#HKSFCUnveilsNewDigitalAssetRules

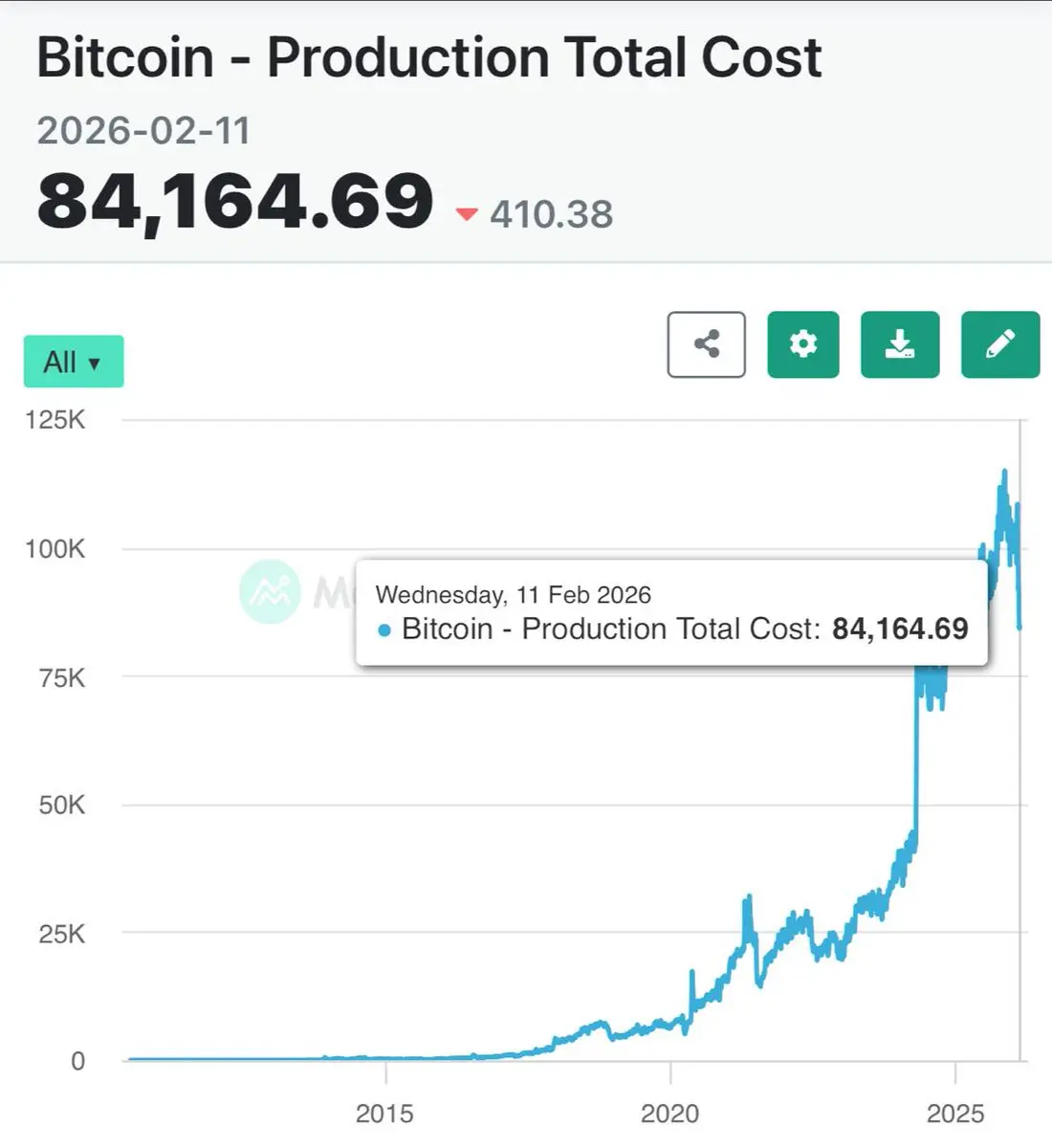

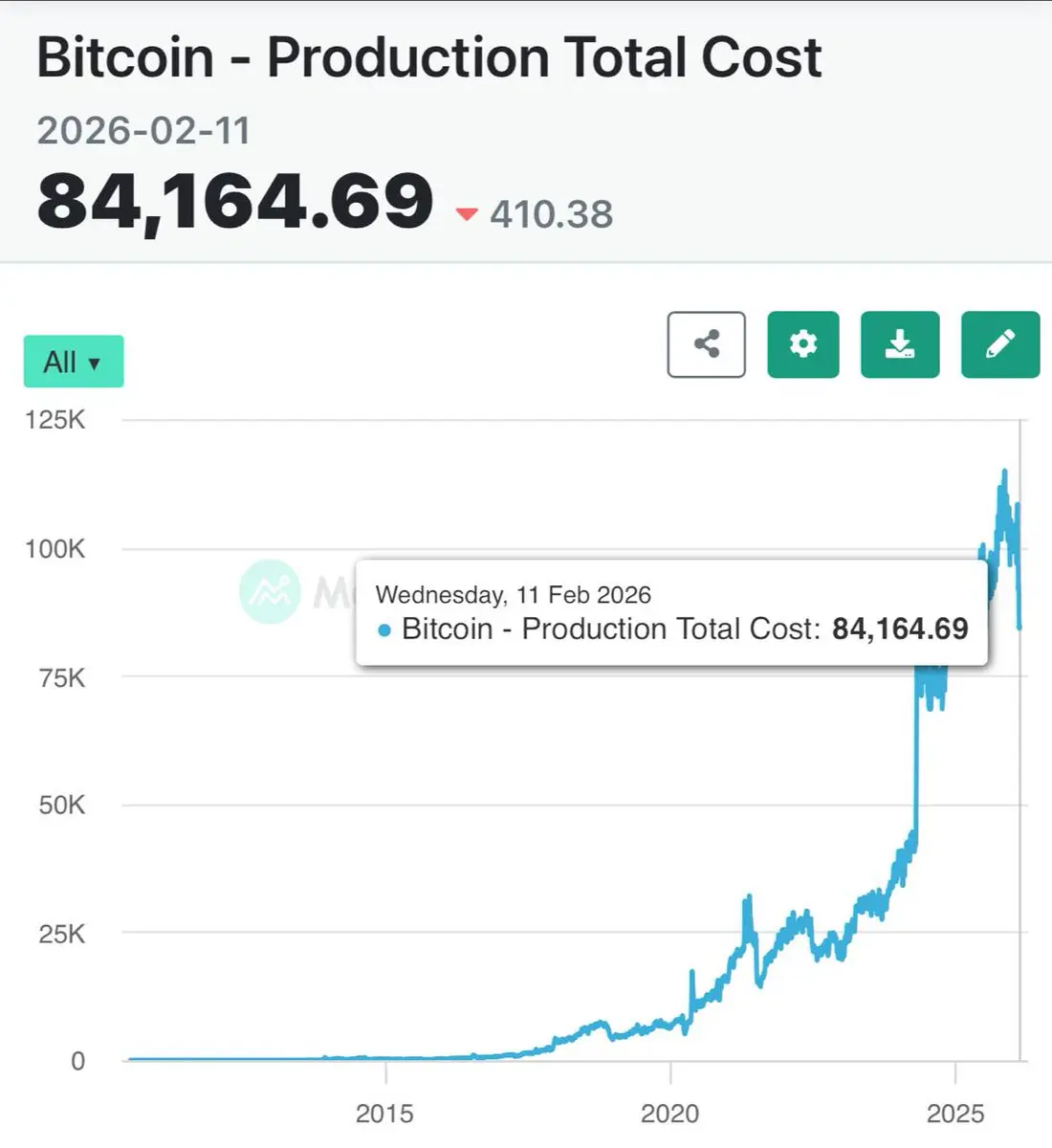

The Hong Kong Securities and Futures Commission (SFC) released new rules and guidelines on February 11, 2026, to revitalize the digital asset market. Under these guidelines, licensed brokers (VA brokers) were permitted to offer virtual asset (VA)-backed margin financing – specifically, assets like Bitcoin and Ether could be accepted as collateral, but subject to strict risk controls and investor suitability tests. Furthermore, a high-level framework was announced for the development of leveraged products, such as perpetual contracts, for licensed virtual asset trading platforms (VATPs). These products will be accessible only to professional investors and will include strict measures such as leverage limits, margin requirements, liquidation mechanisms, and transparency rules. These steps reinforce the SFC's goal of making Hong Kong a regulated crypto hub in Asia, as part of its regulatory expansion strategy under the ASPIRe Roadmap, which has been in place since 2025. It aims to increase market liquidity and further integrate traditional finance with digital assets.

The Hong Kong Securities and Futures Commission (SFC) released new rules and guidelines on February 11, 2026, to revitalize the digital asset market. Under these guidelines, licensed brokers (VA brokers) were permitted to offer virtual asset (VA)-backed margin financing – specifically, assets like Bitcoin and Ether could be accepted as collateral, but subject to strict risk controls and investor suitability tests. Furthermore, a high-level framework was announced for the development of leveraged products, such as perpetual contracts, for licensed virtual asset trading platforms (VATPs). These products will be accessible only to professional investors and will include strict measures such as leverage limits, margin requirements, liquidation mechanisms, and transparency rules. These steps reinforce the SFC's goal of making Hong Kong a regulated crypto hub in Asia, as part of its regulatory expansion strategy under the ASPIRe Roadmap, which has been in place since 2025. It aims to increase market liquidity and further integrate traditional finance with digital assets.