Bit_Bull

No content yet

Bit_Bull

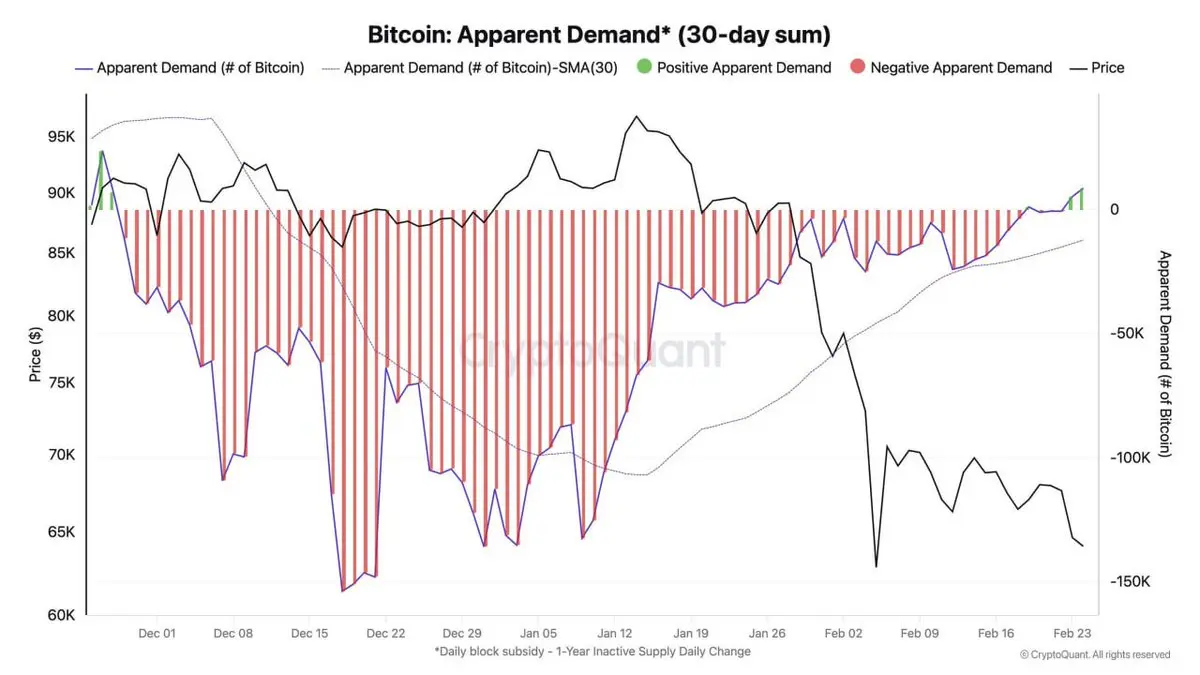

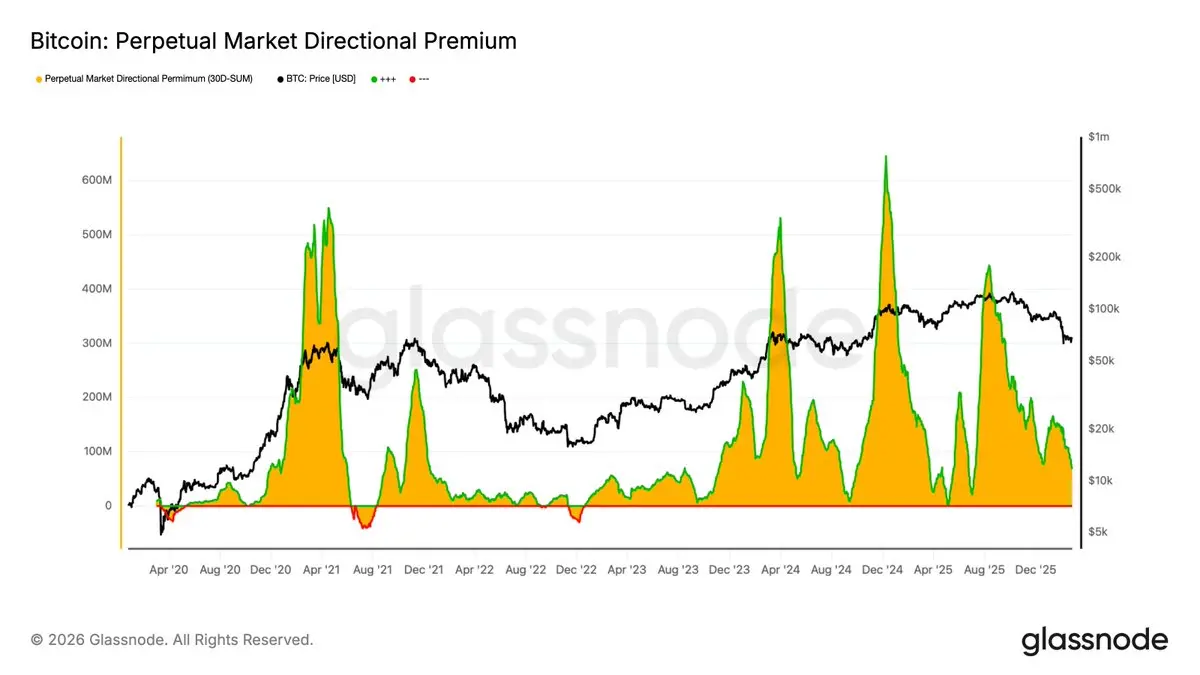

BITCOIN LEVERAGE IS UNWINDING AGAIN.

The Perpetual Market Directional Premium is compressing sharply.

Aggressive long exposure is steadily being flushed out as $BTC continues to chop sideways.

Leverage is quietly leaving the system.

This is what time capitulation looks like, not panic selling, but exhaustion.

Funding cools. Speculation fades. Positioning resets.

The market is clearing excess before the next major move.

The Perpetual Market Directional Premium is compressing sharply.

Aggressive long exposure is steadily being flushed out as $BTC continues to chop sideways.

Leverage is quietly leaving the system.

This is what time capitulation looks like, not panic selling, but exhaustion.

Funding cools. Speculation fades. Positioning resets.

The market is clearing excess before the next major move.

BTC-6,21%

- Reward

- 1

- Comment

- 1

- Share

Which cult is associated with the number 10 ?

$10B revenue.

May 10 meltdown.

October 10 wipeout.

10 AM dumps.

Jane street surely follow some cult and I really want to join that.

$10B revenue.

May 10 meltdown.

October 10 wipeout.

10 AM dumps.

Jane street surely follow some cult and I really want to join that.

- Reward

- 2

- Comment

- Repost

- Share

Which cult is associated with the number 10 ?

$10B revenue.

May 10 meltdown.

October 10 wipeout.

10 AM dumps.

Jane street surely follow some cult and I really want to join that.

$10B revenue.

May 10 meltdown.

October 10 wipeout.

10 AM dumps.

Jane street surely follow some cult and I really want to join that.

- Reward

- like

- Comment

- Repost

- Share

ETH at the Crossroads: Liquidity, Leverage, and the Real Long-Short Battle

ETH is sitting in one of those rare zones where the market is split almost evenly between optimism and caution. That’s why the current long-short battle is so interesting — it’s not just about price direction, it’s about positioning, liquidity, and which group of traders is misaligned with reality.

On one side, whales appear to be reducing exposure. On the other, accumulation addresses reportedly added around **2.5M ETH during February**. At first glance these signals look contradictory, but in reality they represent di

ETH is sitting in one of those rare zones where the market is split almost evenly between optimism and caution. That’s why the current long-short battle is so interesting — it’s not just about price direction, it’s about positioning, liquidity, and which group of traders is misaligned with reality.

On one side, whales appear to be reducing exposure. On the other, accumulation addresses reportedly added around **2.5M ETH during February**. At first glance these signals look contradictory, but in reality they represent di

ETH-8,84%

- Reward

- 4

- 1

- Repost

- Share

SYEDA :

:

