Gate Research: Solana and Ethereum Lead Ecosystem Growth as Prediction Market Scale Continues to Expand|Web3 On-Chain Data Insights for December 2025

On-Chain Insights Overview

Overview of On-Chain Activity and Capital Flows

To accurately assess the real usage level of blockchain ecosystems, this section examines several key on-chain activity indicators, including daily transaction volume, gas fees, active addresses, and net cross-chain bridge flows. These metrics capture user behavior, network utilization intensity, and asset mobility across ecosystems. Compared with simply tracking capital inflows and outflows, on-chain native data provides a more comprehensive view of the underlying fundamentals, helping evaluate whether changes in capital direction are supported by genuine usage demand and user growth. This enables the identification of networks with sustainable development potential.

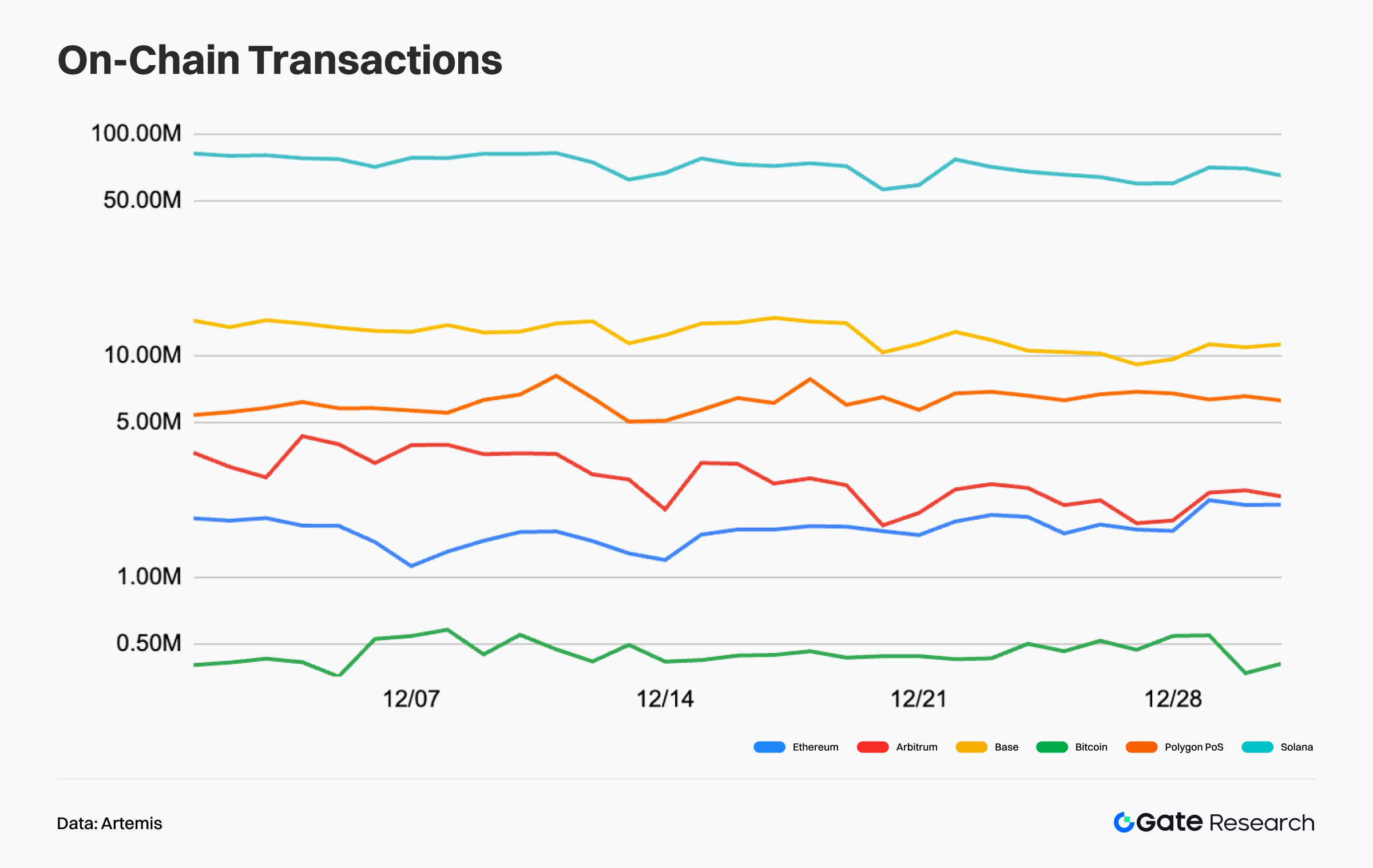

Transaction Count Analysis: Solana in High-Level Consolidation, Base and Major L2s Maintain Stable Structures

