advance decline index

What Is the Advance-Decline Index?

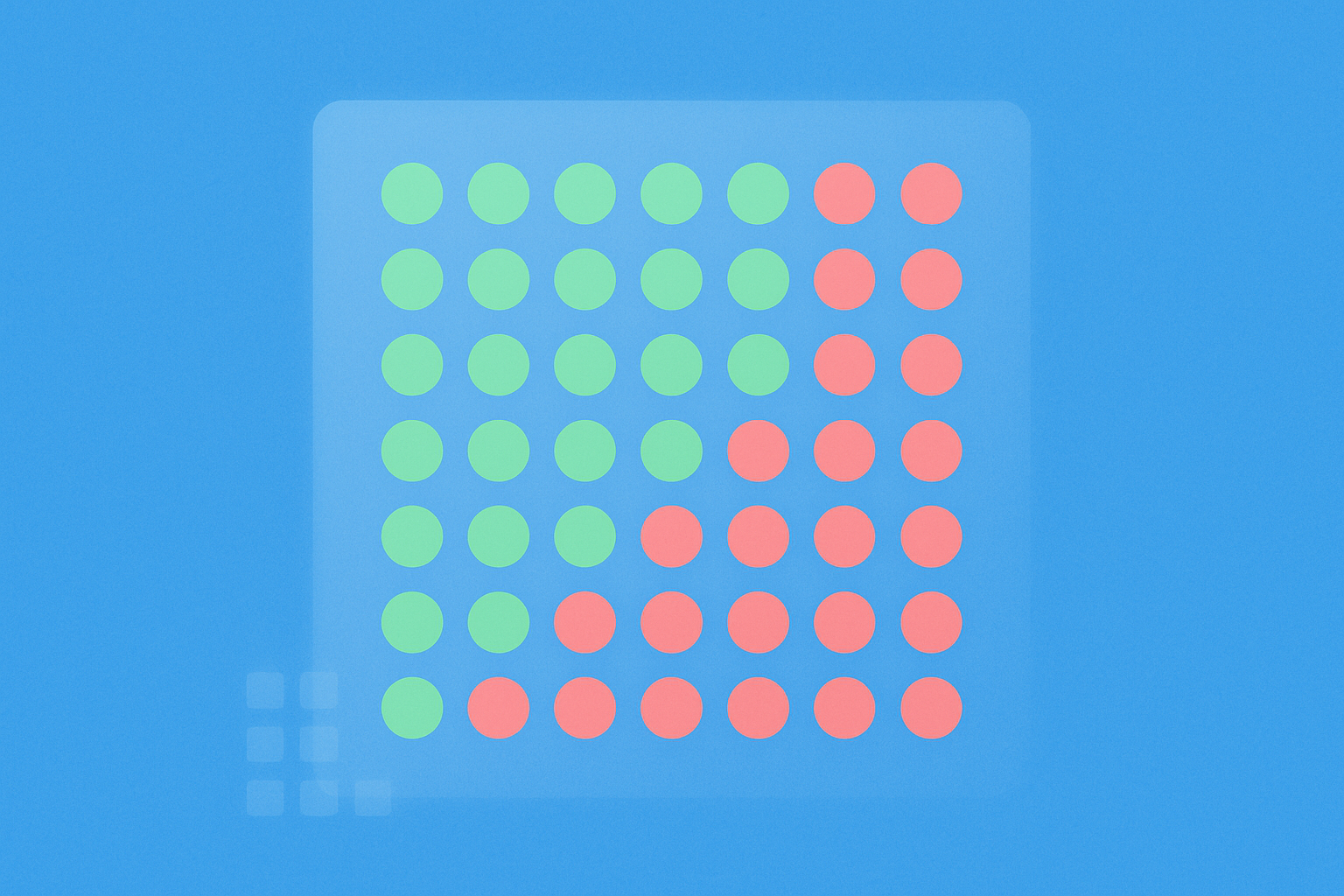

The Advance-Decline Index measures the comparative number of assets rising versus those falling within a specific period.

