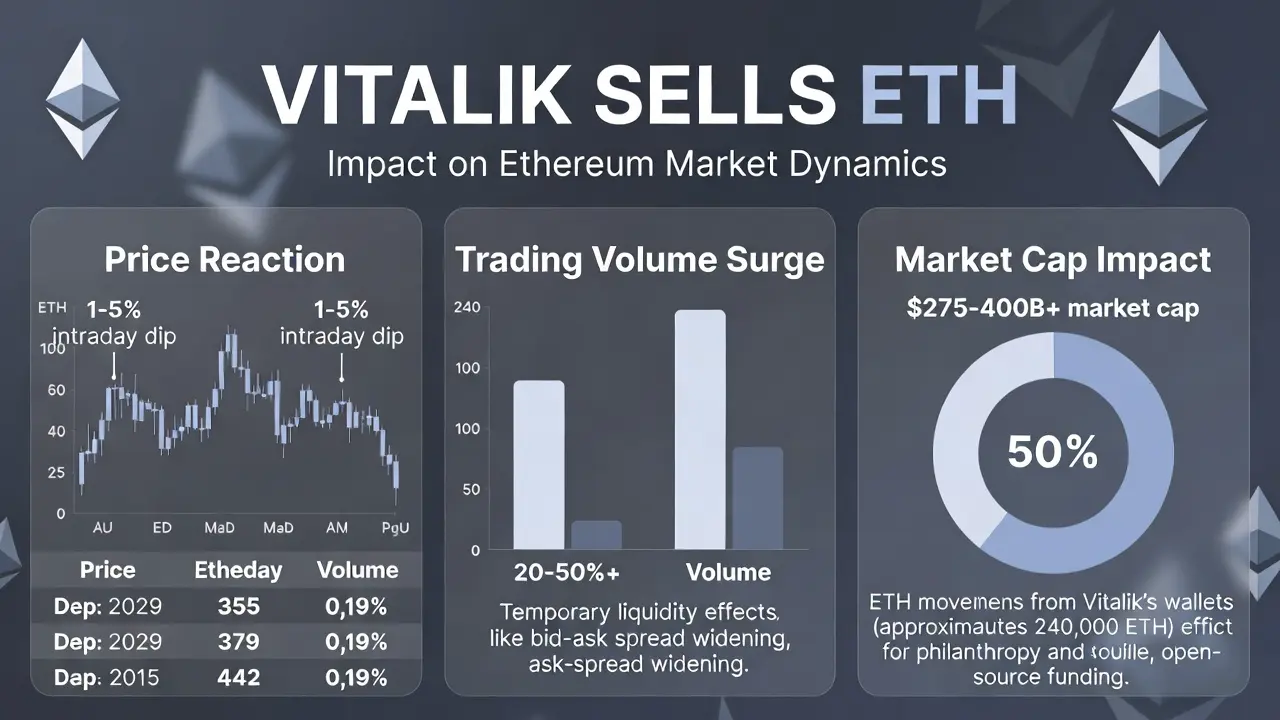

📊 Vitalik Sells ETH — What This Means for the Market

Dragon Fly Official Market View

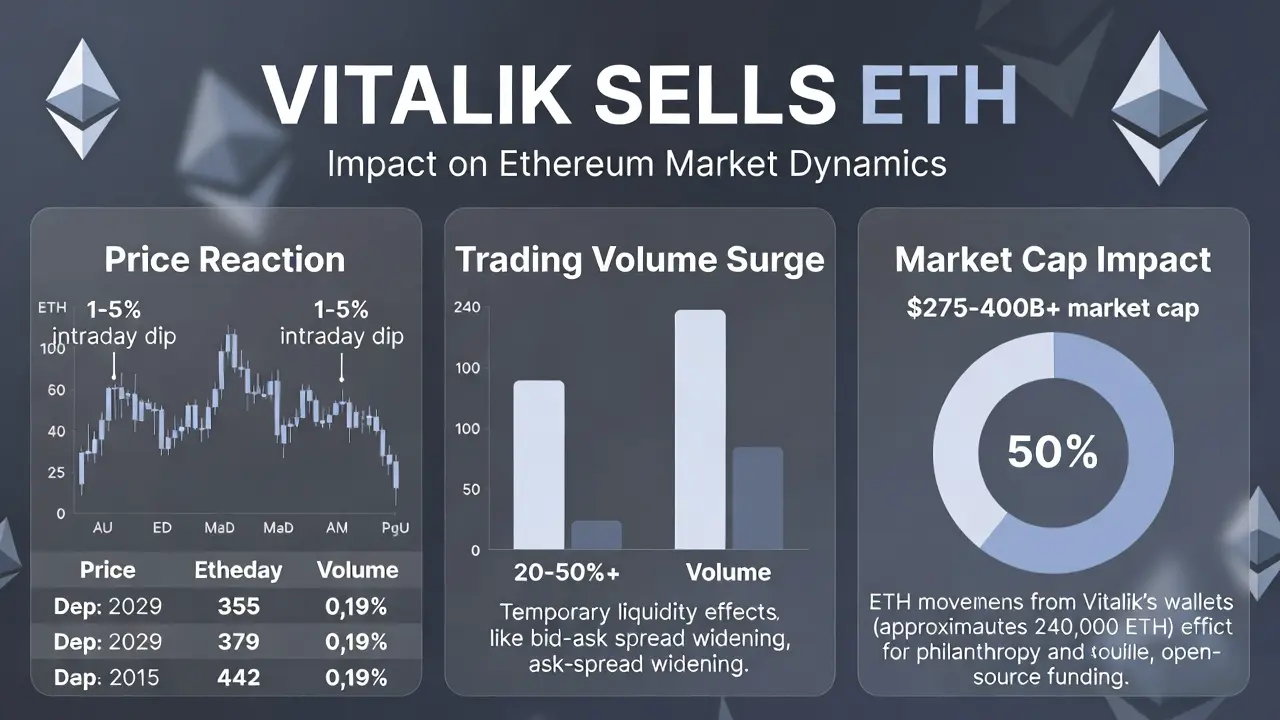

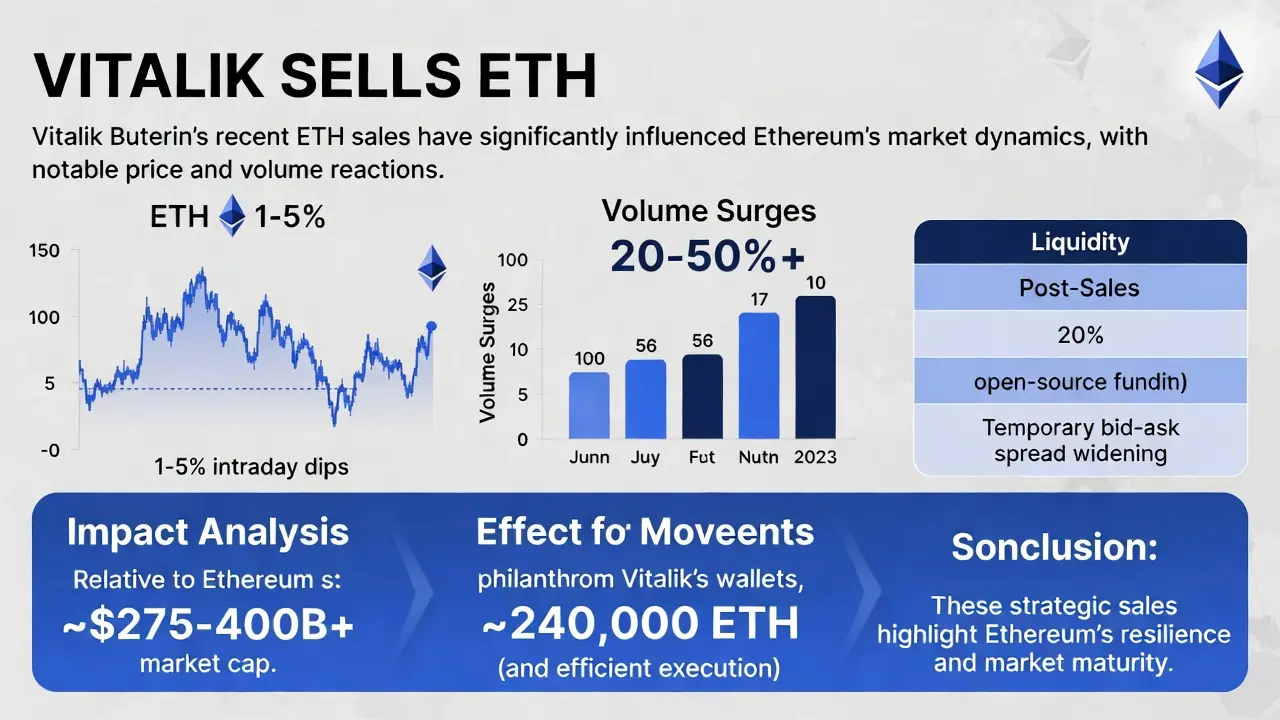

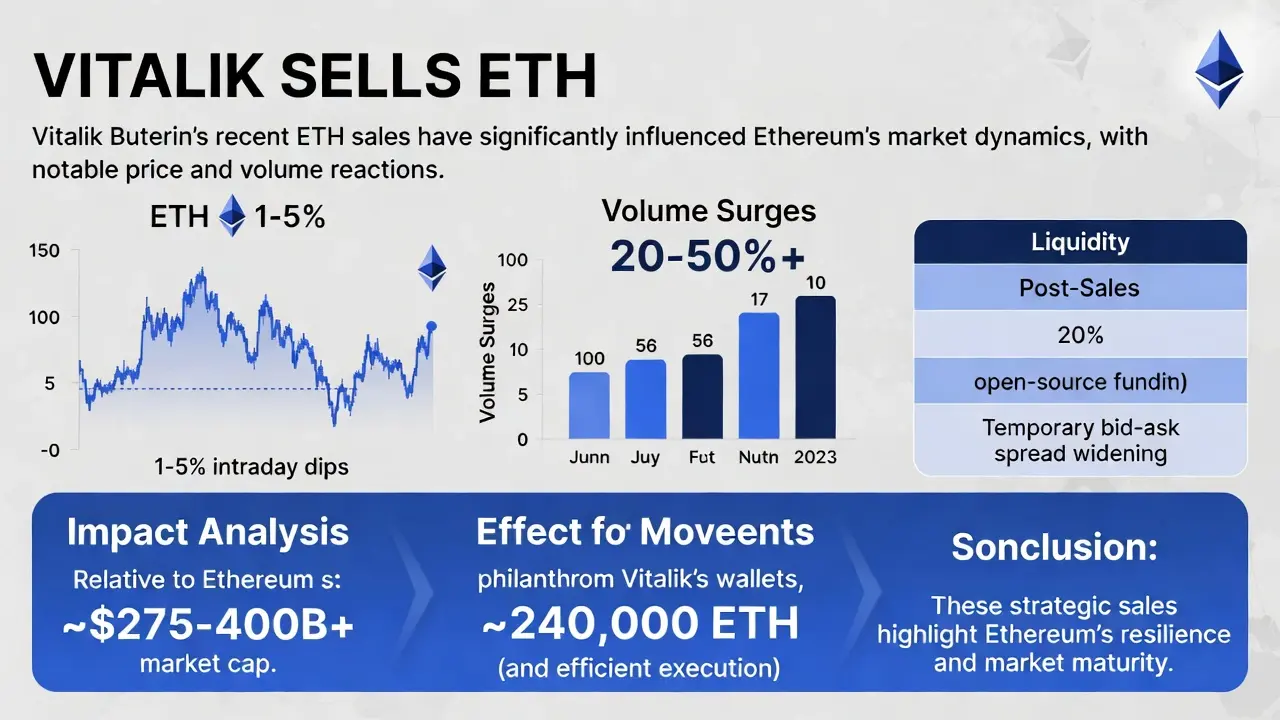

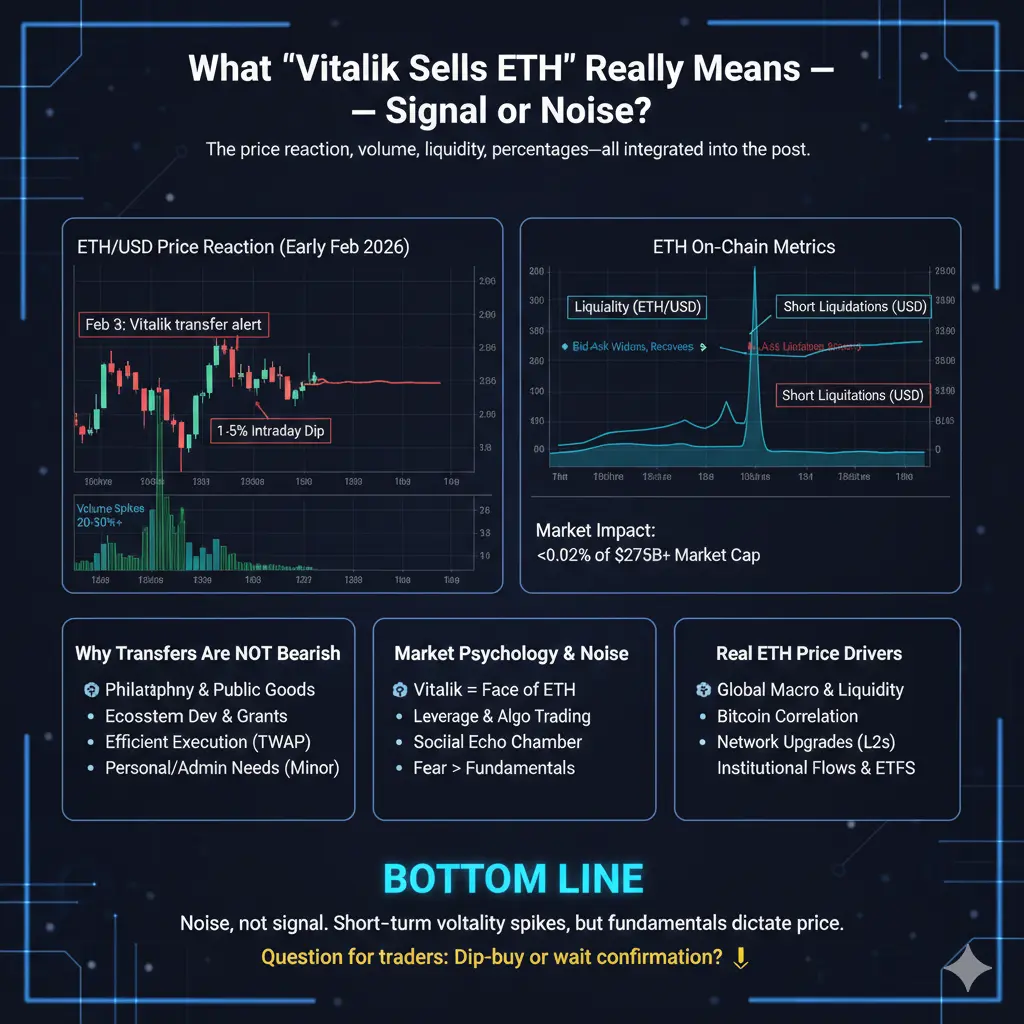

Reports indicate that Vitalik Buterin has sold a portion of his ETH holdings. Such moves often create market buzz, but the impact depends on context — overall supply, market sentiment, and ongoing network activity.

🔍 Key Market Considerations

• Short-term price pressure: Large moves by prominent holders can create temporary volatility

• Network fundamentals: ETH adoption, Layer-2 activity, and staking levels continue to provide structural support

