CryptoLens

No content yet

CryptoLens

**You need to be taking more risks. Life is a game, and if you play with 0 risk and take the absolutely safe path 100% of the time, then 100% of the time you will lose to someone who is even 1-5% better who is doing the exact same thing. But luckily life is kind of like poker in the sense that you can have a good hand and still lose, or a bad hand and still win. So take risks.**

#TakeTheRisk

#MindsetShift

#WinnersMentality

#TakeTheRisk

#MindsetShift

#WinnersMentality

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

#CryptoMarketRebounds

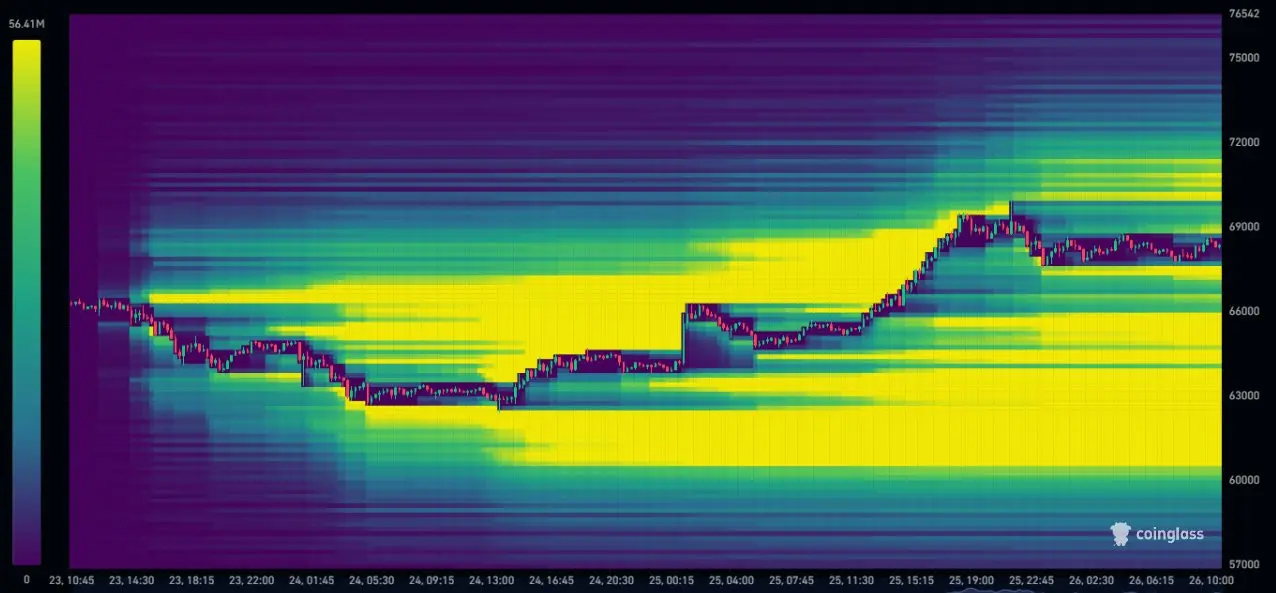

Everything just changed.

$BTC pumped above $69,000 yesterday liquidating $697M.

Now, above us at $70,000 - $72,000 there is only thin liquidity which could easily be swept and potentially ran through leading to higher levels.

However, $61,000 - $66,000 has left behind around 3x more liquidity, making this the 'higher probability' area from a liquidity perspective.

Bulls have finally responded.

Everything just changed.

$BTC pumped above $69,000 yesterday liquidating $697M.

Now, above us at $70,000 - $72,000 there is only thin liquidity which could easily be swept and potentially ran through leading to higher levels.

However, $61,000 - $66,000 has left behind around 3x more liquidity, making this the 'higher probability' area from a liquidity perspective.

Bulls have finally responded.

BTC-2,36%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕🚨 THIS IS THE NEXT JANE STREET MANIPULATION!!

Look at the pic below.

Jane Street is the BIGGEST holder in SLV with 20,672,537 shares.

