TopCryptoNews

Últimas Notícias | Análise Técnica | Sinais | Web3 | Anunciar | Principais Notícias no Mundo Cripto | Projetos | Oferta de Negócios | topcrypton.com

Fixar

TopCryptoNews

📉 Porque é que o Mercado de Criptomoedas Está em Baixa Hoje?

O valor total de mercado de criptomoedas (TOTAL) e o Bitcoin ($BTC ) começaram a quinta-feira com uma tendência de baixa, e o impacto do mesmo estendeu-se às altcoins.

🔸 A Capitalização Total do Mercado de Criptomoedas Cai

O valor total de mercado de criptomoedas caiu $44 bilhões e agora situa-se em $2,95 trilhões no momento da escrita. Apesar da queda, a estrutura do mercado mostra sinais iniciais de estabilização. A pressão de venda diminuiu após um fim de semana de tendência de baixa, permitindo que os ativos digitais tentem um

O valor total de mercado de criptomoedas (TOTAL) e o Bitcoin ($BTC ) começaram a quinta-feira com uma tendência de baixa, e o impacto do mesmo estendeu-se às altcoins.

🔸 A Capitalização Total do Mercado de Criptomoedas Cai

O valor total de mercado de criptomoedas caiu $44 bilhões e agora situa-se em $2,95 trilhões no momento da escrita. Apesar da queda, a estrutura do mercado mostra sinais iniciais de estabilização. A pressão de venda diminuiu após um fim de semana de tendência de baixa, permitindo que os ativos digitais tentem um

BTC-2,39%

- Recompensa

- 32

- 28

- 1

- Partilhar

GateUser-87084a1b :

:

hVer mais

- Recompensa

- 1

- 2

- Republicar

- Partilhar

Vortex_King :

:

GOGOGO 2026 👊Ver mais

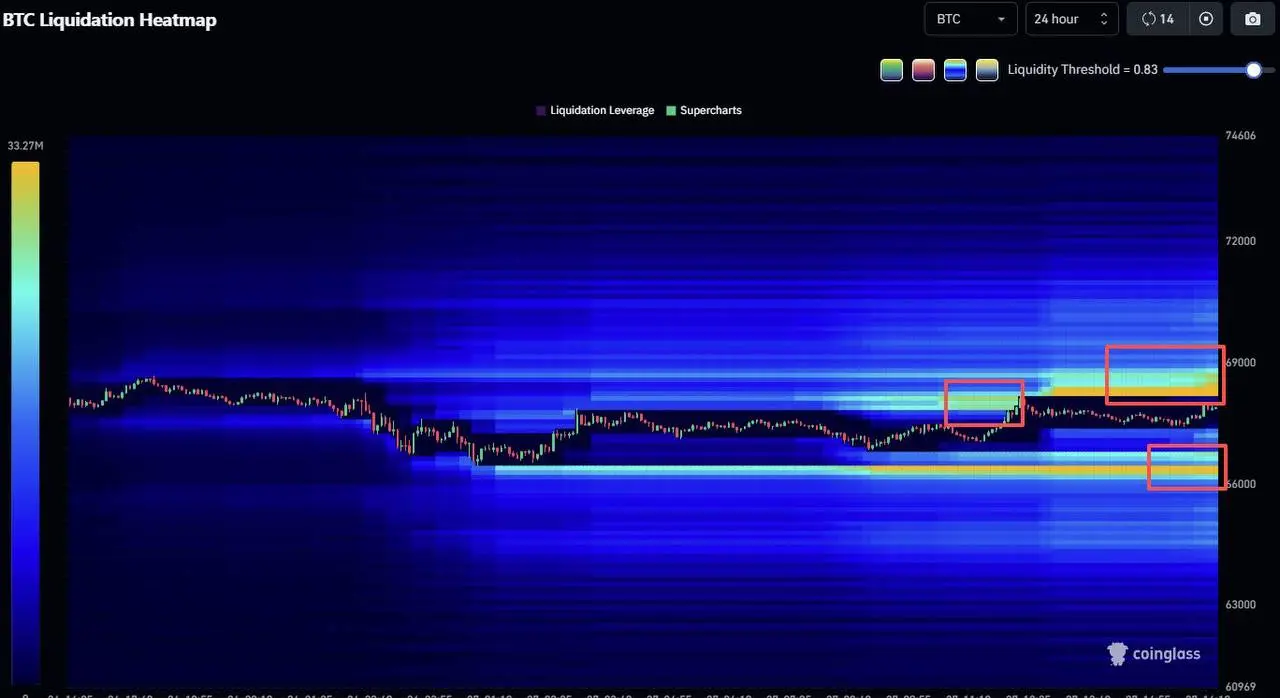

🤑 Mapa de Liquidez do Bitcoin (24 horas)

