# BTCvsGold

8.07K

KAZ_BREKKER

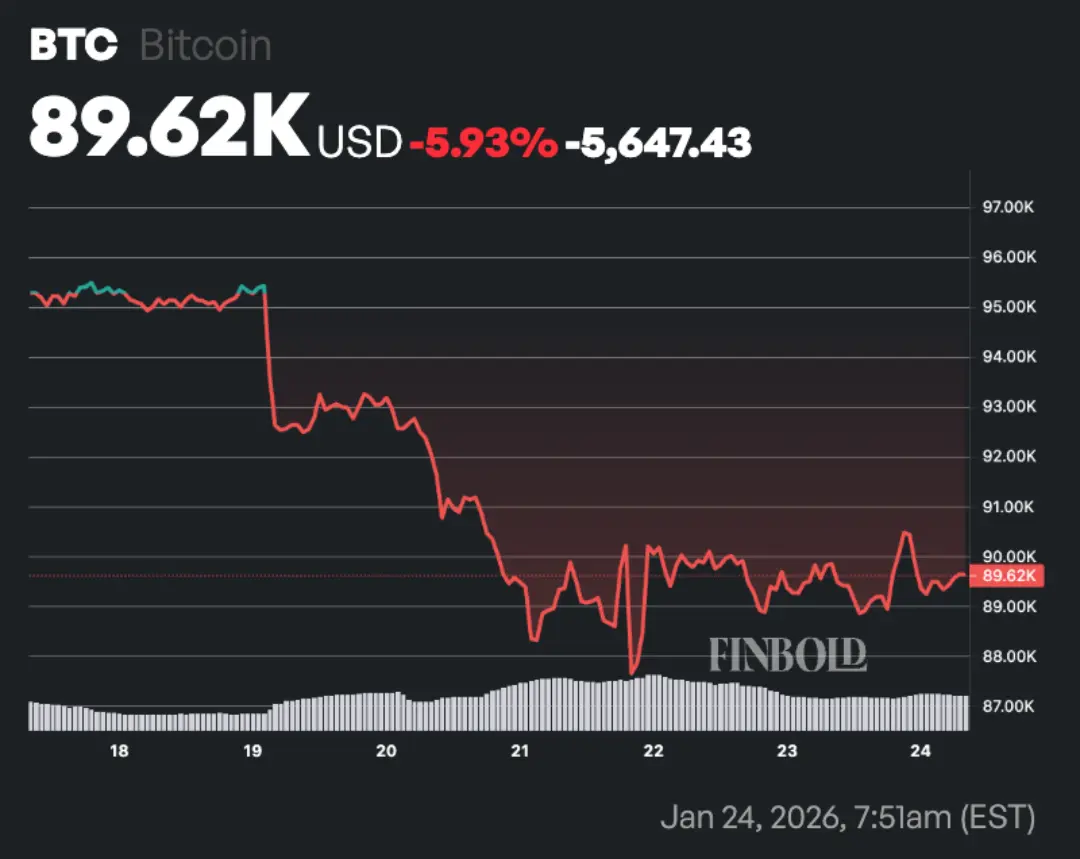

Bitcoin's Brutal February: Worst Monthly Performance in Nearly Three Years

Bitcoin is closing out February 2026 in deeply bruised shape, cementing what analysts are calling its steepest monthly decline since the infamous crypto winter of June 2022. The world's largest cryptocurrency has shed roughly 24% of its value this month alone, trading near $62,557 a stark reversal from the dizzying heights of $109,000 it reached just weeks into January.

The slide is part of a broader losing streak, with Bitcoin now on track for a fifth consecutive monthly decline — its longest such run since 2018, when

Bitcoin is closing out February 2026 in deeply bruised shape, cementing what analysts are calling its steepest monthly decline since the infamous crypto winter of June 2022. The world's largest cryptocurrency has shed roughly 24% of its value this month alone, trading near $62,557 a stark reversal from the dizzying heights of $109,000 it reached just weeks into January.

