Post content & earn content mining yield

placeholder

🏆 Gate Live Spring Festival Streamer Leaderboard is LIVE! 🔥

All streamers can join — the leaderboard is moving fast

Existing streamers: stream more → win $100 CASH + 2026 Gift Box

New streamers: first stream → +20% points + $50 CASH + Gift Box 🎁

🎙 Livestream nights × platform-wide red packet drops

👉 Spring Festival is the best window to climb the leaderboard

https://www.gate.com/campaigns/3937

All streamers can join — the leaderboard is moving fast

Existing streamers: stream more → win $100 CASH + 2026 Gift Box

New streamers: first stream → +20% points + $50 CASH + Gift Box 🎁

🎙 Livestream nights × platform-wide red packet drops

👉 Spring Festival is the best window to climb the leaderboard

https://www.gate.com/campaigns/3937

- Reward

- 1

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

🔤

abc

Created By@RideTheWavesToEarnBigRice.

Subscription Progress

0.00%

MC:

$0

Create My Token

Once you thought that the second probe of 80,000 was very far away, and it was a matter of an instant to come back to your senses, and gold continued to plummet, driving Bitcoin to collapse continuously to the 81,000 mark.

I don't know what happened to those who insisted on watching 100,000 now? At least a little bit of people who watch the konger are still active in the crypto market, and I didn't let you buy the bottom during the whole process, on the contrary, I have been letting you hold it in the medium and long term in mid-January.

And I am bearish, not on a whim. If you have been follow

I don't know what happened to those who insisted on watching 100,000 now? At least a little bit of people who watch the konger are still active in the crypto market, and I didn't let you buy the bottom during the whole process, on the contrary, I have been letting you hold it in the medium and long term in mid-January.

And I am bearish, not on a whim. If you have been follow

BTC-5,35%

- Reward

- 1

- 1

- Repost

- Share

WaterIsTheMasterOfW :

:

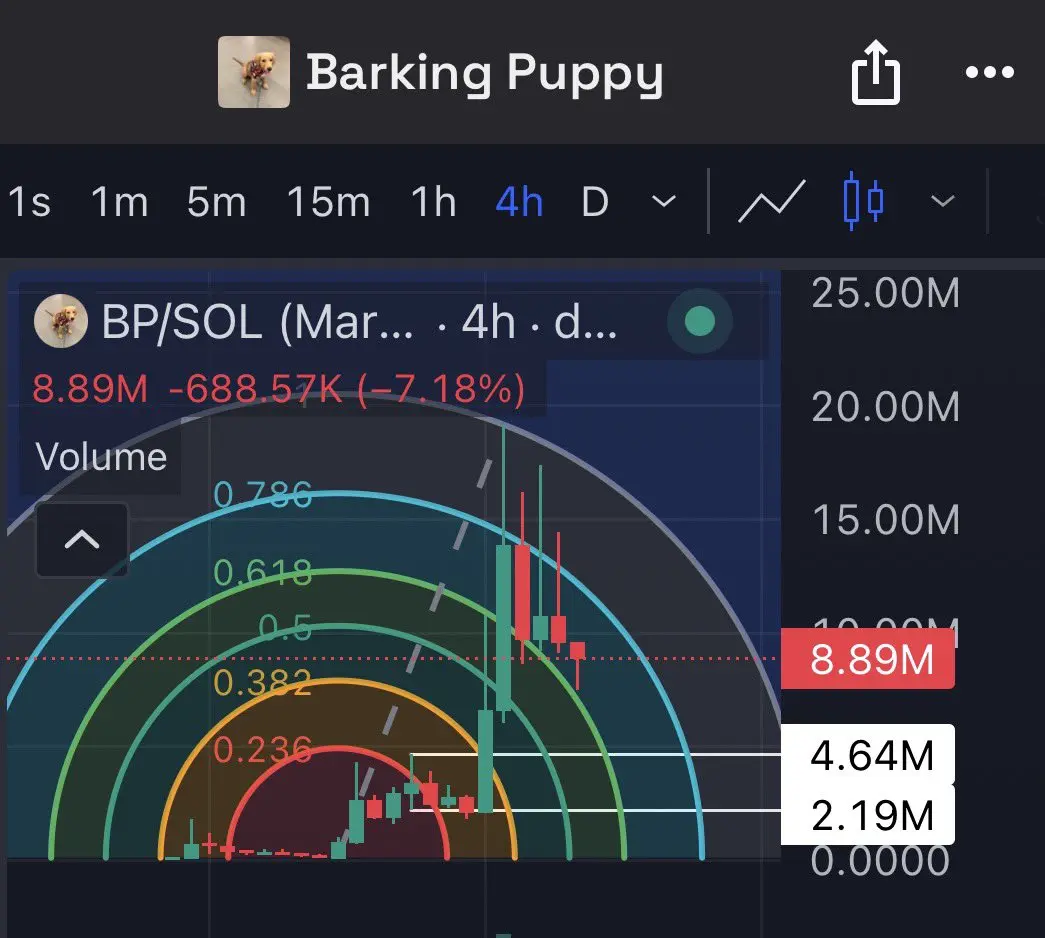

Insert the pins up and down, indicating looseness$BP BARKING PUPPY on its descentfailed every attempt to break 0.786 speed resistlet’s see who is able to force a breakout above that speed resist before touching 4.6 and belowi’d think about bounce only when the candles at least touche or sniff at those levelsby all means, invalidate my TA pls🫡

- Reward

- like

- Comment

- Repost

- Share

#FedKeepsRatesUnchanged —🚀 Market and Macro Outlook

🚀The Federal Reserve’s decision to hold interest rates steady marks a pivotal moment for global financial markets. By maintaining the current rate levels, the Fed is signaling a careful, data-driven approach rather than a reactive or aggressive policy shift. Inflation has continued to moderate but remains above target levels, while the labor market has shown unexpected resilience, reducing the immediate need for further monetary stimulus. This balanced stance underscores a commitment to policy credibility and central bank independence, send

🚀The Federal Reserve’s decision to hold interest rates steady marks a pivotal moment for global financial markets. By maintaining the current rate levels, the Fed is signaling a careful, data-driven approach rather than a reactive or aggressive policy shift. Inflation has continued to moderate but remains above target levels, while the labor market has shown unexpected resilience, reducing the immediate need for further monetary stimulus. This balanced stance underscores a commitment to policy credibility and central bank independence, send

- Reward

- 3

- 4

- Repost

- Share

dragon_fly2 :

:

2026 GOGOGO 👊View More

#AIBT A strong community consensus, a dedicated and wise project team working hand in hand, jointly creating a better AIBT and moving towards brilliance!

View Original

- Reward

- like

- Comment

- Repost

- Share

#AIBT Very good project, I believe in my choice to follow... Optimistic about AIBT, friends are welcome to come and learn more

View Original

- Reward

- like

- Comment

- Repost

- Share

This wave of sharp decline, Bitcoin's market share is actually dropping too. Think about it, take your time to ponder...

BTC-5,35%

- Reward

- 2

- 3

- Repost

- Share

HowCanABornPrideful :

:

YSARB Shen Bi, the ceiling of zero-commission, do you want to learn more?View More

💵 $FDUSD — Trade Analysis (Stablecoin)

Overview: FDUSD is a USD-backed stablecoin used for trading, hedging, and capital protection.

Price: ~$0.9985

Trend: Stable / range-bound

Technical Levels:

Support: $0.9980

Resistance: $1.0000

Indicators:

RSI: Neutral

MACD: Flat

Low volatility environment

Trade Plan:

Entry: $0.9980

Target: $1.000

Stop Loss: $0.9965

R:R: Low-risk

Outlook:

Short & long-term: Stability focused

Sentiment: Capital preservation mode

$FDUSD

#GoldBreaks$5,500 #GateLiveMiningProgramPublicBeta #FedKeepsRatesUnchanged #SEConTokenizedSecurities

Overview: FDUSD is a USD-backed stablecoin used for trading, hedging, and capital protection.

