Post content & earn content mining yield

placeholder

MrThanks77

#TrumpWithdrawsEUTariffThreats #TrumpWithdrawsEUTariffThreats 🇺🇸🇪🇺

Big development: President Trump has officially rescinded his planned tariffs on the EU and UK after reaching a new Arctic security framework with NATO at Davos — including discussions around Greenland. This reversal eased global market jitters and boosted stocks worldwide. Markets cheered, EU trade tensions cooled (for now), and major retaliatory tariff actions have been paused.

Reuters +2

📣

#TrumpWithdrawsEUTariffThreats

In a major shift with global economic and geopolitical impact, President Donald J. Trump has withdra

Big development: President Trump has officially rescinded his planned tariffs on the EU and UK after reaching a new Arctic security framework with NATO at Davos — including discussions around Greenland. This reversal eased global market jitters and boosted stocks worldwide. Markets cheered, EU trade tensions cooled (for now), and major retaliatory tariff actions have been paused.

Reuters +2

📣

#TrumpWithdrawsEUTariffThreats

In a major shift with global economic and geopolitical impact, President Donald J. Trump has withdra

- Reward

- 1

- Comment

- Repost

- Share

🔥 #Crypto Payments Aren’t Replacing Cards, They’re Backup Rail#DeFi_News #Market_News#crypto

- Reward

- like

- Comment

- Repost

- Share

Hong Kong and the UAE signed an MoU on cross-border digital asset regulatory cooperation

- Reward

- 1

- 1

- Repost

- Share

HeavenSlayerFaithful :

:

Experienced driver, guide me 📈成功上市

成功上市

Created By@ChineseMemeGlobalAmbassador

Listing Progress

0.00%

MC:

$3.47K

Create My Token

#GoldBreaksAbove$5,200

Gold has surged past the $5,200 level, marking a historic milestone for the precious metal and signaling a major shift in global market sentiment. This breakout is not happening in isolation — it reflects deep structural changes in the global economy, monetary policy expectations, and investor psychology. Below is a detailed, point-by-point explanation of what this move means and why it matters.

1️⃣ A Historic Technical Breakout

Breaking above $5,200 confirms a strong bullish trend for gold. This level acted as a long-term psychological resistance, and crossing it signa

Gold has surged past the $5,200 level, marking a historic milestone for the precious metal and signaling a major shift in global market sentiment. This breakout is not happening in isolation — it reflects deep structural changes in the global economy, monetary policy expectations, and investor psychology. Below is a detailed, point-by-point explanation of what this move means and why it matters.

1️⃣ A Historic Technical Breakout

Breaking above $5,200 confirms a strong bullish trend for gold. This level acted as a long-term psychological resistance, and crossing it signa

