Amarylliss_14

No content yet

Amarylliss_14

Tokenization is shaping up as the defining theme for 2026.

Analysts increasingly see on-chain stocks and ETFs as the next major wave, with U.S. regulators pushing capital markets toward blockchain rails.

It’s a $1B market today, but once rules are clear, growth could be exponential.

Share via @coinexcom

#coinex

Analysts increasingly see on-chain stocks and ETFs as the next major wave, with U.S. regulators pushing capital markets toward blockchain rails.

It’s a $1B market today, but once rules are clear, growth could be exponential.

Share via @coinexcom

#coinex

- Reward

- like

- Comment

- Repost

- Share

WAHA power economics show the real squeeze on miners.

Efficient rigs can survive short term, but once capex, downtime, and taxes are counted, margins get thin fast at current $BTC prices.

That’s why hashrate growth has stalled, not collapsed.

Miners aren’t exiting, they’re waiting.

Share via @coinexcom

#coinex #coinexcreator

Efficient rigs can survive short term, but once capex, downtime, and taxes are counted, margins get thin fast at current $BTC prices.

That’s why hashrate growth has stalled, not collapsed.

Miners aren’t exiting, they’re waiting.

Share via @coinexcom

#coinex #coinexcreator

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

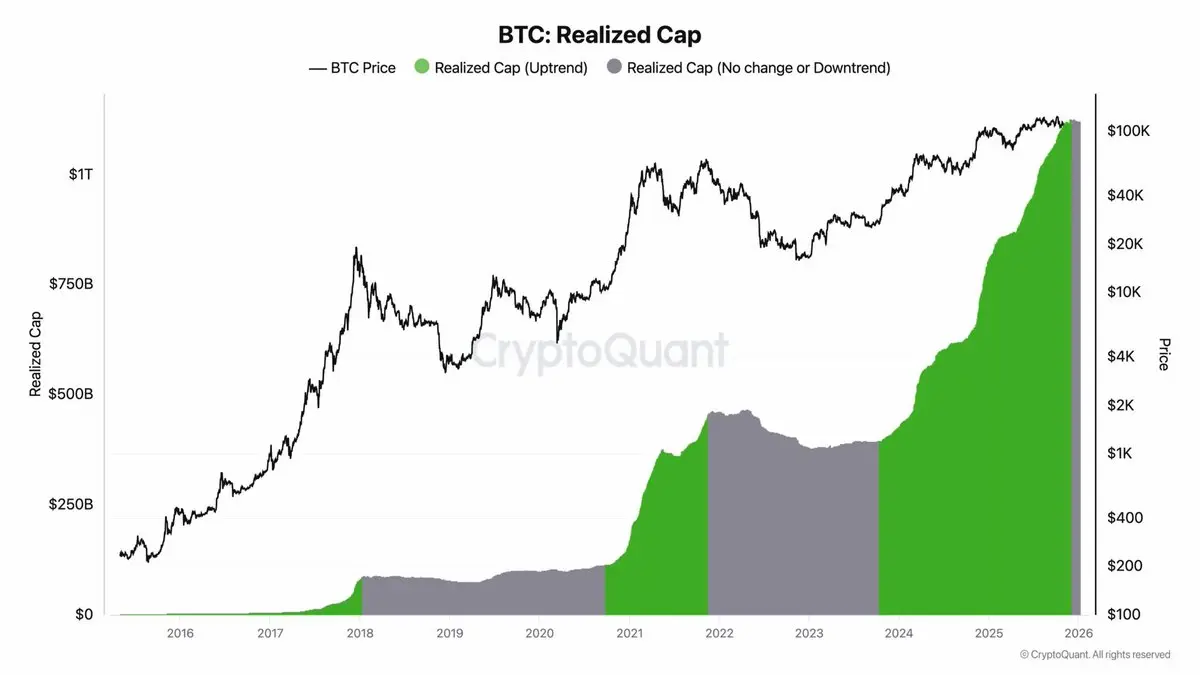

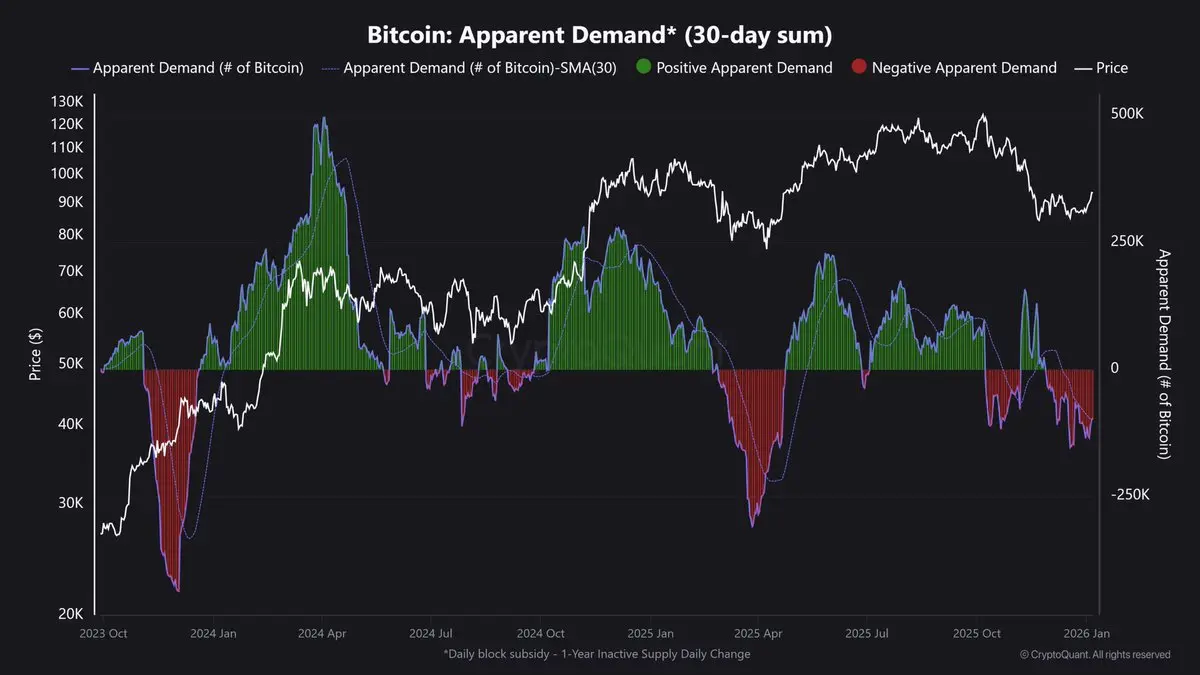

Bitcoin ETFs are roaring into 2026 🦁

$1.2B inflows in just 2 days = $150B annualized, showing strong institutional conviction.

But there’s a catch

On-chain data still shows overall BTC demand is negative, and price keeps stalling near $94K–$96K.

Sustainable rally to $100K needs demand to flip positive, not just ETF hype.

Share in collab with @coinexcreators

#CoinEx #CoinExCreator

$1.2B inflows in just 2 days = $150B annualized, showing strong institutional conviction.

But there’s a catch

On-chain data still shows overall BTC demand is negative, and price keeps stalling near $94K–$96K.

Sustainable rally to $100K needs demand to flip positive, not just ETF hype.

Share in collab with @coinexcreators

#CoinEx #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

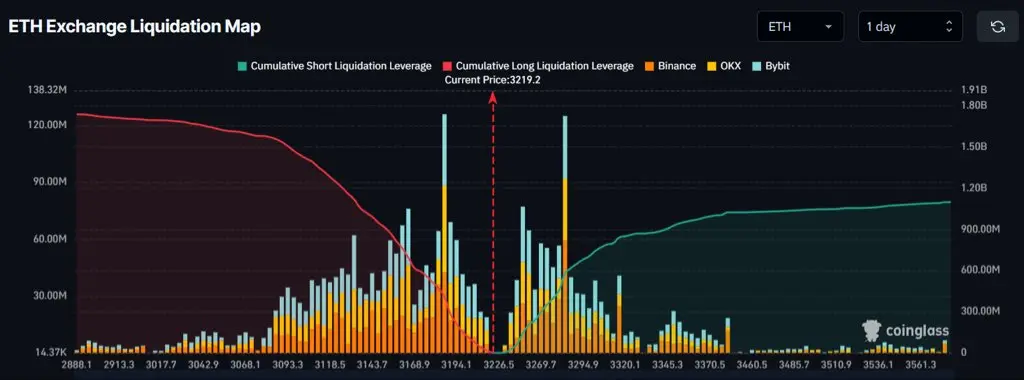

$ETH broke out and flipped short-term structure in favor of buyers.