Price: ~$0.9985

Trend: Stable / range-bound

Technical Levels:

Support: $0.9980

Resistance: $1.0000

Indicators:

RSI: Neutral

MACD: Flat

Low volatility environment

Trade Plan:

Entry: $0.9980

Target: $1.000

Stop Loss: $0.9965

R:R: Low-risk

Outlook:

Short & long-term: Stability focused

Sentiment: Capital preservation mode

$FDUSD

#GoldBreaks$5,500 #GateLiveMiningProgramPublicBeta #FedKeepsRatesUnchanged #SEConTokenizedSecurities

FDUSD-0,07%

- Reward

- 2

- 1

- Repost

- Share

Zsepikeee95 :

:

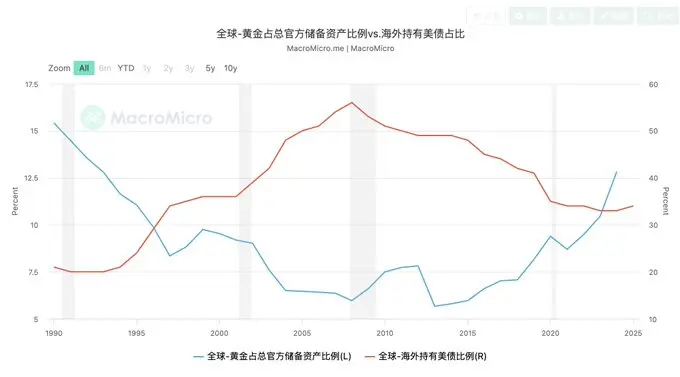

🥰A conspiracy theory about gold. Why did gold plummet? Actually, it's because when gold exceeded $5300, its total market value surpassed the entire US debt holdings, triggering a systemic sell-off. People are pondering one question: will gold become so large that it is 'not allowed' to continue absorbing global safe-haven funds? Under the current system: gold ≈ non-sovereign, non-credit, zero-yield assets; US debt ≈ the world's largest and most core risk-free asset. Once the structural market value of gold surpasses that of US debt, it is no longer a market issue but a financial order problem.

View Original

- Reward

- like

- Comment

- Repost

- Share

Mufasa

Mufasa

Created By@Fisherman_sDiary

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 2

- 3

- Repost

- Share

ox_Alan :

:

Happy New Year! 🤑View More

- Reward

- like

- Comment

- Repost

- Share

$SOL holding up after an aggressive sell off.

Buyers reacting as price stabilizes at demand.

EP

112.50 – 114.00

TP

TP1 116.00

TP2 118.50

TP3 121.00

SL

111.00

Liquidity was swept below 112 with a sharp reaction and bounce. Structure is compressing after the flush, showing absorption and early signs of a range reclaim as selling pressure fades.

Let’s go $SOL

Buyers reacting as price stabilizes at demand.

EP

112.50 – 114.00

TP

TP1 116.00

TP2 118.50

TP3 121.00

SL

111.00

Liquidity was swept below 112 with a sharp reaction and bounce. Structure is compressing after the flush, showing absorption and early signs of a range reclaim as selling pressure fades.

