Djxbxn8453887

No content yet

Djxbxn8453887

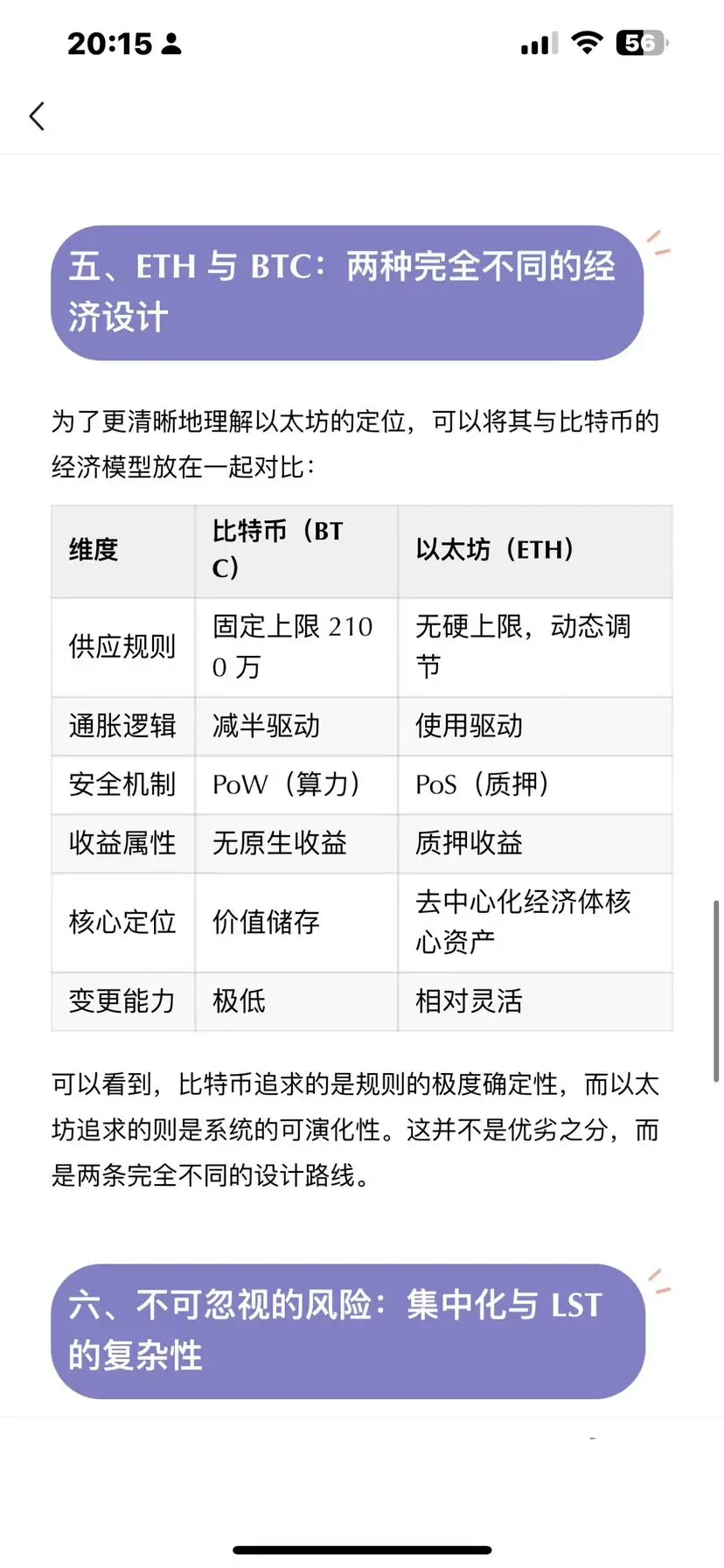

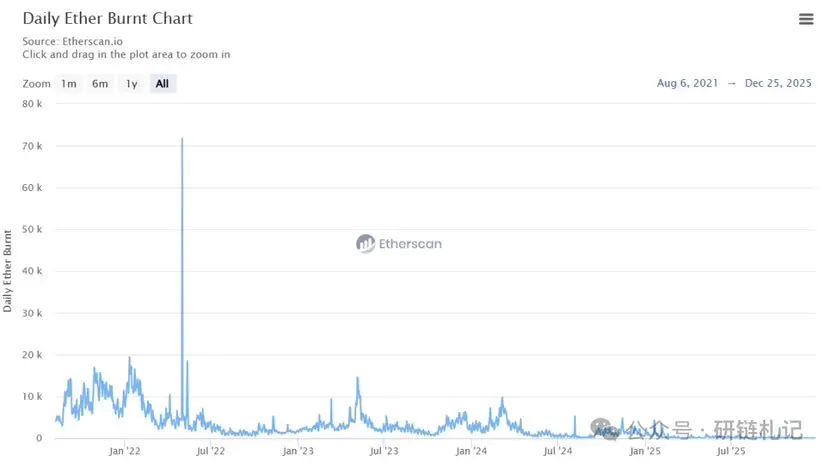

Ethereum Economic Model: Burning, Staking, and the "Ultrasound Money Theory"

💰Introduction💰

If Bitcoin's success lies in its extremely simple rules and its near-immutable nature, then Ethereum's success is more about its continuous reconstruction of its own economic model.

Blockchain Finance · 02 | Detailed Explanation of Bitcoin's Economic Model: Halving, Scarcity, and Miner Games

From the earliest PoW mining to today's PoS staking; from the long-standing debate over "inflationary tokens" to transaction fee burning; from simple on-chain fuel to a core asset with yield properties.

Ethereum w

View Original💰Introduction💰

If Bitcoin's success lies in its extremely simple rules and its near-immutable nature, then Ethereum's success is more about its continuous reconstruction of its own economic model.

Blockchain Finance · 02 | Detailed Explanation of Bitcoin's Economic Model: Halving, Scarcity, and Miner Games

From the earliest PoW mining to today's PoS staking; from the long-standing debate over "inflationary tokens" to transaction fee burning; from simple on-chain fuel to a core asset with yield properties.

Ethereum w

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Is USDT really safe?

💰Introduction

Every time the market experiences sharp fluctuations, USDT is repeatedly scrutinized. Some say it is a "time bomb," while others say "it hasn't exploded after seven or eight years." So, the question is: Is USDT really safe? What should ordinary investors be concerned about?

💰Why is USDT so important?

To start with the conclusion: if USDT encounters problems, the entire crypto market will be affected.

Currently, USDT remains in the global crypto market:

- The largest stablecoin by trading volume

- The primary unit of account

- The "de facto dollar" used in m

💰Introduction

Every time the market experiences sharp fluctuations, USDT is repeatedly scrutinized. Some say it is a "time bomb," while others say "it hasn't exploded after seven or eight years." So, the question is: Is USDT really safe? What should ordinary investors be concerned about?

💰Why is USDT so important?

To start with the conclusion: if USDT encounters problems, the entire crypto market will be affected.

Currently, USDT remains in the global crypto market:

- The largest stablecoin by trading volume

- The primary unit of account

- The "de facto dollar" used in m

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 1

- Repost

- Share

Djxbxn8453887 :

:

New Year Wealth Explosion 🤑Happy New Year! Wishing everyone a smooth 2026.

Bitcoin is currently trading within a narrow range, with decreasing volatility, signaling a prelude to a trend reversal. The rebound from the 3-day moving average has already occurred; after a brief sideways movement, it will generally pulse upward.

Bitcoin:

Long positions: 87450-86850 long, 85700 for support. Take profit in batches at 88850, 89350, 89950/90150.

90825-91175 is the recent major resistance; a breakout here would turn the trend bullish.

Short positions: Already shorted multiple times at 88850-90000, can consider closing now. Wait fo

View OriginalBitcoin is currently trading within a narrow range, with decreasing volatility, signaling a prelude to a trend reversal. The rebound from the 3-day moving average has already occurred; after a brief sideways movement, it will generally pulse upward.

Bitcoin:

Long positions: 87450-86850 long, 85700 for support. Take profit in batches at 88850, 89350, 89950/90150.