Os principais clusters de liquidez formam-se nos níveis:

🔼 $69.000 - uma zona de forte liquidação de posições curtas

🔽 $66.000 - um cluster denso de liquidação de posições longas

Atualmente, o preço está comprimido entre dois ímanes.

Assim que um lado for ultrapassado, é provável que ocorra uma reação em cadeia de grandes liquidações.

#BTC | #Bitcoin

Os principais clusters de liquidez formam-se nos níveis:

🔼 $69.000 - uma zona de forte liquidação de posições curtas

🔽 $66.000 - um cluster denso de liquidação de posições longas

Atualmente, o preço está comprimido entre dois ímanes.

Assim que um lado for ultrapassado, é provável que ocorra uma reação em cadeia de grandes liquidações.

#BTC | #Bitcoin

BTC-2,39%

- Recompensa

- 1

- 2

- Republicar

- Partilhar

Vortex_King :

:

GOGOGO 2026 👊Ver mais

🔵 Análise de Preço Cardano: ADA Está a Preparar-se para uma Quebra Acima de $0.29?

A Cardano apresenta sinais iniciais de reversão à medida que o SAR passa a ser bullish e o financiamento torna-se positivo, indicando um aumento do momentum de alta.

A Cardano ( $ADA ) está atualmente a negociar a $0.2926, uma queda de 0.4% nas últimas 24 horas, enquanto a ação do preço continua a consolidar-se dentro de uma faixa intradiária estreita. Apesar da pausa de curto prazo, o momentum mais amplo permanece misto.

A ADA ganhou 7.4% na última semana e 12.6% nos últimos 14 dias, sinalizando uma melhoria

A Cardano apresenta sinais iniciais de reversão à medida que o SAR passa a ser bullish e o financiamento torna-se positivo, indicando um aumento do momentum de alta.

A Cardano ( $ADA ) está atualmente a negociar a $0.2926, uma queda de 0.4% nas últimas 24 horas, enquanto a ação do preço continua a consolidar-se dentro de uma faixa intradiária estreita. Apesar da pausa de curto prazo, o momentum mais amplo permanece misto.

A ADA ganhou 7.4% na última semana e 12.6% nos últimos 14 dias, sinalizando uma melhoria

ADA-2,8%

- Recompensa

- 1

- 2

- Republicar

- Partilhar

Vortex_King :

:

GOGOGO 2026 👊Ver mais

🤔 Aptos olha $1 novamente: A atualização do Decibel pode sustentar a recuperação do APT?

À medida que os planos para atualizar a blockchain Aptos [APT] continuam, a altcoin superou o mercado total de criptomoedas com ganhos diários de 13%, no momento da publicação. Este aumento resultou na recuperação do preço do APT ao nível $1 , mas desde então caiu abaixo dele.

É importante notar que este pico tanto no preço quanto no volume foi comum em todo o mercado de altcoins. No entanto, foram aquelas altcoins que tinham apoio real por trás delas que prosperaram.

🔸 Os indicadores sinalizam possível

À medida que os planos para atualizar a blockchain Aptos [APT] continuam, a altcoin superou o mercado total de criptomoedas com ganhos diários de 13%, no momento da publicação. Este aumento resultou na recuperação do preço do APT ao nível $1 , mas desde então caiu abaixo dele.

É importante notar que este pico tanto no preço quanto no volume foi comum em todo o mercado de altcoins. No entanto, foram aquelas altcoins que tinham apoio real por trás delas que prosperaram.

🔸 Os indicadores sinalizam possível

APT-0,32%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

🤔 Aptos olha $1 novamente: A atualização do Decibel pode sustentar a recuperação do APT?

