#BTCMarketAnalysis Bitcoin (BTC) continues to show dynamic price action as markets wrestle with macroeconomic forces, investor sentiment, and evolving crypto-specific factors. Here’s a clear, up-to-date analysis of where BTC stands and what could influence its next moves:

Current Price Condition

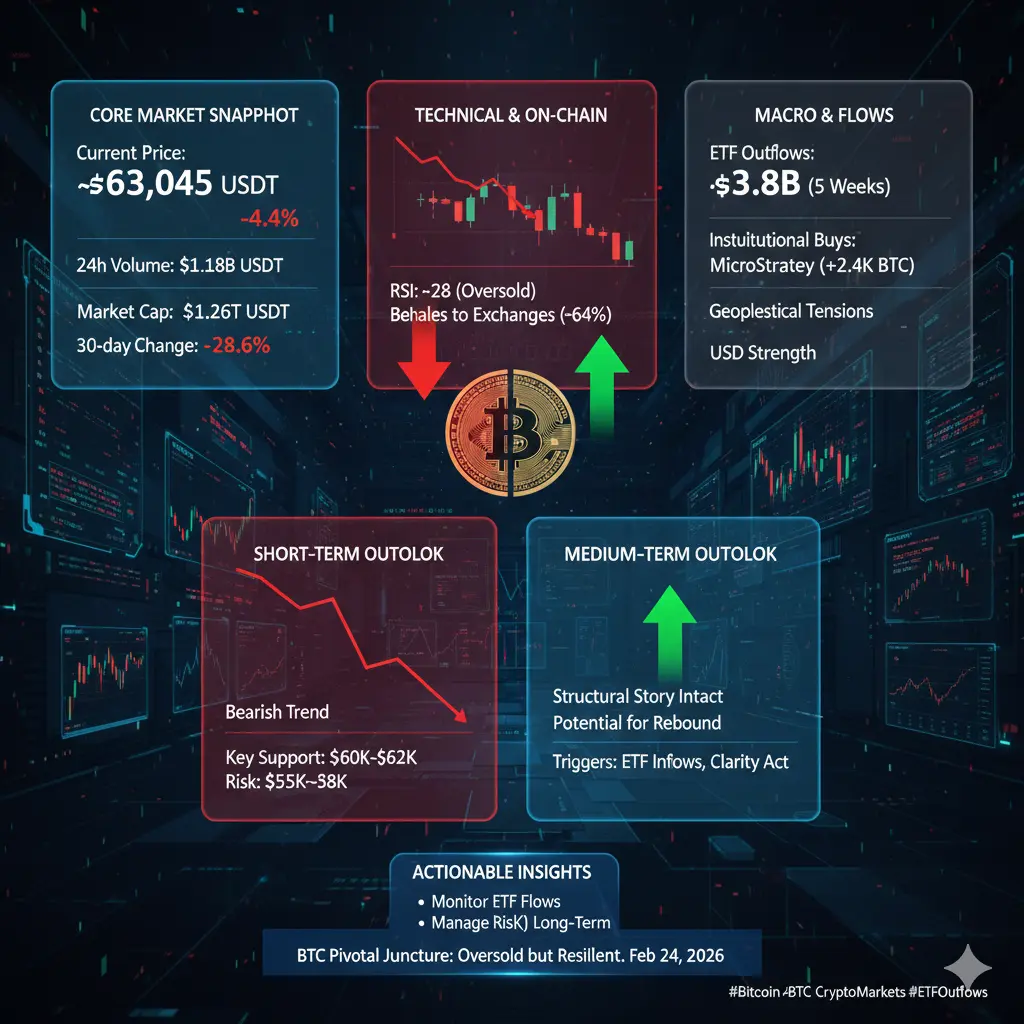

Bitcoin has been trading with notable volatility — alternating between short-term rallies and pullbacks. This choppiness reflects a market that is still searching for clear direction, with buyers and sellers reacting to both global economic signals and crypto-specific data.

Bullish Signals

1. Institutional Interest Still Present

Institutional players, including asset managers and large funds, continue to engage with BTC through regulated vehicles like futures and custody solutions. Periods of inflows into institutional products often support price floors.

2. On-Chain Demand Metrics

Key on-chain indicators, such as long-term holder accumulation and declining exchange balances, suggest that many holders prefer to keep BTC off exchanges — a bullish sign historically linked with price strength.

3. Reduced Miner Sell Pressure

Miners have periodically slowed down their sales, indicating that selling supply from production sources is less aggressive than in some past periods. This can reduce downward pressure over time.

Bearish or Risk Factors

1. Spot BTC ETF Outflows

Recent weeks have shown continuous outflows from major spot Bitcoin ETF products. While flows can be short-term driven by sentiment, they indicate temporary weakness in capital inflows and trader caution.

