Gate Research: Tokenized Stocks AUM Surpasses $1 Billion | Nike Unwinds Its NFT Business Assets

Summary

- BTC and ETH remain in a consolidation phase with unconfirmed trends; capital preference has shifted toward low-volatility and mid-to-long-term narrative assets.

- Aave Horizon RWA market net deposits have surpassed $600 million, with institutional capital continuing to enter.

- Tokenized stock assets under management have exceeded $1 billion, with on-chain securities expanding rapidly.

- Nike has sold RTFKT, marking a phased liquidation of its Web3 business venture.

- Polymarket has introduced real estate prediction markets, accelerating its coverage of real-world economic variables.

- CONX, APT, and STRK will unlock approximately $25.23 million, $21.26 million, and $11.10 million in tokens respectively over the next 7 days.

Market Overview

Market Commentary

- BTC Market Update — After a brief surge and pullback on the 1-hour chart, BTC has entered a consolidation phase, finding support around $91,000. In the short term, it is attempting a recovery toward the MA5 and MA10 levels, but overall remains below the MA30, indicating a weak rebound structure. The MACD is below the zero axis, with the green bars continuously narrowing, suggesting that downward momentum is slowing. This is viewed as a technical rebound in the short term, while a trend reversal is yet to be confirmed.

- ETH Market Update — ETH’s pullback has been relatively limited, and after stabilizing around $3,150, it has been slowly rebounding. The price is gradually approaching short-term moving averages, but resistance from the MA30 still remains above. Although the MACD is in a weak zone, the momentum bars are marginally improving. In the short term, ETH is showing a consolidation and recovery pattern, with a slightly stronger structure compared to BTC. However, confirmation of direction still requires support from trading volume.

- Altcoins — Over the past week, capital has continued to flow into lower-layer and general-purpose sectors, with Layer 2, Rollup, DAG, and Storage segments posting weekly gains of approximately 13%–17%. Amid the consolidation of mainstream assets, the market is showing a stronger preference for infrastructure assets that possess long-term narratives and definitive application scenarios.

- Stablecoins — The current total market capitalization of stablecoins is $308.1 billion, with an increase of $426 million over the past week, reflecting a growth of 0.14%.

- Gas Fee — Gas fees on the Ethereum network have generally remained below 1 Gwei over the past week, with the highest hourly peak reaching 1.90 Gwei. As of January 8, the average daily Gas fee was 0.052 Gwei.

Trending Tokens

Over the past 24 hours, the crypto market has continued its corrective trend, with overall sentiment still clearly in risk-averse territory. The Fear Index has fallen to 28, showing slight recovery from previous lows but still remaining in the “Fear” zone, indicating that investor confidence has yet to return. In terms of market structure, BTC and ETH have dropped by approximately 1.1% and 2.2% respectively, continuing to be the main drag on the index. Major assets such as XRP and SOL saw declines in the 1%–3% range. Sectoral divergence remains limited, with most assets weakening in tandem, suggesting that the market is still dominated by deleveraging and wait-and-see sentiment.

ZKP zkPass (+59.74%, market cap $39.86 million)

According to data from Gate, the ZKP token is currently priced at $0.1885, having surged over 59.74% in the past 24 hours. zkPass is a privacy and identity verification protocol based on Zero-Knowledge Proofs (ZKP), with the core goal of enabling “verifiable without disclosure” identity and behavior proofs without exposing users’ original data.

This round of price increase has been primarily driven by a combination of narrative and event resonance. Firstly, multiple Twitch creators experienced account and revenue manipulation incidents despite having 2FA enabled, sparking widespread reflection on the traditional security model of “login as the endpoint.” The zkPass team and community leveraged this moment to highlight their design philosophy that “trust shouldn’t end at login,” significantly increasing public discussion. Secondly, zkPass’s native token ZKP has entered circulation, and the project’s continued engagement on topics such as ZK identity, zkTLS, and general-purpose proxy has positioned it as a representative asset in the ZK privacy and identity track. Under the influence of amplified sentiment and a relatively limited circulating supply, the token saw a rapid short-term surge.

ELF aelf (+49.25%, market cap $102 million)

According to data from Gate, the ELF token is currently priced at $0.14374, having risen over 49.25% in the past 24 hours. aelf is a high-performance modular public blockchain project that was initially focused on DeFi and multi-chain architecture, and in recent years has gradually shifted its narrative focus to DeSci and cross-chain infrastructure layers. Through a mainchain + sidechain design, aelf enhances execution efficiency and resource isolation, and has launched tools like TomorrowDAO to provide on-chain structural support for research funding management, governance, and data transparency, reinforcing its long-term positioning as a “general-purpose base-layer protocol.”