À medida que os planos para atualizar a blockchain Aptos [APT] continuam, a altcoin superou o mercado total de criptomoedas com ganhos diários de 13%, no momento da publicação. Este aumento resultou na recuperação do preço do APT ao nível $1 , mas desde então caiu abaixo dele.

É importante notar que este pico tanto no preço quanto no volume foi comum em todo o mercado de altcoins. No entanto, foram aquelas altcoins que tinham apoio real por trás delas que prosperaram.

🔸 Indicadores sinalizam possível mud

À medida que os planos para atualizar a blockchain Aptos [APT] continuam, a altcoin superou o mercado total de criptomoedas com ganhos diários de 13%, no momento da publicação. Este aumento resultou na recuperação do preço do APT ao nível $1 , mas desde então caiu abaixo dele.

É importante notar que este pico tanto no preço quanto no volume foi comum em todo o mercado de altcoins. No entanto, foram aquelas altcoins que tinham apoio real por trás delas que prosperaram.

🔸 Indicadores sinalizam possível mud

APT-0,32%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

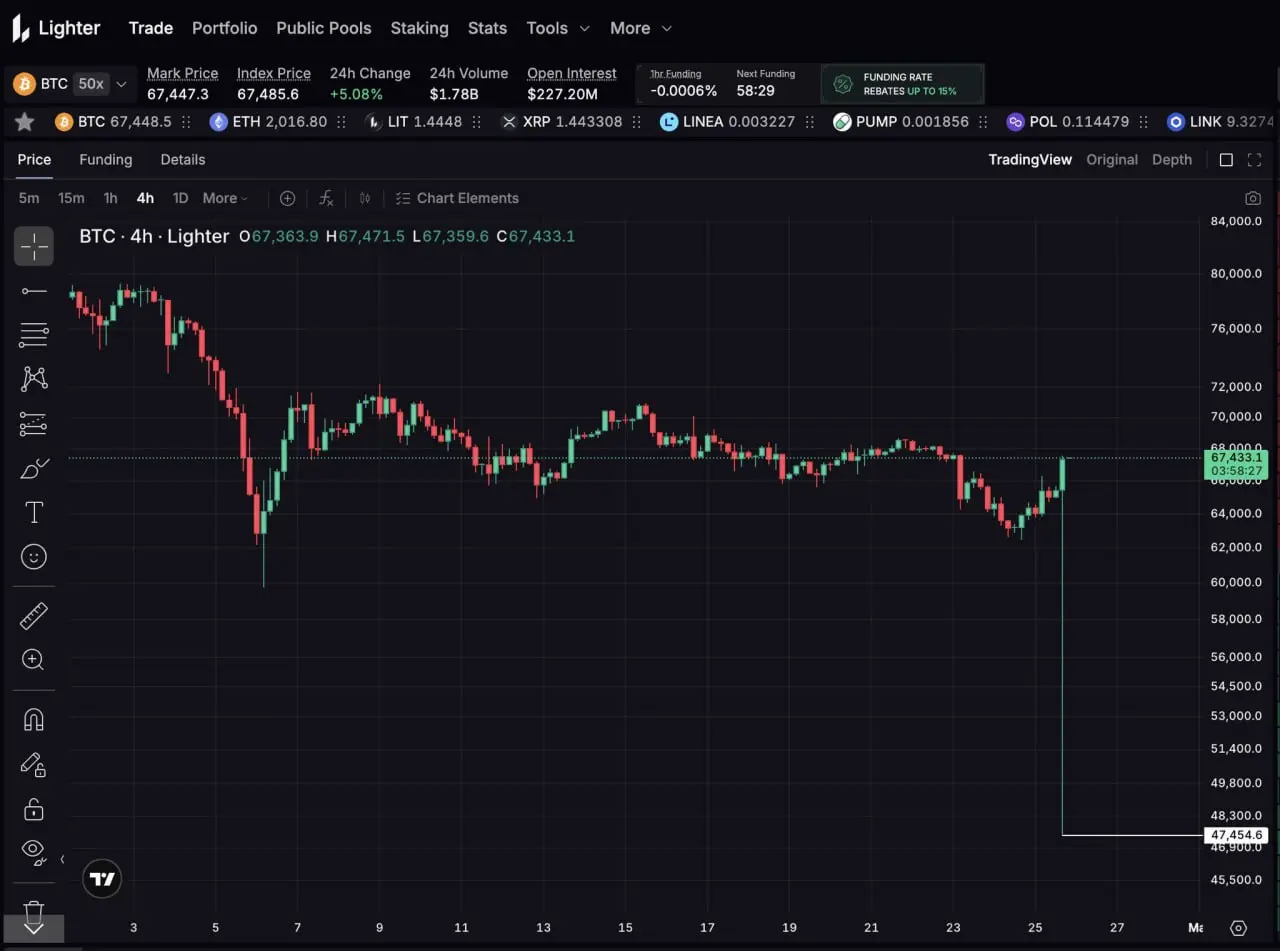

😳 $BTC on Lighter ligeiramente caiu

Enquanto o Bitcoin se aproxima dos $70k, perdeu a oportunidade de comprar nos mínimos novamente, pois no gráfico da plataforma Lighter o preço do BTC caiu para $47k.

⚙️ Na verdade, nada de crítico aconteceu — alguém apenas colocou uma ordem de 1000 BTC, o que acionou a quebra de todas as ordens limite disponíveis, após o que o preço voltou rapidamente ao normal. Não houve liquidações.

No entanto, isso afetou o token da plataforma LIT, que corrigiu um pouco. Talvez a baleia tenha decidido formar uma posição desta forma? 🙄

#BTC | #Bitcoin

{spot}(BTCUSDT)

Ver originalEnquanto o Bitcoin se aproxima dos $70k, perdeu a oportunidade de comprar nos mínimos novamente, pois no gráfico da plataforma Lighter o preço do BTC caiu para $47k.

⚙️ Na verdade, nada de crítico aconteceu — alguém apenas colocou uma ordem de 1000 BTC, o que acionou a quebra de todas as ordens limite disponíveis, após o que o preço voltou rapidamente ao normal. Não houve liquidações.

