# What’sNextforBitcoin?

19.05K

StylishKuri

#What’sNextforBitcoin? Headline: 🔥 $70K TAKEN BACK — Bitcoin Roars Again! 👑🚀

Bitcoin just staged a resilient comeback on February 15, 2026, reclaiming the $70,000 zone and invalidating the recent bearish narrative that had been building since the early-year correction. After testing lower support near $60K, the market quickly found its footing as macro tailwinds shifted sentiment in favor of risk assets, highlighting the growing influence of liquidity and institutional positioning in Bitcoin’s price action.

📊 Macro & Market Drivers

Several key factors contributed to Bitcoin’s renewed stren

Bitcoin just staged a resilient comeback on February 15, 2026, reclaiming the $70,000 zone and invalidating the recent bearish narrative that had been building since the early-year correction. After testing lower support near $60K, the market quickly found its footing as macro tailwinds shifted sentiment in favor of risk assets, highlighting the growing influence of liquidity and institutional positioning in Bitcoin’s price action.

📊 Macro & Market Drivers

Several key factors contributed to Bitcoin’s renewed stren

BTC-1,39%

- Reward

- 2

- Comment

- Repost

- Share

#What’sNextforBitcoin?

📊 Key Takeaway

Bitcoin (BTC) is currently in a "wait-and-see" phase—after a major drop, market direction is unclear but volatility is picking up. Short-term risks are elevated, but fundamental drivers remain strong. Let’s dissect where BTC could head next, what’s moving the market, and how to approach it as a trader/investor.

