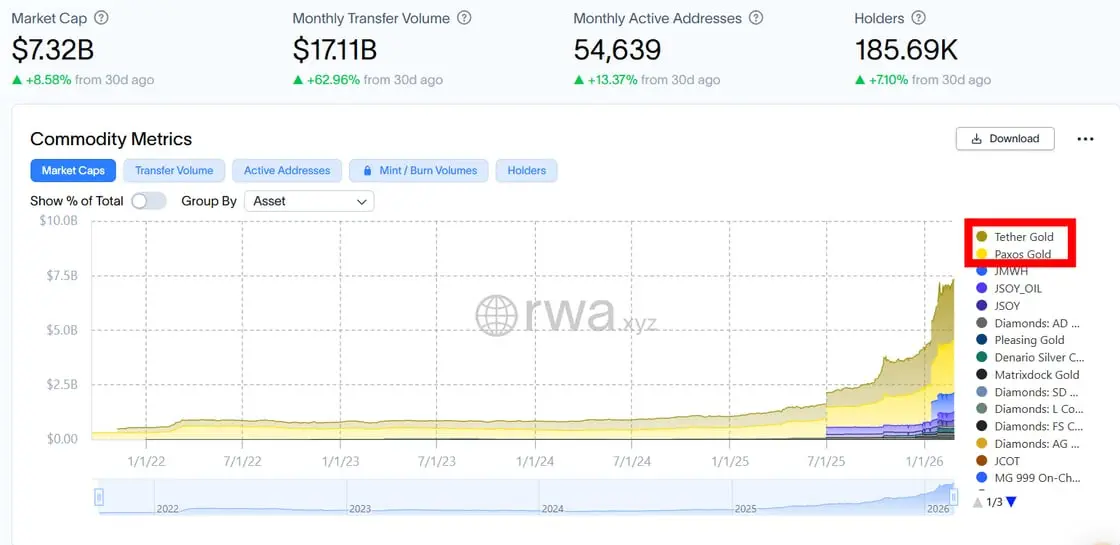

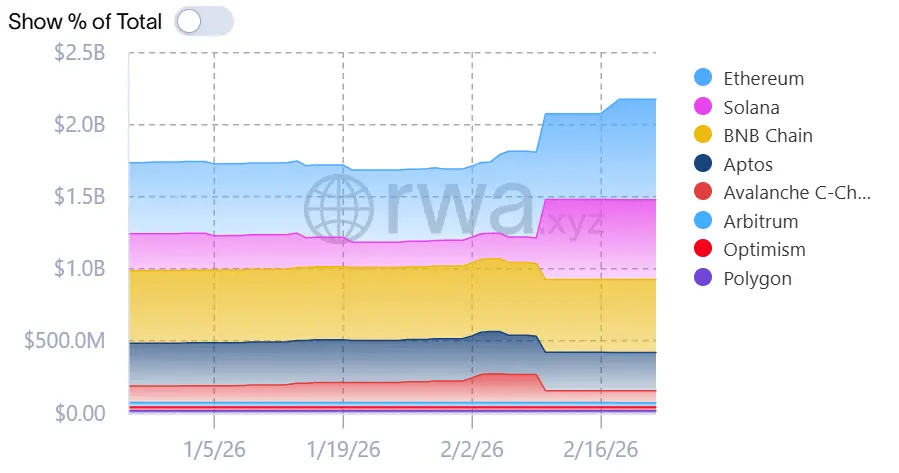

The aggregate market capitalization for tokenized commodities and equities has reached a record $7.32 billion, reflecting an 8.58% increase over the last 30 days.