This round of ELF’s price increase has been driven by both capital movements and narrative developments. Firstly, aelf officially disclosed the allocation of 5 million ELF to eBridge for cross-chain liquidity, reinforcing expectations of asset interoperability between aelf and the Ethereum ecosystem, boosting market confidence in its cross-chain utility. Secondly, the project continues to strengthen its DeSci narrative, positioning itself as the “structural layer for decentralized science,” gaining attention amid the market’s current preference for infrastructure and mid-to-long-term application narratives.

GUN Gunz (+41.21%, market cap $13.83 million)

According to data from Gate, the GUN token is currently priced at $0.021974, having surged over 41.21% in the past 24 hours. Gunz is the gaming ecosystem token launched by Gunzilla Games, supporting the on-chain economic system of its flagship title, Off The Grid. The project is positioned at the intersection of AAA shooting games and Web3 asset mechanisms, aiming to enhance player engagement and content lifecycle through tokenized items, on-chain settlement, and programmable rules, all while maintaining gameplay quality and introducing a sustainable on-chain economic model.

This round of GUN’s price increase has been driven by both game content updates and increased exposure. Firstly, Off The Grid rolled out a major Ranked Protocol update in December, introducing ranked mode, custom servers, and multiple core system overhauls, significantly boosting player activity and community buzz. Secondly, the project has received exposure from mainstream gaming media such as Game Informer, both online and offline, reinforcing its “mainstream game” positioning and expanding its reach to non-crypto users.

Highlights Data

Net Deposits in Aave’s Horizon RWA Market Surpass $600 Million, Institutional Capital Continues to Flow In

Net deposits in Aave’s Horizon RWA market have exceeded $600 million, indicating growing capital interest in the real-world asset (RWA) sector. This growth is not a short-term fluctuation, but a steady accumulation driven by increased institutional participation and a gradually clarifying compliance framework. It reflects the market’s rising confidence in the stability of returns and controllability of risks associated with on-chain RWA products.

Structurally, the capital expansion of Horizon RWA signals that DeFi is evolving beyond high-volatility, heavily traded asset forms toward financial scenarios anchored in credit, cash flow, and real-world assets. This trend not only helps reduce DeFi’s overall sensitivity to market cycles in terms of returns, but also strengthens Aave’s strategic position as institutional-grade DeFi infrastructure—laying the groundwork for more compliant asset tokenization and scaled adoption in the future.

