#ADPJobsMissEstimates The latest ADP employment report showing weaker-than-expected private-sector job growth has added a new layer of uncertainty to global markets. The slowdown in hiring signals that economic momentum may be cooling, raising questions about the sustainability of recent growth trends. For investors, this data point is important because labor market strength is one of the Federal Reserve’s primary indicators when shaping monetary policy. When employment misses expectations, markets begin reassessing interest rate trajectories and liquidity conditions.

A softer labor report suggests that companies are becoming more cautious with hiring, reflecting tighter financial conditions, slower demand, and rising operational costs. This trend indicates that businesses may be preparing for slower economic activity ahead. While one weak report does not confirm a recession, it does reinforce the narrative that economic growth is losing momentum. Over time, repeated weakness in employment data can influence both corporate confidence and consumer spending behavior.

From a monetary policy perspective, weaker job creation reduces pressure on central banks to maintain restrictive interest rates. A cooling labor market lowers inflationary risks tied to wage growth, increasing the probability of policy pauses or eventual rate cuts. Markets often react to this shift in expectations before any official decision is made, adjusting bond yields, currency valuations, and risk positioning in advance.

Equity markets typically respond in mixed ways to disappointing jobs data. In the short term, stocks may rally on expectations of easier monetary policy and improved liquidity. Growth-oriented and technology sectors often benefit most from this reaction. However, if employment weakness persists, concerns about corporate earnings and consumer demand can offset monetary optimism, leading to increased volatility and uneven performance across sectors.

Bond markets tend to react more directly to labor data. Slower job growth usually strengthens demand for government bonds, pushing yields lower as investors price in reduced rate pressure. Changes in yield curves and credit spreads reflect shifting expectations about economic stability and future policy direction. These adjustments influence funding costs and capital flows across financial markets.

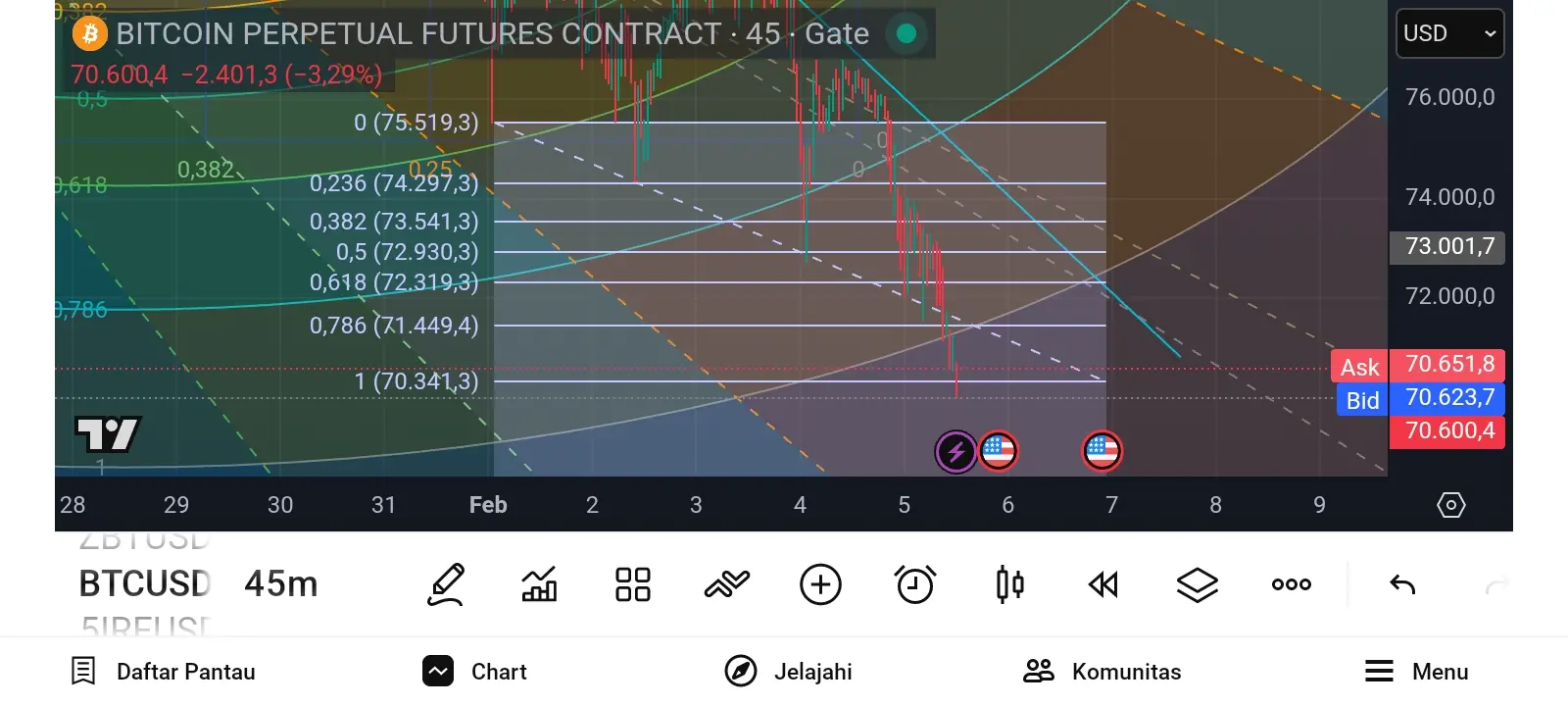

For crypto and other high-risk assets, the ADP miss carries important implications. Digital assets are highly sensitive to liquidity and monetary policy expectations. If markets interpret weak employment as a signal for future easing, crypto may benefit from improved risk appetite. However, if job weakness is viewed as a sign of broader economic deterioration, capital may rotate toward safer assets, increasing volatility in speculative markets.