The slide is part of a broader losing streak, with Bitcoin now on track for a fifth consecutive monthly decline — its longest such run since 2018, when

BTC-3,24%

- Reward

- 2

- Comment

- Repost

- Share

Here are 5 key points comparing the future of gold and Bitcoin (over the next 5–10 years,

:Store of Value Role — Gold remains the traditional, stable safe-haven with 5,000+ years of history; Bitcoin is emerging as "digital gold" but stays more volatile and risk-on.

Price Growth Potential — Gold forecasts point to $5,000+/oz by 2026–2030 (driven by central banks & inflation hedges); Bitcoin predictions range widely from $150K–$1.5M+ by 2030, offering higher upside but greater uncertainty.

$BTC

Volatility & Risk — Gold provides lower volatility and crisis stability; Bitcoin shows extreme s

:Store of Value Role — Gold remains the traditional, stable safe-haven with 5,000+ years of history; Bitcoin is emerging as "digital gold" but stays more volatile and risk-on.

Price Growth Potential — Gold forecasts point to $5,000+/oz by 2026–2030 (driven by central banks & inflation hedges); Bitcoin predictions range widely from $150K–$1.5M+ by 2030, offering higher upside but greater uncertainty.

$BTC

Volatility & Risk — Gold provides lower volatility and crisis stability; Bitcoin shows extreme s

- Reward

- like

- Comment

- Repost

- Share

Liquidity Sweep → IFVG → CISD

1. Liquidity sweep of Asia or London high or low

2. IFVG forms (inversion FVG)

3. CISD shows a clear shift in direction

4. DOL aligns and confirms overall bias

Study.and bookmark 🔖

FOLLOW 👑

#CPIWatch #BTCVSGOLD #MarketRebound #WhoIsNextFedChair $XRP $SOL $BNB $btc$ $ada$

1. Liquidity sweep of Asia or London high or low

2. IFVG forms (inversion FVG)

3. CISD shows a clear shift in direction

4. DOL aligns and confirms overall bias

Study.and bookmark 🔖

FOLLOW 👑

#CPIWatch #BTCVSGOLD #MarketRebound #WhoIsNextFedChair $XRP $SOL $BNB $btc$ $ada$

- Reward

- like

- Comment

- Repost

- Share

🚨 Just saw the numbers and wow…

In only 2 years, Bitcoin ETFs have already pulled in $57B in net inflows.

Gold ETFs? Just $8B at the same point in their history.

That’s over 7× more money flowing into BTC ETFs.

Looks like digital gold is taking the lead in this inflow battle 👀

$BTC $XAU $MUBARAK

#BTCvsGold #BitcoinETFs #CryptoNews #bitcoin #WriteToEarnUpgrade

In only 2 years, Bitcoin ETFs have already pulled in $57B in net inflows.

Gold ETFs? Just $8B at the same point in their history.

That’s over 7× more money flowing into BTC ETFs.

Looks like digital gold is taking the lead in this inflow battle 👀

$BTC $XAU $MUBARAK

#BTCvsGold #BitcoinETFs #CryptoNews #bitcoin #WriteToEarnUpgrade

BTC-3,24%

- Reward

- like

- Comment

- Repost

- Share

#BitcoinGoldBattle ✨

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

BTC-3,24%

- Reward

- 10

- 11

- Repost

- Share

natadoz :

:

Paying Close Attention🔍View More

#BitcoinGoldBattle ✨

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

2026 Outlook: Why I’m Favoring Bitcoin Over Gold & Silver

2025 was a dramatic year for investors looking to hedge against inflation. Gold and silver stole the spotlight — breaking records and delivering huge gains — while Bitcoin spent much of the year consolidating after a volatile correction.

As we step into 2026, the key question is clear: should your hedge be traditional metals, or is it time to give Bitcoin the spotlight? Here’s my take.

