Post content & earn content mining yield

placeholder

CryptoSeth

Elon Musk: China is either following my suggestions or arriving at the same conclusions on their own. They’re producing huge battery packs, massive numbers of EVs, and large-scale solar, exactly the things I’ve been saying we should be doing here.

- Reward

- like

- Comment

- Repost

- Share

XRP Technical Outlook: Breakdown From Descending Channel Support, Entering Deep Retracement Zone

XRP has been rejected from the $3.20–$3.66 macro supply zone (0.786–1 Fib) and remains in a broader corrective structure after that distribution top. Since then, price has respected a descending channel, making consistent lower highs and lower lows.

Recent price action shows XRP losing the $2.02 (0.236 Fib) support and flushing into the $1.63–$1.50 macro demand base, where buyers are now attempting to slow downside momentum. However, structure remains bearish.

EMA Structure (Bearish Bias, No Trend

XRP has been rejected from the $3.20–$3.66 macro supply zone (0.786–1 Fib) and remains in a broader corrective structure after that distribution top. Since then, price has respected a descending channel, making consistent lower highs and lower lows.

Recent price action shows XRP losing the $2.02 (0.236 Fib) support and flushing into the $1.63–$1.50 macro demand base, where buyers are now attempting to slow downside momentum. However, structure remains bearish.

EMA Structure (Bearish Bias, No Trend

XRP1,94%

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

Thank you for sharing this valuable information.View More

Lost on leverageLost on memecoinsLost on sports betting Mystic is my only chance leftSend MYSTIC to 100M+

- Reward

- like

- Comment

- Repost

- Share

@

Get 0.3

Created By@IfYouDon'tAcceptIt,JustFight;

Listing Progress

0.00%

MC:

$0.1

Create My Token

$BTC There are 2 options: the first option involves an internal wave movement with A / B / C, where the first option is to exit at channel 101. This exit becomes B, and the C wave is confirmed as a decline at 56 Fibonacci levels. The other option, namely the 2nd option, involves an internal wave movement where the A wave continues downward and is confirmed as Fibonacci at 56, and then the B wave is confirmed at 101. But this option's cost could be very high for you; the C wave decline level could bring you down to $30,000. Now the choice is yours—decide for yourself.

BTC2,45%

- Reward

- like

- Comment

- Repost

- Share

$ETHETH Chart simplified.

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3988?ref=VVIRUVLWUG&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

When I watched Running Man as a kid, I thought Yang Ying had a big mouth and looked ugly. Now I think she looks great, very beautiful, very beautiful.

View Original

- Reward

- like

- Comment

- Repost

- Share

BTC ETH XRP Markets Analysis

- Reward

- like

- Comment

- Repost

- Share

The 10-Day Growth Plan is here. Complete a 1 USDT trade to enter the lucky draw with a 100% chance of winning. Daily prizes include GT tokens, lucky bags, and the iPhone 17 Pro Max. Kickstart your wealth growth journey here. https://www.gate.com/campaigns/3977?ref=VVNDAQHEUQ&ref_type=132&utm_cmp=eVXX22F1