As long as price holds above $3,170, a push toward $3,600 (+11.7%) stays on the table.

Lose $3,170, and the setup weakens fast downside risk reopens.

Technicals are mixed:

• Above the 50-day EMA = short-term trend up

• ADX at 24.56 = momentum still fragile

Liquidation clusters sit near $3,186 (support) and $3,284 (resistance).

That range likely decides the next move.

Via @coinexcreators

#coinex #CoinExCreator

As long as price holds above $3,170, a push toward $3,600 (+11.7%) stays on the table.

Lose $3,170, and the setup weakens fast downside risk reopens.

Technicals are mixed:

• Above the 50-day EMA = short-term trend up

• ADX at 24.56 = momentum still fragile

Liquidation clusters sit near $3,186 (support) and $3,284 (resistance).

That range likely decides the next move.

Via @coinexcreators

#coinex #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

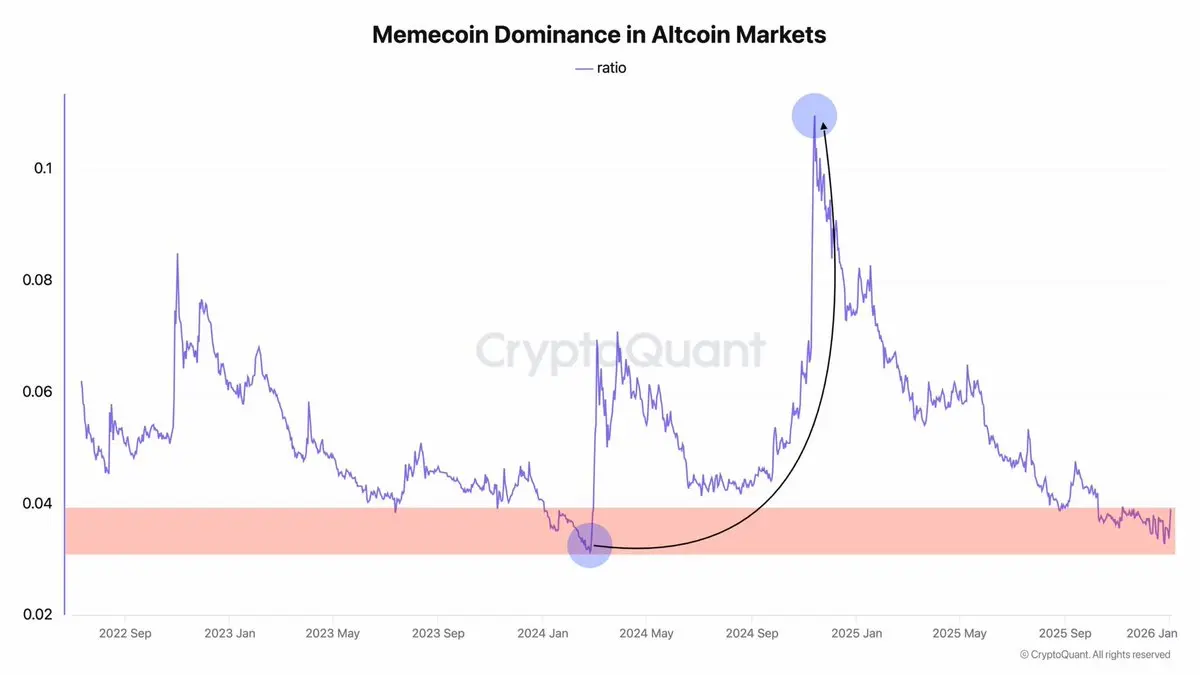

Memecoin dominance is quietly waking up.

After losing ground through late 2024, the ratio bottomed in Dec 2025 right at levels that previously came before explosive memecoin runs.

Now it’s turning higher again, with major names already showing strength.

Too early to call a season, but this setup is getting hard to ignore.

Share in collab via @coinexcreators

#coinex #coinexcreater

After losing ground through late 2024, the ratio bottomed in Dec 2025 right at levels that previously came before explosive memecoin runs.

Now it’s turning higher again, with major names already showing strength.

Too early to call a season, but this setup is getting hard to ignore.

Share in collab via @coinexcreators

#coinex #coinexcreater

- Reward

- like

- Comment

- Repost

- Share

$ZEC defended the $300–$320 zone cleanly and built a rounded base that wasn’t a dead-cat bounce, it was trend exhaustion.