---

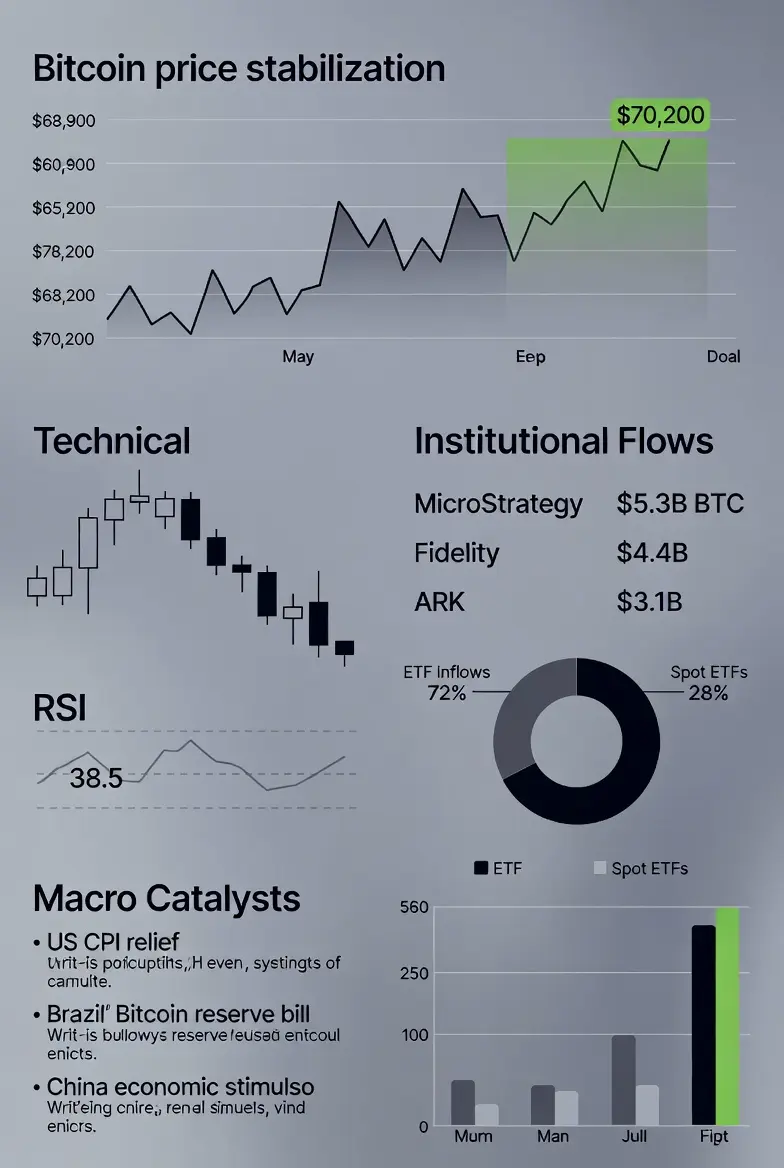

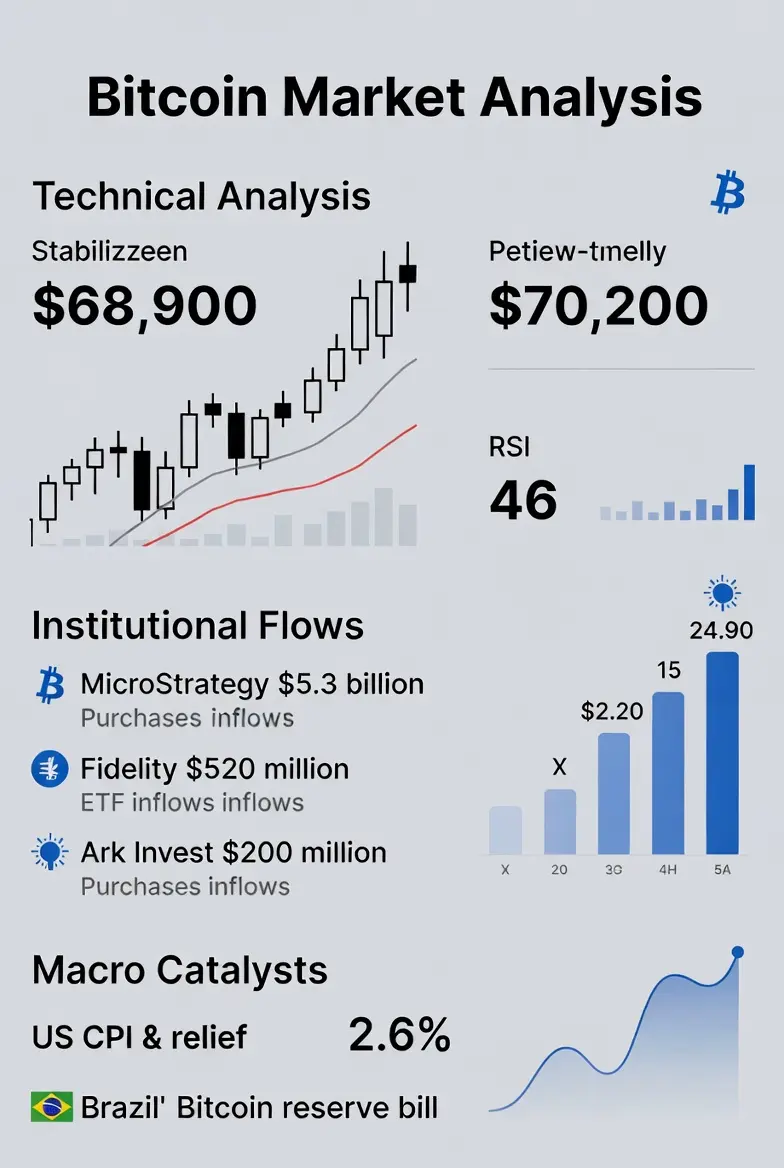

📈 Latest Metrics & Technicals

Current Price: $68,924.70 (as of 2026-02-16)

24h Change: -1.15%

24h Volume: $700,829,658

7-Day Change: +0.13%

30-Day Change: -26.41%

Market Cap: $1,375,396,783,650

Technical Signals:

Daily Trend: Bearish ("MA7 <

📊 Key Takeaway

Bitcoin (BTC) is currently in a "wait-and-see" phase—after a major drop, market direction is unclear but volatility is picking up. Short-term risks are elevated, but fundamental drivers remain strong. Let’s dissect where BTC could head next, what’s moving the market, and how to approach it as a trader/investor.

---

📈 Latest Metrics & Technicals

Current Price: $68,924.70 (as of 2026-02-16)

24h Change: -1.15%

24h Volume: $700,829,658

7-Day Change: +0.13%

30-Day Change: -26.41%

Market Cap: $1,375,396,783,650

Technical Signals:

Daily Trend: Bearish ("MA7 <

BTC-1,39%

- Reward

- 3

- 1

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴#What’sNextforBitcoin?

#WhatsNextforBitcoin

Bitcoin has once again entered a decisive phase that could shape the entire crypto market for months ahead. After experiencing extreme volatility, sharp corrections, and rapid recoveries, traders and investors are now asking the most important question in the digital asset space. What comes next for Bitcoin, and how should market participants prepare for the next major move?

As the flagship cryptocurrency, Bitcoin does not move in isolation. Its direction influences altcoins, investor sentiment, institutional flows, and even broader risk markets. Wh

#WhatsNextforBitcoin

Bitcoin has once again entered a decisive phase that could shape the entire crypto market for months ahead. After experiencing extreme volatility, sharp corrections, and rapid recoveries, traders and investors are now asking the most important question in the digital asset space. What comes next for Bitcoin, and how should market participants prepare for the next major move?