No entanto, isso afetou o token da plataforma LIT, que corrigiu um pouco. Talvez a baleia tenha decidido formar uma posição desta forma? 🙄

#BTC | #Bitcoin

{spot}(BTCUSDT)

- Recompensa

- 2

- Comentar

- Republicar

- Partilhar

😳 $BTC no Lighter caiu ligeiramente

Enquanto o Bitcoin se aproxima dos 70 mil dólares, você perdeu a oportunidade de comprar na baixa novamente, pois no gráfico da plataforma Lighter o preço do BTC caiu para 47 mil dólares.

⚙️ Na verdade, nada de crítico aconteceu — alguém apenas colocou uma ordem de 1000 BTC, o que acionou a quebra de todas as ordens limite disponíveis, após o que o preço voltou rapidamente ao normal. Não houve liquidações.

No entanto, isso afetou o token da plataforma LIT, que corrigiu um pouco. Talvez a baleia tenha decidido formar uma posição dessa forma? 🙄

Enquanto o Bitcoin se aproxima dos 70 mil dólares, você perdeu a oportunidade de comprar na baixa novamente, pois no gráfico da plataforma Lighter o preço do BTC caiu para 47 mil dólares.

⚙️ Na verdade, nada de crítico aconteceu — alguém apenas colocou uma ordem de 1000 BTC, o que acionou a quebra de todas as ordens limite disponíveis, após o que o preço voltou rapidamente ao normal. Não houve liquidações.

No entanto, isso afetou o token da plataforma LIT, que corrigiu um pouco. Talvez a baleia tenha decidido formar uma posição dessa forma? 🙄

BTC-2,39%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

- Recompensa

- 1

- Comentar

- Republicar

- Partilhar

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

🪙 $XRP Vai Fazer Muitas Pessoas Ricas em 2026: Analista

O otimismo em torno do XRP está a crescer novamente após meses de fraqueza no preço.

Curiosamente, um comentador de mercado está a prever audaciosamente que 2026 poderá ser o ano em que o ativo transforme detentores de longo prazo em milionários.

Especificamente, o comentador do XRP Archie gerou debate no X após publicar um gráfico que prevê que o XRP “vai fazer muitas pessoas ficarem ricas em 2026.”

🔸 XRP de Quatro Dígitos?

Notavelmente, o gráfico partilhado projeta o XRP a atingir até $83. Da sua posição atual de $1,38, isto represen

O otimismo em torno do XRP está a crescer novamente após meses de fraqueza no preço.