- Reward

- 1

- Comment

- Repost

- Share

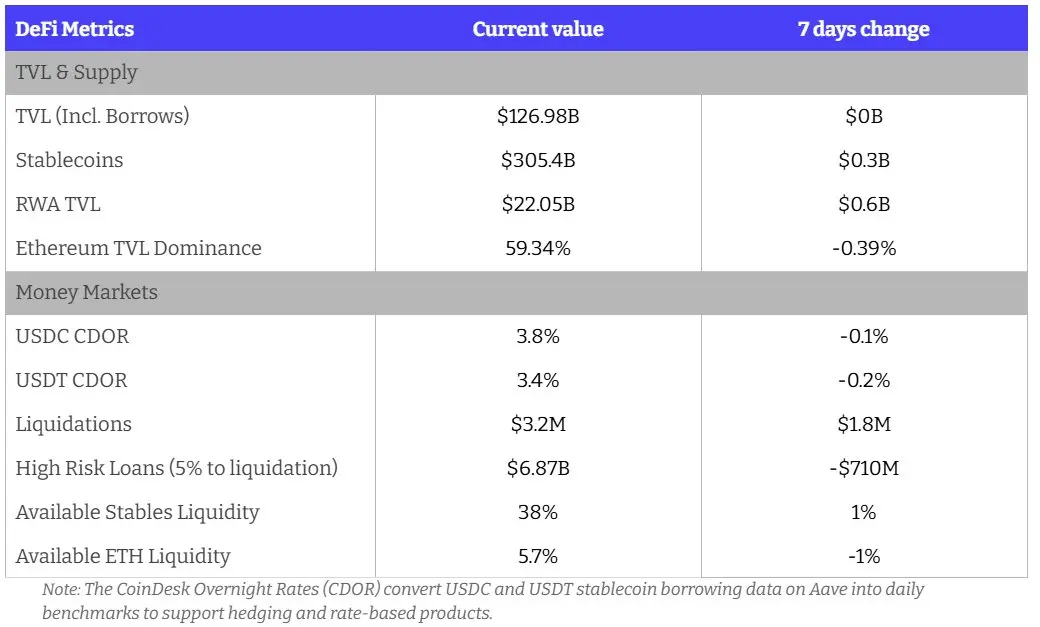

Here are this week's key DeFi metrics👇

Our key takeaways:

✔️Liquidations: $5.2M in new liquidations suggest a volatile week for leveraged traders.

✔️RWAs: Real World Assets added $631.8M

✔️Deleveraging : High-risk loans dropped by $262M while overall liquidity improved.

Our key takeaways:

✔️Liquidations: $5.2M in new liquidations suggest a volatile week for leveraged traders.

✔️RWAs: Real World Assets added $631.8M

✔️Deleveraging : High-risk loans dropped by $262M while overall liquidity improved.

- Reward

- 1

- Comment

- Repost

- Share

In this week's newsletter we dive into the surprising growth of tokenized commodities.

Catch up on it below👇

Catch up on it below👇

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

PTs and YTs can offer significant benefits for DeFi strategies, but keep the following risk in mind👇