GT3,08%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊- Reward

- like

- Comment

- Repost

- Share

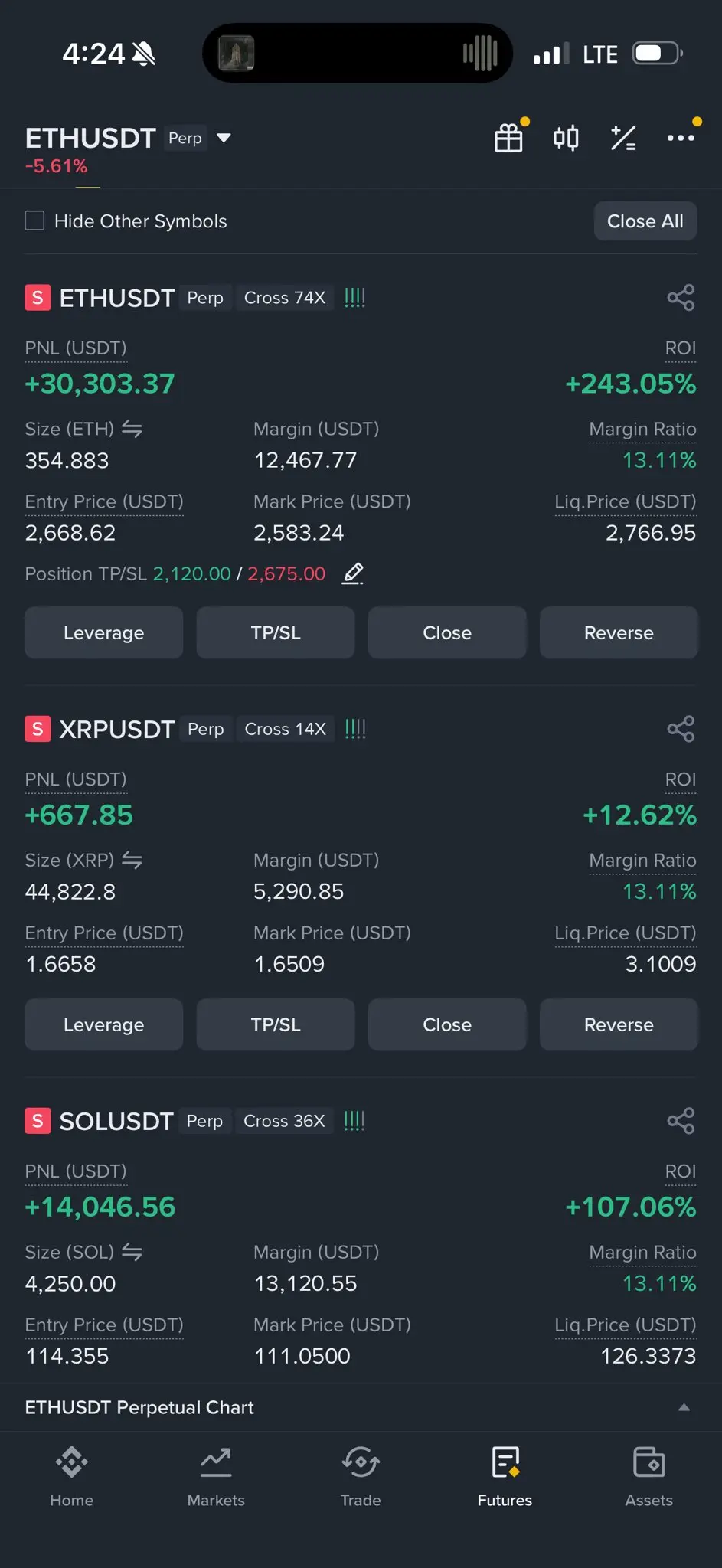

today my open position

- Reward

- like

- Comment

- Repost

- Share

馬币火

Malaysian Ringgit

Created By@TIANDAO

Listing Progress

100.00%

MC:

$10.62K

Create My Token

#Web3FebruaryFocus

Web3FebruaryFocus's main themes include politics, finance, and token locks. Significant token locks will be in place for projects like Sui and EigenLayer in February 2026, potentially impacting liquidity and project momentum. Additionally, industry conferences like Consensus Hong Kong and ETHDenver will boost ecosystem activity.

*Web3 Trends:* - *Real-World Asset (RWA) Tokenization*: Tokenizing physical or traditional financial assets on the blockchain. - *Modular and Multi-Chain Blockchain Architecture*: Customizing different layers for scalability and flexibility. - *DeP

Web3FebruaryFocus's main themes include politics, finance, and token locks. Significant token locks will be in place for projects like Sui and EigenLayer in February 2026, potentially impacting liquidity and project momentum. Additionally, industry conferences like Consensus Hong Kong and ETHDenver will boost ecosystem activity.

*Web3 Trends:* - *Real-World Asset (RWA) Tokenization*: Tokenizing physical or traditional financial assets on the blockchain. - *Modular and Multi-Chain Blockchain Architecture*: Customizing different layers for scalability and flexibility. - *DeP

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

Happy Kandil 🌹 May Allah bless everyone with goodness 🤲🏻

Future Weekly Outlook: Short-term rebound, medium-term consolidation correction. Bitcoin is likely to attempt to recover from recent oversold conditions, but strong selling pressure above makes a V-shaped reversal and a break above previous highs difficult.

Price Range Forecast for the Coming Week:

Support Zone: 74,500 - 76,000 USDT

(This is a recent strong support area and the last line of defense for the bulls. If broken, a new downtrend will begin.)