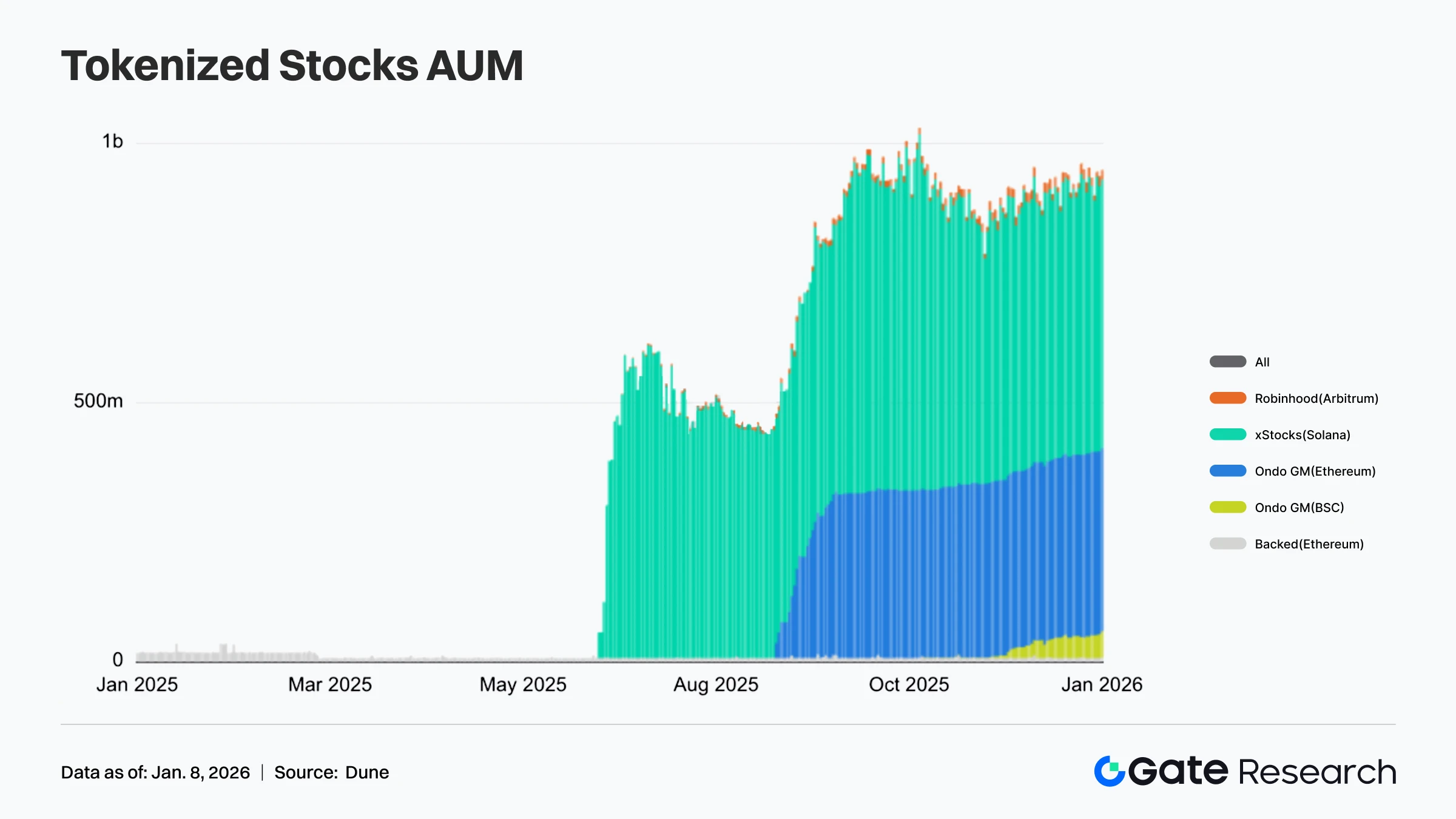

Tokenized Stock Assets Under Management Surpass $1 Billion, On-Chain Securities Accelerate Expansion

According to Dune data, the total assets under management (AUM) for tokenized stocks have surpassed $1 billion, marking the beginning of a scaled development phase for on-chain securities. In terms of time structure, this growth has not been a steady linear rise, but has notably accelerated in the second half of the year, reflecting a significant increase in market acceptance of on-chain stock products. Capital allocation is shifting from early experimental participation to more sustained and sizable investment.

Structurally, the AUM expansion has been primarily driven by leading issuance and trading platforms. A clear stratification is emerging among different blockchains and issuance models: some platforms dominate through deep liquidity and regulatory pathways, while others cater to long-tail demand via low costs or cross-chain advantages. This shift indicates that tokenized stocks are transitioning from the “proof-of-concept” phase to a stage of “product competition.” Future growth will hinge on the feasibility of regulation, transparency in underlying asset custody, and whether secondary market liquidity can consistently meet the demands of institutional capital.

Barclays Makes First Bet on Stablecoin Infrastructure, Signaling Traditional Banking Entry

Banking giant Barclays, with approximately $2.2 trillion in assets under management, has made its first investment in the stablecoin sector by backing infrastructure project Ubyx. This move signals a shift among major traditional banks from cautious observation to active capital deployment. Stablecoins are no longer viewed merely as payment tools within the crypto market but are gradually entering the long-term strategic evaluation frameworks of mainstream financial institutions.

Strategically, this investment leans more toward an “infrastructure bet” rather than a single stablecoin issuance model. Ubyx focuses on institutional-level clearing, settlement, and system integration capabilities for stablecoins—aligning with banks’ core requirements around compliance, risk control, and scalability. This development highlights how stablecoins are evolving from fringe innovation into a critical connective layer within the financial system. Going forward, they may play an increasingly structural role in cross-border payments, corporate treasury management, and on-chain settlement networks.

Weekly Focus

Web3 Dream Shattered: Nike Quietly Sells Off RTFKT

Nike has quietly completed the sale of its digital product subsidiary RTFKT, with the transaction taking effect on December 16, 2025—though it was only recently disclosed by the media. The identity of the buyer and specific terms of the deal have not been made public. RTFKT was acquired by Nike during the peak of the NFT boom in 2021, focusing on virtual sneakers, digital collectibles, and NFT creation. It once attracted significant attention in the metaverse and blockchain fashion space. However, starting in late 2024, Nike began gradually pulling out of the sector—first announcing a pause in NFT production, ending its Web3 services, and officially shutting down RTFKT operations in January 2025.

This sale also marks Nike’s strategic shift under CEO Elliott Hill, moving further away from the aggressive digital and direct-to-consumer strategies pursued under former CEO John Donahoe. Instead, Nike is refocusing on its core sports business and rebuilding wholesale channels. The broader slump in the NFT market has also accelerated this exit.

Polymarket Teams Up with Parcl to Launch Real Estate Prediction Era

Polymarket has officially partnered with Solana-based real estate platform Parcl this week to launch a real estate prediction market powered by the Parcl Index. This marks the first time a prediction market platform has deeply integrated real-time residential real estate data into an on-chain trading system. As the world’s largest prediction market, Polymarket will manage the listing, operation, and trading interface of these markets, while Parcl provides a daily housing price index—based on aggregated public records, tax assessments, and listing services—to serve as an objective and transparent settlement benchmark.

