EyeOnChain

No content yet

EyeOnChain

Really one’s… awkward. In that quiet, wait-a-second kind of way.

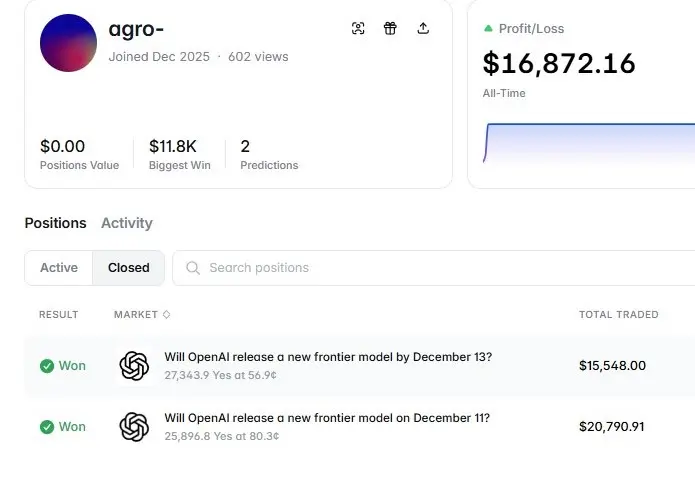

So rewind to Dec 10, 2025. A new wallet shows up out of nowhere and immediately makes a very specific call: OpenAI is about to drop a new frontier model. Not “soon.” Not “this month.” But Dec 11, or at the latest before Dec 13. Sharp timing.

And then .....yes,,,,, it happens. The model launches right in that window. The wallet closes out and pockets $16,872. of course, Not life-changing money, but also not nothing.

Now today, and suddenly there’s news floating around that OpenAI fired an employee over prediction-market insider tr

So rewind to Dec 10, 2025. A new wallet shows up out of nowhere and immediately makes a very specific call: OpenAI is about to drop a new frontier model. Not “soon.” Not “this month.” But Dec 11, or at the latest before Dec 13. Sharp timing.

And then .....yes,,,,, it happens. The model launches right in that window. The wallet closes out and pockets $16,872. of course, Not life-changing money, but also not nothing.

Now today, and suddenly there’s news floating around that OpenAI fired an employee over prediction-market insider tr

- Reward

- 2

- Comment

- Repost

- Share

This one was #GOLD not a small nudge -- more like a full-on shove.

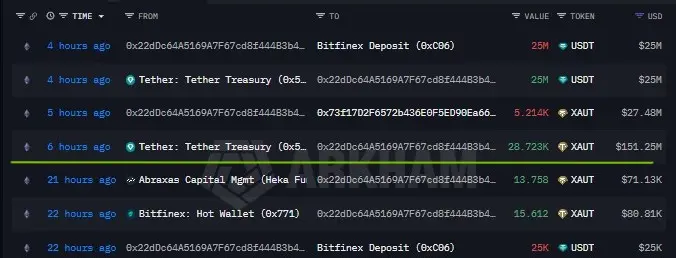

6 hours ago, the Tether treasury moved 28,723 #XAUT in a single shot. That’s around $151 million, making it the largest $XAUT transfer by size we’ve seen in the last three weeks.

The destination is Abraxas Capital Management and that’s where it gets interesting. Abraxas, through its Heka Funds, isn’t just some random counterparty ... it’s one of #Tether ’s most important institutional relationships. At one point, Heka reportedly held around 1.5% of all USDT in circulation, which is… massive. Even today, looking only at Tether’s

6 hours ago, the Tether treasury moved 28,723 #XAUT in a single shot. That’s around $151 million, making it the largest $XAUT transfer by size we’ve seen in the last three weeks.

The destination is Abraxas Capital Management and that’s where it gets interesting. Abraxas, through its Heka Funds, isn’t just some random counterparty ... it’s one of #Tether ’s most important institutional relationships. At one point, Heka reportedly held around 1.5% of all USDT in circulation, which is… massive. Even today, looking only at Tether’s

XAUT3,44%

- Reward

- 2

- Comment

- Repost

- Share

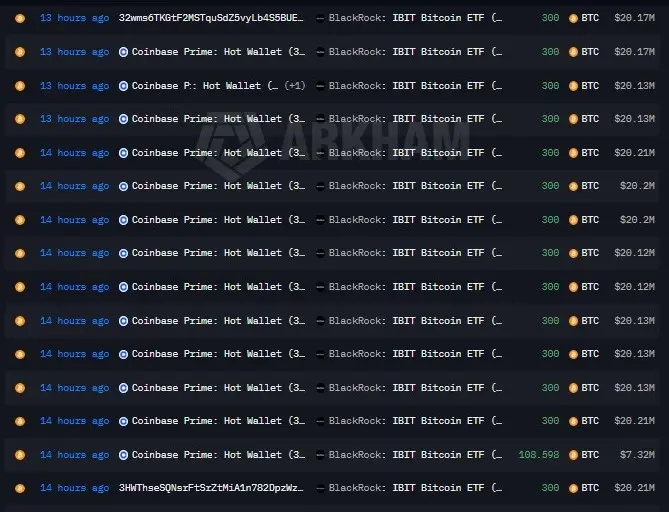

It just keeps going. #blackRock pulled in another 4,082 $BTC about $269.4M, straight from Coinbase Prime.