90825-91175 is the recent major resistance; a breakout here would turn the trend bullish.

Short positions: Already shorted multiple times at 88850-90000, can consider closing now. Wait fo

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

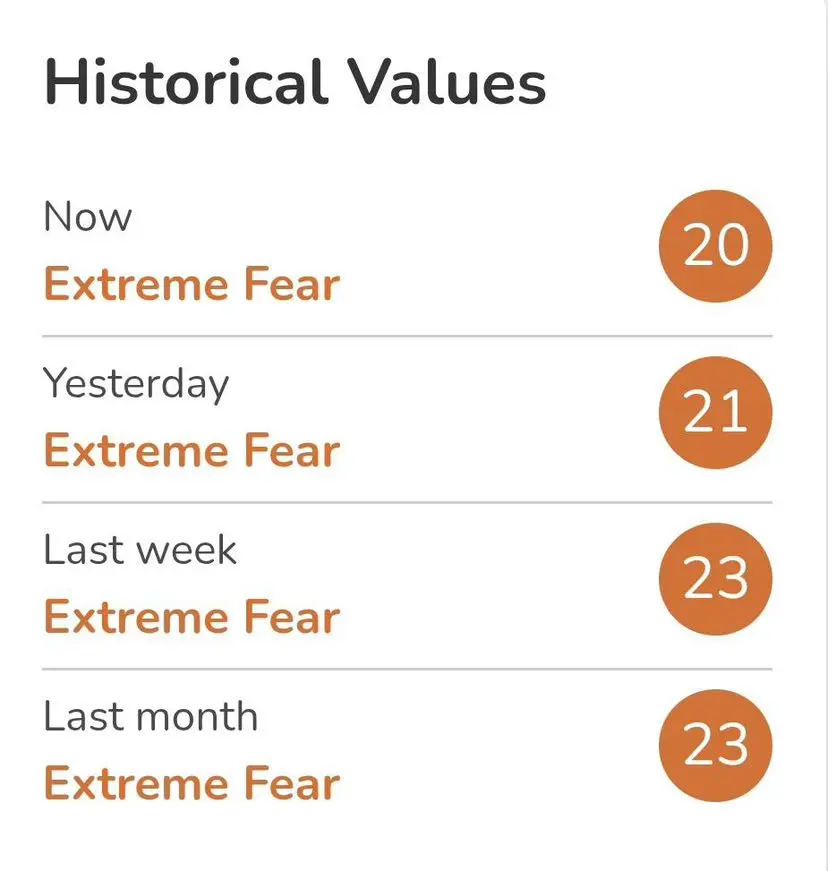

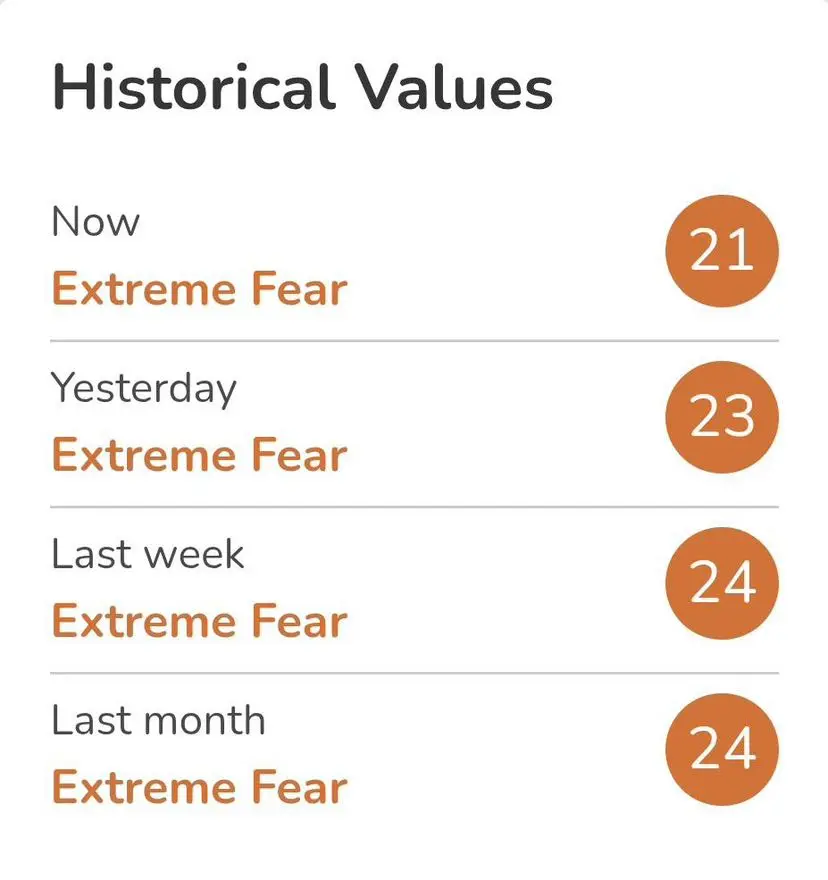

Cryptocurrency Fear and Greed Index:

Index Value: 20

Emotion: Extreme Fear

Bitcoin Price: $88,000

Index Value: 20

Emotion: Extreme Fear

Bitcoin Price: $88,000

BTC-3,11%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

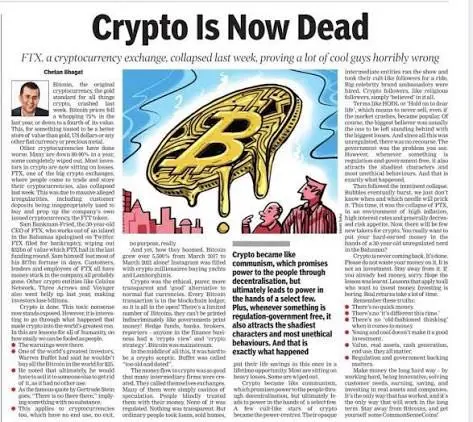

Is Crypto Dead?

Editor's Note: In this episode of Hive Mind Podcast, Dougie discusses his widely circulated article on Twitter, "Crypto is Dead," with the Delphi team. The discussion covers industry cycles, technology adoption, the value of stablecoins and perpetual contracts, and how to find long-term opportunities during industry downturns. The guests believe that crypto is moving from native communities toward broader real-world applications, and opportunities will belong to builders and investors who solve practical problems and connect crypto with non-crypto users.

Jose:

Hello everyone, a

View OriginalEditor's Note: In this episode of Hive Mind Podcast, Dougie discusses his widely circulated article on Twitter, "Crypto is Dead," with the Delphi team. The discussion covers industry cycles, technology adoption, the value of stablecoins and perpetual contracts, and how to find long-term opportunities during industry downturns. The guests believe that crypto is moving from native communities toward broader real-world applications, and opportunities will belong to builders and investors who solve practical problems and connect crypto with non-crypto users.

Jose:

Hello everyone, a

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 2

- Repost

- Share

Djxbxn8453887 :

:

2026 Go Go Go 👊View More

Bitcoin faces a steadfast resistance at 89,400, with support at 87,000 as stable as Mount Tai, and narrow fluctuations causing anxiety.

The "wolf is coming" drama has played out again and again,

When will this wave finally break the deadlock?

The market is always unpredictable, but we can stay true to our original intention, remain patient and calm. 2025, to me, is like a nightmare, but 2026 will surely be a year full of honor! Keep going!

The "wolf is coming" drama has played out again and again,

When will this wave finally break the deadlock?

The market is always unpredictable, but we can stay true to our original intention, remain patient and calm. 2025, to me, is like a nightmare, but 2026 will surely be a year full of honor! Keep going!

BTC-3,11%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Making money is satisfying, but the market's harvest is even harsher.

One wave couldn't hold on, and efforts instantly reset to zero. Those who can grow small funds into large ones don't rely on luck, but on a set of rules that prevent death, not chasing quick profits, just aiming to survive longer.

In contract trading, the right direction is an amplifier; the wrong direction is a meat grinder.

If you don't understand risk structure, you're just giving away money.

