#CPIDataAhead

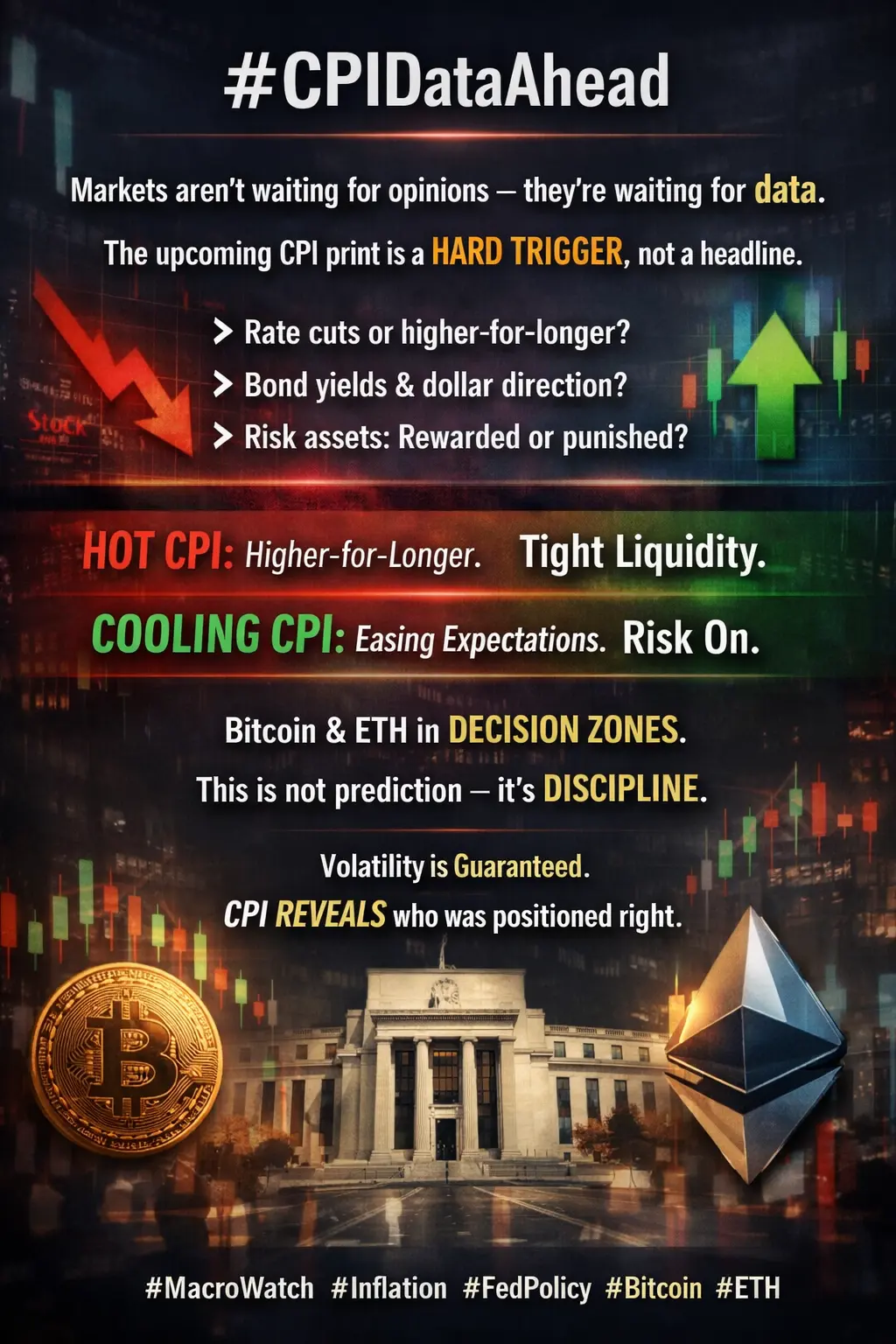

📊 CPI Data Ahead: A Moment That Can Move the Market

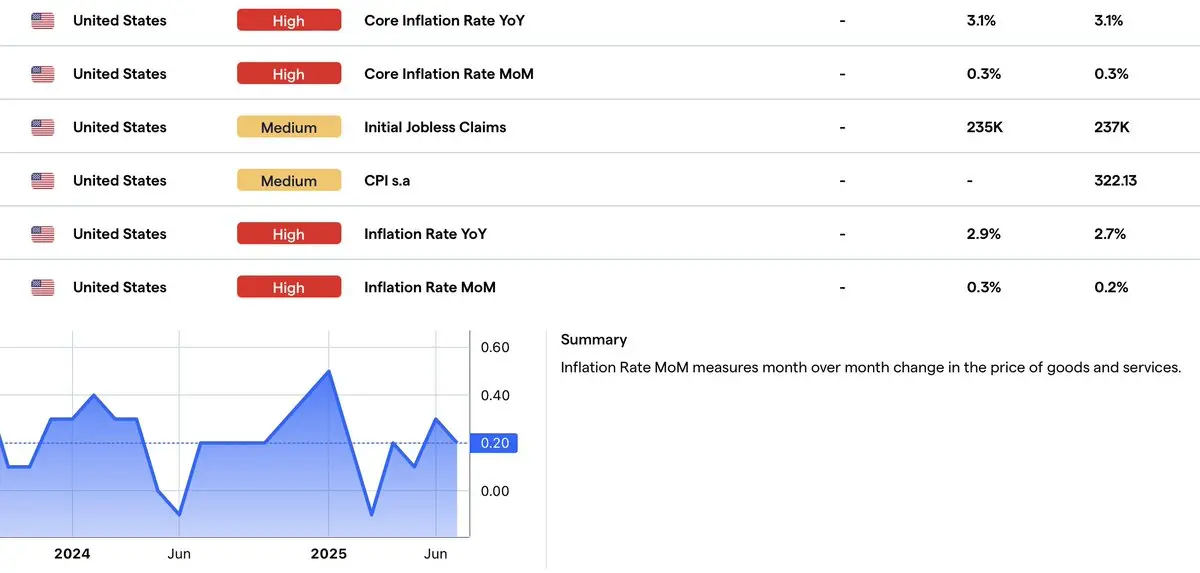