According to Artemis data, on-chain transaction activity across major public blockchains in December exhibited a pattern of high-level consolidation. Despite the market entering a year-end consolidation phase, usage intensity on core chains did not show a material decline, indicating that on-chain interaction remains supported by a solid underlying base. Solana stayed at an absolute high throughout the month, with daily transaction counts broadly holding in the range of 60–80 million. Although there were periodic pullbacks around mid-month and toward month-end, overall volatility remained limited. This reflects the stabilizing effect of high-frequency applications and an active user base on transaction volumes, demonstrating that on-chain usage intensity retained resilience even as market sentiment cooled.【1】

On Base, daily transaction counts in December mainly fluctuated between 10 and 13 million. The monthly trend was characterized by sideways consolidation, with no clear signs of trend-based expansion, but the overall structure remained relatively stable. This suggests that its social and lightweight application ecosystem continues to generate consistent day-to-day interaction demand. By comparison, Arbitrum’s transaction activity in December was closer to range-bound fluctuations, with most readings falling between approximately 2 and 3.5 million transactions per day. After a mid-month dip, activity rebounded, though the rebound lacked persistence, indicating that while ecosystem activity remains ongoing, it has not yet entered a clear expansion phase.

Overall, the structure of on-chain transaction counts in December continued to reflect a pattern of “high-performance chains leading, with divergence among Layer 2s.” Solana remains the primary carrier of on-chain traffic, Base sustains a stable mid-tier level of activity, and Arbitrum operates in a state that is stable but not expanding. Against the backdrop of slowing year-end market momentum, the stratified nature of on-chain activity remains evident, and short-term fluctuations have not been sufficient to alter the established usage positioning or competitive landscape among these public chains.

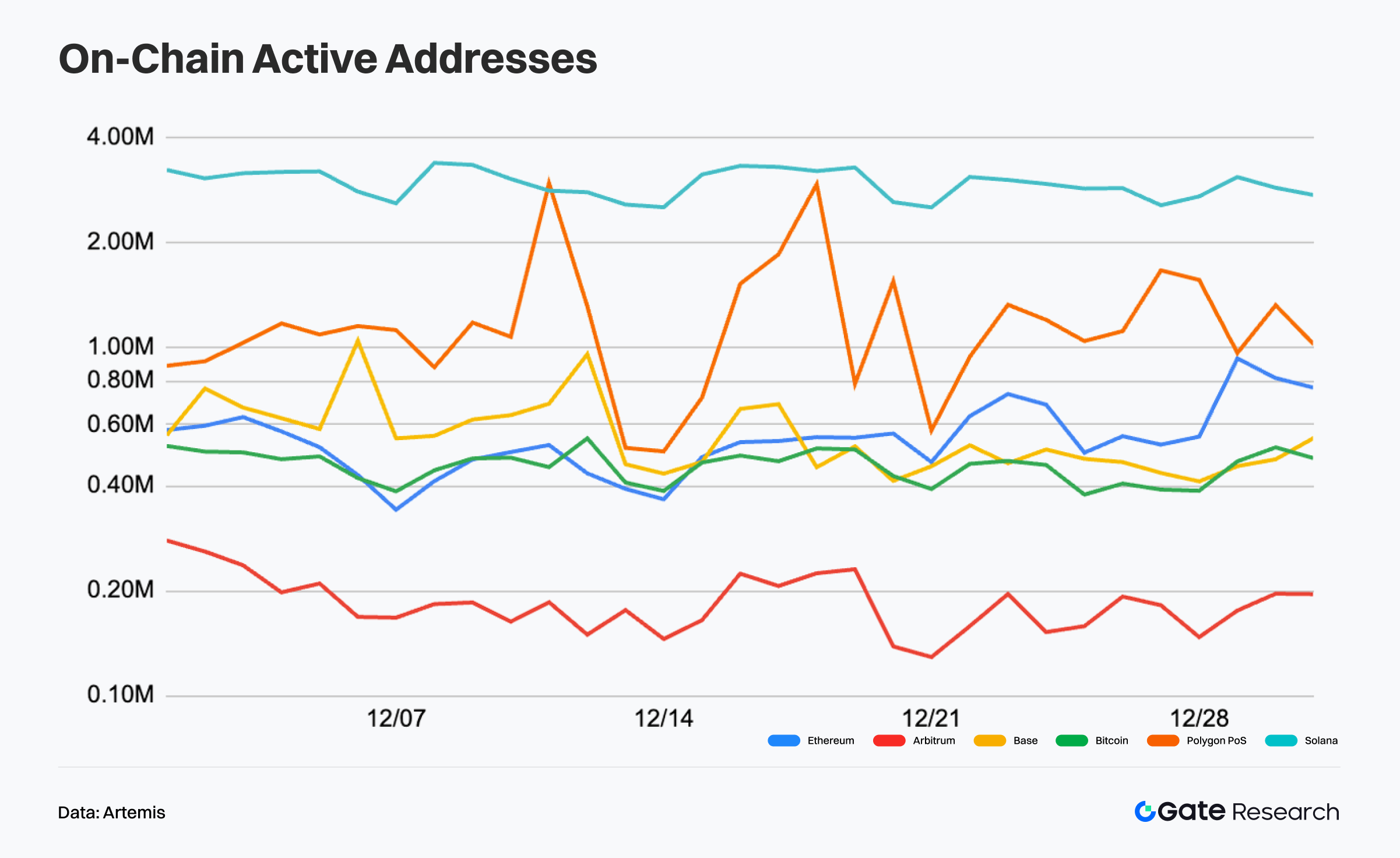

Active Address Analysis: Solana Maintains Leadership, Arbitrum Remains in Low-Level Consolidation

