# MajorStockIndexesPlunge

2.39K

U.S. stocks closed lower as risk appetite weakened, with crypto stocks also under pressure. Strategy (MSTR) fell over 7% in one day. How are you managing risk or finding opportunities in this pullback?

MissCrypto

#MajorStockIndexesPlunge

US Stock Market Plunge: What Investors Need to Know

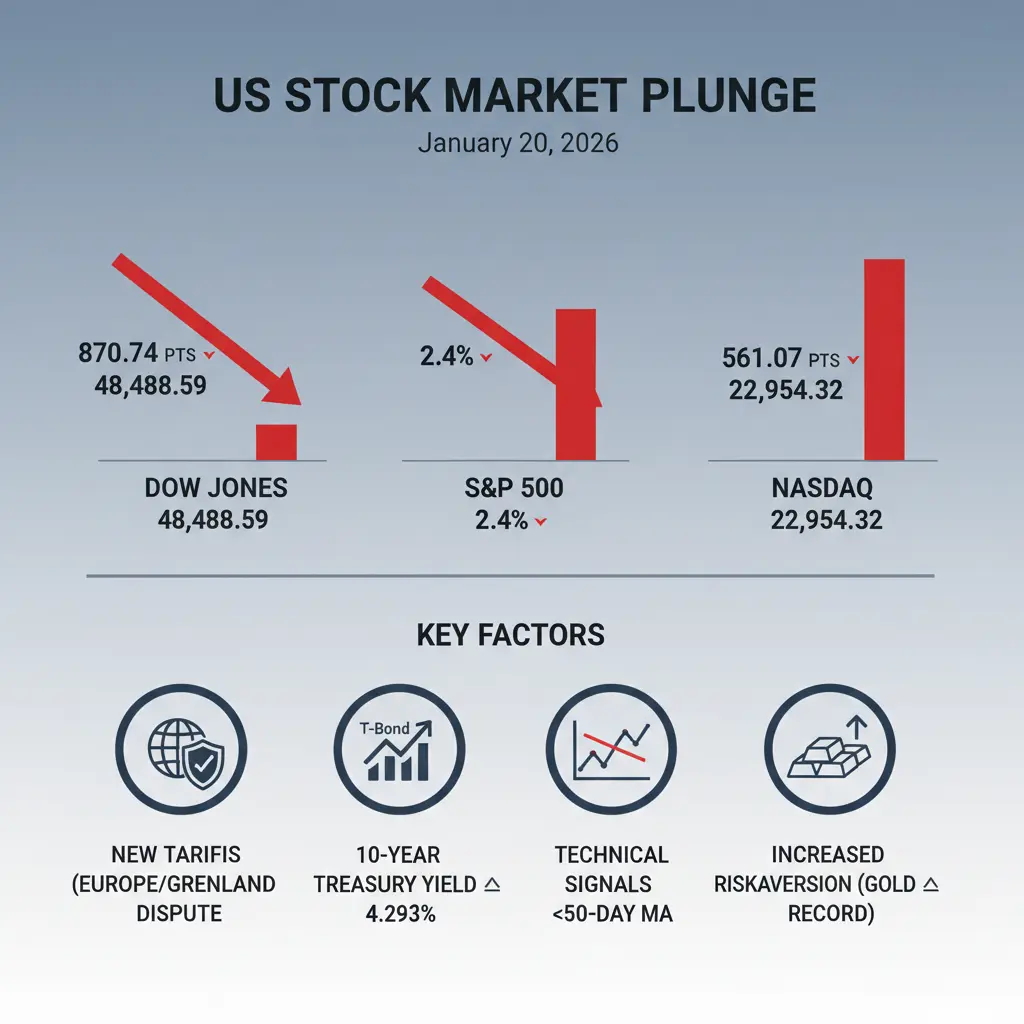

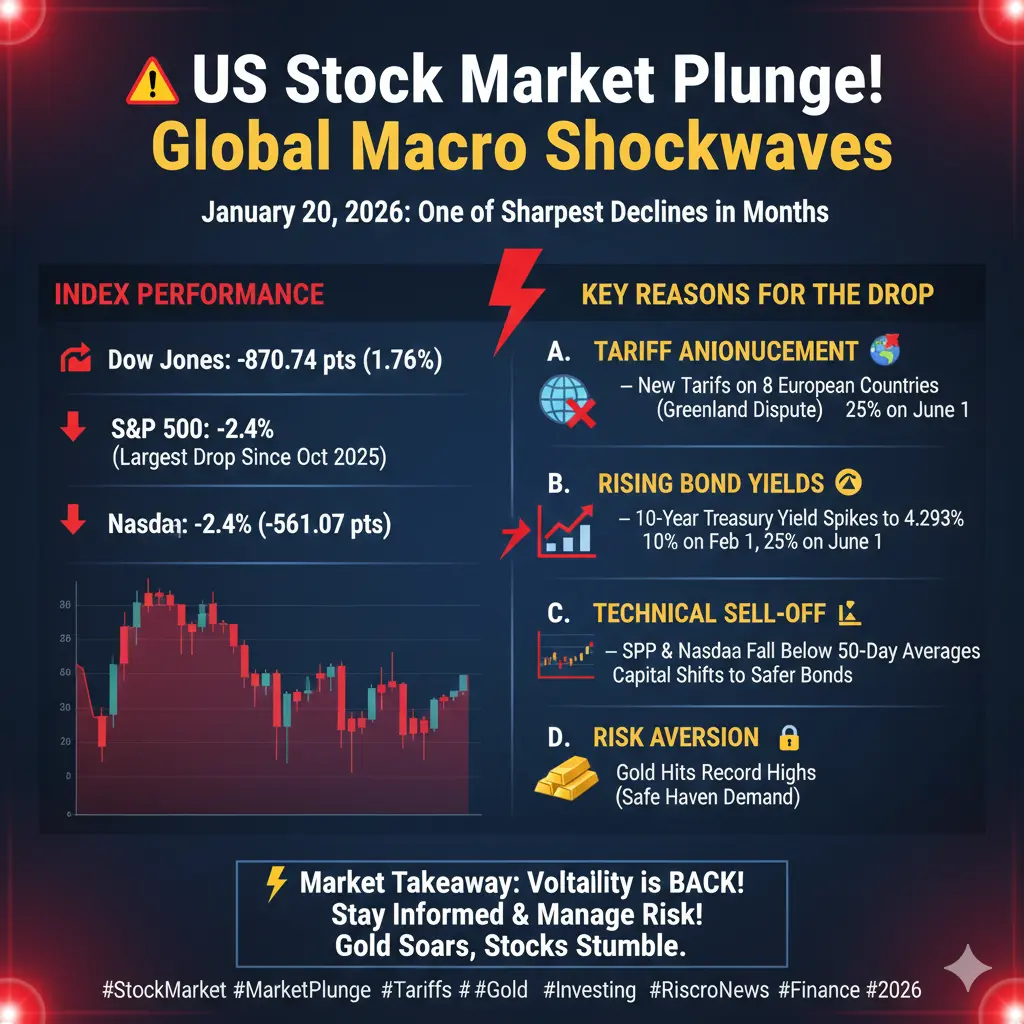

On January 20, 2026, the U.S. stock market experienced one of its sharpest one-day declines in months. All three major indexes — Dow Jones, S&P 500, and Nasdaq — fell dramatically, signaling heightened market uncertainty.

1. Index Performance

Dow Jones Industrial Average: Fell 870.74 points (–1.76%), closing at 48,488.59

S&P 500: Dropped 2.4%, its largest decline since October 2025

Nasdaq Composite: Declined 561.07 points (–2.4%), closing at 22,954.32

This widespread decline highlights that investors are reacting to

US Stock Market Plunge: What Investors Need to Know

On January 20, 2026, the U.S. stock market experienced one of its sharpest one-day declines in months. All three major indexes — Dow Jones, S&P 500, and Nasdaq — fell dramatically, signaling heightened market uncertainty.