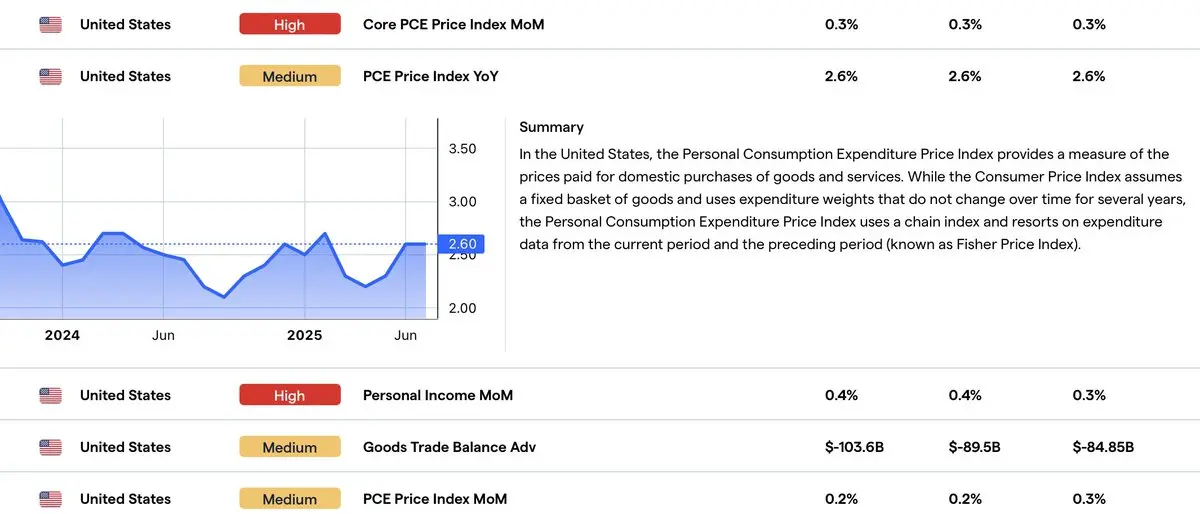

All eyes are on the upcoming CPI (Consumer Price Index) data, a key macro event that often sets the tone for both traditional markets and crypto.