According to Artemis data, active address performance across major public blockchains in December showed clear divergence. Overall user activity did not experience a systemic decline, but year-end sentiment turned more cautious, limiting expansion momentum. High-performance chains and certain application-oriented networks remained relatively resilient, while some Layer 2s continued to trade in low-level consolidation.【2】

Solana continued to lead by a wide margin in terms of active address scale, with daily active addresses remaining stable in the range of approximately 2.5 to 3.5 million and limited volatility throughout the month. High-frequency applications and trading scenarios continued to underpin strong user participation. Polygon PoS recorded active addresses mostly fluctuating between 0.8 and 1.5 million; while there were occasional bursts of activity, overall performance remained range-bound. By contrast, Arbitrum’s active addresses stayed in a prolonged low range of roughly 120,000 to 200,000, with limited recovery and no clear signs of a meaningful rebound. Active address levels on Ethereum and Bitcoin were broadly stable, continuing to reflect their roles as settlement layers and value-bearing networks.

Overall, the stratification of on-chain active addresses in December was clearly defined: Solana dominated high-frequency interactions, Polygon PoS and Base maintained stable mid-tier activity, while Arbitrum remained in low-level consolidation. Divergence within the Layer 2 ecosystem became more pronounced toward year-end.

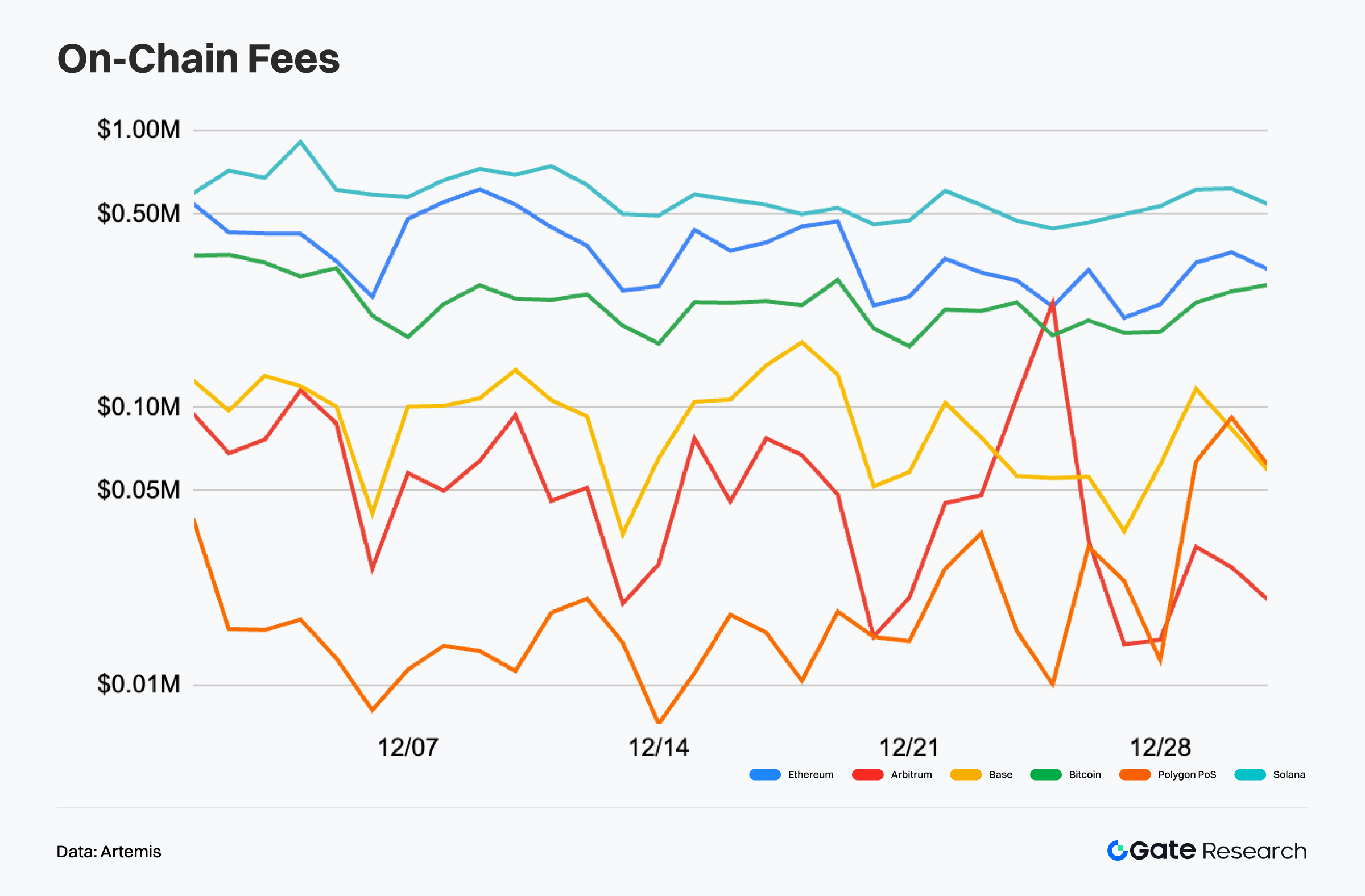

On-Chain Fee Revenue Analysis: Ethereum and Solana Remain at the Top, Volatility Increases for Base and Arbitrum

According to Artemis data, on-chain fee revenue across major public blockchains in December displayed a broadly volatile pattern. High-value base-layer networks remained relatively stable, while mid- and lower-tier chains experienced more pronounced fluctuations. Against the backdrop of a slowing year-end trading pace, fee revenue did not show trend-based expansion and was instead largely driven by episodic events. 【3】

Ethereum and Solana continued to rank at the top in terms of fee revenue. Ethereum’s daily fees generally ranged between $300,000 and 700,000, fluctuating alongside DeFi activity and high-value smart contract interactions, and remained a core indicator of on-chain economic activity. Solana’s fee revenue was comparatively steady, mostly distributed between $500,000 and 800,000 per day, supported by high-frequency trading and sustained application interaction.

By comparison, fee revenues on Base and Arbitrum were more volatile. Base fluctuated mostly within the $50,000 to 150,000 range during the month, with occasional short-lived spikes that lacked persistence. Arbitrum’s fee revenue remained at relatively low levels, with brief, pulse-like rebounds quickly fading. Overall, the December fee structure was clearly stratified, with value capture still concentrated on Ethereum and Solana, while other chains had yet to establish stable growth momentum.

