DanielRomero

No content yet

DanielRomero

$QCOM AI200 will likely deliver worse performance than $AMD MI355X or $NVDA B200, and it’s expected to launch around the same time as MI450 and Vera Rubin

Just like $INTC, $QCOM is probably late to the party

The tokenomics will hardly be competitive

Just like $INTC, $QCOM is probably late to the party

The tokenomics will hardly be competitive

- Reward

- 1

- Comment

- Repost

- Share

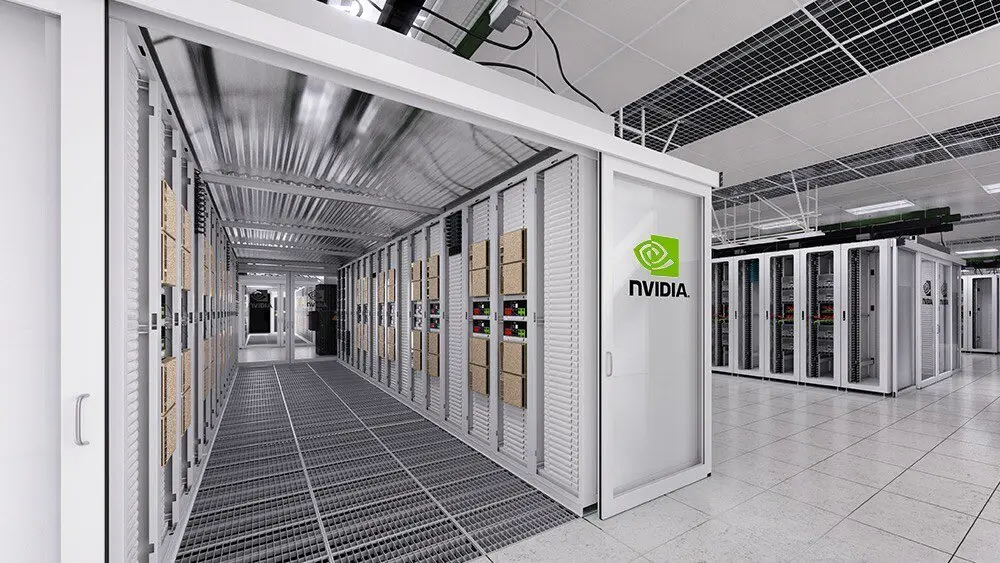

$CORZ pushing for the $CRWV acquisition was a massive mistake

Not just for the obvious reasons

The CEO just confirmed that hyperscalers and other large potential tenants stopped talking to them

That left them negotiating with smaller neoclouds, which would’ve obviously cratered credit quality and pricing

Not just for the obvious reasons

The CEO just confirmed that hyperscalers and other large potential tenants stopped talking to them

That left them negotiating with smaller neoclouds, which would’ve obviously cratered credit quality and pricing

- Reward

- like

- Comment

- Repost

- Share

$NVDA has invested so far

$5B in Intel | $INTC

$2B in Synopsys | $SNPS

$2B in CoreWeave | $CRWV

$2B in Coherent | $COHR

$2B in Lumentum | $LITE

$1B in Nokia | $NOK

$30m in Nebius | $NBIS

$30B in OpenAI

$5B in xAI

$500M in Wayve

€300M in Mistral AI

$300M in Crusoe

$250M in Scale AI

$250M in Cohere

$150M in Figure AI

$125M in Perplexity

$120M in Lambda

$100M in Poolside

$75M in Together AI

$70M in Runway

$50M in Waabi

$40M in Ayar Labs

$5B in Intel | $INTC

$2B in Synopsys | $SNPS

$2B in CoreWeave | $CRWV

$2B in Coherent | $COHR

$2B in Lumentum | $LITE

$1B in Nokia | $NOK

$30m in Nebius | $NBIS

$30B in OpenAI

$5B in xAI

$500M in Wayve

€300M in Mistral AI

$300M in Crusoe

$250M in Scale AI

$250M in Cohere

$150M in Figure AI

$125M in Perplexity

$120M in Lambda

$100M in Poolside

$75M in Together AI

$70M in Runway

$50M in Waabi

$40M in Ayar Labs

- Reward

- 1

- Comment

- Repost

- Share

RUMOR: $MSFT to be the third gigawatt-scale customer of $AMD

According to a report by UBS, $AMD indicated a potential third gigawatt-scale customer beyond its existing agreements with OpenAI and $META. Microsoft appears to be the most likely candidate.