- Reward

- like

- Comment

- Repost

- Share

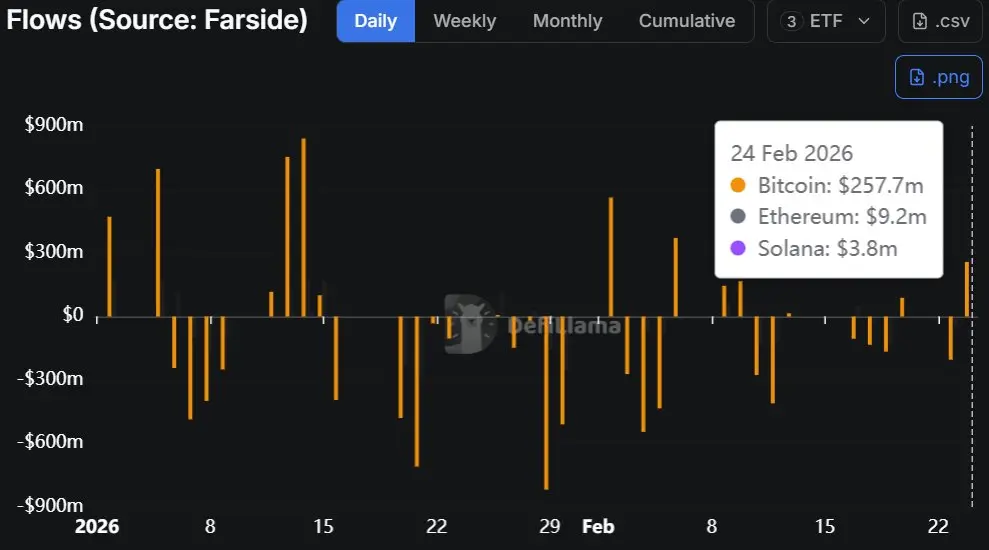

Bitcoin ETFs added over $250 million yesterday.

While still well below the highs seen earlier this year, it marks the largest daily inflow since early February, suggesting ETF investors may be taking advantage of lower BTC prices.

While still well below the highs seen earlier this year, it marks the largest daily inflow since early February, suggesting ETF investors may be taking advantage of lower BTC prices.

BTC-2,91%

- Reward

- 2

- Comment

- Repost

- Share

Risk curation is foundational to DeFi infrastructure.

Join our next webinar to learn how curation works, why it’s essential, and how it strengthens on-chain markets.

Join our next webinar to learn how curation works, why it’s essential, and how it strengthens on-chain markets.

- Reward

- like

- Comment

- Repost

- Share

Tokenized equities are the fastest-growing segment within on-chain real-world assets

Read the report👇

Read the report👇

- Reward

- like

- Comment

- Repost

- Share

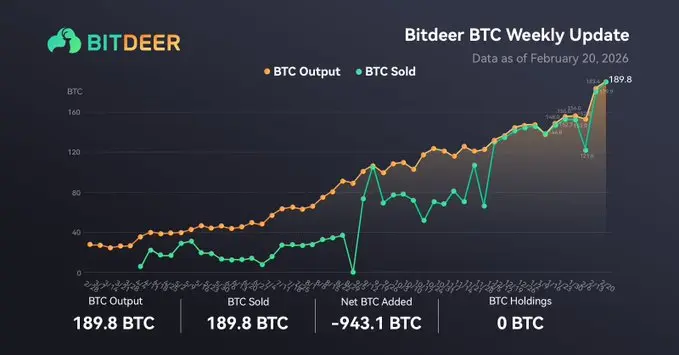

Bitdeer, a major BTC mining company, sold its BTC holdings last week.

Miner capitulation has historically been a late-cycle stress signal: in the short term it can increase sell pressure as operators liquidate reserves, but it has often coincided with improving miner economics and stronger BTC price recoveries

Miner capitulation has historically been a late-cycle stress signal: in the short term it can increase sell pressure as operators liquidate reserves, but it has often coincided with improving miner economics and stronger BTC price recoveries

BTC-2,91%

- Reward

- 1

- Comment

- Repost

- Share

BlackRock’s BUIDL fund market cap grew by nearly 30% over the past 30 days, with growth accelerating after BUIDL became tradable on Uniswap.

- Reward

- 1

- Comment

- Repost

- Share

Our next webinar will unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

Sign up below 👇

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

RWA momentum continued as two of the world’s largest traditional asset managers, BlackRock and Apollo Global Management, moved to deep infrastructure integration.

We break it down in our latest newsletter👇

We break it down in our latest newsletter👇

- Reward

- like

- Comment

- Repost

- Share

Here are this week's key DeFi metrics👇

Major takeaways:

✔️TVL and supply remains flat as markets continue to chop

✔️$700M decrease in high-risk loans, driven by repayments in leveraged restaking

Major takeaways:

✔️TVL and supply remains flat as markets continue to chop

✔️$700M decrease in high-risk loans, driven by repayments in leveraged restaking

- Reward

- 1

- Comment

- Repost

- Share

Total Ethereum fees saw a drastic 70% decline this week, signaling a lull in high-velocity DeFi activity

ETH-2,06%

- Reward

- like

- Comment

- Repost

- Share