As the flagship cryptocurrency, Bitcoin does not move in isolation. Its direction influences altcoins, investor sentiment, institutional flows, and even broader risk markets. Wh

BTC-1,39%

- Reward

- 3

- Comment

- Repost

- Share

#What’sNextforBitcoin? #What’sNextforBitcoin?

When we ask what’s next for Bitcoin, we’re really asking what’s next for global liquidity, investor confidence, and risk appetite. Bitcoin doesn’t move in isolation — it reacts to macro data, institutional flows, ETF demand, regulatory clarity, and overall market psychology.

Right now, several key factors are shaping the next phase:

First, macro conditions. If inflation continues cooling and rate cuts become more likely, risk assets typically benefit. Bitcoin often responds positively when liquidity expectations improve.

Second, institutional momen

When we ask what’s next for Bitcoin, we’re really asking what’s next for global liquidity, investor confidence, and risk appetite. Bitcoin doesn’t move in isolation — it reacts to macro data, institutional flows, ETF demand, regulatory clarity, and overall market psychology.

Right now, several key factors are shaping the next phase:

First, macro conditions. If inflation continues cooling and rate cuts become more likely, risk assets typically benefit. Bitcoin often responds positively when liquidity expectations improve.

Second, institutional momen

BTC-1,39%

- Reward

- like

- Comment

- Repost

- Share

#What’sNextforBitcoin?

Bitcoin once again stands at a fascinating crossroads. After years of volatility, cycles of euphoria and fear, and growing institutional attention, the biggest question investors are asking is simple: What comes next? While no one can predict the market with certainty, several key factors can help us understand the possible direction.

First, Bitcoin’s long-term narrative remains intact. It continues to be viewed as digital gold — a scarce, decentralized asset resistant to inflation and monetary manipulation. In a world where economic uncertainty, debt expansion, and curr

Bitcoin once again stands at a fascinating crossroads. After years of volatility, cycles of euphoria and fear, and growing institutional attention, the biggest question investors are asking is simple: What comes next? While no one can predict the market with certainty, several key factors can help us understand the possible direction.

First, Bitcoin’s long-term narrative remains intact. It continues to be viewed as digital gold — a scarce, decentralized asset resistant to inflation and monetary manipulation. In a world where economic uncertainty, debt expansion, and curr

BTC-1,39%

- Reward

- 4

- 8

- Repost

- Share

MrThanks77 :

:

LFG 🔥View More

#What’sNextforBitcoin?

Bitcoin is at a decision point.

After recent volatility, the market is asking the same question:

Is this consolidation before continuation — or distribution before another leg down?

Here’s what actually matters:

📌 Structure — Are higher lows forming, or are lower highs capping upside?

📌 Volume — Is the move supported by real demand, or thin liquidity?

📌 Macro backdrop — Are yields and the dollar helping or hurting risk assets?

📌 Liquidity flows — Is capital rotating back into BTC or staying defensive?

Short-term noise is everywhere.

But trends are built on liquidity

Bitcoin is at a decision point.

After recent volatility, the market is asking the same question:

Is this consolidation before continuation — or distribution before another leg down?

Here’s what actually matters:

📌 Structure — Are higher lows forming, or are lower highs capping upside?

📌 Volume — Is the move supported by real demand, or thin liquidity?

📌 Macro backdrop — Are yields and the dollar helping or hurting risk assets?

📌 Liquidity flows — Is capital rotating back into BTC or staying defensive?

Short-term noise is everywhere.

But trends are built on liquidity

BTC-1,39%

- Reward

- 3

- 3

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

What is next for crypto market?

The cryptocurrency market remains highly sensitive to external and internal forces. Here are **5 key topics** currently influencing its dynamics in 2026.

1. **Macroeconomic Conditions and Interest Rates**

Central bank policies, particularly U.S. Federal Reserve rate decisions, heavily impact risk assets like crypto. Sticky inflation, slower rate cuts, and stronger economic data have delayed easing, leading to higher real yields and risk-off sentiment. This has contributed to recent Bitcoin dips and broader market corrections, as liquidity tightens and invest

The cryptocurrency market remains highly sensitive to external and internal forces. Here are **5 key topics** currently influencing its dynamics in 2026.