According to a report by UBS, $AMD indicated a potential third gigawatt-scale customer beyond its existing agreements with OpenAI and $META. Microsoft appears to be the most likely candidate.

- Reward

- 1

- Comment

- Repost

- Share

UBS raises $AMD price target to 310

The chipmaker trades at a PEG ratio of 0.46

The firm said AMD indicated a potential third gigawatt-scale customer, likely $MSFT

The chipmaker trades at a PEG ratio of 0.46

The firm said AMD indicated a potential third gigawatt-scale customer, likely $MSFT

- Reward

- 2

- Comment

- Repost

- Share

Samsung and $AMD Reinforce Strategic Collaboration to Advance AI-Powered Network Innovations for Commercial Deployments

Samsung and AMD say their joint work has moved from testing into real commercial deployments across 5G core, software-based RAN, and private networks

They call out a concrete win in Canada: Videotron selected Samsung to deploy 5G NSA and 4G LTE core gateway solutions running on AMD EPYC 9005 Series CPUs, aligned with a cloud-native, AI-ready core strategy

At MWC 2026, Samsung plans to demo AI-RAN using its AI-powered vRAN on AMD EPYC, including multi-cell test results aimed a

Samsung and AMD say their joint work has moved from testing into real commercial deployments across 5G core, software-based RAN, and private networks

They call out a concrete win in Canada: Videotron selected Samsung to deploy 5G NSA and 4G LTE core gateway solutions running on AMD EPYC 9005 Series CPUs, aligned with a cloud-native, AI-ready core strategy

At MWC 2026, Samsung plans to demo AI-RAN using its AI-powered vRAN on AMD EPYC, including multi-cell test results aimed a

- Reward

- like

- Comment

- Repost

- Share

$VECO and $ACLS merger is interesting

$VECO supplies machinery for compound semiconductors, including lasers, plus laser annealing systems and advanced packaging equipment

$ACLS supplies ion implantation systems used in memory, logic, power semiconductors, and silicon photonics

Together, they could be an interesting company if the synergies actually materialise

$VECO supplies machinery for compound semiconductors, including lasers, plus laser annealing systems and advanced packaging equipment

$ACLS supplies ion implantation systems used in memory, logic, power semiconductors, and silicon photonics

Together, they could be an interesting company if the synergies actually materialise

- Reward

- like

- Comment

- Repost

- Share

$POET and $ALMU look like two companies that could have a $LITE moment sometime in the next 3 years

Still, they’re high risk

If you’re an investor, why did you decide to get in at such an early stage?

$POET 2026 revenue should be ~$10M

Interested in hearing some thoughts

Still, they’re high risk

If you’re an investor, why did you decide to get in at such an early stage?

$POET 2026 revenue should be ~$10M

Interested in hearing some thoughts

- Reward

- 1

- Comment

- Repost

- Share

Optical networking stocks have been the best-performing theme in 2026

YTD Returns:

$AXTI — 126%

$AAOI — 112%

$LITE — 82%

$GLW — 66%

$MTSI — 43%

$CIEN — 42%

$COHR — 33%

$GFS — 29%

$LWLG — 21%

$SMTC — 20%

$NOK — 19%

$FN — 14%

YTD Returns:

$AXTI — 126%

$AAOI — 112%

$LITE — 82%

$GLW — 66%

$MTSI — 43%

$CIEN — 42%

$COHR — 33%

$GFS — 29%

$LWLG — 21%

$SMTC — 20%

$NOK — 19%

$FN — 14%

- Reward

- like

- Comment

- Repost

- Share

$XYZ was always a bloated company

Elon Musk showed how much Dorsey overspends

This is not a great example of AI taking over

40% of $XYZ employees could have been fired three years ago and nobody would have noticed