That makes three days in a row now. BlackRock’s net inflow sits at 9,615 #BTC , approx. $635M. And what’s wild is how calm it all looks.... which somehow makes it louder.

At this point it’s less “news” and more a pattern. And patterns like this usually don’t happen by accident.

That makes three days in a row now. BlackRock’s net inflow sits at 9,615 #BTC , approx. $635M. And what’s wild is how calm it all looks.... which somehow makes it louder.

At this point it’s less “news” and more a pattern. And patterns like this usually don’t happen by accident.

BTC-6,38%

- Reward

- 3

- Comment

- Repost

- Share

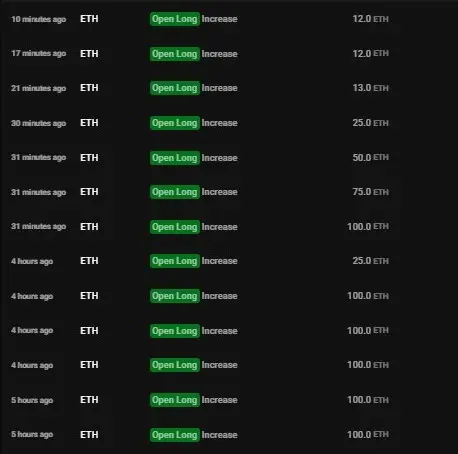

Man… this is starting to feel like a loop you can’t pause.

#MachiBigBrother got wiped again -- 5 hours ago, fully liquidated, no leftovers. And when you add it all up, his total damage now sits at $27,454,371.20. Yes. That number really hurts just to read.

But if you’ve watched Machi long enough, you already know what comes next. He doesn’t disappear. He doesn’t cool off. He reloads.

Right after the liquidation, he jumps straight back in and opens a fresh 25x long on 1,212 $ETH , roughly $2.3M in size. Aggressive, as usual. The liquidation line is around $1,890.03.

Address:

0x020cA66C30beC2c4F

#MachiBigBrother got wiped again -- 5 hours ago, fully liquidated, no leftovers. And when you add it all up, his total damage now sits at $27,454,371.20. Yes. That number really hurts just to read.

But if you’ve watched Machi long enough, you already know what comes next. He doesn’t disappear. He doesn’t cool off. He reloads.

Right after the liquidation, he jumps straight back in and opens a fresh 25x long on 1,212 $ETH , roughly $2.3M in size. Aggressive, as usual. The liquidation line is around $1,890.03.

Address:

0x020cA66C30beC2c4F

ETH-8,84%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- 1

- Share

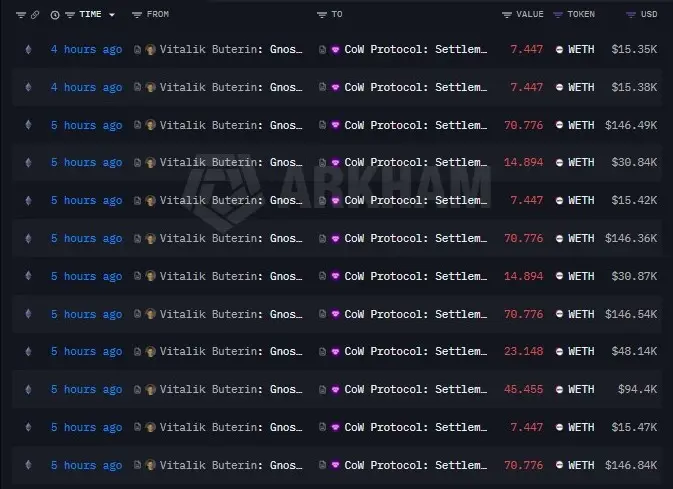

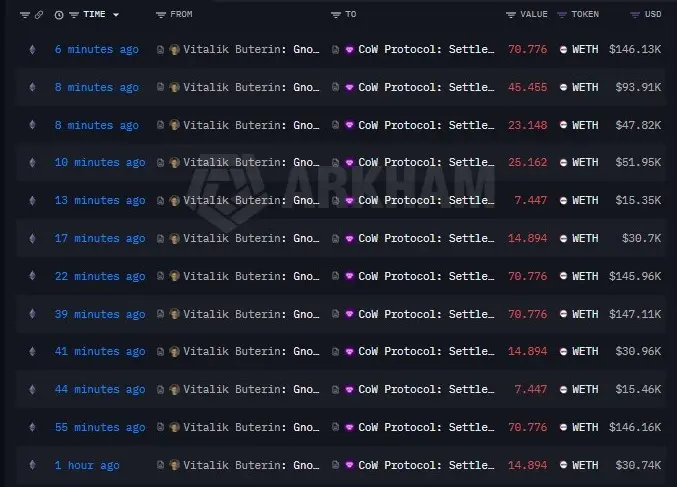

ugh… finally, right... Feels like the room for $ETH just exhaled🥳.

#VitalikButerin is done selling -- at least for now, and the #ETH market’s acting like it noticed.

All in, he moved 19,326 ETH, about $39.36M, averaging around $2,037. And honestly, the pause says more than the selling ever did.

Either way, ETH feels less tense today. And yeah… that’s nice.

#VitalikButerin is done selling -- at least for now, and the #ETH market’s acting like it noticed.

All in, he moved 19,326 ETH, about $39.36M, averaging around $2,037. And honestly, the pause says more than the selling ever did.

Either way, ETH feels less tense today. And yeah… that’s nice.

ETH-8,84%

- Reward

- 1

- 1

- Repost

- Share

DyingLeeks :

:

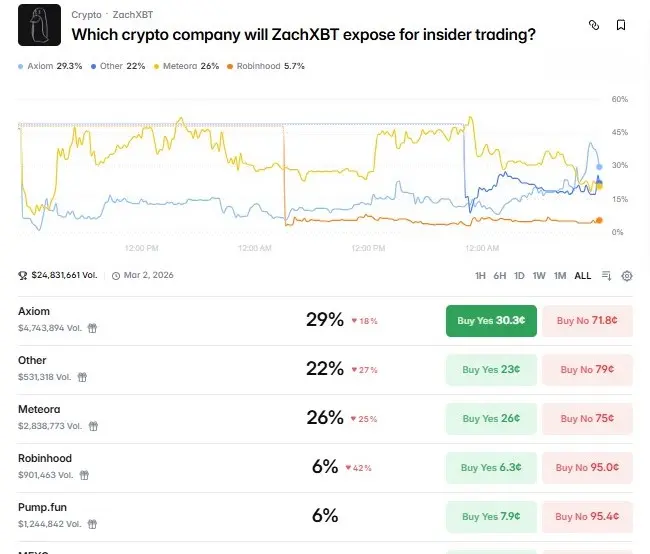

So what does it mean?This whole thing feels like the calm right before someone flips the breaker.

#zachxbt hasn’t even dropped a name yet and the market’s already acting like it knows what’s coming. Odds are flying around, narratives stacking on top of narratives. As of early afternoon, Axiom somehow leapfrogs Meteora, now sitting at a chunky 37% probability in the unofficial guessing game of “who’s about to get called out.” That shift alone is… interesting. Maybe telling. Or maybe just noise pretending to be signal.

What makes it extra weird is the vibe. It doesn’t feel like random spectators placing bets -- it l

#zachxbt hasn’t even dropped a name yet and the market’s already acting like it knows what’s coming. Odds are flying around, narratives stacking on top of narratives. As of early afternoon, Axiom somehow leapfrogs Meteora, now sitting at a chunky 37% probability in the unofficial guessing game of “who’s about to get called out.” That shift alone is… interesting. Maybe telling. Or maybe just noise pretending to be signal.

What makes it extra weird is the vibe. It doesn’t feel like random spectators placing bets -- it l

- Reward

- like

- Comment

- Repost

- Share

Getting a little hard to ignore now. #VitalikButerin just keeps selling more $ETH into the market, drip by drip, and at this point the numbers have already slipped past the original plan. He said 16,384 ETH. Reality says 17,196 #ETH , around $35M, give or take depending on the hour. So of course… line crossed.

And now everyone’s doing the same thing -- leaning back, squinting at the chart, wondering if that was supposed to be the finish line or just a checkpoint. Is he almost done.. Or is this one of those “I’ll stop soon” situations that slowly keeps going.... steady selling.

That’s the real

And now everyone’s doing the same thing -- leaning back, squinting at the chart, wondering if that was supposed to be the finish line or just a checkpoint. Is he almost done.. Or is this one of those “I’ll stop soon” situations that slowly keeps going.... steady selling.

That’s the real

ETH-8,84%

- Reward

- 3

- 4

- Repost

- Share

MrKing :

:

GM fam, what are you buying lately? #BTC #ETH #GT #GateLive #Gate.io

View More