Curiosamente, um comentador de mercado está a prever audaciosamente que 2026 poderá ser o ano em que o ativo transforme detentores de longo prazo em milionários.

Especificamente, o comentador do XRP Archie gerou debate no X após publicar um gráfico que prevê que o XRP “vai fazer muitas pessoas ficarem ricas em 2026.”

🔸 XRP de Quatro Dígitos?

Notavelmente, o gráfico partilhado projeta o XRP a atingir até $83. Da sua posição atual de $1,38, isto represen

XRP-4,86%

- Recompensa

- 2

- 3

- Republicar

- Partilhar

ybaser :

:

Obrigado pelas informações úteis 🙂Ver mais

🐋 Grandes Baleias e Tubarões Cardano Adicionam 819.400.000 ADA em 6 Meses Apesar da Queda de Preço

As baleias e tubarões de Cardano estão comprando enquanto outros entram em pânico, aproveitando os preços descontados durante a queda para acumular mais tokens ADA.

🔸 Baleias de Cardano Carregam em ADA

O sentimento do mercado atingiu níveis extremos de medo à medida que os preços despencaram. A liquidez foi reduzida, as atividades dos utilizadores desaceleraram, mas as baleias de Cardano permaneceram firmes. Segundo dados da Santiment, elas estavam ocupadas a comprar na baixa.

Numa publicação r

As baleias e tubarões de Cardano estão comprando enquanto outros entram em pânico, aproveitando os preços descontados durante a queda para acumular mais tokens ADA.

🔸 Baleias de Cardano Carregam em ADA

O sentimento do mercado atingiu níveis extremos de medo à medida que os preços despencaram. A liquidez foi reduzida, as atividades dos utilizadores desaceleraram, mas as baleias de Cardano permaneceram firmes. Segundo dados da Santiment, elas estavam ocupadas a comprar na baixa.

Numa publicação r

ADA-2,8%

- Recompensa

- 2

- Comentar

- Republicar

- Partilhar

🔵 Fundação Ethereum Começa a Staking de Parte do Tesouro de Ether Apesar da Venda de ETH por Buterin

A Fundação Ethereum começou a fazer staking de parte das suas holdings de ether. Em 24 de fevereiro, a organização sem fins lucrativos anunciou um depósito inicial de 2.016 ETH ( avaliado em cerca de 3,8 milhões de dólares). Com o tempo, a Fundação planeja fazer staking de aproximadamente 70.000 ETH — avaliado em cerca de $127 milhões — através de staking solo. As recompensas nativas em ETH resultantes serão canalizadas para o tesouro da organização para apoiar iniciativas futuras.

“Ao partici

A Fundação Ethereum começou a fazer staking de parte das suas holdings de ether. Em 24 de fevereiro, a organização sem fins lucrativos anunciou um depósito inicial de 2.016 ETH ( avaliado em cerca de 3,8 milhões de dólares). Com o tempo, a Fundação planeja fazer staking de aproximadamente 70.000 ETH — avaliado em cerca de $127 milhões — através de staking solo. As recompensas nativas em ETH resultantes serão canalizadas para o tesouro da organização para apoiar iniciativas futuras.

“Ao partici

ETH-4,99%

- Recompensa

- 2

- Comentar

- Republicar

- Partilhar

🥏 $AAVE Crise de Governação: Controvérsia de Fundo de 50M$

A disputa de governação no ecossistema Aave (AAVE) $117,11 intensificou-se com dois relatórios opostos antes da votação do pacote de financiamento de $50 milhões para Aave Labs. Marc Zeller, fundador da iniciativa Aave Chan (ACI), publicou um relatório de transparência analisando o financiamento histórico do Aave Labs e argumentou que as subvenções DAO devem ser avaliadas usando uma estrutura de retorno-impacto. Há poucas horas, o Aave Labs partilhou um relatório de contribuições destacando seu papel no desenvolvimento do protocolo de

A disputa de governação no ecossistema Aave (AAVE) $117,11 intensificou-se com dois relatórios opostos antes da votação do pacote de financiamento de $50 milhões para Aave Labs. Marc Zeller, fundador da iniciativa Aave Chan (ACI), publicou um relatório de transparência analisando o financiamento histórico do Aave Labs e argumentou que as subvenções DAO devem ser avaliadas usando uma estrutura de retorno-impacto. Há poucas horas, o Aave Labs partilhou um relatório de contribuições destacando seu papel no desenvolvimento do protocolo de

AAVE1,91%

- Recompensa

- 1

- 1

- Republicar

- Partilhar

ybaser :

:

Boa sorte e prosperidade 🧧- Recompensa

- 2

- Comentar

- Republicar

- Partilhar

🟠 Bitcoin (BTC) Explosão de Dubai! O maior banco do país revela plano massivo de Bitcoin!