That's about 3.62% of the whole trust, and roughly $1.65 BILLION+ sitting in one name

If you still think silver is a “free market”

YOU'RE COMPLETELY WRONG.

Let me explain this in simple words.

Jane Street isn't some slow long only investor.

This is one of the most aggressive trading machines in the world, and now it's sitting on the BIGGEST visible SLV position while silver stays one of the most unstable markets on earth.

That one fact explains a lot.

Because t

Look at the pic below.

Jane Street is the BIGGEST holder in SLV with 20,672,537 shares.

That's about 3.62% of the whole trust, and roughly $1.65 BILLION+ sitting in one name

If you still think silver is a “free market”

YOU'RE COMPLETELY WRONG.

Let me explain this in simple words.

Jane Street isn't some slow long only investor.

This is one of the most aggressive trading machines in the world, and now it's sitting on the BIGGEST visible SLV position while silver stays one of the most unstable markets on earth.

That one fact explains a lot.

Because t

- Reward

- 1

- Comment

- Repost

- Share

JUST IN: Coinbase CEO Brian Armstrong says Bitcoin is an "inflation-resistant asset" and crypto is the "path to economic freedom."

BTC-2,36%

- Reward

- 1

- 1

- Repost

- Share

GateUser-1dbde106 :

:

To The Moon 🌕- Reward

- 1

- 1

- 1

- Share

GateUser-1dbde106 :

:

more dump coming#TrumpAnnouncesNewTariffs

🚨 DONALD TRUMP JUST POSTED THIS

He just threatened to escalate the tariff war even further.

Here’s everything you need to know.

The Supreme Court just ruled his tariffs illegal under the 1977 IEEPA law.

Trump responded within minutes.

He’s now threatening any country that tries to enforce that ruling with tariffs higher than what was already agreed to.

Not the same tariffs, but HIGHER ones.

Plus “worse” consequences he refused to specify.

He signed it off with “BUYER BEWARE” in all caps. That’s a warning to markets too.

The economy is already fragile, earnings are s

🚨 DONALD TRUMP JUST POSTED THIS

He just threatened to escalate the tariff war even further.

Here’s everything you need to know.

The Supreme Court just ruled his tariffs illegal under the 1977 IEEPA law.

Trump responded within minutes.

He’s now threatening any country that tries to enforce that ruling with tariffs higher than what was already agreed to.

Not the same tariffs, but HIGHER ones.

Plus “worse” consequences he refused to specify.

He signed it off with “BUYER BEWARE” in all caps. That’s a warning to markets too.

The economy is already fragile, earnings are s

- Reward

- 1

- 2

- Repost

- Share

GateUser-1dbde106 :

:

Diamond Hands 💎View More

JUST IN: The European Union has paused approval of its trade deal with the United States, citing uncertainty created by renewed tariff threats from U.S. President Donald Trump.

What happened

EU officials say they cannot move forward with ratifying the agreement while Washington considers new import tariffs and explores alternative legal paths to impose them. A recent U.S. court ruling blocking earlier tariffs has added further legal uncertainty, making European lawmakers wary of committing to a deal that could soon be undermined.

Why the EU hit pause

Tariff uncertainty: Trump has floated new g

What happened

EU officials say they cannot move forward with ratifying the agreement while Washington considers new import tariffs and explores alternative legal paths to impose them. A recent U.S. court ruling blocking earlier tariffs has added further legal uncertainty, making European lawmakers wary of committing to a deal that could soon be undermined.

Why the EU hit pause

Tariff uncertainty: Trump has floated new g

- Reward

- 2

- 1

- Repost

- Share

GateUser-1dbde106 :

:

2026 GOGOGO 👊⭐ The Most Important Only.

— Polymarket traders expect US strikes on Iran before the end of March

— US Macro Data (PCE)

— US Macro Data (GDP)

— Trump tariffs canceled

— Trump announced new tariffs

#PolyMarket

— Polymarket traders expect US strikes on Iran before the end of March

— US Macro Data (PCE)

— US Macro Data (GDP)

— Trump tariffs canceled

— Trump announced new tariffs

#PolyMarket

- Reward

- 3

- 2

- Repost

- Share

GateUser-1dbde106 :

:

To The Moon 🌕View More

Whoa, insiders are dumping stocks at the fastest rate since the COVID crash check this out from Crypto Rover's post with Cresco Investments proposing to offload billions in shares across a ton of tickers.