• Trader psychology: News can trigger reactions beyond actual market impact

Dragon Fly Official view:

“High-profile sales are signals, not forecasts. The market often absorbs these moves if fundamentals remain strong.”

📈 Outlook for Traders

Short-term trading: Watch for reactions near support levels to gauge market absorption

Medium-term perspective: Fundamentals of ETH and Layer-2 adoption remain key

Risk management: Volatility can spike — plan entries and exits carefully

Dragon Fly Official insight:

“News-driven volatility is an opportunity for disciplined traders. Avoid chasing headlines.”

🧭 Key Takeaway

While Vitalik’s sale may stir headlines, structural factors and market positioning will ultimately determine ETH’s direction. Traders who align their strategies with both technical levels and fundamentals can navigate this event more effectively.

#VitalikSellsETH

Dragon Fly Official Market View

Reports indicate that Vitalik Buterin has sold a portion of his ETH holdings. Such moves often create market buzz, but the impact depends on context — overall supply, market sentiment, and ongoing network activity.

🔍 Key Market Considerations

• Short-term price pressure: Large moves by prominent holders can create temporary volatility

• Network fundamentals: ETH adoption, Layer-2 activity, and staking levels continue to provide structural support

• Trader psychology: News can trigger reactions beyond actual market impact

Dragon Fly Official view:

“High-profile sales are signals, not forecasts. The market often absorbs these moves if fundamentals remain strong.”

📈 Outlook for Traders

Short-term trading: Watch for reactions near support levels to gauge market absorption

Medium-term perspective: Fundamentals of ETH and Layer-2 adoption remain key

Risk management: Volatility can spike — plan entries and exits carefully

Dragon Fly Official insight:

“News-driven volatility is an opportunity for disciplined traders. Avoid chasing headlines.”

🧭 Key Takeaway

While Vitalik’s sale may stir headlines, structural factors and market positioning will ultimately determine ETH’s direction. Traders who align their strategies with both technical levels and fundamentals can navigate this event more effectively.

#VitalikSellsETH