Reclaimed $401, then $528, and now pressing into $520–$550 supply around $536.

Pullbacks stay shallow, sellers look controlled.

If this level gives way, structure opens higher.

Share in collab with @coinexcreators

#CoinEx #CoinExCreator

Reclaimed $401, then $528, and now pressing into $520–$550 supply around $536.

Pullbacks stay shallow, sellers look controlled.

If this level gives way, structure opens higher.

Share in collab with @coinexcreators

#CoinEx #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

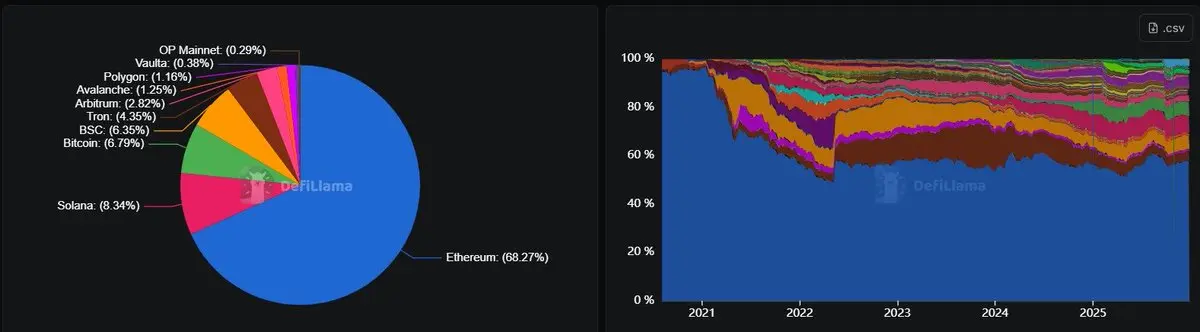

$ETH dominance in DeFi is still unmatched.

Mainnet alone controls 68% of total DeFi TVL and even during the 2022 crash, its share never fully broke, bottoming near 45% before steadily recovering into 2024–2025.

Zoom out further:

When you exclude Ethereum’s own L2s (Arbitrum, Optimism, Base), Ethereum’s effective share pushes well above 70%.

Liquidity follows resilience.

And DeFi keeps choosing Ethereum.

Share via @coinexcom

Mainnet alone controls 68% of total DeFi TVL and even during the 2022 crash, its share never fully broke, bottoming near 45% before steadily recovering into 2024–2025.

Zoom out further:

When you exclude Ethereum’s own L2s (Arbitrum, Optimism, Base), Ethereum’s effective share pushes well above 70%.

Liquidity follows resilience.

And DeFi keeps choosing Ethereum.