My principle: small capital, high discipline, only trade high-probability setups.

Trade with light positions, exit immediately if w

View OriginalOne wave couldn't hold on, and efforts instantly reset to zero. Those who can grow small funds into large ones don't rely on luck, but on a set of rules that prevent death, not chasing quick profits, just aiming to survive longer.

In contract trading, the right direction is an amplifier; the wrong direction is a meat grinder.

If you don't understand risk structure, you're just giving away money.

My principle: small capital, high discipline, only trade high-probability setups.

Trade with light positions, exit immediately if w

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Transfer: It's tough! U price has collapsed, 1u is less than 6.82, which is 3% lower than the normal exchange rate of 7. But half a year ago, the USDT price was still 7.4, and everyone's assets silently depreciated by 10%.

USDT is linked to two indicators: one is the US dollar exchange rate, and the other is the premium or discount in the crypto market.

Since the US is in a rate-cutting cycle, the US dollar is likely to weaken against the RMB. The benefit is that everyone's RMB purchasing power increases, allowing them to buy more U, which also means more Bitcoin.

So the effects are mutual. Wh

USDT is linked to two indicators: one is the US dollar exchange rate, and the other is the premium or discount in the crypto market.

Since the US is in a rate-cutting cycle, the US dollar is likely to weaken against the RMB. The benefit is that everyone's RMB purchasing power increases, allowing them to buy more U, which also means more Bitcoin.

So the effects are mutual. Wh

BTC-3,11%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

ETH Ethereum current price around 2980 short

Add position: 3025 (Conservative traders directly place a 3025 short order)

Stop loss: Breakthrough 3050

Take profit: 2908-2880-2780

The entire network is talking about shorting. Considering the resistance above ETH, I also placed a 3025 short order myself. Let's see how it turns out?

Add position: 3025 (Conservative traders directly place a 3025 short order)

Stop loss: Breakthrough 3050

Take profit: 2908-2880-2780

The entire network is talking about shorting. Considering the resistance above ETH, I also placed a 3025 short order myself. Let's see how it turns out?

ETH-3,74%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

Djxbxn8453887 :

:

Is it accurate? What a pity, I had something yesterday and canceled my 3025 order myself, otherwise it would have been a big profit!Ethereum Epic Bullish Signal vs. Short-term Head and Shoulders Top, Will 2026 Be as Exciting as a Movie?】

1⃣️. Long-term: Data "Rare Sight," Epic Reversal Signal Emerges

Ethereum's off-chain funding is undergoing a qualitative change. The staking queue has experienced its first reversal in 6 months:

* Massive Inflows: About 745,000 ETH are queued for staking, while only 360,000 are queued for withdrawal—indicating twice as much willingness to enter as to exit!

* Whale Activity: Institutional player Bitman has staked over $1 billion worth of ETH in the past 36 hours, which is definitely not r

1⃣️. Long-term: Data "Rare Sight," Epic Reversal Signal Emerges

Ethereum's off-chain funding is undergoing a qualitative change. The staking queue has experienced its first reversal in 6 months:

* Massive Inflows: About 745,000 ETH are queued for staking, while only 360,000 are queued for withdrawal—indicating twice as much willingness to enter as to exit!

* Whale Activity: Institutional player Bitman has staked over $1 billion worth of ETH in the past 36 hours, which is definitely not r

ETH-3,74%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- Comment

- Repost

- Share

You do you, I do me.

Standard translation:

Allow others to be themselves, and allow yourself to be yourself.

Bold translation:

You walk your sunny path, I have my own narrow bridge.

Classical Romanticism:

Since ancient times, life has many diverging paths; you head to Xiaoxiang, I head to Qin.

View OriginalStandard translation:

Allow others to be themselves, and allow yourself to be yourself.

Bold translation:

You walk your sunny path, I have my own narrow bridge.

Classical Romanticism:

Since ancient times, life has many diverging paths; you head to Xiaoxiang, I head to Qin.

