what is the price of BTC

What Is Bitcoin?

Bitcoin is a decentralized digital currency that is not issued or controlled by any bank or corporation. It operates on a blockchain—an open, chronological ledger that records all transactions. The network uses peer-to-peer (P2P) transmission to propagate transactions and blocks, allowing anyone to participate and validate activity without third-party intermediaries.

Bitcoin relies on Proof of Work (PoW) as its consensus mechanism. Miners compete using computational power to package transactions and generate new blocks; the successful miner receives newly minted bitcoins and transaction fees as a reward. With a maximum supply capped at 21 million coins, Bitcoin is inherently scarce, making it popular for cross-border payments and as a long-term store of value.

What Are Bitcoin’s (BTC) Current Price, Market Cap, and Circulating Supply?

As of January 9, 2026 (source: input data), Bitcoin’s latest price is approximately $90,939.60. Its market capitalization stands at $1,816,373,006,640. Market cap is calculated as “price × circulating supply” and serves as a metric for overall size and relative ranking.

The circulating supply is 19,973,353 BTC, with a total supply of 19,973,400 BTC and a hard cap of 21,000,000 BTC. The maximum supply is an absolute limit set by protocol and cannot be arbitrarily changed. The fully diluted market cap is $1,816,373,006,640, representing the market value if all coins were in circulation.

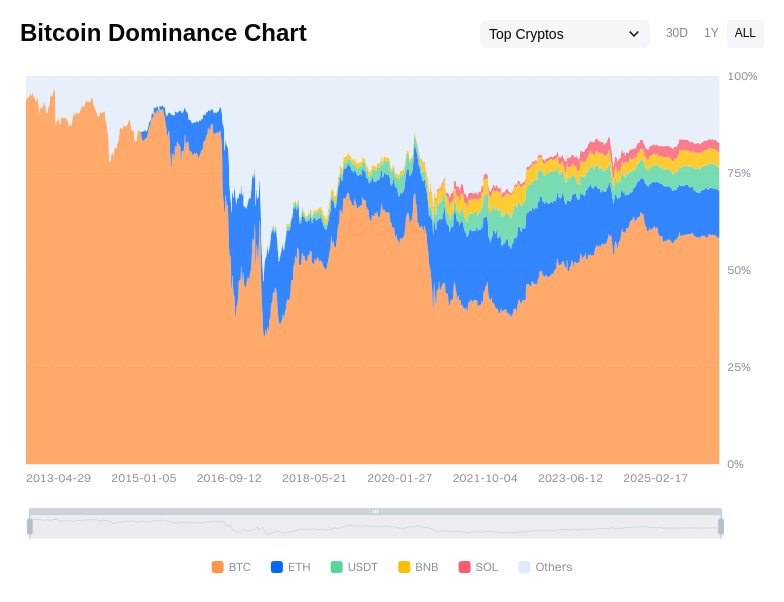

Bitcoin’s market dominance is about 55.82%, reflecting its share of the total crypto market capitalization.

Click to view Top Crypto Market Share

The 24-hour trading volume is approximately $932,481,337.87—an indicator of daily trading activity. Short-term price changes: 1 hour -0.20%, 24 hours +0.50%, 7 days +2.25%, 30 days -1.91%.

Click to view BTC USDT Price

Figures may fluctuate with the market; always refer to Gate’s real-time quotes for up-to-date information.

Who Created Bitcoin (BTC) and When?

Bitcoin was proposed by the pseudonymous Satoshi Nakamoto, who published the whitepaper in 2008 outlining an electronic cash system without trusted third parties. In 2009, the genesis block—the first block—was mined, officially launching the network. The genesis block marks the starting point of the chain; subsequent blocks are appended in order to create a complete ledger.

Early milestones include the famous “Bitcoin pizza” transaction in 2010, demonstrating its viability as a payment tool. Since then, the network has evolved with more participants and a growing ecosystem. Bitcoin incorporates a “halving” mechanism: about every four years, block rewards are halved, slowing new issuance and reinforcing scarcity.

How Does Bitcoin (BTC) Work?

Bitcoin transactions are initiated by users with their private key and confirmed via digital signatures. The private key is the critical secret for controlling assets; the public key and address are used for receiving funds and public identification. Once a transaction is included in a block and more blocks are added on top, its confirmation count rises, making reversal increasingly difficult.

