IncomeSharks

No content yet

IncomeSharks

Trader A)

Year 1: up 100% in a bull

Year 2: down 50% in a bear

Roundtrips

Trader B)

Year 1: up 20% in a bull

Year 2: down 5% in a bear

Profitable

The true test of a trader is not how well they can do in a bull market. It's how well they can survive in a bear.

Year 1: up 100% in a bull

Year 2: down 50% in a bear

Roundtrips

Trader B)

Year 1: up 20% in a bull

Year 2: down 5% in a bear

Profitable

The true test of a trader is not how well they can do in a bull market. It's how well they can survive in a bear.

- Reward

- 1

- Comment

- Repost

- Share

I think AI makes good coders, good developers, and good traders much better. But I also think AI makes those average or those with very little knowledge much worse off because they get a false sense of being superior. Textbook Dunning-Kruger effect with the "I know it all" phase

- Reward

- 1

- Comment

- Repost

- Share

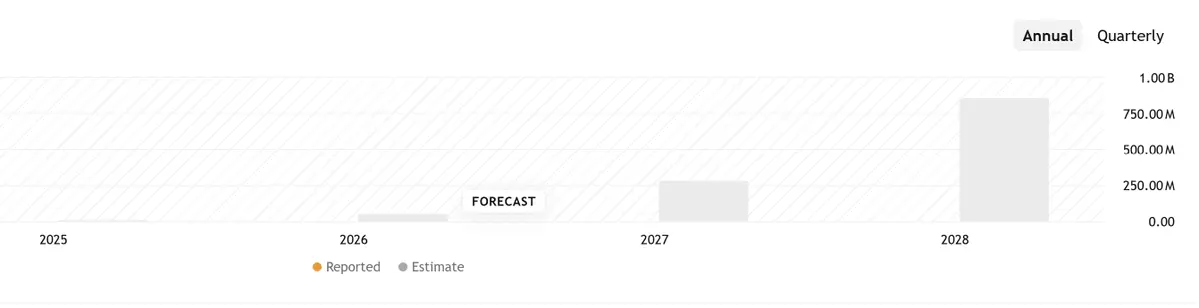

$USAR - This will be the first quarter they start generating revenue. Then it really starts ramping up with projected 2.6 billion by 2030. Assuming it all plays out:

Current marketcap: 4 billion

Projected marketcap: 25 to 30 billion

20x EBITDA / 10–12x revenue / 15x FCF

Current marketcap: 4 billion

Projected marketcap: 25 to 30 billion

20x EBITDA / 10–12x revenue / 15x FCF

- Reward

- like

- Comment

- Repost

- Share

It's called the Box of Despair for a reason. Still think we see a bullish March for Bitcoin but it's going to be an upwards crawl. It could also take until May or June to see an actual breakout.

BTC-6,66%

- Reward

- like

- Comment

- Repost

- Share

$QD - Inverse ETF of the Mag 7. Still can't unsee this as being bullish which means more downside for them. I don't think the capital rotation out of them is done yet but the best part of a hedge like this is you want to be wrong.

- Reward

- 1

- Comment

- Repost

- Share

$LAR - Closing the trade here up 136%. Great run on lithium, couldn't break that resistance so locking in gains here.

- Reward

- 1

- Comment

- Repost

- Share

By 2040 there will be an estimated 80 million people over the age of 65 in the US. This means tens of millions retiring and leaving the work force. This was a serious issue before AI which actually offers a solution now.

- Reward

- like

- Comment

- Repost

- Share

It'll be nice as weather changes and so will the optimism. There's a lot of doom and gloom on the timeline right now. Science even supports it too. From Grok "Studies show that sunny weather at stock exchange locations correlates with slightly higher daily stock returns"

- Reward

- 1

- Comment

- Repost

- Share

The amount of news stories you hear on X that turn out to be rumors or fake is getting so high it's becoming unusable as a source of information.

- Reward

- 1

- Comment

- Repost

- Share

Total Crypto Marketcap giving us a pretty clear picture of what levels need to break for either the bulls or bears to be happy.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$OPRA - Another trade with a big earnings beat. Good bounce at the bottom of the massive bullish wedge with strong fundamentals and looks like it wants to reach the top.

- Reward

- like

- Comment

- Repost

- Share

$MSTR - If we start flipping these Supertrend lines from red to green on the crypto majors and crypto stock plays it could lead to a pretty good March/April.