O banco estatal com sede em Dubai, Emirates NBD, anunciou que está considerando adicionar Bitcoin ($BTC) ao seu portefólio.

Apesar das quedas acentuadas no preço do Bitcoin, a sua adoção continua a crescer. A última notícia vem de Dubai.

Participando no programa Squawk Box da CNBC, o Diretor de Investimentos do grupo Emirates NBD, (CIO) Maurice Gravier, descreveu o Bitcoin como uma reserva de valor e afirmou que o banco está a considerar alocar uma participação potencial de 1% no ativo no seu portefólio.

O banco estatal com sede em Dubai, Emirates NBD, anunciou que está considerando adicionar Bitcoin ($BTC) ao seu portefólio.

Apesar das quedas acentuadas no preço do Bitcoin, a sua adoção continua a crescer. A última notícia vem de Dubai.

Participando no programa Squawk Box da CNBC, o Diretor de Investimentos do grupo Emirates NBD, (CIO) Maurice Gravier, descreveu o Bitcoin como uma reserva de valor e afirmou que o banco está a considerar alocar uma participação potencial de 1% no ativo no seu portefólio.

BTC-2,39%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

🗣️ A estratégia da Saylor registou mais de $9B de prejuízo à medida que o Bitcoin cai em direção a $63K

A estratégia, maior detentora corporativa de Bitcoin, enfrenta perdas não realizadas superiores a $9 bilhões na sua tesouraria de ativos digitais, à medida que o principal ativo cripto caiu abaixo de $74.000 numa venda generalizada do mercado.

A empresa detém 717.722 $BTC comprados por cerca de $54,5 mil milhões a um custo médio de aproximadamente $76.000 por moeda. Com o Bitcoin a ser negociado a cerca de $63.100 nas primeiras horas de Nova Iorque hoje, o valor de mercado da carteira ca

A estratégia, maior detentora corporativa de Bitcoin, enfrenta perdas não realizadas superiores a $9 bilhões na sua tesouraria de ativos digitais, à medida que o principal ativo cripto caiu abaixo de $74.000 numa venda generalizada do mercado.

A empresa detém 717.722 $BTC comprados por cerca de $54,5 mil milhões a um custo médio de aproximadamente $76.000 por moeda. Com o Bitcoin a ser negociado a cerca de $63.100 nas primeiras horas de Nova Iorque hoje, o valor de mercado da carteira ca

BTC-2,39%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

🔷 Analista Prediz o Fundo do Preço do Ethereum Com Um Caminho Marcado Para os $600

Apesar de o preço do Ethereum parecer estar estabilizando abaixo de $2.000, a desaceleração na queda não fez nada para aliviar os temores de que mais declínio está por vir. Na verdade, os analistas acreditam que essa pausa é apenas temporária e que a segunda maior criptomoeda por capitalização de mercado fará outra grande queda em breve. Isso se deve ao desempenho passado, onde o preço do Ethereum frequentemente passou por um grande reset antes de eventualmente atingir um possível fundo.

🔸 O Cenário Que Diz Qu

Apesar de o preço do Ethereum parecer estar estabilizando abaixo de $2.000, a desaceleração na queda não fez nada para aliviar os temores de que mais declínio está por vir. Na verdade, os analistas acreditam que essa pausa é apenas temporária e que a segunda maior criptomoeda por capitalização de mercado fará outra grande queda em breve. Isso se deve ao desempenho passado, onde o preço do Ethereum frequentemente passou por um grande reset antes de eventualmente atingir um possível fundo.

🔸 O Cenário Que Diz Qu

ETH-4,99%

- Recompensa

- 2

- Comentar

- Republicar

- Partilhar