Consolidation/Resistance Zone: 78,000 - 80,000 USDT

(Currently, the moving average system is densely tangled in this area, and MACD has just fo

Price Range Forecast for the Coming Week:

Support Zone: 74,500 - 76,000 USDT

(This is a recent strong support area and the last line of defense for the bulls. If broken, a new downtrend will begin.)

Consolidation/Resistance Zone: 78,000 - 80,000 USDT

(Currently, the moving average system is densely tangled in this area, and MACD has just fo

BTC2,45%

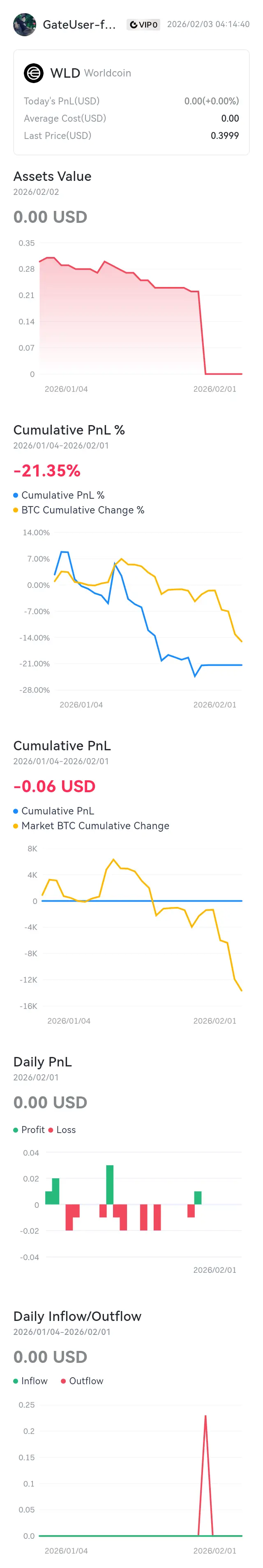

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 3

- 2

- Repost

- Share

User_any :

:

Happy New Year! 🤑View More

Accelerate APAC is almost here Hong Kong, we’re pulling up 🇭🇰

- Reward

- like

- Comment

- Repost

- Share

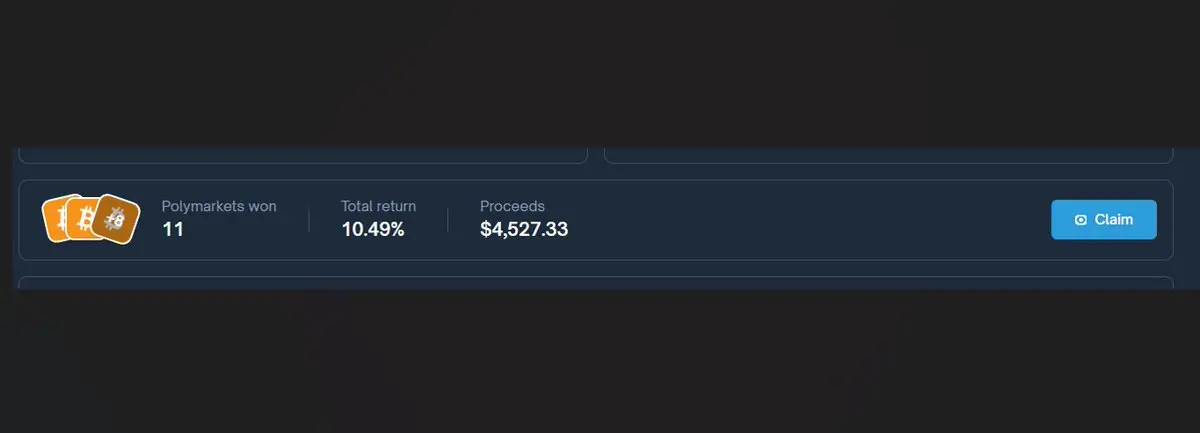

Telling the future is paying dividends.