This screams risk-off mode and it's already spilling into crypto big time.

With the Feb 2026 selloff wiping out trillions in stocks, $BTC

plunged nearly 50% from its highs down to around $60k.

Geopolitical jitters, insane Al spending and overvalued markets are fueling the fire.

Could be a brutal dip for alts too, but maybe a buying opp if you believe in the long game.

Buckle up! #Crypto #Ma

This screams risk-off mode and it's already spilling into crypto big time.

With the Feb 2026 selloff wiping out trillions in stocks, $BTC

plunged nearly 50% from its highs down to around $60k.

Geopolitical jitters, insane Al spending and overvalued markets are fueling the fire.

Could be a brutal dip for alts too, but maybe a buying opp if you believe in the long game.

Buckle up! #Crypto #Ma

BTC-2,36%

- Reward

- 3

- 1

- Repost

- Share

GateUser-1dbde106 :

:

LFG 🔥SAYLOR’S STRATEGY STARTED BUYING BITCOINS ON AUG 10, 2020 AROUND ~$11.6K.

AFTER 2022 DAYS & 99 BUYS,

TOTAL SPENT: $54.5B+

AVERAGE COST: $76K+

WITH BTC NEAR $68K,

STRATEGY IS DOWN BY -$5.5B (UNREALIZED)

REMINDER: PROFIT TAKING MATTERS.

WILL SAYLOR BE FORCED TO SEL…

#Strategy: #btc $BTC

AFTER 2022 DAYS & 99 BUYS,

TOTAL SPENT: $54.5B+

AVERAGE COST: $76K+

WITH BTC NEAR $68K,

STRATEGY IS DOWN BY -$5.5B (UNREALIZED)

REMINDER: PROFIT TAKING MATTERS.

WILL SAYLOR BE FORCED TO SEL…

#Strategy: #btc $BTC

BTC-2,36%

- Reward

- 2

- 1

- Repost

- Share

GateUser-1dbde106 :

:

To The Moon 🌕- Reward

- 2

- 1

- Repost

- Share

ArenarIntel :

:

follow back🇺🇸 AMERICANS WILL GET STIMULUS IN 2026.

And here's why it could happen.

President Trump has repeatedly said that he'll use tariff money to provide $1,200 stimulus.

If somehow tariffs remain in place, the US administration could provide a stimulus check this year.

But what if the US had to refund the collected tariffs?

In this case also, US businesses and consumers will benefit.

As per the NY Fed, 90% of the tariffs have been paid by US consumers and businesses.

If the Trump administration will refund $175B+ in tariffs, $157 billion will go towards US entities.

This means no matter what happe

And here's why it could happen.

President Trump has repeatedly said that he'll use tariff money to provide $1,200 stimulus.

If somehow tariffs remain in place, the US administration could provide a stimulus check this year.

But what if the US had to refund the collected tariffs?

In this case also, US businesses and consumers will benefit.

As per the NY Fed, 90% of the tariffs have been paid by US consumers and businesses.

If the Trump administration will refund $175B+ in tariffs, $157 billion will go towards US entities.

This means no matter what happe

- Reward

- like

- Comment

- Repost

- Share

🚨🇷🇺 RUSSIA JUST SOLD 300,000 OUNCES OF GOLD 🪙📉

As gold prices surge to RECORD HIGHS, Russia has offloaded 300,000 oz of physical gold from its reserves.

That’s roughly:

💰 $1.4 BILLION worth of bullion sold into strength.

Even after the sale…

📈 The TOTAL VALUE of Russia’s remaining gold reserves actually INCREASED thanks to rising gold prices.