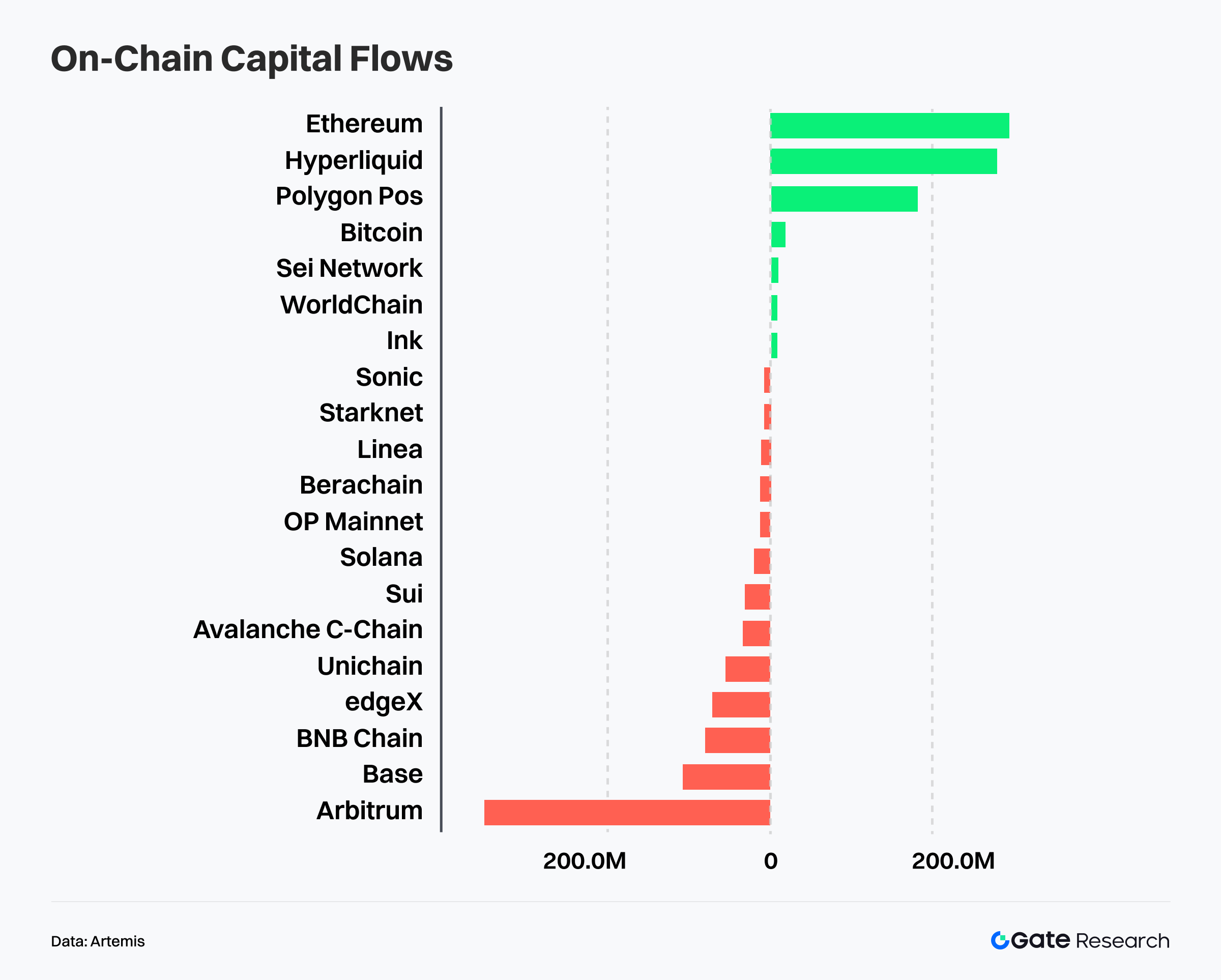

Divergence in Public Chain Capital Flows: Funds Return to Settlement Layers, Trading-Oriented Networks Absorb Risk Appetite

According to Artemis data, capital flows across public blockchains over the past month exhibited clear structural divergence. Rather than a broad-based expansion in risk-taking, capital was allocated in parallel according to differing risk preferences—flowing into core settlement layers with stronger safety margins, as well as into trading-oriented networks with higher capital efficiency. Meanwhile, some traditional Layer 2s and higher-valuation ecosystems faced sustained net outflow pressure.【4】

On the inflow side, Ethereum, Hyperliquid, and Polygon PoS ranked among the top networks by net inflows over the past month, significantly outperforming other chains. Ethereum recorded the largest net inflow, indicating that amid uncertain market direction and narrowing volatility ranges, capital has prioritized returning to the deepest liquidity pools and the most robust settlement networks for cross-cycle position parking and reallocation. Continued inflows into Hyperliquid suggest that trading-oriented capital has not exited the market, but has instead shifted toward specialized networks offering higher matching efficiency and faster capital turnover. Inflows into Polygon PoS were comparatively moderate and appeared more aligned with application usage and routine interaction demand.

On the outflow side, pressure was most concentrated on Arbitrum, which recorded the largest net outflows among major chains over the past month, making it the primary source of capital drainage. Viewed alongside the inflow structure, part of the capital exiting Arbitrum may be migrating toward higher-efficiency, shorter-cycle trading networks such as Hyperliquid. Base and Avalanche also recorded varying degrees of net outflows, indicating that within the Layer 2 and application-chain landscape, capital is undergoing internal reallocation rather than a simple withdrawal from risk assets.