- Reward

- 2

- Comment

- Repost

- Share

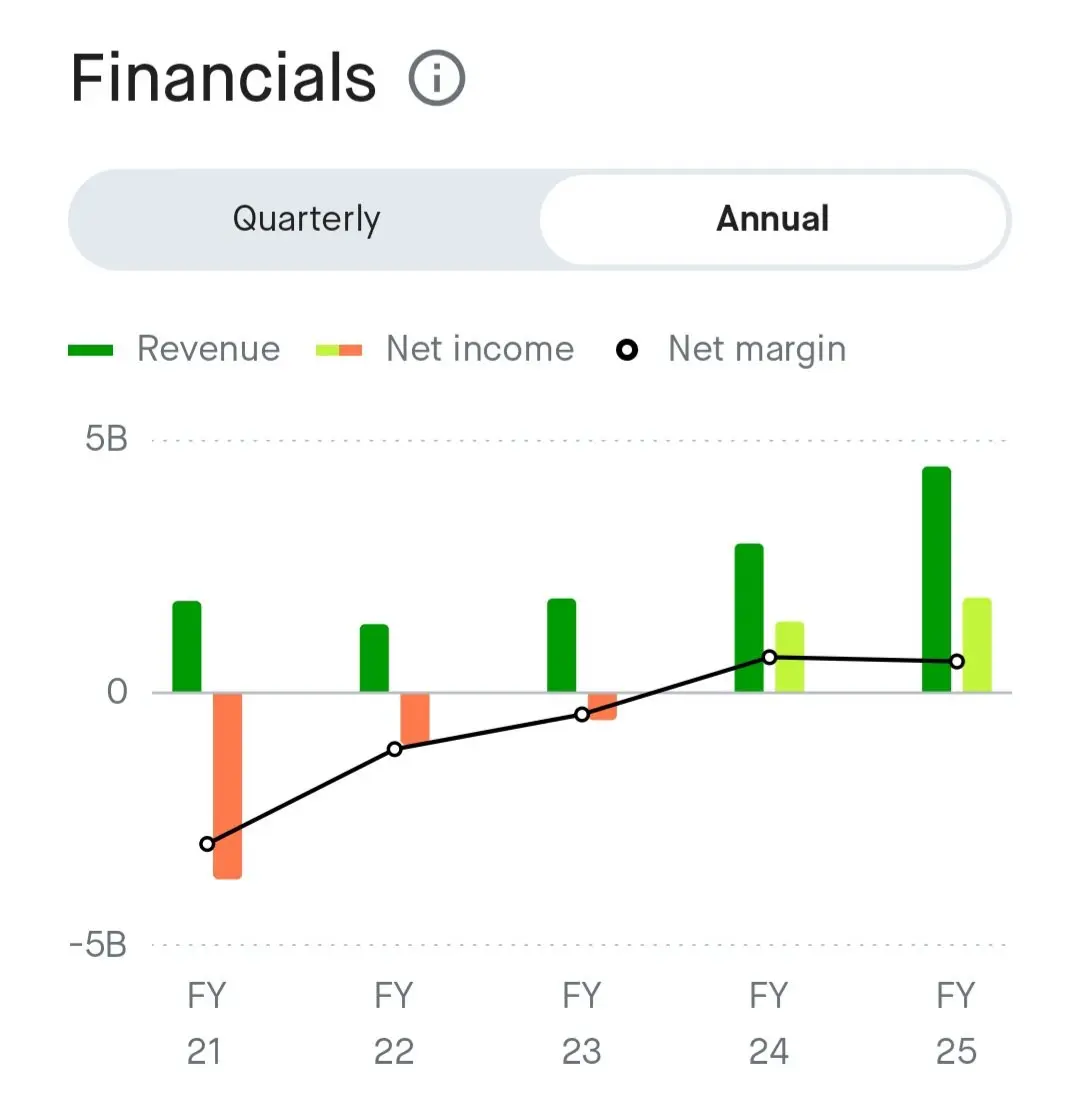

$HOOD - Every year they find a way to get better and more profitable. All I see with the price is a 50% discount.

- Reward

- like

- Comment

- Repost

- Share

$NVDA - OBV in a strong and upwards channel. Another earnings beat.

- Reward

- 1

- Comment

- Repost

- Share

Supertrend has been red on Crypto since the events of October 10th. A clear signal to get out and wait for a reversal. Bulls having a good day but I'd wait for at least it to flip green before any celebrating happens.

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕$CRCL - Trade up 30%. Went down a big rabbit hole on Slice about stable coins and treasuries. This is what's going to hopefully help fuel a crypto rally.

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$PYPL - Finally a bullish OBV spike up. Good for a mean revision or a local bottom if there's institutional buying or a catalyst/headline that's coming.

- Reward

- like

- Comment

- Repost

- Share