2. Macro Uncertainty

Broader market stress — especially concerns about interest rates or equity volatility — can pull risk appetite down, with Bitcoin often moving in sync with traditional risk assets during periods of global uncertainty.

3. Psychological Resistance Levels

BTC has faced resistance at major psychological price zones. Breaking above these levels convincingly is crucial for momentum to return.

Support & Resistance Levels to Watch

Here’s a simplified snapshot of key price levels:

📌 Support Zones:

Near historically strong areas where buyers previously stepped in

Often aligned with major moving averages or previous consolidation zones

📌 Resistance Levels:

Psychological round numbers

Previous swing highs that have capped upside momentum

These levels serve as reference points for traders seeking potential breakouts or pullbacks.

Market Structure & Sentiment

Short-Term:

Choppy price action and range trading

Traders reacting to news events and ETF flow reports

Mid-Term:

Still range-bound until a catalyst pushes BTC decisively above key resistance

Either macro relief or renewed institutional inflows could ignite momentum

Long-Term:

Fundamentals like adoption, security, and blockchain network effects remain supportive

Long-term accumulation behavior and decreasing supply on exchanges often favor bullish trends over time

What’s Next? Key Drivers to Monitor

🔸 Macro Economic Data:

Inflation trends, interest rate guidance, and risk market performance

🔸 ETF Flows:

Direction and size of capital moving in/out of Bitcoin investment products

🔸 On-Chain Metrics:

Exchange balance changes, long-term holder activity, miner behavior

🔸 Regulation News:

Any clarity or shifts in global crypto policy affects sentiment

Bottom Line

Bitcoin’s market currently reflects cautious confidence mixed with uncertainty. While fundamentals and network strength remain healthy, short-term volatility is expected as traders watch macro conditions and ETF flows closely.

In simple terms:

Bullish if key resistance breaks cleanly,

Neutral to cautious if range persists,

Shift bearish only if major support fails.

Current Price Condition

Bitcoin has been trading with notable volatility — alternating between short-term rallies and pullbacks. This choppiness reflects a market that is still searching for clear direction, with buyers and sellers reacting to both global economic signals and crypto-specific data.

Bullish Signals

1. Institutional Interest Still Present

Institutional players, including asset managers and large funds, continue to engage with BTC through regulated vehicles like futures and custody solutions. Periods of inflows into institutional products often support price floors.

2. On-Chain Demand Metrics

Key on-chain indicators, such as long-term holder accumulation and declining exchange balances, suggest that many holders prefer to keep BTC off exchanges — a bullish sign historically linked with price strength.

3. Reduced Miner Sell Pressure

Miners have periodically slowed down their sales, indicating that selling supply from production sources is less aggressive than in some past periods. This can reduce downward pressure over time.

Bearish or Risk Factors

1. Spot BTC ETF Outflows

Recent weeks have shown continuous outflows from major spot Bitcoin ETF products. While flows can be short-term driven by sentiment, they indicate temporary weakness in capital inflows and trader caution.

2. Macro Uncertainty

Broader market stress — especially concerns about interest rates or equity volatility — can pull risk appetite down, with Bitcoin often moving in sync with traditional risk assets during periods of global uncertainty.

3. Psychological Resistance Levels

BTC has faced resistance at major psychological price zones. Breaking above these levels convincingly is crucial for momentum to return.

Support & Resistance Levels to Watch

Here’s a simplified snapshot of key price levels:

📌 Support Zones:

Near historically strong areas where buyers previously stepped in

Often aligned with major moving averages or previous consolidation zones

📌 Resistance Levels:

Psychological round numbers

Previous swing highs that have capped upside momentum

These levels serve as reference points for traders seeking potential breakouts or pullbacks.

Market Structure & Sentiment

Short-Term:

Choppy price action and range trading

Traders reacting to news events and ETF flow reports

Mid-Term:

Still range-bound until a catalyst pushes BTC decisively above key resistance

Either macro relief or renewed institutional inflows could ignite momentum

Long-Term:

Fundamentals like adoption, security, and blockchain network effects remain supportive

Long-term accumulation behavior and decreasing supply on exchanges often favor bullish trends over time

What’s Next? Key Drivers to Monitor

🔸 Macro Economic Data:

Inflation trends, interest rate guidance, and risk market performance

🔸 ETF Flows:

Direction and size of capital moving in/out of Bitcoin investment products

🔸 On-Chain Metrics:

Exchange balance changes, long-term holder activity, miner behavior

🔸 Regulation News:

Any clarity or shifts in global crypto policy affects sentiment

Bottom Line

Bitcoin’s market currently reflects cautious confidence mixed with uncertainty. While fundamentals and network strength remain healthy, short-term volatility is expected as traders watch macro conditions and ETF flows closely.

In simple terms:

Bullish if key resistance breaks cleanly,

Neutral to cautious if range persists,

Shift bearish only if major support fails.