1. Index Performance

Dow Jones Industrial Average: Fell 870.74 points (–1.76%), closing at 48,488.59

S&P 500: Dropped 2.4%, its largest decline since October 2025

Nasdaq Composite: Declined 561.07 points (–2.4%), closing at 22,954.32

This widespread decline highlights that investors are reacting to

- Reward

- 2

- 6

- Repost

- Share

CryptoChampion :

:

Watching Closely 🔍️View More

#MajorStockIndexesPlunge

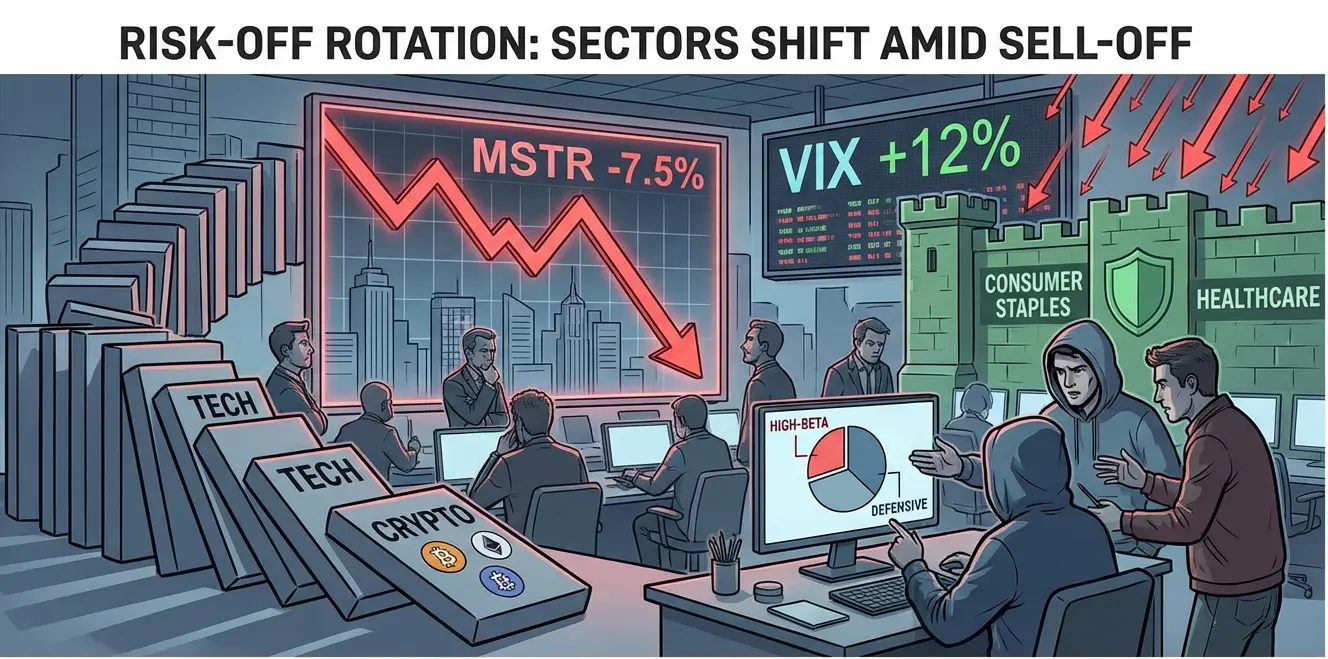

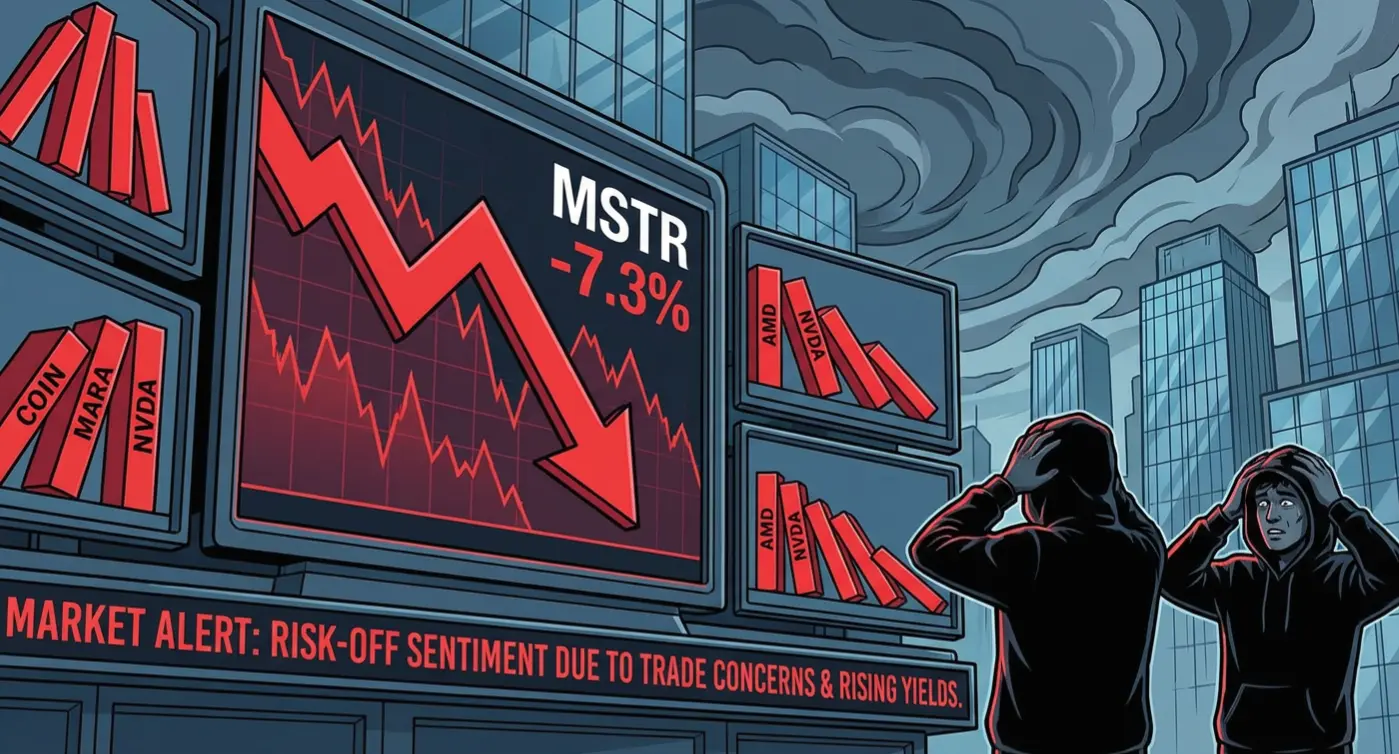

Risk-Off Sentiment Hits U.S. Stocks and Crypto Stocks

U.S. equities closed lower today as risk appetite weakened, and crypto-related stocks felt the pressure. MicroStrategy (MSTR) led the decline, dropping over 7% in a single session, reflecting both stock market and crypto exposure risk.

Market Context

Tech & Crypto Stocks: Underperforming as investors rotate out of high-beta or crypto-correlated assets.

Macro Drivers: Trade concerns, inflation signals, and rising global yields are keeping traders cautious.

Volatility: VIX remains elevated, suggesting investors are h

Risk-Off Sentiment Hits U.S. Stocks and Crypto Stocks

U.S. equities closed lower today as risk appetite weakened, and crypto-related stocks felt the pressure. MicroStrategy (MSTR) led the decline, dropping over 7% in a single session, reflecting both stock market and crypto exposure risk.

Market Context

Tech & Crypto Stocks: Underperforming as investors rotate out of high-beta or crypto-correlated assets.

Macro Drivers: Trade concerns, inflation signals, and rising global yields are keeping traders cautious.

Volatility: VIX remains elevated, suggesting investors are h

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#MajorStockIndexesPlunge

A Sudden Wave of Selling Across Global Markets

The moment major stock indexes plunge, it reflects more than a routine market correction it signals a sharp change in investor confidence. Across global markets, heavy selling pressure has emerged as traders reassess risk, valuations, and macroeconomic stability. When leading indexes fall together, it often points to systemic concerns rather than isolated sector weakness.

Why Index Movements Matter So Much

Stock indexes represent the collective performance of the largest and most influential companies in an economy. When

A Sudden Wave of Selling Across Global Markets

The moment major stock indexes plunge, it reflects more than a routine market correction it signals a sharp change in investor confidence. Across global markets, heavy selling pressure has emerged as traders reassess risk, valuations, and macroeconomic stability. When leading indexes fall together, it often points to systemic concerns rather than isolated sector weakness.