Taken together, current public-chain capital flows are consistent with a pattern of “parallel allocation under differentiated risk preferences.” More conservative capital is rotating back to core settlement layers represented by Ethereum, supporting cross-cycle asset holding and position management, while higher risk-tolerant capital is exiting certain traditional execution environments and concentrating on networks such as Hyperliquid that emphasize trading functionality and capital efficiency. The broader market has entered a phase of structural rotation and risk repricing, with capital allocation logic shifting from single-narrative drivers toward more granular assessments of network roles and capital utilization efficiency.

Bitcoin Key Metrics Analysis

In December, macro conditions and risk asset performance diverged, with equity markets strengthening while the broader crypto market remained under pressure. Labor market data delivered mixed signals, and the Federal Reserve continued to adopt a wait-and-see stance on its policy path. Against this backdrop, BTC entered a phase of consolidation and recovery: short-term structure has stabilized, but upside momentum has yet to be confirmed. The key focus remains whether the current price can be absorbed by existing cost structures and supported by the underlying distribution of supply.

In this context, on-chain data are delivering consistent signals across three dimensions—cost distribution, unrealized loss supply, and holder structure. BTC continues to trade above its core cost basis, indicating that the primary trend remains intact; however, dense overhead supply is constraining short-term rebounds. Rising unrealized losses suggest ongoing sentiment washout, while selling pressure is concentrated mainly among short-term holders, with long-term supply remaining relatively stable. Overall, the market appears to be transitioning from a one-way advance into a phase of consolidation, digestion, and rebalancing.