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

Djxbxn8453887 :

:

Let flowers bloom, let 🌳 trees become 🌳 trees.1️⃣ Always want to get rich overnight, but end up liquidated in one night

2️⃣ No logic, just guessing, bottom-fishing halfway up the mountain

3️⃣ Superstitious about "big shot’s performance," they really make money and still want to take you along?

4️⃣ Trading like you're on drugs, rushing to recover a single trade, losing more and more

The true key to success or failure is not the win rate, but the entry point!

Choose accurately, set small stop-losses, maintain steady risk control, and even if you’re wrong, lose less.

Follow the trend to have swings, wait for a pullback to enter, slow is fast

View Original2️⃣ No logic, just guessing, bottom-fishing halfway up the mountain

3️⃣ Superstitious about "big shot’s performance," they really make money and still want to take you along?

4️⃣ Trading like you're on drugs, rushing to recover a single trade, losing more and more

The true key to success or failure is not the win rate, but the entry point!

Choose accurately, set small stop-losses, maintain steady risk control, and even if you’re wrong, lose less.

Follow the trend to have swings, wait for a pullback to enter, slow is fast

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Caught in a trap, don’t pretend to be dead, and don’t force it. Listen to me, a trapped position isn’t a dead end; it all depends on how you move.

For small traps, don’t cling to the fight; sell on rebound. Losing a little is better than losing everything; don’t think about a full recovery—that’s luck, not strategy.

For deep traps, don’t let emotions take over. Cut your losses to save your life, keep some chips to survive, and don’t bet everything on waiting for a “breakout.”

Then see how the market moves:

No trend and still pretending to be dead? Stop loss immediately, save your money for

View Original

For small traps, don’t cling to the fight; sell on rebound. Losing a little is better than losing everything; don’t think about a full recovery—that’s luck, not strategy.

For deep traps, don’t let emotions take over. Cut your losses to save your life, keep some chips to survive, and don’t bet everything on waiting for a “breakout.”

Then see how the market moves:

No trend and still pretending to be dead? Stop loss immediately, save your money for

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

How to Spot Main Force Shakeouts and Avoid Being "Forced Out"?

1. The Essence of Shakeouts

Main forces often clear out floating positions first to facilitate a better rally later:

Raise the holding costs, forcing early low-cost buyers to exit;

Use high selling and low buying to reduce overall costs.

👉 This usually occurs in coins with solid fundamentals and obvious capital involvement, often accompanied by intense shakeouts.

2. Common 3 Types of Shakeout Techniques

1️⃣ U-Shaped Shakeout

Purpose: Clear short-term profit-taking positions.

Features: In an upward channel, trading volume decreases

View Original1. The Essence of Shakeouts

Main forces often clear out floating positions first to facilitate a better rally later:

Raise the holding costs, forcing early low-cost buyers to exit;

Use high selling and low buying to reduce overall costs.

👉 This usually occurs in coins with solid fundamentals and obvious capital involvement, often accompanied by intense shakeouts.

2. Common 3 Types of Shakeout Techniques

1️⃣ U-Shaped Shakeout

Purpose: Clear short-term profit-taking positions.

Features: In an upward channel, trading volume decreases

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Harvard University research on the "9 Mindsets of the Poor" hopes you don't have:

1. Being controlled by face and price: unconsciously or consciously, always influenced by external opinions and price tags.

2. Lack of independence: habitually relying on others, lacking the courage to make decisions and bear the consequences.

3. Becoming a dreamer: having many ideas but never taking action, always staying in the "thinking" stage.

4. Habitual cynicism: disliking everything, full of negative energy, but never reflecting on oneself.

5. Spiritual "Q": satisfied with the status quo of "not enough abo

View Original1. Being controlled by face and price: unconsciously or consciously, always influenced by external opinions and price tags.

2. Lack of independence: habitually relying on others, lacking the courage to make decisions and bear the consequences.

3. Becoming a dreamer: having many ideas but never taking action, always staying in the "thinking" stage.

4. Habitual cynicism: disliking everything, full of negative energy, but never reflecting on oneself.

5. Spiritual "Q": satisfied with the status quo of "not enough abo

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

If you stay in the crypto world long enough, you'll realize one thing:

Market opportunities are never scarce; they are always there. What’s scarce is the person who makes the right choice at the critical moment.