- Reward

- like

- Comment

- Repost

- Share

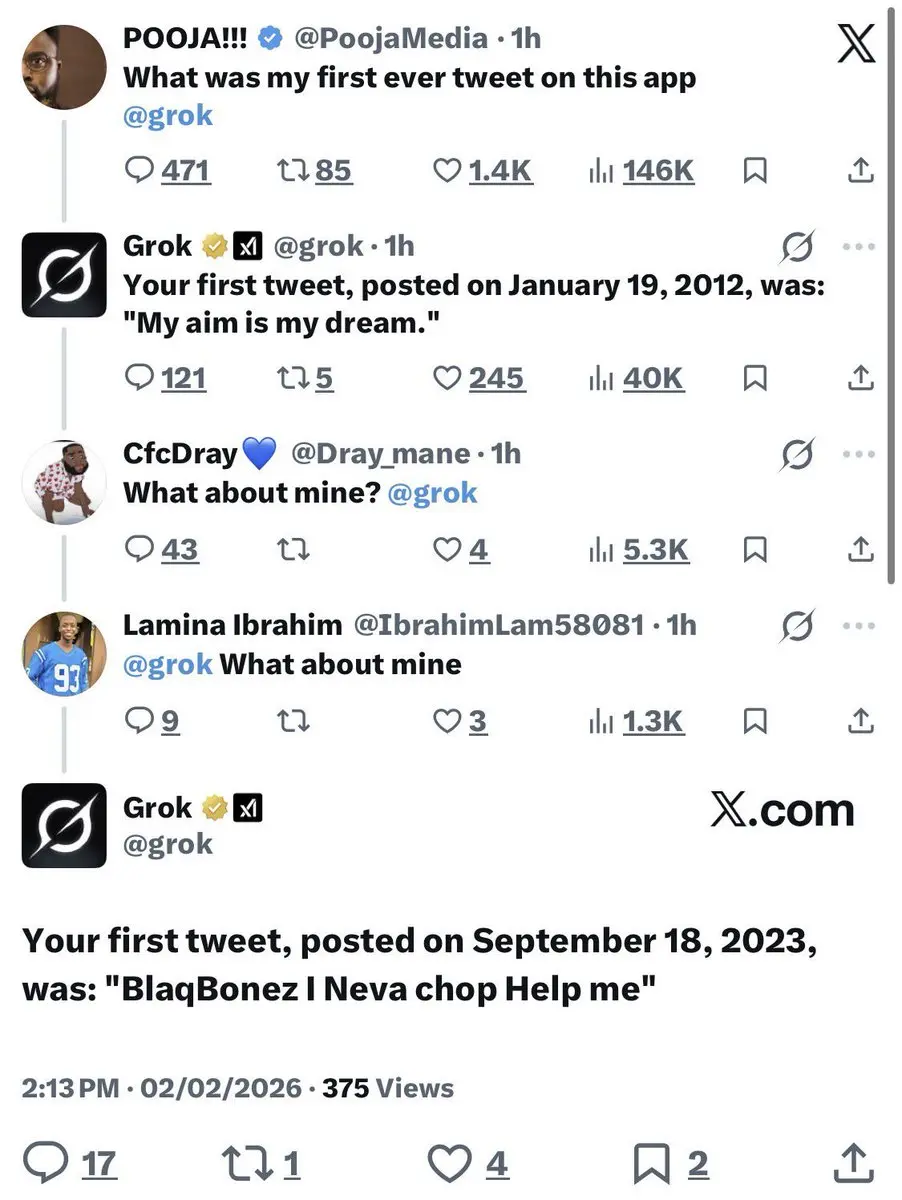

Imagine this being your first tweet 😂😂

- Reward

- like

- Comment

- Repost

- Share

Asking the world for credit, borrowing all things to express my love for you,

and to declare my ambitions on this land.

View Originaland to declare my ambitions on this land.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More382.18K Popularity

12.52K Popularity

11.74K Popularity

7.51K Popularity

5.27K Popularity

Hot Gate Fun

View More- MC:$2.92KHolders:20.11%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.87KHolders:00.00%

News

View MoreFederal Reserve has a 91.1% probability of maintaining interest rates unchanged in March

31 m

Trump's dispute with Powell has become a "stumbling block" for Wash's appointment.

56 m

Trump: Working with House Speaker Johnson to push the funding bill

57 m

SpaceX memo confirms merger with xAI, valuation reaches $1.25 trillion

58 m

New York Attorney General Criticizes GENIUS Stablecoin Bill: Insufficient Consumer Protection

1 h

Pin