The initial markets will focus on high-liquidity major cities such as New York, San Francisco, Miami, and Austin. Users can bet on events like whether the housing price index will rise or fall within a month, quarter, or year, or whether it will cross specific thresholds. Each market is linked to a dedicated Parcl resolution page, displaying final settlement values, historical index trends, and calculation methodologies—ensuring a fully transparent, auditable, and dispute-free process.

Solana’s Official 2025 Recap: A Year of Revenue, Assets, and Transactions

Solana released its 2025 annual data report this week, framing the year as one of “Revenue, Assets, and Transactions.” Total ecosystem application revenue reached $2.39 billion—up 46% year-over-year and marking an all-time high. Seven applications generated over $100 million in revenue, including leading projects like Pump.fun, Meteora, Raydium, and Jupiter. At the network level, Real Economic Value (REV) reached $1.4 billion, with an average of 3.2 million daily active wallets (a 50% year-over-year increase), average transaction fees dropped to $0.017, and total non-vote transactions hit 33 billion—highlighting Solana’s continued optimization in high throughput and low cost.

On the asset side, stablecoin supply grew to $14.8 billion, doubling year-over-year. Total stablecoin transfer volume reached $11.7 trillion—a 7x increase over two years. The year also marked the first introduction of on-chain stock assets. DEX trading volume surged to $1.5 trillion for the year, up 57% year-over-year, with SOL accounting for 42% of trading pairs. Several DEX platforms like Raydium and Orca each processed over $100 billion in volume, while DEX aggregators handled $922 billion.

Funding Weekly Recap

According to data from RootData, between January 2 and January 8, 2026, a total of 9 crypto and related projects announced completed funding rounds or acquisitions, covering sectors such as AI, RWA, BTCFi, and infrastructure. Below is a brief overview of the top-funded projects this week:

Tres.finance

On January 7, it was announced that Tres Finance had been acquired by Fireblocks for $130 million.

Tres Finance is an enterprise-grade financial management and accounting platform focused on the Web3 space. It primarily serves companies, institutions, protocols, and DAOs handling digital assets such as cryptocurrencies, DeFi, and staking. The platform enables automated accounting, treasury management, compliance reporting, and auditing.

Its AI-driven tool suite helps users achieve full financial compliance for digital asset operations: it aggregates and cleans on-chain data from over 220 blockchains, exchanges, custodians, and DeFi protocols, transforming it into structured financial information. The platform supports transaction categorization, cost basis calculation, real-time valuation, revaluation, impairment handling, and multi-source reconciliation—ultimately producing journal entries and complete audit trails compliant with regulatory standards such as GAAP and IFRS.

Babylon

On January 7, Babylon announced the completion of a $15 million funding round, led by a16z.

Babylon Protocol is the first decentralized infrastructure to enable native BTC staking. It allows BTC holders to directly lock their BTC on the Bitcoin chain using time-locked Taproot outputs and delegate it to Finality Providers, who help secure PoS chains. In return, users earn rewards such as BABY tokens, all while maintaining full self-custody and efficient unbonding capabilities.

HabitTrade

On January 6, HabitTrade announced the completion of a nearly $10 million funding round, led by Newborn Town.

HabitTrade is a compliant multi-asset trading platform that allows users to invest in global assets—such as stocks, options, ETFs, and cryptocurrencies—across multiple regions using stablecoins or cryptocurrencies in a single click. By leveraging open-source infrastructure like Stove Protocol, the platform offers 1:1 on-chain tokenized representations of real stocks and provides settlement, custody, API access, and institutional-grade services—bridging the gap between TradFi and Web3.

Next Week to Watch

Token Unlocks

According to data from Tokenomist, several major token unlocks are set to take place over the next 7 days (January 9–15, 2026). The top three are as follows:

- CONX will unlock tokens worth approximately $25.23 million, accounting for 82.4% of its circulating supply.

- APT will unlock tokens worth approximately $21.26 million, accounting for 1.5% of its circulating supply.

- STRK will unlock tokens worth approximately $11.10 million, accounting for 2.5% of its circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- CoinGecko, https://www.coingecko.com/en/categories

- DefiLlama, https://defillama.com/stablecoins

- Etherscan, https://etherscan.io/gastracker

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

- X, https://x.com/Cointelegraph/status/2008947006626992400?s=20

- Dune, https://dune.com/gateresearch/stocks

- X, https://x.com/Cointelegraph/status/2008856277380698308?s=20

- X, https://x.com/solana/status/2008536556475478349?s=20

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025