- Reward

- 1

- Comment

- Repost

- Share

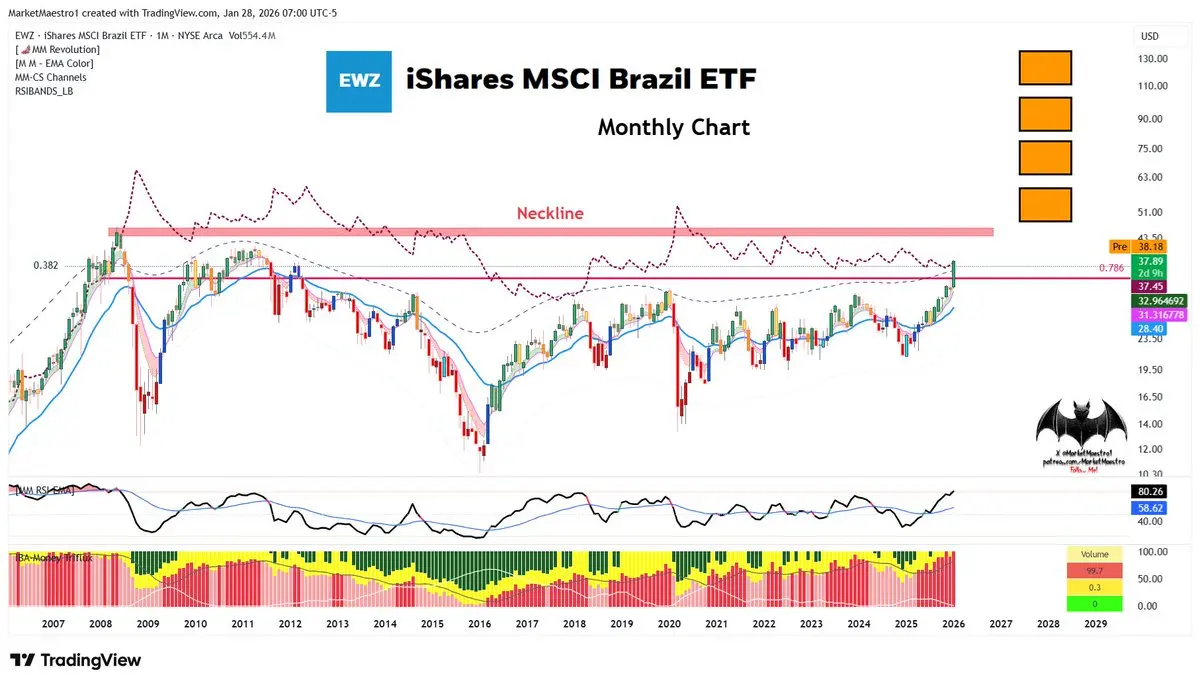

$EWZ 🇧🇷I think 2026 will be a good year for emerging markets. Brazil is one of the most important, and I’m positive on it. It’s also a country rich in REEs. It’s making an attack toward the neckline coming from 2008. At the same time, it also pushed above both the RSI Band and the correction band 🤞

- Reward

- like

- Comment

- Repost

- Share

#FedRateDecisionApproaches

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a cautious and highly sensitive phase. Investors across equities, commodities, and crypto are closely monitoring economic signals, as the outcome of this decision will influence liquidity, risk appetite, and capital flows worldwide.

Below is a detailed, point-by-point explanation of why this event matters and what markets are watching.

1️⃣ Markets Shift Into Wait-and-See Mode

Ahead of the Fed’s decision, volatility often compresses as traders reduce large positions. Thi

- Reward

- 1

- Comment

- Repost

- Share

Today\'s news: $AMZN cuts 16,000 jobsWho\'s surprised?With the introduction of AI many more cuts will happen. Many other companies will do the same.Is this a good or bad thing?

- Reward

- like

- Comment

- Repost

- Share

$USD1 Stablecoins threaten banks with a $500,000,000,000 outflow from deposits.

➤ Standard Chartered believes that as stablecoins grow, banks in developed countries could lose up to $500b deposits by 2028.

➤ In the US, the deposit volume could decrease by an amount equal to 1/3 of the stablecoin market capitalization. Currently, this is already over $300 billion, and the market is growing at approximately 40% per year.

➤ Standard Chartered believes that as stablecoins grow, banks in developed countries could lose up to $500b deposits by 2028.

➤ In the US, the deposit volume could decrease by an amount equal to 1/3 of the stablecoin market capitalization. Currently, this is already over $300 billion, and the market is growing at approximately 40% per year.

USD1-0,02%

- Reward

- like

- Comment

- Repost

- Share

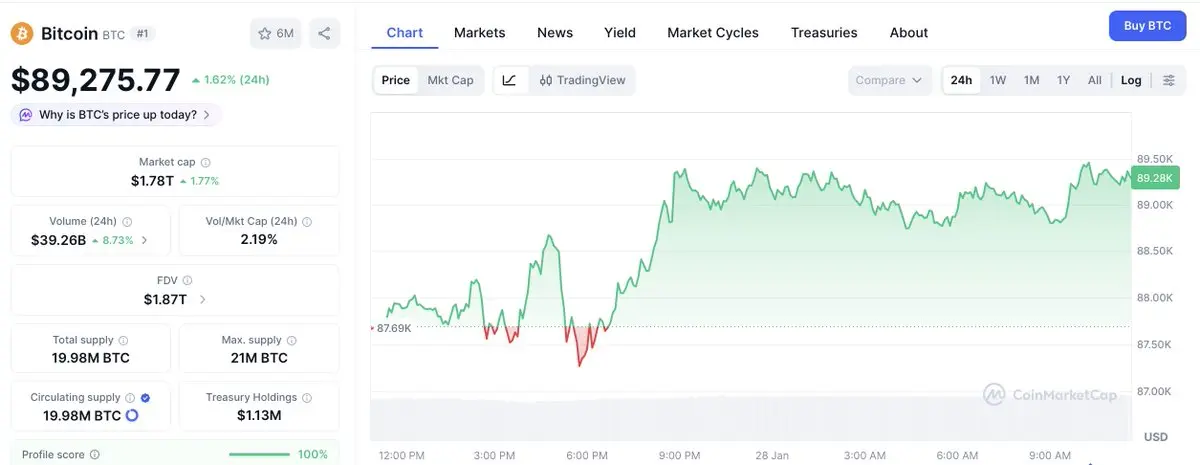

#GoldBreaksAbove$5,200 🚀 Gold hits $5,247 as safe-haven demand surges — Bitcoin remains in focus