1. **Macroeconomic Conditions and Interest Rates**

Central bank policies, particularly U.S. Federal Reserve rate decisions, heavily impact risk assets like crypto. Sticky inflation, slower rate cuts, and stronger economic data have delayed easing, leading to higher real yields and risk-off sentiment. This has contributed to recent Bitcoin dips and broader market corrections, as liquidity tightens and invest

BTC-1,39%

- Reward

- like

- Comment

- Repost

- Share

#What’sNextforBitcoin? WhatsNextForBitcoin

Headline: 🔥 $70K TAKEN BACK — Bitcoin Roars Again! 👑🚀

Bitcoin just delivered a strong comeback on Feb 15, reclaiming the $70,000 zone and invalidating the recent bearish fear. After shaking out weak hands near $60K, the market found its footing as softer US inflation data shifted sentiment back in favor of risk assets. 📊

Why the “Wait & Watch” crowd got sidelined:

🔹 Macro Tailwind: Inflation easing to 2.4% reduced pressure on risk markets

🔹 Battle-Tested Support: $60K proved to be a solid demand zone

🔹 Smart Money Flow: Spot ETF demand stayed f

Headline: 🔥 $70K TAKEN BACK — Bitcoin Roars Again! 👑🚀

Bitcoin just delivered a strong comeback on Feb 15, reclaiming the $70,000 zone and invalidating the recent bearish fear. After shaking out weak hands near $60K, the market found its footing as softer US inflation data shifted sentiment back in favor of risk assets. 📊

Why the “Wait & Watch” crowd got sidelined:

🔹 Macro Tailwind: Inflation easing to 2.4% reduced pressure on risk markets

🔹 Battle-Tested Support: $60K proved to be a solid demand zone

🔹 Smart Money Flow: Spot ETF demand stayed f

BTC-1,39%

- Reward

- 2

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin?

February 15, 2026 , Bitcoin stands at a pivotal crossroads as it enters the next chapter of its evolution. After years of breaking new ground, defying skeptics, and growing from niche digital experiment to increasingly mainstream financial asset, the question no longer is if Bitcoin will matter but how it will continue to shape global finance, technology, and investor behavior. Whether you’re a dedicated hodler, a new crypto participant, or an institutional strategist, the landscape ahead is defined by innovation, adoption, and macroeconomic forces.

At its core, Bitcoi

February 15, 2026 , Bitcoin stands at a pivotal crossroads as it enters the next chapter of its evolution. After years of breaking new ground, defying skeptics, and growing from niche digital experiment to increasingly mainstream financial asset, the question no longer is if Bitcoin will matter but how it will continue to shape global finance, technology, and investor behavior. Whether you’re a dedicated hodler, a new crypto participant, or an institutional strategist, the landscape ahead is defined by innovation, adoption, and macroeconomic forces.

At its core, Bitcoi

BTC-1,39%

- Reward

- 5

- 5

- Repost

- Share

BeautifulDay :

:

To The Moon 🌕View More

#What’sNextforBitcoin? Mid-February 2026 Market Outlook (Feb 15 Update) 📊

Bitcoin has continued its rebound from the $65K dip, solidifying above the $70,000 psychological barrier. The past 48–72 hours have seen a dramatic shift in market sentiment—from “Extreme Fear” to Aggressive Accumulation—as macro signals, on-chain flows, and institutional activity align in favor of BTC.

📈 The Bullish Momentum

Several factors are driving the upside:

Macro Tailwinds:

US Core CPI hit a 4-year low of 2.5%, reinforcing hopes of a March Fed rate cut. Lower rates traditionally fuel crypto rallies by reducing

Bitcoin has continued its rebound from the $65K dip, solidifying above the $70,000 psychological barrier. The past 48–72 hours have seen a dramatic shift in market sentiment—from “Extreme Fear” to Aggressive Accumulation—as macro signals, on-chain flows, and institutional activity align in favor of BTC.

📈 The Bullish Momentum

Several factors are driving the upside:

Macro Tailwinds:

US Core CPI hit a 4-year low of 2.5%, reinforcing hopes of a March Fed rate cut. Lower rates traditionally fuel crypto rallies by reducing

- Reward

- 7

- 7

- Repost

- Share

Peacefulheart :

:

To The Moon 🌕View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

123.79K Popularity

21.4K Popularity

19.05K Popularity

64.23K Popularity

8.88K Popularity

271.71K Popularity

305.58K Popularity

21.55K Popularity

11.26K Popularity

9.18K Popularity

9.63K Popularity

9.52K Popularity

8.45K Popularity

36.75K Popularity

News

View MoreAlibaba will open-source the new generation Qwen3.5 model on New Year's Eve

5 m

Founder of DefiLama: The death rate of token issuance projects after reaching PMF is 50% higher than that of non-token issuance projects

19 m

Data: Hyperliquid platform whales currently hold positions worth 2.82 billion USD, with a long-short position ratio of 0.94.

23 m

Market Report: Overview of the top 5 cryptocurrencies by gain on February 16, 2026, with the leading coin being Stable

24 m

YZi Labs submits a revised preliminary consent solicitation to the US SEC, pushing for the expansion of the CEA Industries Board of Directors

25 m

Pin