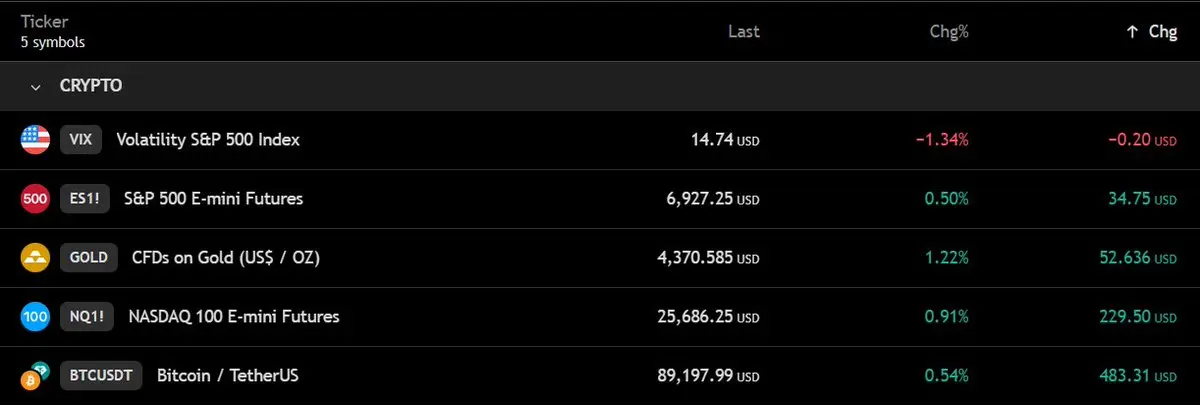

FTX just unlocked $28M worth of $SOL… and the market barely blinked.

That’s the real signal.

Despite fresh supply, Solana’s liquidity absorbed it smoothly, TVL is rising, volume is steady, and structure remains bullish.

Strong markets don’t react to noise

Via @creators

That’s the real signal.

Despite fresh supply, Solana’s liquidity absorbed it smoothly, TVL is rising, volume is steady, and structure remains bullish.

Strong markets don’t react to noise

Via @creators

SOL2,13%