#XAU #XAUT #PAXG

Market Snapshot

• Spot Gold: $5,247 per ounce (around twenty percent gain year-to-date)

• Bitcoin: approximately 88,911 USDT

• Fear & Greed Index: 29 — Fear zone

Why this matters

Global markets are shifting into protection mode. Persistent dollar weakness combined with rising macro and geopolitical uncertainty is accelerating capital flow toward safe-haven assets.

Gold continues to lead as the primary defensive asset, while Bitcoin increasingly attracts attention as a digital alte

#XAU #XAUT #PAXG

Market Snapshot

• Spot Gold: $5,247 per ounce (around twenty percent gain year-to-date)

• Bitcoin: approximately 88,911 USDT

• Fear & Greed Index: 29 — Fear zone

Why this matters

Global markets are shifting into protection mode. Persistent dollar weakness combined with rising macro and geopolitical uncertainty is accelerating capital flow toward safe-haven assets.

Gold continues to lead as the primary defensive asset, while Bitcoin increasingly attracts attention as a digital alte

- Reward

- 1

- 1

- Repost

- Share

HeavenSlayerFaithful :

:

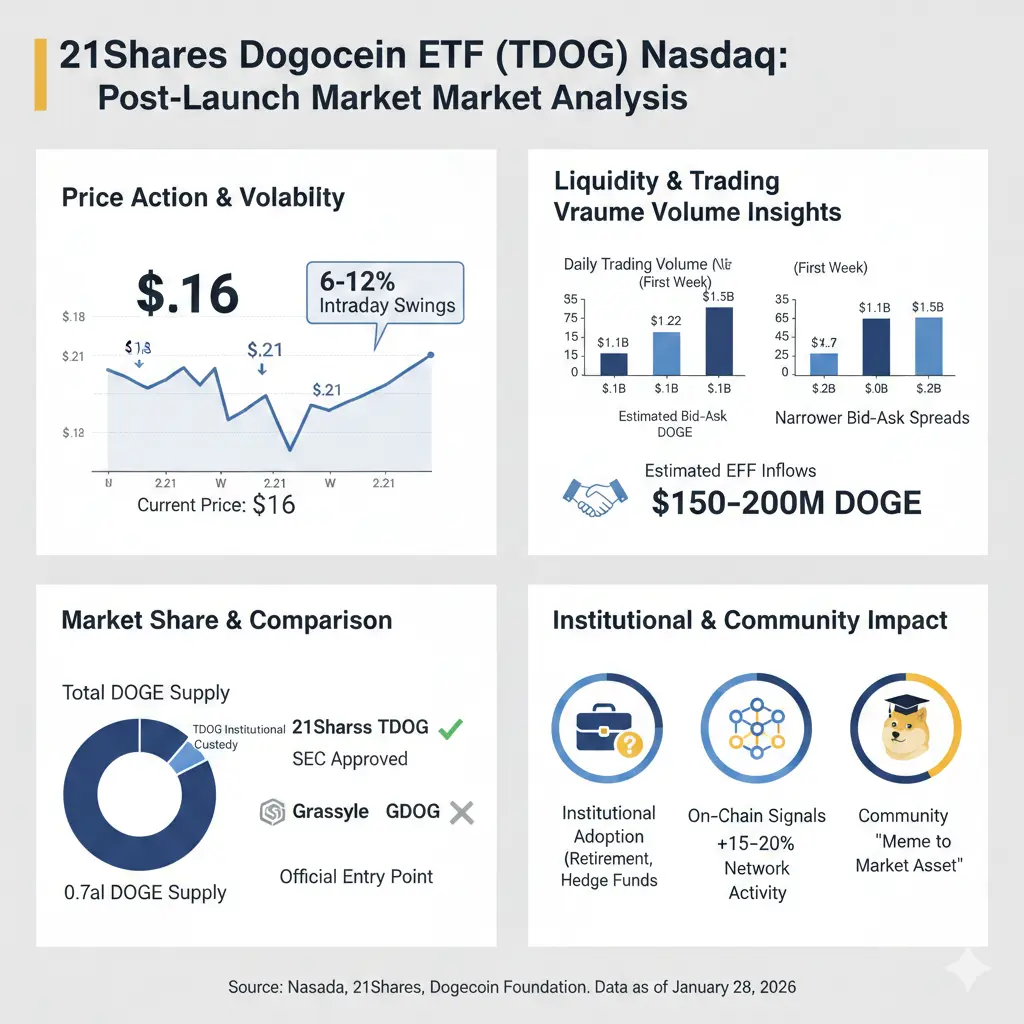

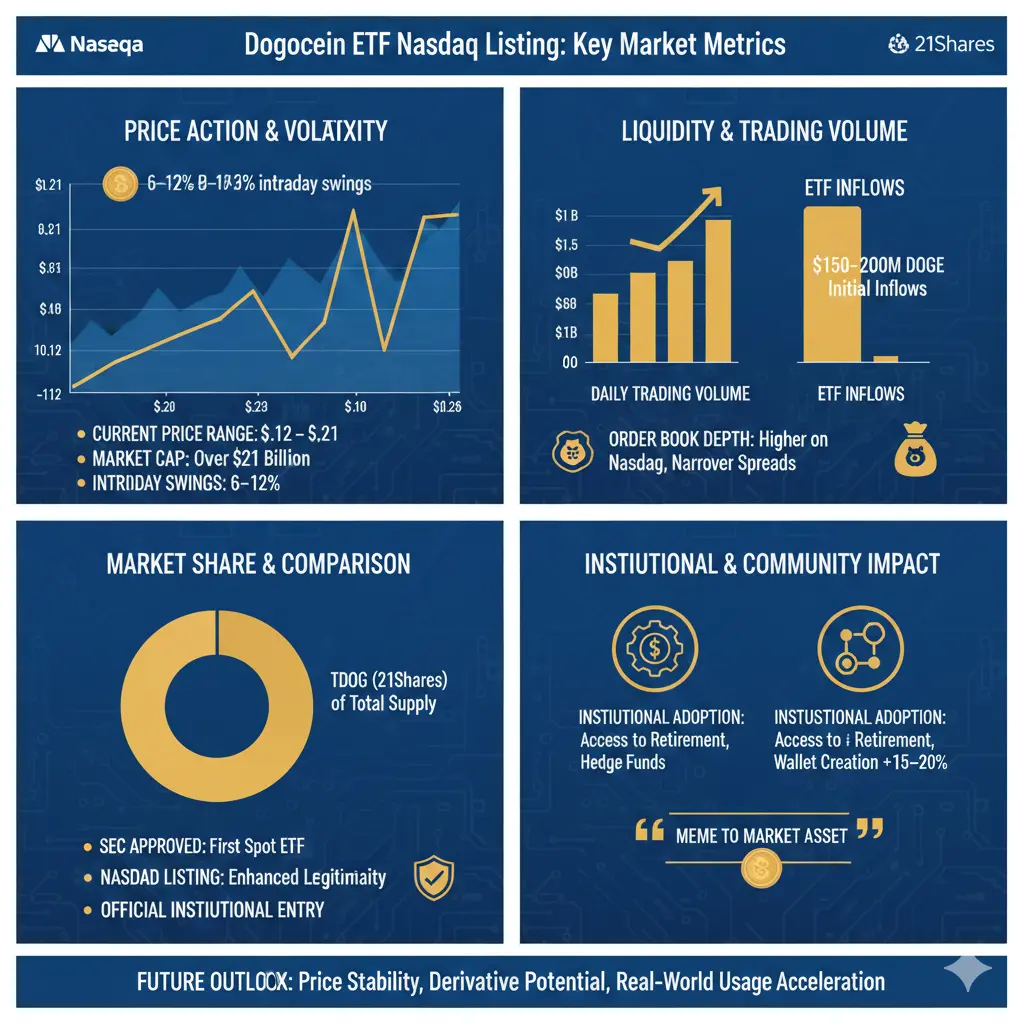

New Year Wealth Explosion 🤑#DOGEETFListsonNasdaq

The Nasdaq listing of the 21Shares Dogecoin ETF (TDOG) marks a watershed moment for Dogecoin (DOGE), transitioning it from a community-driven meme coin into an institutional-grade asset. This development not only highlights Dogecoin’s mainstream adoption but also offers detailed insights into market behavior, liquidity, and trading dynamics post-launch.