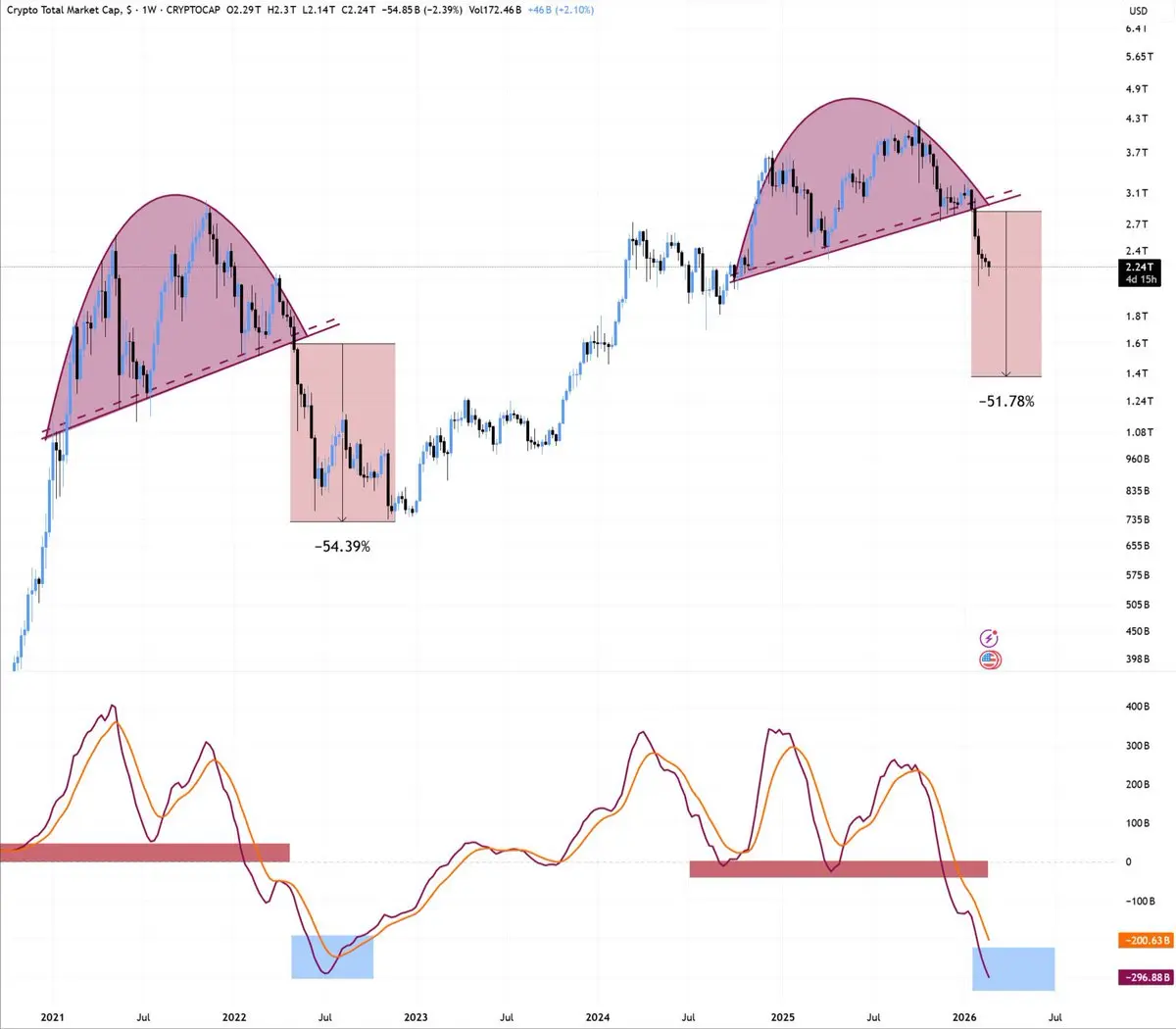

1000x VIbes 🤑Crypto MCap is still not at the bottom yet.

Just look at the fractal from 2022, and you'll realise the similarities.

Just look at the fractal from 2022, and you'll realise the similarities.

- Reward

- 1

- Comment

- Repost

- Share

Crypto MCap is still not at the bottom yet.

Just look at the fractal from 2022, and you'll realise the similarities.

Just look at the fractal from 2022, and you'll realise the similarities.