Why Index Movements Matter So Much

Stock indexes represent the collective performance of the largest and most influential companies in an economy. When

- Reward

- 1

- 3

- Repost

- Share

Luna_Star :

:

Happy New Year! 🤑View More

#MajorStockIndexesPlunge

A Sudden Wave of Selling Across Global Markets

The moment major stock indexes plunge, it reflects more than a routine market correction it signals a sharp change in investor confidence. Across global markets, heavy selling pressure has emerged as traders reassess risk, valuations, and macroeconomic stability. When leading indexes fall together, it often points to systemic concerns rather than isolated sector weakness.

Why Index Movements Matter So Much

Stock indexes represent the collective performance of the largest and most influential companies in an economy. When

A Sudden Wave of Selling Across Global Markets

The moment major stock indexes plunge, it reflects more than a routine market correction it signals a sharp change in investor confidence. Across global markets, heavy selling pressure has emerged as traders reassess risk, valuations, and macroeconomic stability. When leading indexes fall together, it often points to systemic concerns rather than isolated sector weakness.

Why Index Movements Matter So Much

Stock indexes represent the collective performance of the largest and most influential companies in an economy. When

- Reward

- 1

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊#MajorStockIndexesPlunge

US Stock Market Plunge: What Investors Need to Know

On January 20, 2026, the U.S. stock market experienced one of its sharpest one-day declines in months. All three major indexes — Dow Jones, S&P 500, and Nasdaq — fell dramatically, signaling heightened market uncertainty.

1. Index Performance

Dow Jones Industrial Average: Fell 870.74 points (–1.76%), closing at 48,488.59

S&P 500: Dropped 2.4%, its largest decline since October 2025

Nasdaq Composite: Declined 561.07 points (–2.4%), closing at 22,954.32

This widespread decline highlights that investors are reacting to

US Stock Market Plunge: What Investors Need to Know

On January 20, 2026, the U.S. stock market experienced one of its sharpest one-day declines in months. All three major indexes — Dow Jones, S&P 500, and Nasdaq — fell dramatically, signaling heightened market uncertainty.

1. Index Performance

Dow Jones Industrial Average: Fell 870.74 points (–1.76%), closing at 48,488.59

S&P 500: Dropped 2.4%, its largest decline since October 2025

Nasdaq Composite: Declined 561.07 points (–2.4%), closing at 22,954.32

This widespread decline highlights that investors are reacting to

- Reward

- 6

- 8

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge 📉

📊 Global markets took a hit today as major stock indexes plunged sharply following rising geopolitical tensions and trade concerns. Investors dumped equities, pushing major benchmarks into red territory. �

The Washington Post +1

📉 Key Moves:

• S&P 500 fell over 2% — its biggest drop in months. �

• Nasdaq Composite slumped around 2.4%, led by tech losses. �

• Dow Jones Industrial Average declined nearly 1.8%. �

AP News

AP News

AP News

🔥 Why It’s Happening:

Investors were spooked by tariff threats and geopolitical uncertainties that sparked sell‑offs across global

📊 Global markets took a hit today as major stock indexes plunged sharply following rising geopolitical tensions and trade concerns. Investors dumped equities, pushing major benchmarks into red territory. �

The Washington Post +1

📉 Key Moves:

• S&P 500 fell over 2% — its biggest drop in months. �

• Nasdaq Composite slumped around 2.4%, led by tech losses. �

• Dow Jones Industrial Average declined nearly 1.8%. �

AP News

AP News

AP News

🔥 Why It’s Happening:

Investors were spooked by tariff threats and geopolitical uncertainties that sparked sell‑offs across global

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge Global equity markets are facing a sharp wave of selling as major stock indexes across the world plunge simultaneously, signaling a sudden shift in investor sentiment. What began as localized weakness has rapidly transformed into a broad risk-off movement, pulling down U.S., European, and Asian markets together. The scale and speed of the decline suggest deeper concerns than short-term profit-taking.