TDOG Launch Overview

ETF Type: Spot ETF holding DOGE 1:1 (no derivatives)

Ticker: TDOG

Exchange: Nasdaq

Management Fee: 0.50% daily accrual, payable in DOGE weekly

SEC Status: First fully approved spot Dogecoin ETF, not c

The Nasdaq listing of the 21Shares Dogecoin ETF (TDOG) marks a watershed moment for Dogecoin (DOGE), transitioning it from a community-driven meme coin into an institutional-grade asset. This development not only highlights Dogecoin’s mainstream adoption but also offers detailed insights into market behavior, liquidity, and trading dynamics post-launch.

TDOG Launch Overview

ETF Type: Spot ETF holding DOGE 1:1 (no derivatives)

Ticker: TDOG

Exchange: Nasdaq

Management Fee: 0.50% daily accrual, payable in DOGE weekly

SEC Status: First fully approved spot Dogecoin ETF, not c

DOGE3,76%

- Reward

- like

- 3

- Repost

- Share

sigitBI :

:

1000x Vibes 🤑View More

A big rate cut is coming! Yo-yo master Trump: "I will appoint a compliant Federal Reserve Chair." This time, the rate is not just a little cut, but a lot, a big cut! Sponsored by @Gate_zh | Grab gold on the Gate App

View Original- Reward

- like

- Comment

- Repost

- Share

q

spe

Created By@SuperInvincibleLuckyLuckyStar

Listing Progress

0.00%

MC:

$3.46K

Create My Token

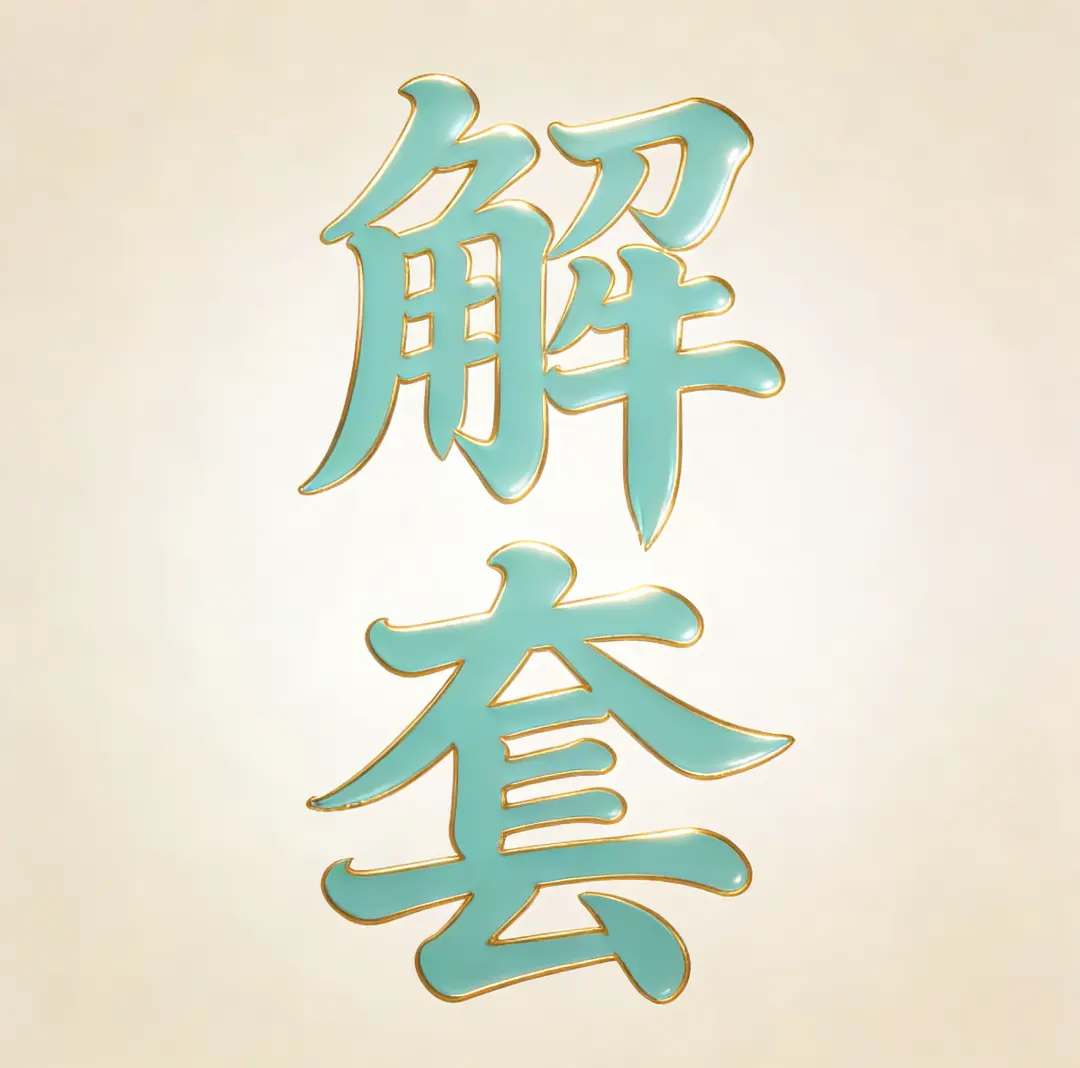

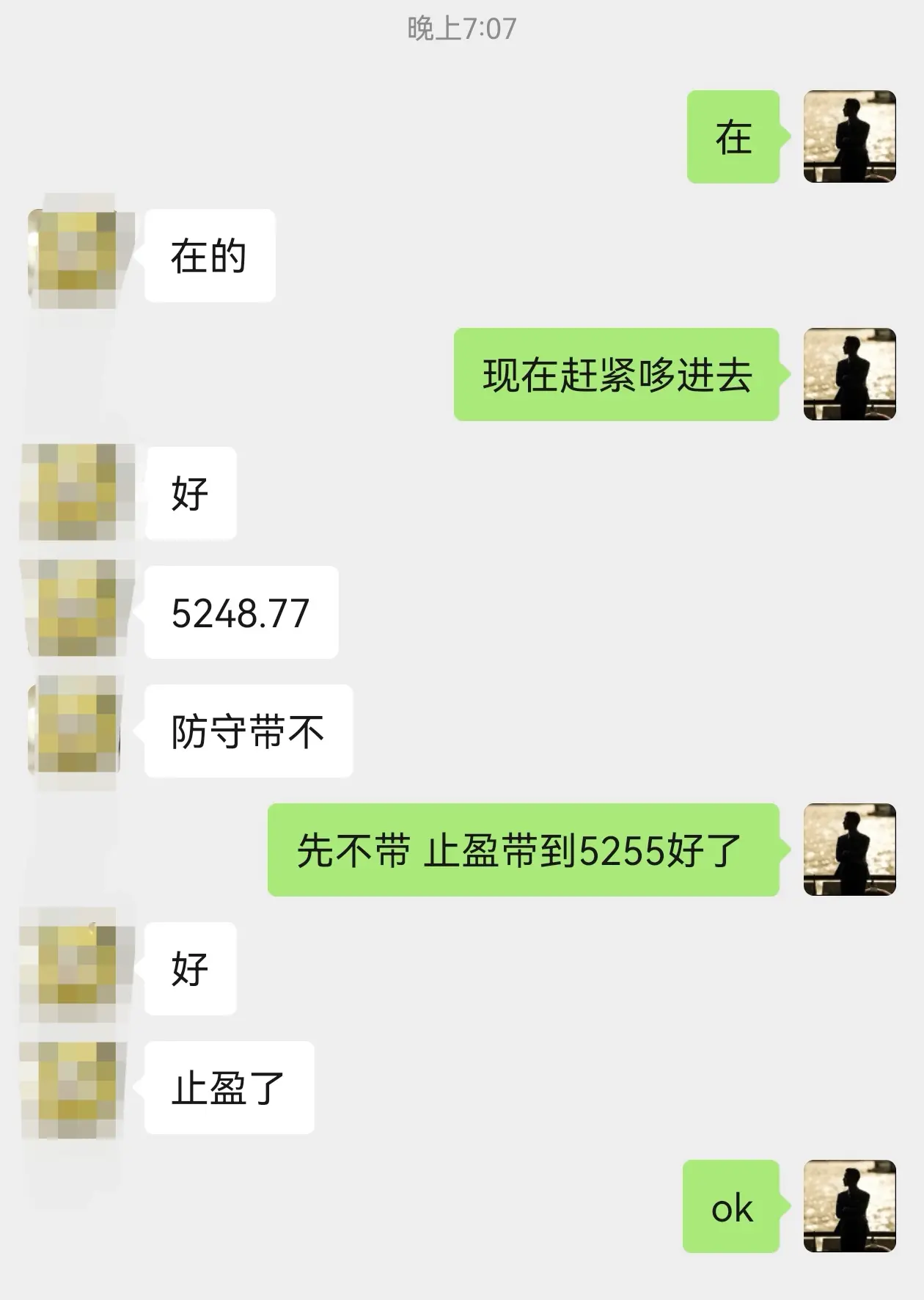

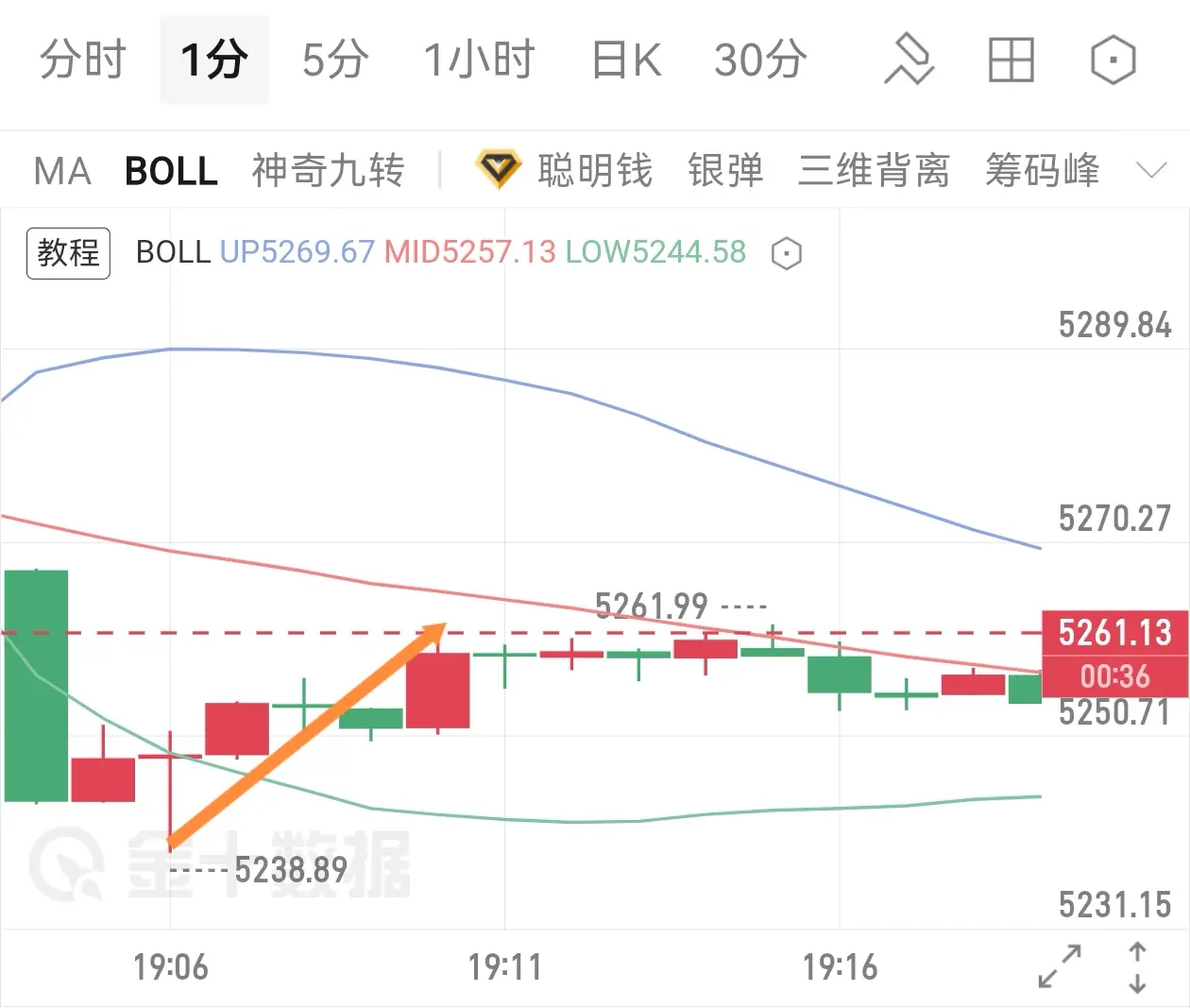

Trading often involves dealing with trapped orders, which is a common challenge. Market fluctuations are rapid, and only by adopting the correct methods can you maintain control. Here are the core strategies for handling trapped orders:

1. Take different measures based on the loss magnitude

· Shallow trap (small loss): Exit promptly during rebounds, or reduce positions at high points to control risk.