AI was just a convenient excuse for fixing an obvious issue

Elon Musk showed how much Dorsey overspends

This is not a great example of AI taking over

40% of $XYZ employees could have been fired three years ago and nobody would have noticed

AI was just a convenient excuse for fixing an obvious issue

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$NVDA is at a 4.7T market cap

The market is probably nervous that this valuation can only be sustained with multi-hundred-billion-dollar AI CAPEX spending

There’s a good chance the Overton window shifts drastically when it comes to valuations

Maybe hundreds of billions of dollars in CAPEX isn’t the top the market thinks it is

Maybe it’s actually a minuscule amount compared to what could come over the next decade as AI progresses

If that happens, $NVDA at 20x 2026 EPS would look very obvious in retrospect

The market is probably nervous that this valuation can only be sustained with multi-hundred-billion-dollar AI CAPEX spending

There’s a good chance the Overton window shifts drastically when it comes to valuations

Maybe hundreds of billions of dollars in CAPEX isn’t the top the market thinks it is

Maybe it’s actually a minuscule amount compared to what could come over the next decade as AI progresses

If that happens, $NVDA at 20x 2026 EPS would look very obvious in retrospect

- Reward

- 3

- 1

- Repost

- Share

GateUser-06070724 :

:

There's only one thing to say: it's a giant.$NVDA destroyed earnings, demolished guidance, and bought one of its largest competitors with pocket change, and the stock is red

Imagine what happens if they show even the slightest sign of weakness

Imagine what happens if they show even the slightest sign of weakness

- Reward

- like

- Comment

- Repost

- Share

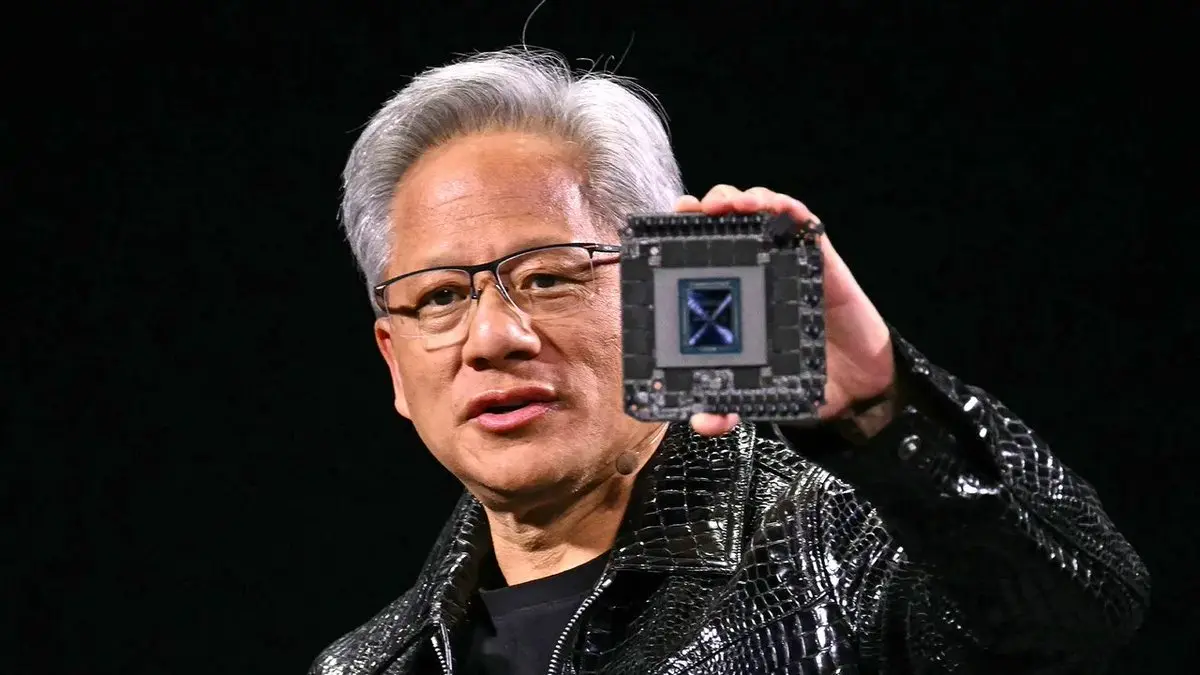

Key points from the $NVDA call:

> AI is amazing and makes a ton of money. You need compute for AI. More AI means more money, so hyperscaler capex should keep growing from 2027 onward.