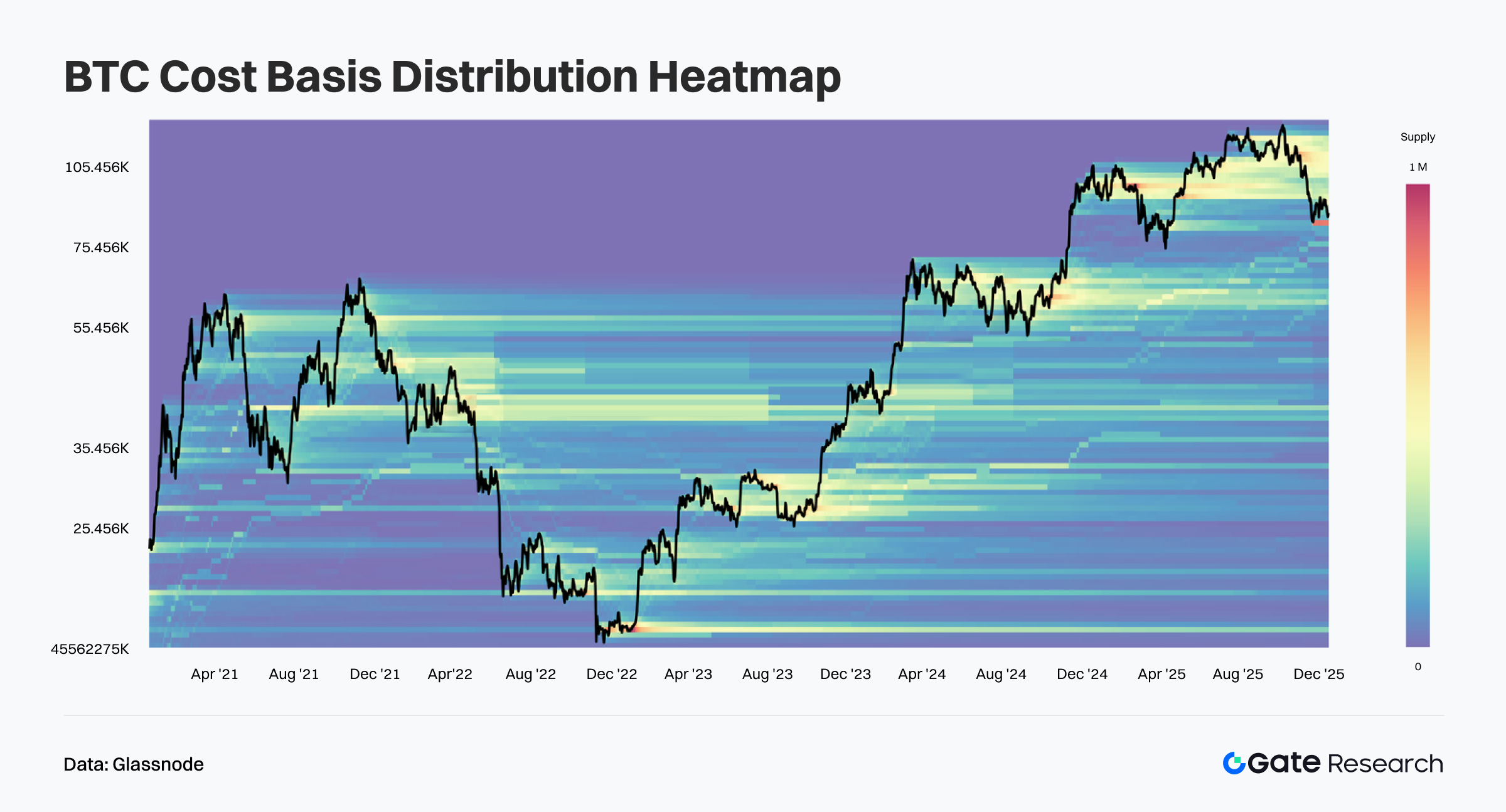

High-Level BTC Supply Loosening, Consolidation Above Dense Cost Zones

According to Glassnode data, BTC’s cost basis distribution heatmap shows that during the recent pullback from elevated levels, high-cost supply above the market has weakened to some extent, though without a broad or abrupt downward migration. Prices have largely traded within nearby cost-dense zones, without triggering large-scale redistribution toward lower levels. This suggests that high-level holders are primarily absorbing drawdowns and waiting for recovery, with market sentiment shifting from optimistic toward a more cautious, neutral stance. 【5】

Structurally, multiple layers of historical cost concentration remain intact below current prices. These continuous and stable supply bands indicate that mid- to low-level holders retain a meaningful cost advantage, providing potential downside support. The absence of rapidly expanding “supply vacuum” zones in the heatmap implies that recent pullbacks are more consistent with high-level turnover and pressure release rather than structural trend damage.

Overall, BTC has exhibited a rebalancing pattern characterized by “overhead supply digestion with underlying support intact.” Short-term upside momentum is constrained by cost resistance, making range-bound consolidation and gradual supply redistribution more likely. However, as long as lower cost structures are not decisively breached, the medium-term bullish framework remains preserved, and the current phase is better interpreted as a healthy correction rather than a trend reversal.