· Deep trap (large loss): Close positions in batches, preserve capital, and avoid emotional over-leverage.

2. Choose the appropriate unwinding method based on price levels

· Trapped at high levels

View Original1. Take different measures based on the loss magnitude

· Shallow trap (small loss): Exit promptly during rebounds, or reduce positions at high points to control risk.

· Deep trap (large loss): Close positions in batches, preserve capital, and avoid emotional over-leverage.

2. Choose the appropriate unwinding method based on price levels

· Trapped at high levels

- Reward

- like

- Comment

- Repost

- Share

😳😳😳😳😳😳😳😳😳😳

- Reward

- like

- Comment

- Repost

- Share

Trading is not something that happens instantly; it is accumulated experience over time. Evening trading also yields a 7% gain.

View Original

- Reward

- 1

- 1

- Repost

- Share

GateUser-a8a8c1a2 :

:

TIM hehewwwwwwwwwwwwww Zhang Xinzhe some person has no way out of the short order of Domperidone ah oh oh oh I seeGoing into the FOMC meeting without giving 2 fvcks about what Trump says

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin eyes $100K 🚀- Fed will hold rates today, but Powell’s tone could spark a breakout.- Resistance: $90/$94K; above that, $98K is next- Support: $80–$84K; downside exists, but let’s not focus on that 😅Macro still favors risk-off, but Trump’s comment last night “doesn’t care about a weaker USD”. signals he’ll do everything to push assets higher 📈

BTC2,69%

- Reward

- like

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats

Former U.S. President Trump’s administration has formally withdrawn previous tariff threats against the European Union, signaling a significant de-escalation in trade tensions between the U.S. and EU. This move has broad implications for global markets, supply chains, and investor sentiment.

Below is a detailed, point-by-point explanation of what this development means for the economy and markets.

1️⃣ Trade Tension Eases

The withdrawal of tariff threats removes uncertainty for companies engaged in transatlantic trade. Businesses in manufacturing, automotive, and

Former U.S. President Trump’s administration has formally withdrawn previous tariff threats against the European Union, signaling a significant de-escalation in trade tensions between the U.S. and EU. This move has broad implications for global markets, supply chains, and investor sentiment.

Below is a detailed, point-by-point explanation of what this development means for the economy and markets.

1️⃣ Trade Tension Eases

The withdrawal of tariff threats removes uncertainty for companies engaged in transatlantic trade. Businesses in manufacturing, automotive, and

- Reward

- like

- Comment

- Repost

- Share

#BitcoinFallsBehindGold 🏆💰

Bitcoin Stumbles as Gold Regains Its Safe-Haven Appeal

In the latest market shift, Bitcoin has fallen behind gold, reigniting investor focus on traditional safe-haven assets. Once celebrated as the ultimate hedge against inflation and economic uncertainty, Bitcoin has struggled to maintain momentum amid growing market volatility and regulatory scrutiny. Meanwhile, gold, the centuries-old store of value, is reclaiming its position as the preferred asset for cautious investors.

The crypto market has faced significant turbulence in recent months. Bitcoin, despite peri

Bitcoin Stumbles as Gold Regains Its Safe-Haven Appeal

In the latest market shift, Bitcoin has fallen behind gold, reigniting investor focus on traditional safe-haven assets. Once celebrated as the ultimate hedge against inflation and economic uncertainty, Bitcoin has struggled to maintain momentum amid growing market volatility and regulatory scrutiny. Meanwhile, gold, the centuries-old store of value, is reclaiming its position as the preferred asset for cautious investors.

The crypto market has faced significant turbulence in recent months. Bitcoin, despite peri

BTC2,69%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More10.5K Popularity

72.4K Popularity

25.58K Popularity

9.85K Popularity

10.05K Popularity

Hot Gate Fun

View More- MC:$3.44KHolders:10.00%

- MC:$3.45KHolders:10.00%

- MC:$3.47KHolders:20.00%

- MC:$3.45KHolders:10.00%

- MC:$3.45KHolders:10.00%

News

View MoreData: 151.58 BTC transferred out from multiple anonymous addresses, worth approximately $13.67 million

6 m

Opinion: Trump may announce the new Federal Reserve Chair tonight

6 m

Uniswap: Token auction feature will be launched on the web version on February 2nd

9 m

Fidelity will launch the stablecoin FIDD on Ethereum

23 m

Data: In the past 24 hours, the entire network experienced liquidations of $314 million, with long positions liquidated at $65.2171 million and short positions at $249 million.

25 m

Pin