📈 Gold & Silver: Strong, but Limited

Gold and silver had incredible runs in 2025:

Gold surged on a weaker dollar, central bank dema

BTC-3,24%

- Reward

- 7

- 5

- Repost

- Share

Crypto_Teacher :

:

HODL Tight 💪View More

Walking on glass above thousands of gold bars in Gold Avenue Guangzhou 💛

Feels unreal wealth right under your feet ✨

#BTCvsGold

$BTC

Feels unreal wealth right under your feet ✨

#BTCvsGold

$BTC

BTC-3,24%

- Reward

- like

- Comment

- Repost

- Share

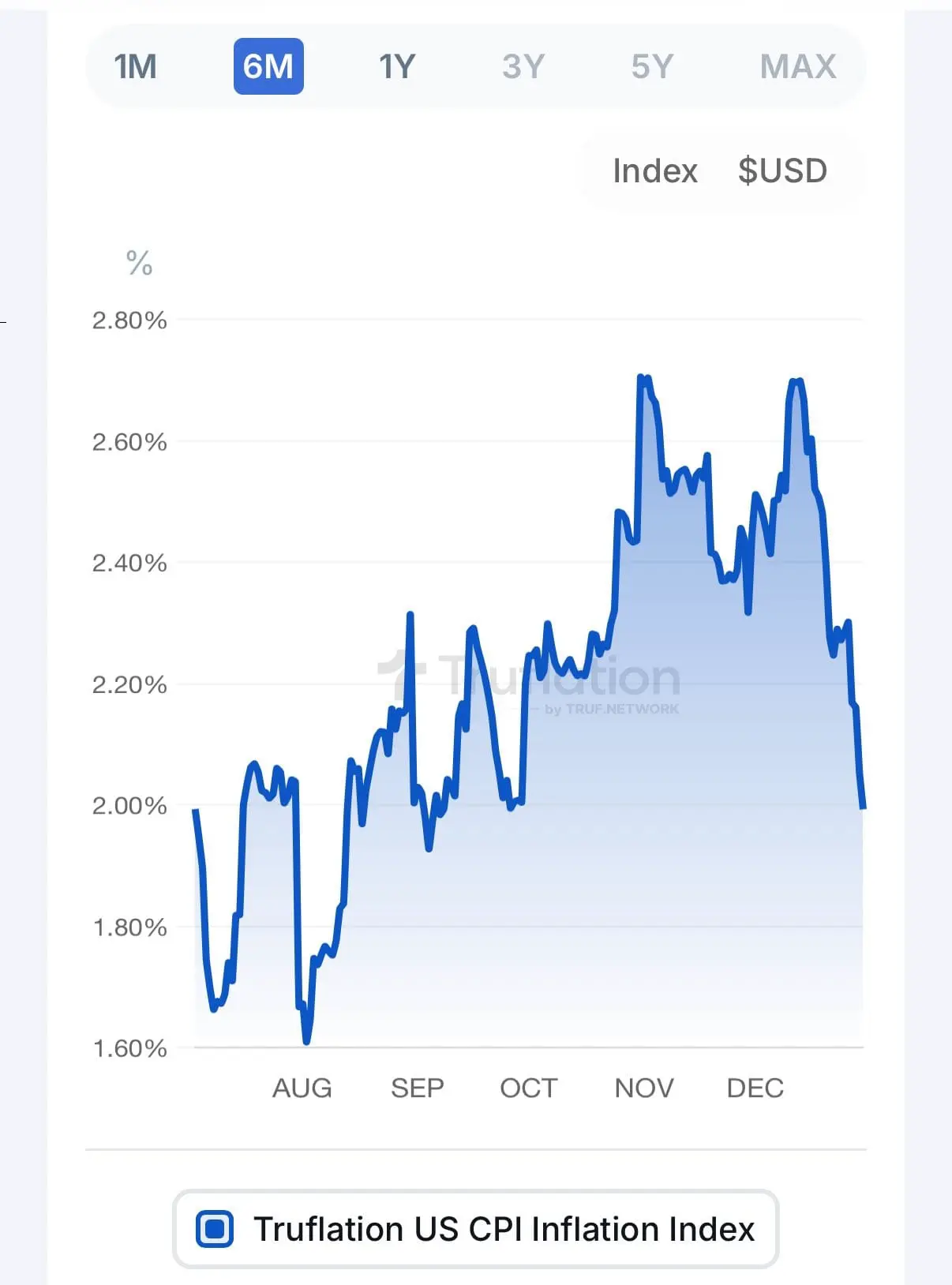

JUST IN: INFLATION SLIPS BELOW 2%

🎯 FED'S TARGET HAS FINALLY BEEN ACHIEVED

Today's macro headline could be a game-changer for the market. Inflation dropping below 2% is not just a number — it signals that the real impact of the Federal Reserve's tight monetary policy over the past several months is now clearly visible 📉💡

When inflation is above 2%, the Fed takes an aggressive stance — rate hikes, tight liquidity, and pressure on risk assets 💥

But now that the goal level has been touched, the narrative seems to be shifting a bit 👀

⚖️ This does not mean that rates will be cut tomorrow.