Proof of Work requires miners to perform extensive computations; the first to find a block hash that meets the difficulty target wins and broadcasts the new block. Difficulty adjusts every 2,016 blocks based on total network hash power to maintain an average block time of roughly 10 minutes. Hash rate measures total computational power securing the network—the higher it is, the greater the cost to attack and the stronger the security.

Bitcoin uses the UTXO model (Unspent Transaction Output). Each UTXO represents spendable balance; when making payments, users select UTXOs as inputs and generate new outputs for recipient and change addresses. Transaction fees are set by users within each transaction; miners prefer to include transactions with higher fees.

What Can You Do With Bitcoin (BTC)?

Bitcoin enables global value transfer and payments without geographic restrictions—ideal for cross-border remittances and P2P settlements. Its fixed supply and predictable issuance make it akin to “digital gold,” suitable for long-term value storage and portfolio diversification.

For micropayments and fast transfers, the community is exploring the Lightning Network. This second-layer scaling solution built on Bitcoin uses payment channels to enable lower fees and faster confirmations—perfect for high-frequency or small-value transactions.

What Are the Main Risks and Regulatory Considerations for Bitcoin (BTC)?

Price volatility is the primary risk; Bitcoin can experience significant short-term swings, so it’s important to manage your investments according to your risk tolerance. Loss or exposure of your private key can result in unrecoverable loss of assets; always securely back up your recovery phrases and avoid entering them in insecure environments.

Network congestion may occur, leading to higher fees and longer confirmation times. There is a theoretical risk of a 51% attack—if a single entity controls most hash power, it could reorganize blocks or double-spend; however, rising hash rate and decentralization make such attacks costly.

From a compliance standpoint, regulations and tax requirements for crypto assets vary by country and region. KYC (identity verification) and anti-money laundering rules are commonly enforced during trading or withdrawals. Holding or trading Bitcoin may incur tax obligations; always familiarize yourself with local laws and report accordingly.

What Is the Long-Term Value Proposition of Bitcoin (BTC)?

Bitcoin’s long-term value stems from its verifiable scarcity (21 million cap), transparent issuance mechanism (halving cycles), and robust security (high hash rate and wide node distribution). It offers cross-border settlement resistant to censorship—enabling global value transfer without unified clearing institutions.

Network effects are crucial: as more holders, developers, and merchants join the ecosystem, liquidity, tools, and applications improve, lowering friction and cost while attracting further participation. Bitcoin’s narrative centers on being a store of value and settlement layer—clear positioning that supports its role in macro strategies and multi-asset portfolios.

How Do I Buy and Safely Store Bitcoin (BTC) on Gate?

Step 1: Register a Gate account and complete identity verification. Visit the official website and follow prompts to submit your documents for KYC to meet security and compliance standards.

Step 2: Prepare funds. Deposit fiat currency or transfer crypto from your personal wallet; confirm your balance and network options on your account assets page. Once deposited, assets will appear in your available balance.

Step 3: Search for BTC markets and select a trading pair such as BTC/USDT. Review price, order book depth, and volume on the quote page; enter the trading interface as needed.

Step 4: Place your order. Market orders execute immediately at current prices—ideal for quick buys; limit orders let you set your target price for pending execution—suitable if you have specific price goals. After placing an order, check order status and positions on your orders and assets pages.

Step 5: Store securely. For short-term holding, you can keep BTC in your exchange account with enhanced security settings such as two-factor authentication (2FA) and anti-phishing codes. For long-term storage, consider transferring to your personal wallet: hot wallets are convenient but riskier due to internet connectivity; cold wallets (hardware wallets) offer higher security but require careful handling. Always back up recovery phrases offline, test transfers with small amounts first, choose the Bitcoin mainnet for withdrawals, and carefully verify addresses and fees.

Step 6: Ongoing management. Monitor prices and on-chain fees; plan dollar-cost averaging or staged buying strategies as needed. Avoid storing private keys or recovery phrases in cloud services or screenshots; periodically review your security settings.

How Is Bitcoin (BTC) Different from Ethereum (ETH)?

Purpose & Use Case: Bitcoin focuses on being a store of value and settlement layer; Ethereum prioritizes programmable smart contract functionality powering DeFi, NFTs, and more.

Supply & Monetary Policy: Bitcoin has a fixed supply of 21 million coins with halving events reducing issuance rate; Ethereum has no hard cap but uses base fee burning (destruction) alongside Proof of Stake to influence net issuance.