Most people don’t lose to the market,

but to greed, fear, and arrogance.

They always want to turn things around with a “divine operation,”

but forget — this is a game of probabilities, not a miracle factory.

My ability to survive repeatedly in bull and bear markets relies on three things:

1. Choosing coins: Only follow the consensus of funds

Don’t bet on obscure altcoins, don’t chase t

View OriginalMarket opportunities are never scarce; they are always there. What’s scarce is the person who makes the right choice at the critical moment.

Most people don’t lose to the market,

but to greed, fear, and arrogance.

They always want to turn things around with a “divine operation,”

but forget — this is a game of probabilities, not a miracle factory.

My ability to survive repeatedly in bull and bear markets relies on three things:

1. Choosing coins: Only follow the consensus of funds

Don’t bet on obscure altcoins, don’t chase t

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

The market doesn't evaluate how much hardship you've endured in the past,

It only measures one thing: whether you currently have the ability to produce consistent results.

Experience itself does not constitute value,

Validated methodologies are what create value.

If you're talking about:

• How to achieve a structural cognitive upgrade

• How to rebuild a trading system after losses

• How to turn random profits into replicable gains

Then people will pay attention.

But if you're just constantly revisiting suffering, emotions, grievances,

Without providing decision-making logic, risk control frame

View OriginalIt only measures one thing: whether you currently have the ability to produce consistent results.

Experience itself does not constitute value,

Validated methodologies are what create value.

If you're talking about:

• How to achieve a structural cognitive upgrade

• How to rebuild a trading system after losses

• How to turn random profits into replicable gains

Then people will pay attention.

But if you're just constantly revisiting suffering, emotions, grievances,

Without providing decision-making logic, risk control frame

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Life is like a long and arduous investment.

Your most important asset is always yourself. Your character, your abilities, your reputation, your resilience.

As long as you don't give up on yourself, don't underestimate yourself, and diligently manage this core asset.

Then, the whole world will make way for you.

View OriginalYour most important asset is always yourself. Your character, your abilities, your reputation, your resilience.

As long as you don't give up on yourself, don't underestimate yourself, and diligently manage this core asset.

Then, the whole world will make way for you.

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Starting today, I will initiate a 100x challenge on my contract account! Let's see how long it takes to achieve my grand goal. Keep it up!

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

The Power of Compound Interest:

Starting with 3000 USDT, based on a monthly return of 30%:

First month: 3000 x 1.3 = 3900

Second month: 3900 x 1.3 = 5070

Third month: 5070 x 1.3 = 6591

Fourth month: 6591 x 1.3 = 8568

Fifth month: 8568 x 1.3 = 11138

Sixth month: 11138 x 1.3 = 14479

Seventh month: 14479 x 1.3 = 18822

Eighth month: 18822 x 1.3 = 24468

Ninth month: 24468 x 1.3 = 31808

Tenth month: 31808 x 1.3 = 41350

Eleventh month: 41350 x 1.3 = 53755

Twelfth month: 53755 x 1.3 = 69881

After one year, the account appreciates to 69881!

69881 / 3000 ≈ 23 times!

After two years, 529 times: 69881 x 2

View OriginalStarting with 3000 USDT, based on a monthly return of 30%:

First month: 3000 x 1.3 = 3900

Second month: 3900 x 1.3 = 5070

Third month: 5070 x 1.3 = 6591

Fourth month: 6591 x 1.3 = 8568

Fifth month: 8568 x 1.3 = 11138

Sixth month: 11138 x 1.3 = 14479

Seventh month: 14479 x 1.3 = 18822

Eighth month: 18822 x 1.3 = 24468

Ninth month: 24468 x 1.3 = 31808

Tenth month: 31808 x 1.3 = 41350

Eleventh month: 41350 x 1.3 = 53755

Twelfth month: 53755 x 1.3 = 69881

After one year, the account appreciates to 69881!

69881 / 3000 ≈ 23 times!

After two years, 529 times: 69881 x 2

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share