Share via @coinexcom

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

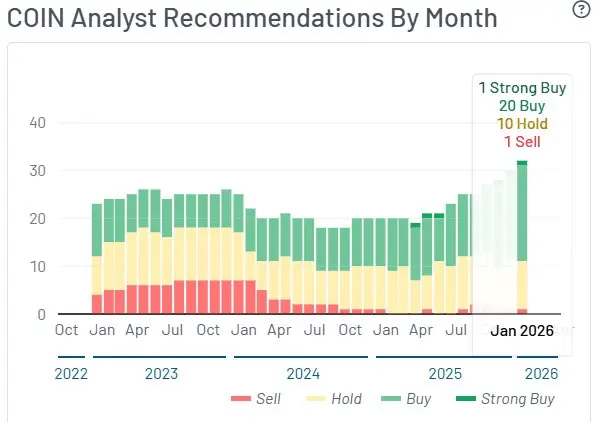

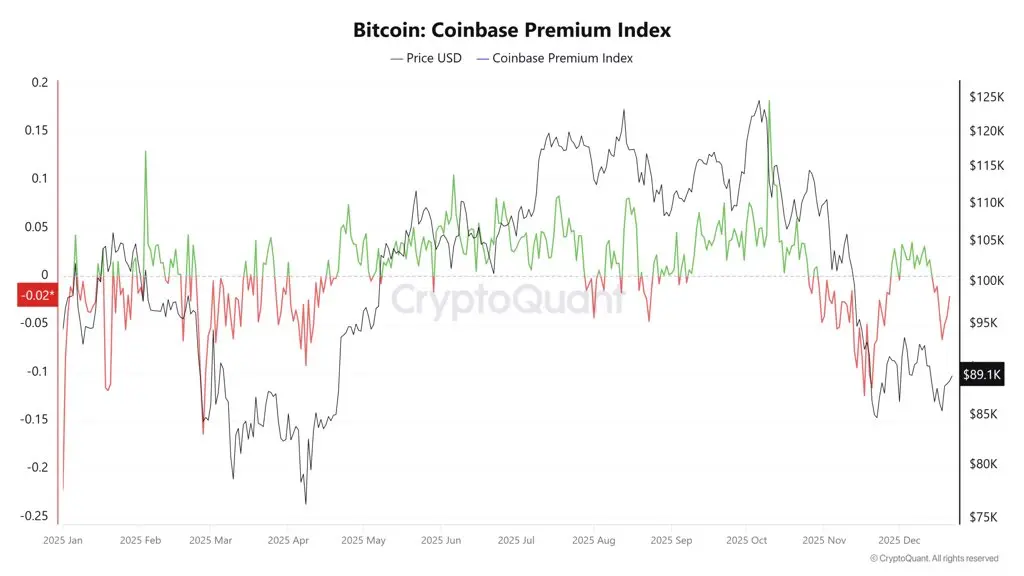

US institutional demand cooled sharply in Q4.

Total Net Assets dropped from $150B to $114B, a $36B decline driven by sustained ETF outflows. Investors reduced exposure as risk appetite faded across spot products.

This pullback directly pressured major Bitcoin ETFs like IBIT, reflecting capital rotation and de-risking not panic.

Institutions stepped back, liquidity thinned, and price followed.

Share via @coinexcreators

Total Net Assets dropped from $150B to $114B, a $36B decline driven by sustained ETF outflows. Investors reduced exposure as risk appetite faded across spot products.

This pullback directly pressured major Bitcoin ETFs like IBIT, reflecting capital rotation and de-risking not panic.

Institutions stepped back, liquidity thinned, and price followed.

Share via @coinexcreators

- Reward

- 1

- 1

- Repost

- Share

Nataliaaly :

:

time to hold n watchhhMarket stayed risk-off, and $LINK reflected that tone.

Price is grinding around 12–12.5, with buyers defending support but no real momentum yet.

On-chain looks steadier than price.

TVS sits near 46B (+2.4% MoM), and exchange outflows point more toward positioning than panic.

Technicals remain mixed.

MACD death cross, RSI divergence.

As long as 12 holds, this looks like consolidation, not a breakdown.

Lose it, and 9–10 becomes the next area to watch.

Share via @coinexcom

#CoinEx #CoinExCreator

Price is grinding around 12–12.5, with buyers defending support but no real momentum yet.

On-chain looks steadier than price.

TVS sits near 46B (+2.4% MoM), and exchange outflows point more toward positioning than panic.

Technicals remain mixed.

MACD death cross, RSI divergence.

As long as 12 holds, this looks like consolidation, not a breakdown.

Lose it, and 9–10 becomes the next area to watch.

Share via @coinexcom

#CoinEx #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

Not every strategy needs candles and adrenaline.

#CoinExFixedSavings is for the part of the portfolio that prefers discipline over drama.

Funds get locked.

Returns stay predictable.

Capital works quietly while the market argues with itself.

No hype.

No timing stress.

Just steady yield doing its job in the background.

Share via @coinexcom

#CoinExFixedSavings is for the part of the portfolio that prefers discipline over drama.

Funds get locked.

Returns stay predictable.

Capital works quietly while the market argues with itself.

No hype.

No timing stress.

Just steady yield doing its job in the background.

Share via @coinexcom

- Reward

- like

- Comment

- Repost

- Share

Every cycle resets the same debate: which crypto exchange is best in 2025.

The answer isn’t about flashy launches. It’s about who survives volatility, protects users, and keeps products usable when markets get rough.

That’s where platforms like CoinEx quietly stand out.

Share via @coinexcreators

#coinex #CoinExCreator

The answer isn’t about flashy launches. It’s about who survives volatility, protects users, and keeps products usable when markets get rough.

That’s where platforms like CoinEx quietly stand out.

Share via @coinexcreators

#coinex #CoinExCreator

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More25.83K Popularity

34.28K Popularity

24.03K Popularity

8.15K Popularity

6.44K Popularity

Pin