Consensus Mechanism: Bitcoin uses Proof of Work—security anchored by hash power; Ethereum employs Proof of Stake (PoS), with validators staking tokens to validate blocks—lower energy consumption but distinct security models and incentives.

Fees & Scaling: Bitcoin’s mainnet prioritizes stability and security; Lightning Network supports high-frequency micro-payments. Ethereum’s mainnet fees fluctuate with congestion, focusing on scaling smart contract throughput via layer-2 networks and rollups.

Summary of Bitcoin (BTC)

Bitcoin is a decentralized network with predictable supply limits whose security grows as global hash power increases. Current price, market cap, and dominance highlight its central role in the crypto ecosystem. Its technical design features Proof of Work consensus and a public ledger; use cases center on cross-border settlement and long-term wealth preservation. Long-term value derives from scarcity, network effects, and reliable issuance rules. Key risks include price volatility, private key management challenges, network congestion, plus regulatory compliance and taxation concerns. To buy Bitcoin on Gate: complete verification, place orders strategically, then store assets using secure wallet solutions for long-term safekeeping. Beginners should focus on security and compliance first—participate gradually within risk limits while staying informed about blockchain developments and market trends.

FAQ

Why Is Bitcoin’s Price So Volatile? How Should Beginners Interpret It?

Bitcoin’s price fluctuates sharply due to constantly shifting supply-demand dynamics and changing market sentiment.

Click to view BTC Fear & Greed Index

Beginners can view Bitcoin as a commodity with fixed supply (total 21 million coins), while demand fluctuates due to market interest, policy changes, institutional involvement, etc., driving price movements up or down. Focus on long-term trends rather than short-term swings—don’t let short-term volatility discourage you.

Why Are Bitcoin Prices Different Across Exchanges at the Same Time?

Because each exchange has distinct supply-demand dynamics and trading liquidity levels. As a global platform, Gate’s exchange rates, order book depth, and user base can all contribute to slight price variations—typically within 1–2%. These differences create arbitrage opportunities for professional traders; beginners can see real-time prices on Gate when purchasing Bitcoin.

Does Bitcoin’s Price Correlate With US Dollar Exchange Rate?

There’s some correlation but limited impact overall. Bitcoin is primarily quoted in USD; when the dollar appreciates, buying Bitcoin with other currencies becomes costlier—potentially reducing non-US demand. However, Bitcoin’s price is mainly driven by its own market supply-demand factors rather than strictly following USD movements. International users can trade Bitcoin against multiple fiat currencies on Gate to hedge single-currency risks.

What Are Bitcoin’s Historical Highest and Lowest Prices?

Bitcoin reached an all-time high near $69,000 in November 2021 but fell below $1 in early 2011—a testament to its history of dramatic cycles marked by extreme market sentiment swings each period. Studying price history helps newcomers understand investment volatility risks; always consult up-to-date quotes on reputable platforms like Gate before planning your investments rationally.

How Are Bitcoin Prices Related to Mining Costs?

Mining costs (electricity, hardware expenses) provide important price support for Bitcoin. If price drops below average mining costs, miners reduce activity—limiting supply which can push prices up; vice versa if prices exceed costs. This mechanism creates a natural price floor but not an absolute rule—market emotions or macro factors may drive prices below cost temporarily; over time, costs remain an important reference point.

Glossary of Key Bitcoin (BTC) Terms

- Proof of Work (PoW): A consensus mechanism where miners solve computational puzzles to validate transactions and create new blocks—ensuring network security.

- Mining: The process where miners use cryptography to validate transactions and earn newly created bitcoins plus transaction fees.

- Blockchain: A sequence of data blocks cryptographically linked together that records all bitcoin transaction history with immutability.

- Private Key & Public Key: Private keys sign transactions to prove ownership; public keys receive funds—together forming the bitcoin account system.

- Block Reward: Bitcoins awarded to miners for successfully mining new blocks—initially 50 BTC per block with rewards halving every four years.

- Transaction Confirmation: The process where transactions are added to blocks and validated by the network; more confirmations make reversals increasingly unlikely.

Bitcoin (BTC) Reference & Further Reading

-

Official Website / Whitepaper:

-

Development / Docs:

-

Industry Media / Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is ORDI in 2025? All You Need to Know About ORDI