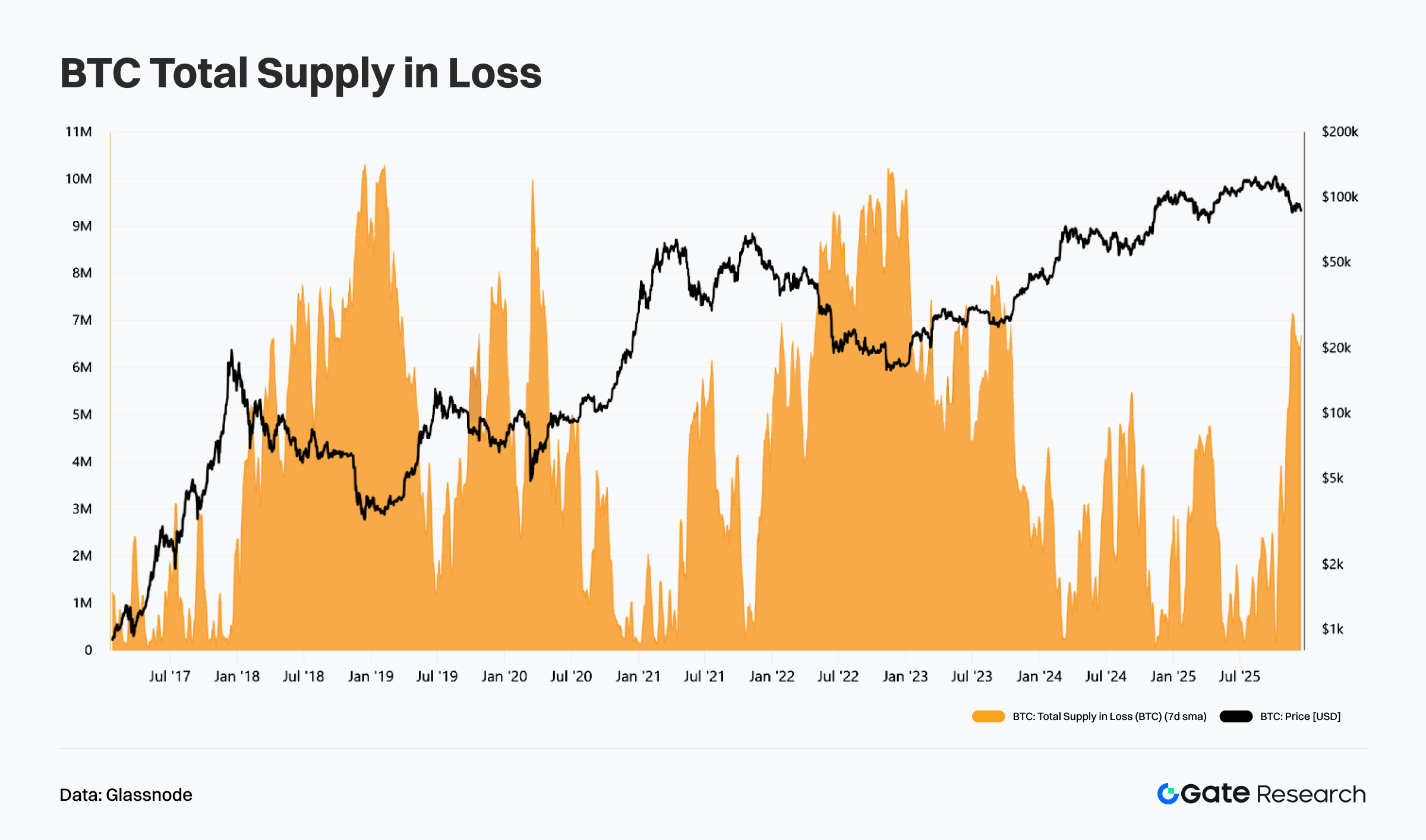

BTC Unrealized Loss Supply Rises but Remains Contained, Entering a Stress-Testing Phase

According to Glassnode data, BTC’s unrealized loss supply (7-day moving average) has increased noticeably over the past month as prices retreated from recent highs. This indicates that a portion of short-term and momentum-driven supply has moved into unrealized loss territory, raising near-term pressure. However, in absolute terms, unrealized losses remain well below the peaks observed during prior deep corrections or bear markets and have not reached levels associated with systemic panic. Instead, the current rise reflects a post-rally stress test and cooling sentiment.【6】

Historically, sharp increases in unrealized loss supply often coincide with the early stages of pullbacks or transitional phases in trend dynamics, while sustained trend reversals are typically accompanied by prolonged periods of elevated unrealized losses. At present, although the metric has expanded, its persistence remains limited, suggesting that loss-bearing supply has not yet translated into widespread capitulation. The market is still largely characterized by passive holding and patience rather than aggressive selling.

In summary, the increase in unrealized loss supply signals tightening risk appetite and a shift from optimism to caution, but without clear signs of structural deterioration. As long as prices do not decisively break below key medium-term cost zones, this indicator is more consistent with a bull-market pullback and supply rotation. Going forward, attention should be paid to whether unrealized losses continue to expand and remain elevated. A rapid contraction would help confirm the end of the adjustment, while sustained growth could imply deeper consolidation and repricing ahead.