It summarizes “how many assets are up and how many are down” in the same time frame, typically using two methods: ratio (number of advancing assets ÷ number of declining assets) and difference (number of advancing assets − number of declining assets). A ratio above 1 or a positive difference indicates broad upward movement; conversely, a ratio below 1 or a negative difference signals broader declines.

Choosing the sample set is crucial. In crypto, common samples include exchange listings, top 100 by market capitalization, or specific sectors, usually excluding stablecoins to prevent “almost non-volatile” assets from skewing breadth calculations.

Why Is the Advance-Decline Index Important?

It helps distinguish between “broad rallies” and “selective rallies,” which can improve portfolio positioning and risk management.

For example, if Bitcoin rises slightly but the Advance-Decline Index is below 1, most coins are still falling—indicating a “lead rally, not a broad rally.” Chasing altcoins during such times carries higher risk. Conversely, when the index consistently exceeds 1.5, market breadth is strong and sector rotation is more sustainable.

It also signals changes in market phases. During late bull markets, it’s common to see new price highs with weakening breadth—a “divergence” that warns short- to medium-term traders. For those using grid trading or liquidity mining, tracking breadth helps identify “broad-based rallies,” enhancing strategy robustness.

How Does the Advance-Decline Index Work?

The core process involves sample selection, time window definition, and calculation of ratio or difference.

First, select your sample: market cap Top 100, Top 200, or major exchange listings. Samples should be stable and exclude stablecoins and pegged assets to avoid distortion.

Second, choose your time window: commonly “intraday,” “24 hours,” or “weekly.” Each window highlights different aspects—intraday for sentiment shifts, weekly for trend analysis.

Third, calculation methods: The ratio method (advancers ÷ decliners) is intuitive; the difference method (advancers − decliners) resembles a “net vote count.” Combining both offers a comprehensive view.

Sometimes, an “AD Line” is used—cumulative daily differences plotted as a line to observe long-term breadth trends. Like a ledger, each advance adds to the total and each decline subtracts. Persistent weakness in the AD Line often indicates increasing market fragmentation.

Typical Patterns of the Advance-Decline Index in Crypto

It offers clear insights in spot markets, sector rotations, and sentiment cycles.

Exchange price boards display 24-hour gainers and losers. Counting the numbers yields that day’s Advance-Decline Index. For example, on Gate’s spot list, 120 coins up vs. 80 down gives a ratio of 1.5—signaling broad gains.

During sector rotation, breadth often improves before price does. For instance, when AI tokens rotate to DeFi, most tokens in the sector might show slight gains or stabilization first—then leaders rally strongly. The index rising from near 1 to 1.3–1.6 is common in these phases.

During periods when dominant coins move sideways, a sustained index above 1.5 suggests capital spreading into mid- and small-cap coins; below 0.8 signals “broad retreat,” prompting short-term traders to tighten strategies.

How to Use the Advance-Decline Index

Begin with sample and methodology selection, then establish a simple observation routine.

Step 1: Set your sample—e.g., “market cap Top 100 excluding stablecoins” or “Gate mainboard listings.” Keep samples consistent for reliable comparison.

Step 2: Select your time window—commonly 24 hours or 7 days. Use 24 hours for intraday sentiment, 7 days for sector rotation and trend continuation.

Step 3: Calculate and record—note daily advancers and decliners, then compute ratio or difference; optionally plot an AD Line (cumulative differences) to track mid-term breadth changes.

Step 4: Define reference thresholds. Experience suggests ≥1.5 indicates strong breadth, ≤0.8 signals weak breadth; signals are more reliable if values persist for three days. Thresholds aren’t strict rules—adjust for volatility as needed.

Step 5: Cross-reference with price and volume trends. If Bitcoin or Ethereum trends upward with rising volume and the index ≥1.3, this favors “broad rallies.” If prices hit new highs but the index <1, be cautious of limited leadership and potential pullbacks.

Three key points:

- Always exclude stablecoins and pegged assets from samples.

- During weeks with many new listings, breadth can be temporarily distorted.

- In extreme market conditions, adjust thresholds dynamically (e.g., use 1.2 and 0.9 in high-volatility periods).