- Reward

- 1

- Comment

- Repost

- Share

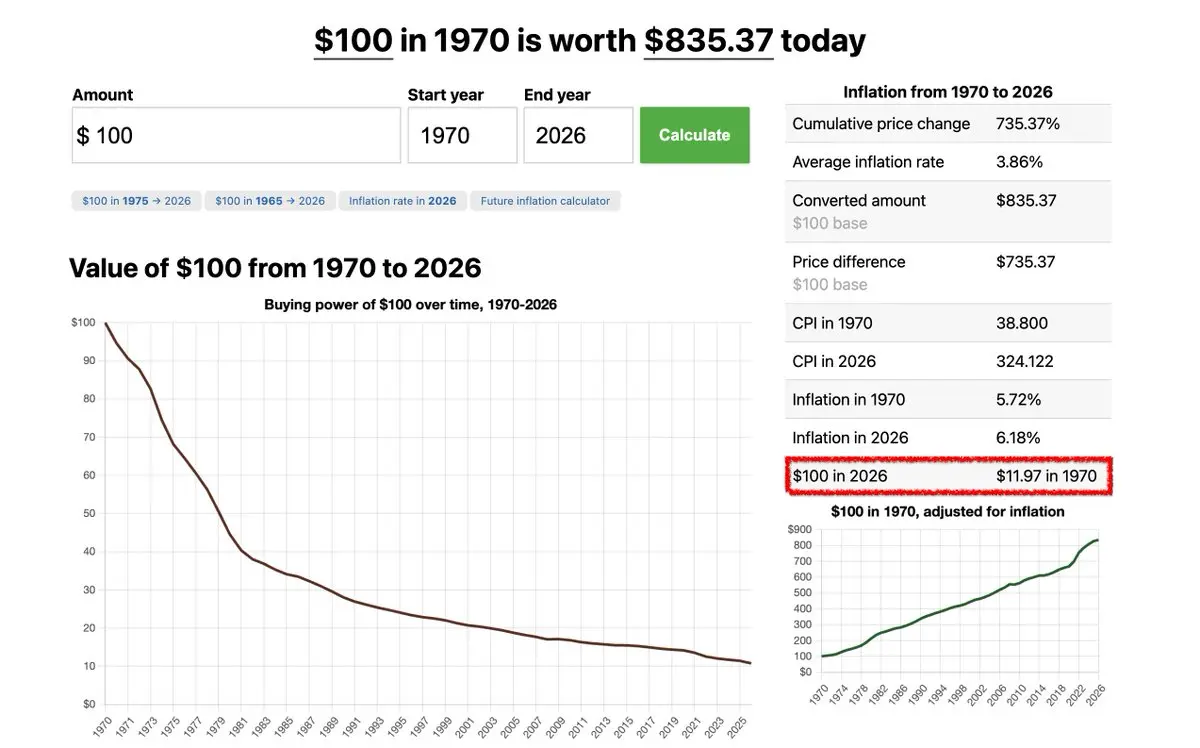

Nothing really stays the same over time.

People change, plans change… and money loses value without you even noticing.

What once felt like $100 now barely holds the same power it used to.

Currencies keep getting weaker.

But 1 Bitcoin still remains 1 Bitcoin.

People change, plans change… and money loses value without you even noticing.

What once felt like $100 now barely holds the same power it used to.

Currencies keep getting weaker.

But 1 Bitcoin still remains 1 Bitcoin.

BTC-6,21%

- Reward

- like

- Comment

- Repost

- Share

The biggest question right now is where are we in this BTC cycle compared to 2022?

Some are saying Feb 2022.

Some are saying May 2022.

Some are saying June 2022.

Some are saying November 2022.

I think we are currently at the same level as May 2022.

This means, there's one brutal dump yet to happen, which will be your generation buying opportunity.

Some are saying Feb 2022.

Some are saying May 2022.

Some are saying June 2022.

Some are saying November 2022.

I think we are currently at the same level as May 2022.

This means, there's one brutal dump yet to happen, which will be your generation buying opportunity.

BTC-6,21%

- Reward

- like

- Comment

- Repost

- Share

This is the first time the entire U.S. leadership setup is openly Bitcoin friendly.

President supports it.

Vice President supports it.

Next Fed Chair expected to be positive on it.

SEC and CFTC leadership not hostile anymore.

That kind of alignment has never happened before.

The next four years could change everything for Bitcoin.

President supports it.

Vice President supports it.

Next Fed Chair expected to be positive on it.

SEC and CFTC leadership not hostile anymore.

That kind of alignment has never happened before.

The next four years could change everything for Bitcoin.

BTC-6,21%

- Reward

- 2

- Comment

- Repost

- Share