U.S. markets have led the downturn, with the Dow Jones, S&P 500, and Nasdaq all experiencing heavy losses in a single session. Technology and growth stocks — which had pre

U.S. markets have led the downturn, with the Dow Jones, S&P 500, and Nasdaq all experiencing heavy losses in a single session. Technology and growth stocks — which had pre

- Reward

- 4

- 2

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

Global equity markets are experiencing a sharp wave of selling as major stock indexes plunge simultaneously, signaling a sudden shift in investor sentiment. What initially appeared as localized weakness has rapidly evolved into a broad risk-off movement, dragging down U.S., European, and Asian markets together. The speed and scale of this decline suggest concerns deeper than simple profit-taking.

U.S. markets are leading the downturn, with the Dow Jones, S&P 500, and Nasdaq all posting heavy losses in a single session. Technology and growth stocks — previously the main

Global equity markets are experiencing a sharp wave of selling as major stock indexes plunge simultaneously, signaling a sudden shift in investor sentiment. What initially appeared as localized weakness has rapidly evolved into a broad risk-off movement, dragging down U.S., European, and Asian markets together. The speed and scale of this decline suggest concerns deeper than simple profit-taking.

U.S. markets are leading the downturn, with the Dow Jones, S&P 500, and Nasdaq all posting heavy losses in a single session. Technology and growth stocks — previously the main

- Reward

- 2

- Comment

- Repost

- Share

🚨 JUST IN:

GOLD HAS HIT A BRAND-NEW ALL-TIME HIGH AT $4,830.

SAFE-HAVEN ASSETS ARE SURGING AS GLOBAL UNCERTAINTY CONTINUES TO RISE.

MARKETS ARE CLEARLY PRICING IN FEAR AND MACRO PRESSURE.

#SpotGoldHitsaNewHigh #MajorStockIndexesPlunge #GoldmanEyesPredictionMarkets #GateSquareCreatorNewYearIncentives

GOLD HAS HIT A BRAND-NEW ALL-TIME HIGH AT $4,830.

SAFE-HAVEN ASSETS ARE SURGING AS GLOBAL UNCERTAINTY CONTINUES TO RISE.

MARKETS ARE CLEARLY PRICING IN FEAR AND MACRO PRESSURE.

#SpotGoldHitsaNewHigh #MajorStockIndexesPlunge #GoldmanEyesPredictionMarkets #GateSquareCreatorNewYearIncentives

- Reward

- 3

- 3

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

Daily Global Foreign Exchange Market Highlights (2026-01-21)

Dollar:

1. The U.S. Supreme Court tariff ruling continues to "break promises."

2. U.S. Secretary of Commerce Raimondo: We believe this quarter's GDP growth rate will exceed 5%.

3. U.S. Treasury Secretary Yellen: The earliest possible announcement of the Federal Reserve Chair candidate could be next week. Powell attending the Supreme Court's Cook hearing was a mistake.

4. Danish pension fund Akademiker Pension will exit the U.S. bond market, holding about $100 million in U.S. Treasuries as of the end of December.

5. ADP Weekly Employm

View OriginalDollar:

1. The U.S. Supreme Court tariff ruling continues to "break promises."

2. U.S. Secretary of Commerce Raimondo: We believe this quarter's GDP growth rate will exceed 5%.

3. U.S. Treasury Secretary Yellen: The earliest possible announcement of the Federal Reserve Chair candidate could be next week. Powell attending the Supreme Court's Cook hearing was a mistake.

4. Danish pension fund Akademiker Pension will exit the U.S. bond market, holding about $100 million in U.S. Treasuries as of the end of December.

5. ADP Weekly Employm

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

23.93K Popularity

6.31K Popularity

57.72K Popularity

49.57K Popularity

340.71K Popularity

2.15K Popularity

2.39K Popularity

12.55K Popularity

106.87K Popularity

18.19K Popularity

196.1K Popularity

15.76K Popularity

6.71K Popularity

11.65K Popularity

168.33K Popularity

News

View MoreParadex trading bot hacked, 57 user keys leaked but funds were not transferred

5 m

Solana stablecoin trading volume exceeds $1 trillion, USDC-driven on-chain payments enter a high-speed era

6 m

BTC drops below $89,000, Bitcoin and Ethereum ETFs face $713 million sell-off pressure

8 m

BTC fell below 89,000 USDT

8 m

"On-chain gold's largest long position" closes Oracle token long position, losing $199,000

9 m

Pin