It is also important to recognize that ADP data is an early indicator rather than a definitive measure of labor market health. It often differs from official employment reports due to methodological differences. As a result, traders and investors typically wait for confirmation from government data before committing to major directional positions. This makes the ADP report more useful as a sentiment and expectation-shaping tool than as a standalone signal.

Market reactions following weak labor data often unfold in stages. Initial moves are driven by rate expectations and liquidity forecasts, followed by more measured positioning as additional economic data becomes available. This process explains why markets sometimes reverse shortly after reacting to employment releases. Understanding this dynamic helps avoid emotional trading based on short-term headlines.

From a strategic perspective, the current environment favors caution and flexibility. Traders may find opportunities in short-term volatility, but risk management remains essential. Long-term investors should focus on structural trends rather than isolated data points, maintaining diversified exposure and adequate liquidity. Employment data should be integrated into broader macro analysis rather than treated in isolation.

Overall, the ADP jobs miss reflects a labor market that is gradually losing momentum, reinforcing uncertainty about economic direction and monetary policy. It increases the importance of upcoming inflation, employment, and central bank signals. Whether this data ultimately proves bullish or bearish will depend on how policymakers respond and how economic conditions evolve. For now, disciplined observation, scenario planning, and balanced positioning remain the most effective approach in navigating this phase of the market cycle.

A softer labor report suggests that companies are becoming more cautious with hiring, reflecting tighter financial conditions, slower demand, and rising operational costs. This trend indicates that businesses may be preparing for slower economic activity ahead. While one weak report does not confirm a recession, it does reinforce the narrative that economic growth is losing momentum. Over time, repeated weakness in employment data can influence both corporate confidence and consumer spending behavior.

From a monetary policy perspective, weaker job creation reduces pressure on central banks to maintain restrictive interest rates. A cooling labor market lowers inflationary risks tied to wage growth, increasing the probability of policy pauses or eventual rate cuts. Markets often react to this shift in expectations before any official decision is made, adjusting bond yields, currency valuations, and risk positioning in advance.

Equity markets typically respond in mixed ways to disappointing jobs data. In the short term, stocks may rally on expectations of easier monetary policy and improved liquidity. Growth-oriented and technology sectors often benefit most from this reaction. However, if employment weakness persists, concerns about corporate earnings and consumer demand can offset monetary optimism, leading to increased volatility and uneven performance across sectors.

Bond markets tend to react more directly to labor data. Slower job growth usually strengthens demand for government bonds, pushing yields lower as investors price in reduced rate pressure. Changes in yield curves and credit spreads reflect shifting expectations about economic stability and future policy direction. These adjustments influence funding costs and capital flows across financial markets.

For crypto and other high-risk assets, the ADP miss carries important implications. Digital assets are highly sensitive to liquidity and monetary policy expectations. If markets interpret weak employment as a signal for future easing, crypto may benefit from improved risk appetite. However, if job weakness is viewed as a sign of broader economic deterioration, capital may rotate toward safer assets, increasing volatility in speculative markets.

It is also important to recognize that ADP data is an early indicator rather than a definitive measure of labor market health. It often differs from official employment reports due to methodological differences. As a result, traders and investors typically wait for confirmation from government data before committing to major directional positions. This makes the ADP report more useful as a sentiment and expectation-shaping tool than as a standalone signal.

Market reactions following weak labor data often unfold in stages. Initial moves are driven by rate expectations and liquidity forecasts, followed by more measured positioning as additional economic data becomes available. This process explains why markets sometimes reverse shortly after reacting to employment releases. Understanding this dynamic helps avoid emotional trading based on short-term headlines.

From a strategic perspective, the current environment favors caution and flexibility. Traders may find opportunities in short-term volatility, but risk management remains essential. Long-term investors should focus on structural trends rather than isolated data points, maintaining diversified exposure and adequate liquidity. Employment data should be integrated into broader macro analysis rather than treated in isolation.

Overall, the ADP jobs miss reflects a labor market that is gradually losing momentum, reinforcing uncertainty about economic direction and monetary policy. It increases the importance of upcoming inflation, employment, and central bank signals. Whether this data ultimately proves bullish or bearish will depend on how policymakers respond and how economic conditions evolve. For now, disciplined observation, scenario planning, and balanced positioning remain the most effective approach in navigating this phase of the market cycle.