Let that sink in:

Central banks are STILL turning to gold as a strategic liquidity asset in times of fiscal pressure.

They don’t sell Treasuries first… They don’t sell fiat…

They sell GOLD. 🟡

Because it’s REAL money.

$XAUT #Russia

As gold prices surge to RECORD HIGHS, Russia has offloaded 300,000 oz of physical gold from its reserves.

That’s roughly:

💰 $1.4 BILLION worth of bullion sold into strength.

Even after the sale…

📈 The TOTAL VALUE of Russia’s remaining gold reserves actually INCREASED thanks to rising gold prices.

Let that sink in:

Central banks are STILL turning to gold as a strategic liquidity asset in times of fiscal pressure.

They don’t sell Treasuries first… They don’t sell fiat…

They sell GOLD. 🟡

Because it’s REAL money.

$XAUT #Russia

XAUT0,07%

- Reward

- like

- Comment

- Repost

- Share

🚨 PRESIDENT TRUMP JUST SHOCKED EVERYONE

He just announced that the US will impose 10% global tariffs on top of other tariffs.

Trump also said that the Supreme Court ruling has made his ability to impose more powerful tariffs.

He mentioned the Trade Expansion Act, 1974 Trade Act and said that tariffs will remain in place.

People thought that Trump would go defensive, but the exact opposite happened.

#trump #trumpterrif

He just announced that the US will impose 10% global tariffs on top of other tariffs.

Trump also said that the Supreme Court ruling has made his ability to impose more powerful tariffs.

He mentioned the Trade Expansion Act, 1974 Trade Act and said that tariffs will remain in place.

People thought that Trump would go defensive, but the exact opposite happened.

#trump #trumpterrif

- Reward

- 2

- Comment

- Repost

- Share

🚨 I THINK WE HAVE A PROBLEM

In just 1 hour, +$0.5T was added to the gold and silver market cap.

This didn’t come out of nowhere.

The move down came first for a reason.

Here’s what actually happened:

Insiders knew the Supreme Court was about to rule Trump-era tariffs ILLEGAL.

They positioned before the headline.

The selloff you saw earlier was not panic.

It was manufactured.

Insiders needed prices lower before the news hit.

Why?

Because the ruling removes one of the last barriers holding inflation expectations in place.

Once tariffs are gone, the repricing is unavoidable.

So they forced the fl

In just 1 hour, +$0.5T was added to the gold and silver market cap.

This didn’t come out of nowhere.

The move down came first for a reason.

Here’s what actually happened:

Insiders knew the Supreme Court was about to rule Trump-era tariffs ILLEGAL.

They positioned before the headline.

The selloff you saw earlier was not panic.

It was manufactured.

Insiders needed prices lower before the news hit.

Why?

Because the ruling removes one of the last barriers holding inflation expectations in place.

Once tariffs are gone, the repricing is unavoidable.

So they forced the fl

XAUT0,07%

- Reward

- like

- Comment

- Repost

- Share

Same Market. Opposite Reality. The Dumb Money Perception Flip In Dumb Money, the same stock surge creates two completely different emotional worlds unfolding at the exact same time. On one side, everyday investors are refreshing their phones in disbelief, asking each other how much they made today, laughing as small positions explode into life-changing gains that feel surreal and defiant. On the other side, hedge fund executives sit in silence asking how much they lost today, watching billions disappear as a trade that was supposed to be controlled turns against them. The numbers are identical

GME1,51%

- Reward

- like

- Comment

- Repost

- Share

❕ US Macro Data (GDP)

• US Q4 GDP: 1.4%

Forecast: 3.0%

The report also came in worse than expected — signaling a sharp slowdown in economic growth.

• US Q4 GDP: 1.4%

Forecast: 3.0%

The report also came in worse than expected — signaling a sharp slowdown in economic growth.

- Reward

- 2

- 1

- Repost

- Share

GateUser-1dbde106 :

:

data is good but market still dump