# NFPBeatsExpectations

17.74K

RjHaroon

⚡ BTRUSDT – $0.13988 (+43.04%)

Still holding bullish structure after recent surge. Higher highs & strong buying pressure suggest dips could be buy opportunities. Keep an eye on volume for confirmation.

$BTR $MON $SIREN #GateSquare$50KRedPacketGiveaway #CelebratingNewYearOnGateSquare #NFPBeatsExpectations #NFPBeatsExpectations

Still holding bullish structure after recent surge. Higher highs & strong buying pressure suggest dips could be buy opportunities. Keep an eye on volume for confirmation.

$BTR $MON $SIREN #GateSquare$50KRedPacketGiveaway #CelebratingNewYearOnGateSquare #NFPBeatsExpectations #NFPBeatsExpectations

- Reward

- 1

- 1

- Repost

- Share

RjHaroon :

:

2026 GOGOGO 👊#NFPBeatsExpectations 🚀 The Future Is Being Written Right Now — Are You Ready?

The next phase of global markets is not coming slowly — it’s accelerating. We are entering an era where technology, digital finance, artificial intelligence, and decentralized systems are reshaping how money moves, how businesses operate, and how individuals build wealth. The future doesn’t belong to the biggest players anymore — it belongs to the smartest and most prepared.

In the coming months, expect volatility to increase across crypto, stocks, and commodities. Liquidity cycles will define the direction. Inflat

The next phase of global markets is not coming slowly — it’s accelerating. We are entering an era where technology, digital finance, artificial intelligence, and decentralized systems are reshaping how money moves, how businesses operate, and how individuals build wealth. The future doesn’t belong to the biggest players anymore — it belongs to the smartest and most prepared.

In the coming months, expect volatility to increase across crypto, stocks, and commodities. Liquidity cycles will define the direction. Inflat

- Reward

- 6

- 8

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#NFPBeatsExpectations 📊

The latest Non-Farm Payrolls (NFP) report has once again surprised markets, delivering stronger-than-expected job growth and reinforcing the narrative of a resilient labor market. Whenever employment data beats forecasts, it sends ripples across equities, bonds, commodities, and crypto — and this release is no exception.

The NFP report, published by the U.S. Bureau of Labor Statistics, is widely regarded as one of the most influential macroeconomic indicators. It provides a snapshot of job creation, wage growth, and unemployment trends, offering valuable insight into t

The latest Non-Farm Payrolls (NFP) report has once again surprised markets, delivering stronger-than-expected job growth and reinforcing the narrative of a resilient labor market. Whenever employment data beats forecasts, it sends ripples across equities, bonds, commodities, and crypto — and this release is no exception.

The NFP report, published by the U.S. Bureau of Labor Statistics, is widely regarded as one of the most influential macroeconomic indicators. It provides a snapshot of job creation, wage growth, and unemployment trends, offering valuable insight into t

- Reward

- 3

- 6

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#NFPBeatsExpectations

On Feb 11, 2026, the U.S. Non-Farm Payroll (NFP) report came in much stronger than expected — and it shook both macro and crypto markets.

📊 The Key Jobs Data (January 2026)

✅ Jobs Added: +130,000

(Expected: ~55K–70K)

✅ Unemployment: 4.3%

(Expected: 4.4%)

🔁 December 2025 jobs were revised sharply lower to +48K

Big annual revisions show 2025 job growth much weaker than first reported.

So January looked strong on the surface, but the underlying trend was softer than markets thought.

This created a “strong headline, softer reality” vibe in markets — which mattered for cryp

On Feb 11, 2026, the U.S. Non-Farm Payroll (NFP) report came in much stronger than expected — and it shook both macro and crypto markets.

📊 The Key Jobs Data (January 2026)

✅ Jobs Added: +130,000

(Expected: ~55K–70K)

✅ Unemployment: 4.3%

(Expected: 4.4%)

🔁 December 2025 jobs were revised sharply lower to +48K

Big annual revisions show 2025 job growth much weaker than first reported.

So January looked strong on the surface, but the underlying trend was softer than markets thought.

This created a “strong headline, softer reality” vibe in markets — which mattered for cryp

BTC1,61%

- Reward

- 19

- 21

- Repost

- Share

EagleEye :

:

Thanks for sharing this infromative postView More

#NFPBeatsExpectations

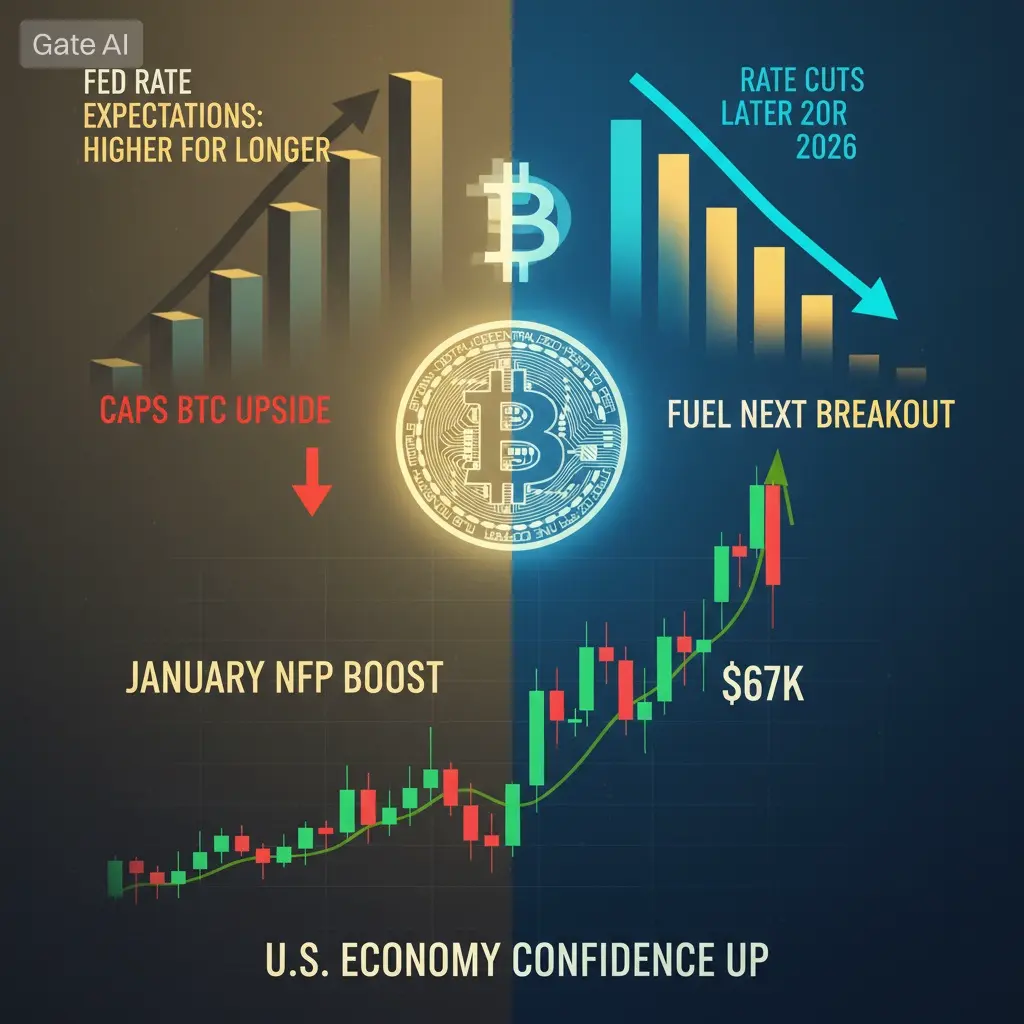

📊🚨 #NFPBeatsExpectations

The latest U.S. Non-Farm Payrolls (NFP) report has come in stronger than expected, shaking global markets and resetting short-term expectations ⚡

A hotter labor market means one thing for traders:

💵 Rates may stay higher for longer — and risk assets feel the pressure.

🔎 Market Impact Breakdown:

• 📈 USD strengthens as rate-cut hopes get pushed back

• 📉 Stocks & crypto face pressure on tighter financial conditions

• 🪙 Gold turns volatile as yields rise

• ₿ Bitcoin reacts short-term to macro, not fundamentals

🧠 Key Insight:

Good economic new

📊🚨 #NFPBeatsExpectations

The latest U.S. Non-Farm Payrolls (NFP) report has come in stronger than expected, shaking global markets and resetting short-term expectations ⚡

A hotter labor market means one thing for traders:

💵 Rates may stay higher for longer — and risk assets feel the pressure.

🔎 Market Impact Breakdown:

• 📈 USD strengthens as rate-cut hopes get pushed back

• 📉 Stocks & crypto face pressure on tighter financial conditions

• 🪙 Gold turns volatile as yields rise

• ₿ Bitcoin reacts short-term to macro, not fundamentals

🧠 Key Insight:

Good economic new

BTC1,61%

- Reward

- 1

- 6

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#NFPBeatsExpectations

13 February 2026 Today the market sentiment felt highly dynamic, and the main focus of discussion was clearly . When Non-Farm Payroll data comes in stronger than expected, it signals that the labor market remains resilient and stable. Strong employment numbers suggest that the economy is not slowing down as much as many were anticipating. Because of this, the market reaction was immediate.

Traders were cautious earlier in the day, but once confirmation spread that #NFPBeatsExpectations volatility noticeably increased. Strong jobs data often influences expectations aroun

13 February 2026 Today the market sentiment felt highly dynamic, and the main focus of discussion was clearly . When Non-Farm Payroll data comes in stronger than expected, it signals that the labor market remains resilient and stable. Strong employment numbers suggest that the economy is not slowing down as much as many were anticipating. Because of this, the market reaction was immediate.