Let’s go $SOL

SOL-5,65%

- Reward

- 2

- Comment

- Repost

- Share

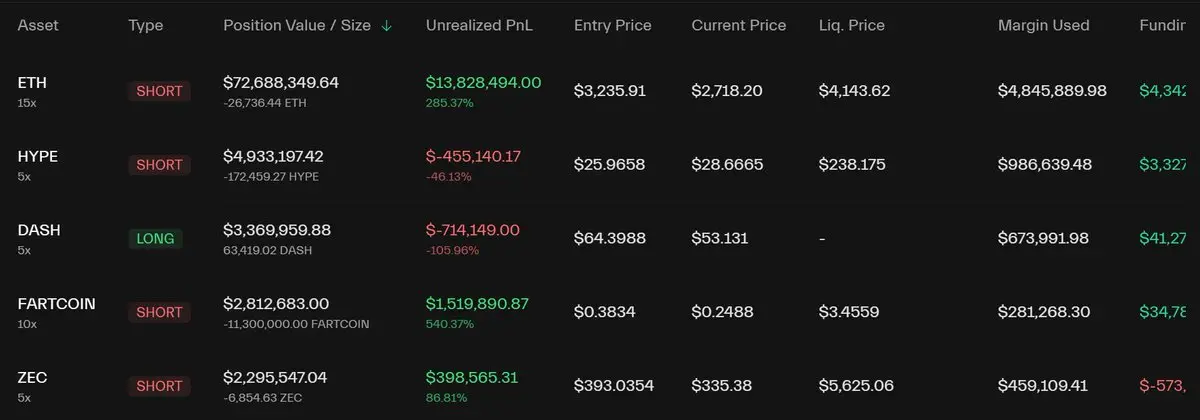

While some Long whales have been under pressure, this whale\'s having a good time.His unrealized profit for all short positions is ~$16M.Address:

- Reward

- like

- Comment

- Repost

- Share

#交易机器人#我正在 Gate Using the BTCUSDT Grid trading bot, the total yield since creation has been +3.12%

The principal is 100, and the big market is soaring

View OriginalThe principal is 100, and the big market is soaring

- Reward

- like

- Comment

- Repost

- Share

$SOL signal: short position + open interest divergence decline

$SOL the open interest divergence is formed in the decline in volume, and the price action shows that the main shipment is not simply long liquidation.

🎯 Direction: Short position

Market logic: The price drop of -7.64% was accompanied by a huge volume of 4032M, but the open interest did not drop sharply (OI: 10.63 million), suggesting that it was not a simple long liquidation drive. This is a typical active suppression of selling orders, with the main force continuing to distribute below the key position (front support). Any ral

$SOL the open interest divergence is formed in the decline in volume, and the price action shows that the main shipment is not simply long liquidation.

🎯 Direction: Short position

Market logic: The price drop of -7.64% was accompanied by a huge volume of 4032M, but the open interest did not drop sharply (OI: 10.63 million), suggesting that it was not a simple long liquidation drive. This is a typical active suppression of selling orders, with the main force continuing to distribute below the key position (front support). Any ral

SOL-5,65%

- Reward

- like

- 1

- Repost

- Share

Shiki :

:

Hold on tight, we're about to take off 🛫The Ethereum market was hit hard today, with the price falling below a key psychological line of defense. According to HTX and Gate market data, the price of ETH has fallen below $2,700, with a 24-hour drop of more than 9.2%-10%. The plunge was not an isolated event, as Bitcoin also fell more than 5% at the same time, once falling below $85,000, driving the entire cryptocurrency market into a sell-off. The core points of market analysis, the main reason for the decline: the general decline is caused by the resonance of multiple factors. Analysts point out that cryptocurrencies, as high-risk as

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More841 Popularity

19.24K Popularity

16.65K Popularity

7.02K Popularity

45.45K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.25KHolders:10.00%

- MC:$3.24KHolders:10.00%

- MC:$3.23KHolders:20.00%

- MC:$3.27KHolders:20.00%

News

View MoreGate TradFi multiple experience upgrades, Chinese display and trading path optimization go live simultaneously

2 m

"ETH Air Force" rolling short positions daily profit reaches $6 million, with total profits exceeding $80 million.

8 m

Gate Contract Stock Zone will launch its first 11 US stocks and ETF perpetual contracts on January 30th, supporting 1-20x leverage trading.

8 m

SSS full-chain autonomous project launched, exploring a deflationary dividend mechanism for long-term profitability

12 m

Data: BTC breaks through $83,000

14 m

Pin