> Jensen wants the entire AI ecosystem built on top of NVIDIA, which is why they’re investing in so many companies.

> The Groq acquisition is being framed as a Mellanox-like move. More details expected at GTC.

>Data centers in space have use cases, but they’re not economically feasible in the short term.

> Hyperscalers account for over 50% of revenue.

> Non-hyperscaler revenue is growing faster than hyperscaler r

> AI is amazing and makes a ton of money. You need compute for AI. More AI means more money, so hyperscaler capex should keep growing from 2027 onward.

> Jensen wants the entire AI ecosystem built on top of NVIDIA, which is why they’re investing in so many companies.

> The Groq acquisition is being framed as a Mellanox-like move. More details expected at GTC.

>Data centers in space have use cases, but they’re not economically feasible in the short term.

> Hyperscalers account for over 50% of revenue.

> Non-hyperscaler revenue is growing faster than hyperscaler r

- Reward

- 1

- Comment

- Repost

- Share

Holy shit

$NVDA is expected to announce the world’s first chips made on $TSM's 1.6nm process at GTC 2026 next month

Reportedly, this includes the next-generation Feynman GPU. Prior reports say $NVDA has reserved nearly all of TSMC’s 1.6nm capacity for it

Nvidia is also expected to unveil a never-seen-before chip, believed to be a GPU with stacked memory to reduce bottlenecks

$NVDA is expected to announce the world’s first chips made on $TSM's 1.6nm process at GTC 2026 next month

Reportedly, this includes the next-generation Feynman GPU. Prior reports say $NVDA has reserved nearly all of TSMC’s 1.6nm capacity for it

Nvidia is also expected to unveil a never-seen-before chip, believed to be a GPU with stacked memory to reduce bottlenecks

- Reward

- 1

- Comment

- Repost

- Share

$AMD to Buy $150 Million of Nutanix Stock in New Partnership

AMD will buy $150 million of Nutanix stock as part of a new partnership that includes joint engineering and sales. $AMD will also provide Nutanix up to $100 million to fund joint initiatives to develop and sell an infrastructure platform for AI applications, according to a person familiar with the plans

Nutanix sells software for managing IT infrastructure across data centers and the cloud, and it already partners with $AMD, $INTC, and $NVDA to offer its software alongside their chips

AMD will buy $150 million of Nutanix stock as part of a new partnership that includes joint engineering and sales. $AMD will also provide Nutanix up to $100 million to fund joint initiatives to develop and sell an infrastructure platform for AI applications, according to a person familiar with the plans

Nutanix sells software for managing IT infrastructure across data centers and the cloud, and it already partners with $AMD, $INTC, and $NVDA to offer its software alongside their chips

- Reward

- 3

- Comment

- Repost

- Share

I like the $AMD deal but still funny

- Reward

- like

- Comment

- Repost

- Share

$DOCN CEO in today’s earnings call:

“We delivered a 100% increase in throughput and about 50% lower cost per token for Character AI on our production inference cloud powered by $AMD Instinct GPUs.

This wasn’t a lab benchmark. It was live production traffic serving tens of millions of users, proving we can run inference at scale for leading AI companies with a platform built inference-first for real-world workloads.”

“We delivered a 100% increase in throughput and about 50% lower cost per token for Character AI on our production inference cloud powered by $AMD Instinct GPUs.

This wasn’t a lab benchmark. It was live production traffic serving tens of millions of users, proving we can run inference at scale for leading AI companies with a platform built inference-first for real-world workloads.”

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More819.94K Popularity

307.48K Popularity

145.49K Popularity

404.09K Popularity

34.3K Popularity

Pin