Traders were cautious earlier in the day, but once confirmation spread that #NFPBeatsExpectations volatility noticeably increased. Strong jobs data often influences expectations aroun

BTC1,61%

- Reward

- 3

- 5

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

#NFPBeatsExpectations 📊 A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data surpasses forecasts, it signals that the labor market in the world’s largest economy remains resilient. This strength extends beyond job creation, reflecting rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise temporarily eases recession concerns and fuels optimism across markets.

Federal Reserve Response and Interest Rate Outlook

The most significant implication of strong NFP data is its influence on Federal Reserve policy. Rapid employmen

When Non-Farm Payroll (NFP) data surpasses forecasts, it signals that the labor market in the world’s largest economy remains resilient. This strength extends beyond job creation, reflecting rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise temporarily eases recession concerns and fuels optimism across markets.

Federal Reserve Response and Interest Rate Outlook

The most significant implication of strong NFP data is its influence on Federal Reserve policy. Rapid employmen

BTC1,61%

- Reward

- 6

- 12

- Repost

- Share

xxx40xxx :

:

LFG 🔥View More

#NFPBeatsExpectations

A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data exceeds forecasts, it sends a powerful message that the labor market in the world’s largest economy remains resilient. This strength goes beyond job creation — it reflects rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise in employment data reinforces optimism and temporarily pushes recession fears into the background.

Federal Reserve Response and Interest Rate Outlook

The most important implication of strong NFP data lies in its impact on

A Signal of Economic Strength and Market Shifts

When Non-Farm Payroll (NFP) data exceeds forecasts, it sends a powerful message that the labor market in the world’s largest economy remains resilient. This strength goes beyond job creation — it reflects rising consumer confidence, expanding spending power, and steady GDP momentum. Each positive surprise in employment data reinforces optimism and temporarily pushes recession fears into the background.

Federal Reserve Response and Interest Rate Outlook

The most important implication of strong NFP data lies in its impact on

BTC1,61%

- Reward

- 3

- 7

- Repost

- Share

Peacefulheart :

:

Buy To Earn 💰️View More

#NFPBeatsExpectations Strong Jobs, Market Implications

The latest U.S. Non-Farm Payroll (NFP) report beat expectations, signaling a resilient labor market and complicating the Federal Reserve’s path toward early rate cuts. Strong employment supports wages and consumer spending, meaning the economy can tolerate tighter financial conditions longer.

Key Market Takeaways:

• Risk Assets: Strong NFP often triggers short-term pullbacks in equities and crypto—liquidity isn’t loosening as fast as markets hoped.

• Interest Rates & Dollar: Higher employment → stronger yields → firmer USD → delayed Fed ea

The latest U.S. Non-Farm Payroll (NFP) report beat expectations, signaling a resilient labor market and complicating the Federal Reserve’s path toward early rate cuts. Strong employment supports wages and consumer spending, meaning the economy can tolerate tighter financial conditions longer.

Key Market Takeaways:

• Risk Assets: Strong NFP often triggers short-term pullbacks in equities and crypto—liquidity isn’t loosening as fast as markets hoped.

• Interest Rates & Dollar: Higher employment → stronger yields → firmer USD → delayed Fed ea

BTC1,61%

- Reward

- 7

- 13

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

#NFPBeatsExpectations

The latest NFP data beating expectations has once again shifted the market’s tone, reminding investors that the U.S. economy remains far more resilient than many narratives suggested. At a time when markets were getting comfortable with the idea of early and aggressive rate cuts, strong job creation challenges that optimism and forces a reassessment of liquidity expectations. Employment strength signals that demand in the economy is still alive, wages remain supported, and consumer spending has not rolled over yet, all of which complicate the Federal Reserve’s path towar

The latest NFP data beating expectations has once again shifted the market’s tone, reminding investors that the U.S. economy remains far more resilient than many narratives suggested. At a time when markets were getting comfortable with the idea of early and aggressive rate cuts, strong job creation challenges that optimism and forces a reassessment of liquidity expectations. Employment strength signals that demand in the economy is still alive, wages remain supported, and consumer spending has not rolled over yet, all of which complicate the Federal Reserve’s path towar

BTC1,61%

- Reward

- 11

- 10

- Repost

- Share

EagleEye :

:

Thnaks for sharing this infromative postView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

47.66K Popularity

45.92K Popularity

17.74K Popularity

43.9K Popularity

257.04K Popularity

196.29K Popularity

9.7K Popularity

8.25K Popularity

5.94K Popularity

7.32K Popularity

123.32K Popularity

28.59K Popularity

24.95K Popularity

9.77K Popularity

4.42K Popularity

News

View MoreWeb3 entertainment company YOAKE secures $3.2 million in strategic funding from Sony Innovation Fund

3 m

BTC 15-minute increase of 0.93%: macro liquidity and institutional buying dominate the short-term rebound

7 m

ETH 15-minute increase of 1.49%: ETF capital inflows and stablecoin supply expansion drive short-term rally

7 m

AINFT officially integrated with TokenPocket

8 m

Bitcoin and Ethereum ETFs Record Outflows While Solana ETF Sees Inflows on Feb 13

30 m

Pin