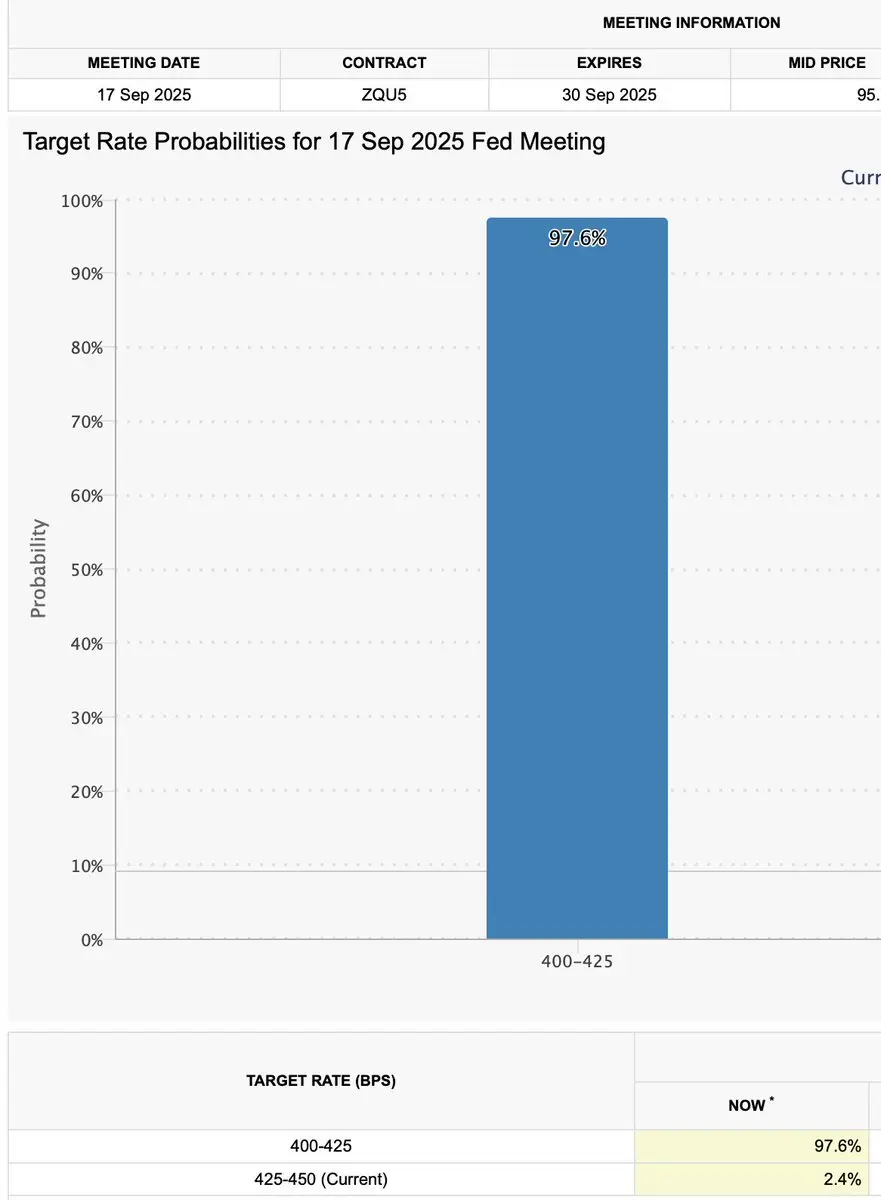

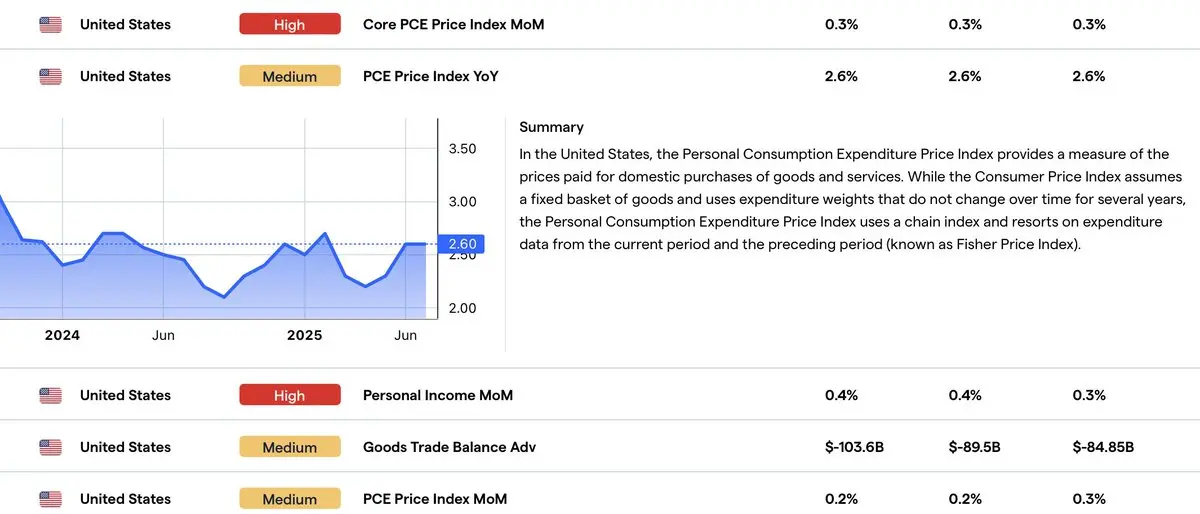

CPI measures inflation at the consumer level, and even a small deviation from expectations can trigger sharp reactions. A cooler CPI could strengthen hopes for rate cuts, improving risk sentiment and supporting assets like Bitcoin and altcoins. On the other hand, a hotter-than-expected CPI may revive inflation fears, push yields higher, and create short-term pressure across the marke

📊 CPI Data Ahead: A Moment That Can Move the Market

All eyes are on the upcoming CPI (Consumer Price Index) data, a key macro event that often sets the tone for both traditional markets and crypto.

CPI measures inflation at the consumer level, and even a small deviation from expectations can trigger sharp reactions. A cooler CPI could strengthen hopes for rate cuts, improving risk sentiment and supporting assets like Bitcoin and altcoins. On the other hand, a hotter-than-expected CPI may revive inflation fears, push yields higher, and create short-term pressure across the marke

BTC4,34%