The

🎯 FED'S TARGET HAS FINALLY BEEN ACHIEVED

Today's macro headline could be a game-changer for the market. Inflation dropping below 2% is not just a number — it signals that the real impact of the Federal Reserve's tight monetary policy over the past several months is now clearly visible 📉💡

When inflation is above 2%, the Fed takes an aggressive stance — rate hikes, tight liquidity, and pressure on risk assets 💥

But now that the goal level has been touched, the narrative seems to be shifting a bit 👀

⚖️ This does not mean that rates will be cut tomorrow.

The

- Reward

- like

- 1

- Repost

- Share

GateUser-3e127dc6 :

:

Send it to me via transfer to my bank account at OTP BANK NOVI PAZAR 36300 SERBIAJapan's central bank just dropped a bombshell: rate hikes are coming in 2026 🔥.

* After 37 years of near-zero rates, the Bank of Japan is finally raising them.

* Inflation and rising wages are the reasons.

* This move will shock markets, end cheap yen carry trades, and impact global liquidity and risk assets like Bitcoin.

$TRUMP #USGDPUpdate #USCryptoStakingTaxReview #BTCVSGOLD #USJobsData

TRUMP

* After 37 years of near-zero rates, the Bank of Japan is finally raising them.

* Inflation and rising wages are the reasons.

* This move will shock markets, end cheap yen carry trades, and impact global liquidity and risk assets like Bitcoin.

$TRUMP #USGDPUpdate #USCryptoStakingTaxReview #BTCVSGOLD #USJobsData

TRUMP

- Reward

- 2

- 1

- Repost

- Share

Joban :

:

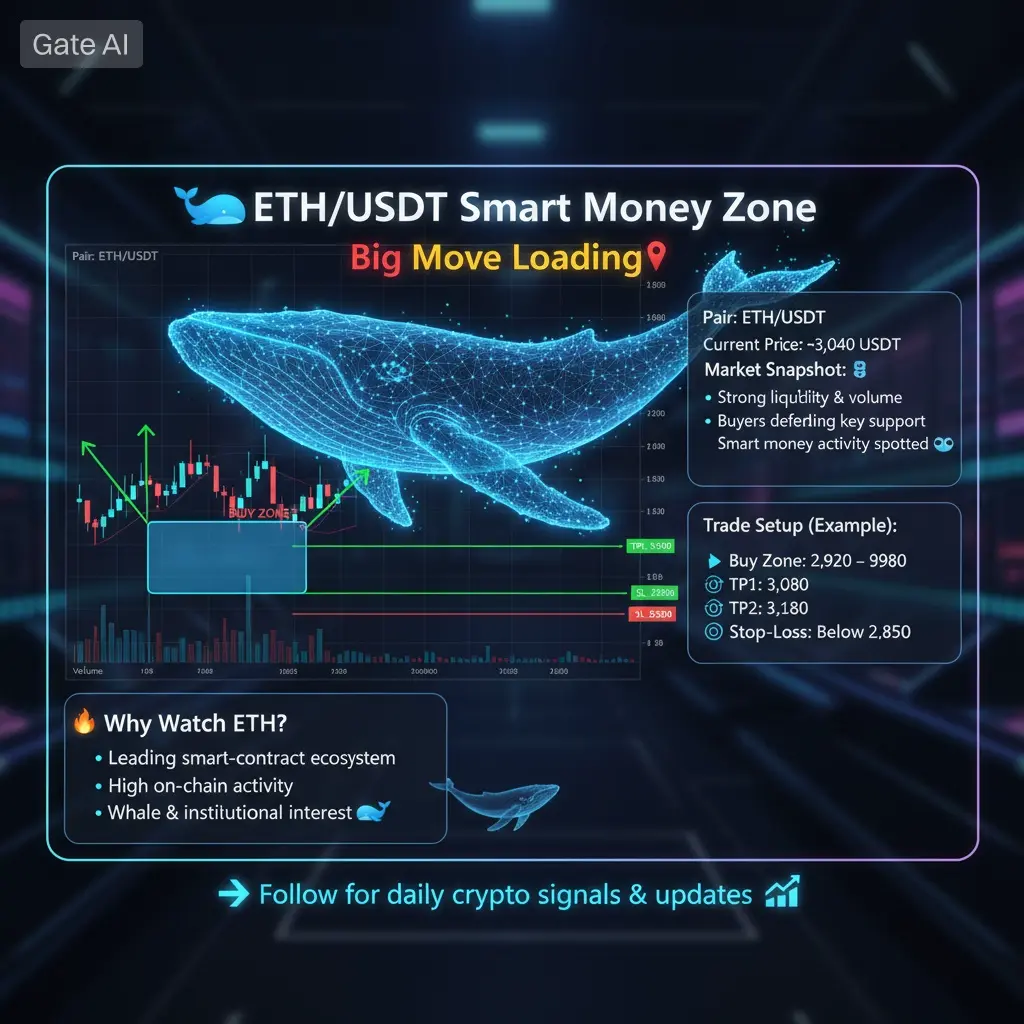

Christmas Bull Run! 🐂🐋 ETH/USDT Smart Money Zone | Big Move Loading

📌 Pair: ETH/USDT

💰 Current Price: ~3,040 USDT

📊 Market Snapshot:

• Strong liquidity & volume

• Buyers defending key support

• Smart money activity spotted 👀

🧠 Trade Setup (Example):

🔹 Buy Zone: 2,920 – 2,980

🎯 Targets:

• TP1: 3,080

• TP2: 3,180

• TP3: 3,300

🛑 Stop-Loss: Below 2,850

🔥 Why Watch ETH?

• Leading smart-contract ecosystem

• High on-chain activity

• Whale & institutional interest 🐋

📌 Not financial advice. Trade with proper risk management. #USGDPUpdate #USJobsData #CPIWatch #BTCVSGOLD #AreYouBullishOrBearishToday?

👉 Follow

📌 Pair: ETH/USDT

💰 Current Price: ~3,040 USDT

📊 Market Snapshot:

• Strong liquidity & volume

• Buyers defending key support

• Smart money activity spotted 👀

🧠 Trade Setup (Example):

🔹 Buy Zone: 2,920 – 2,980

🎯 Targets:

• TP1: 3,080

• TP2: 3,180

• TP3: 3,300

🛑 Stop-Loss: Below 2,850

🔥 Why Watch ETH?

• Leading smart-contract ecosystem

• High on-chain activity

• Whale & institutional interest 🐋

📌 Not financial advice. Trade with proper risk management. #USGDPUpdate #USJobsData #CPIWatch #BTCVSGOLD #AreYouBullishOrBearishToday?

👉 Follow

MC:$3.57KHolders:2

0.00%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

36.52K Popularity

147.34K Popularity

85.3K Popularity

1.66M Popularity

484.53K Popularity

7.52K Popularity

6.52K Popularity

19.62K Popularity

3.53K Popularity

362.37K Popularity

44.27K Popularity

100.25K Popularity

16.51K Popularity

104.54K Popularity

5.56K Popularity

News

View MorePayPal partners with MoonPay to launch the PYUSDx platform, supporting the issuance of customized PYUSD stablecoins.

4 m

Yesterday, the US Bitcoin spot ETF experienced a net outflow of $27.5 million.

8 m

Bitcoin drops back to $65,000! PPI exceeds expectations and Nvidia's sharp decline drag down, Solana, XRP, and Dogecoin all pull back collectively

15 m

Polygon network stablecoin holdings reach $3.28 billion, hitting a record high

34 m

February crypto startups raised $883 million, down 13% year-over-year

35 m

Pin