Recent Trends and Noteworthy Data on the Advance-Decline Index

For recent trends, review all of 2025 for yearly context and H2 2025 for recent shifts—interpret results based on your sample criteria.

As of Q4 2025 (using market cap Top 200 excluding stablecoins), daily advance-decline ratios fluctuated mostly between 0.9–1.1, indicating “moderate fragmentation.” During hot sector cycles, single-day ratios ≥1.8 (“broad rally days”) became more frequent; during market pullbacks, ratios ≤0.7 (“broad selloff days”) also clustered.

In H2 2025, “narrative rotation” accelerated and breadth volatility widened: extreme daily ratios (highs or lows) often appeared at week’s start or around key events; sector diffusion quickened—some weeks saw both strong (≥1.6) and weak (≤0.8) breadth days.

Underlying drivers include: temporary concentration of capital with strong leadership but limited follow-through; clusters of new tokens and narratives boosting advances but lacking durability; in corrections, risk aversion triggered synchronous declines across most assets, causing sharp breadth reversals.

If you primarily trade spot, chart “annual breadth distribution” by week for 2025, marking occurrences of ≥1.5 and ≤0.8 within each week—then compare with weekly BTC and ETH trends. Heading into early 2026, continue using consistent criteria to watch for a shift from “fragmentation norm” to “breadth recovery.”

Related Terms

- Advance-Decline Index: A technical indicator measuring the difference between the number of advancing and declining assets in a market, reflecting overall trend strength.

- Technical Analysis: An approach that forecasts future price movements of crypto assets by studying historical price and volume data.

- Market Sentiment: The overall outlook and psychological expectations of investors regarding future market trends, influencing buy and sell decisions.

- Trading Volume: The total quantity of crypto assets traded during a specific period; reflects market activity and the credibility of price movements.

- Support Level: A key price threshold where buyer interest is strong enough to prevent further declines.

- Resistance Level: A critical price threshold where selling pressure is sufficient to halt further advances.

FAQ

What is the difference between the Advance-Decline Index and volume indicators?

The Advance-Decline Index tracks changes in the number of advancing or declining stocks/assets; volume indicators measure trading amounts or lots exchanged. The index reflects market breadth (how many assets are rising), while volume shows trading intensity. Used together, they provide a fuller picture—a rising index with low volume may hint at weak momentum ahead.

What does a negative Advance-Decline Index mean in crypto markets?

A negative value indicates more assets are declining than advancing—a sign of broad selling pressure. For example, during major corrections when about 70% of coins fall versus only 30% rising, the index will be sharply negative. The deeper the negative value, the more pessimistic market participants are—sometimes an opportunity for contrarian strategies but also a warning for further downside risk.

How can the Advance-Decline Index help identify market tops or bottoms?

Extreme values in the index often signal turning points. Persistently high readings while overall gains stagnate suggest waning participation—potentially marking a top; conversely, deep negative readings coupled with smaller coins ceasing to decline may indicate a bottom forming. Focus on divergences between the index and price—the greater the divergence, the likelier a reversal, though other indicators should also be consulted.

Can I view Advance-Decline Index data directly on Gate?

Gate’s trading tools typically show gain/loss rankings but do not offer a full Advance-Decline Index; professional charting platforms like TradingView or Coingecko provide more complete data. Before trading on Gate, check these platforms for index values and market breadth to reduce the risk of trading against prevailing trends.

Is the Advance-Decline Index useful during range-bound markets?

Yes—it reveals real participation during consolidations. If the index hovers mid-range, bulls and bears are balanced; if it begins trending up or down decisively, a breakout may be imminent. Compared to just watching prices, the index often provides early signals that consolidation is ending—helping you position ahead of moves.

References & Further Reading

- https://en.wikipedia.org/wiki/Advance%E2%80%93decline_line

- https://www.fidelity.com/learning-center/trading-investing/advance-decline

- https://corporatefinanceinstitute.com/resources/equities/advance-decline-line/

- https://chartschool.stockcharts.com/table-of-contents/market-indicators/advance-decline-line

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?