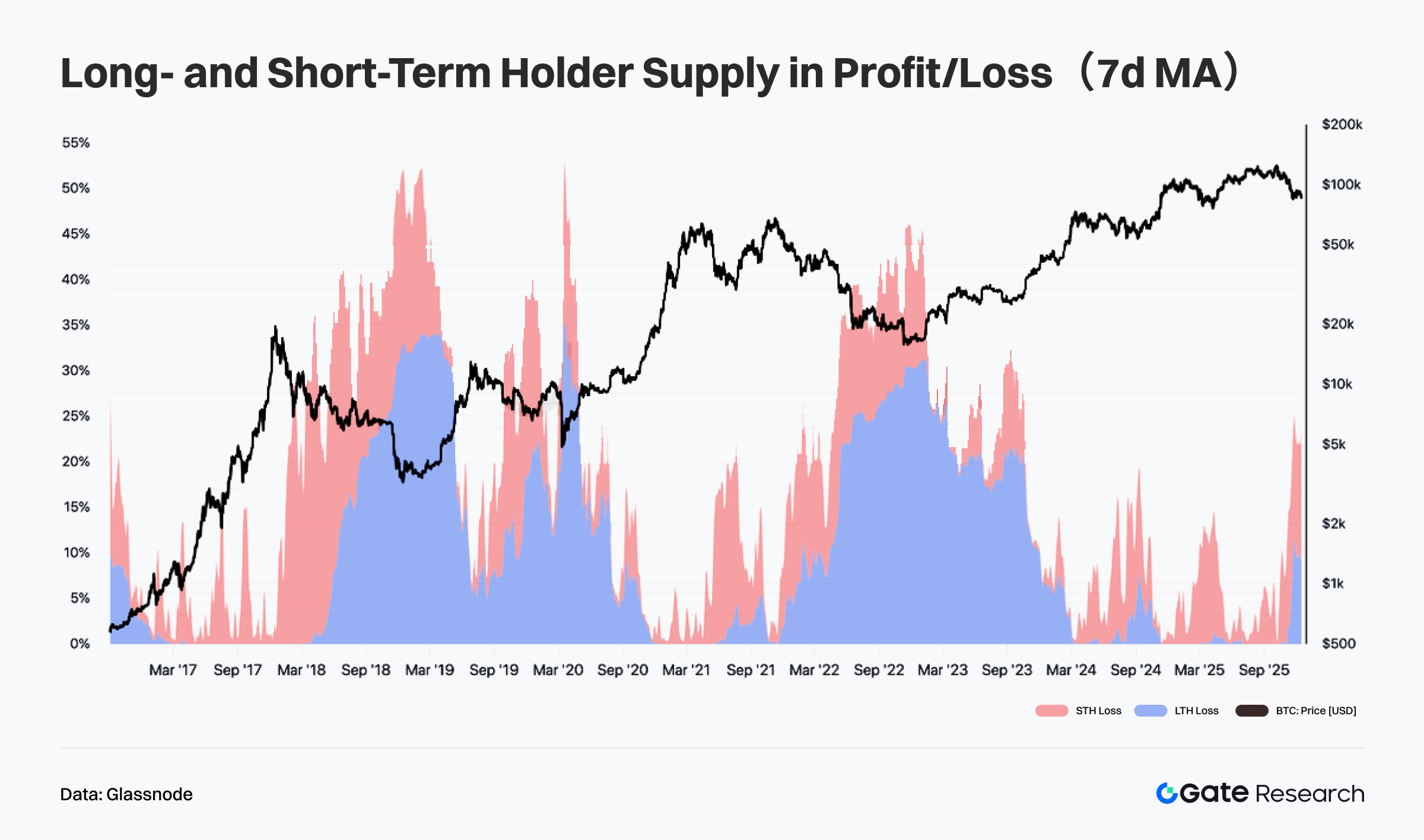

Short-Term Holders Under Pressure, Long-Term Supply Remains Profit-Dominant

According to Glassnode data, BTC’s profit/loss supply split between long-term and short-term holders (7-day moving average) shows that over the past month, the proportion of short-term holder (STH) supply in loss has risen markedly as prices pulled back from highs. This reflects recent entrants gradually moving into unrealized loss territory, reducing short-term risk tolerance and placing the burden of market pressure primarily on short-duration supply. Such dynamics are typical of post-rally pullbacks, indicating digestion by momentum-driven capital rather than broad-based liquidation.【7】

From a structural perspective, long-term holder (LTH) supply remains predominantly in profit, with loss ratios staying near historical lows. This indicates that core supply has not meaningfully weakened in response to short-term volatility. Historically, only when LTH supply shifts en masse into loss has it tended to coincide with trend-level reversals or confirmed bear markets—a scenario that remains far from current conditions.

Overall, BTC’s current profit/loss distribution reflects a classic bull-market correction characterized by “short-term stress, long-term stability.” While expanding losses among short-term holders have pushed the market into a consolidation and rotation phase, the long-cycle supply structure remains intact, supporting medium-term trend resilience. A stabilization and recovery in price would likely lead to a rapid contraction in STH losses and a repair of short-term structure. Conversely, a prolonged decline extending into long-term cost zones would warrant closer monitoring for escalating structural risk.

Trending Project & Token Activity

On-chain data indicates that capital and users are increasingly concentrating in ecosystems with solid interaction foundations and strong application depth. Meanwhile, projects with strong narratives and technological innovation are becoming the new focal points for investors. This section highlights the most prominent projects and tokens of recent weeks, analyzing the logic behind their growth and potential market impact.

Overview of Trending Project

BSC Prediction Markets

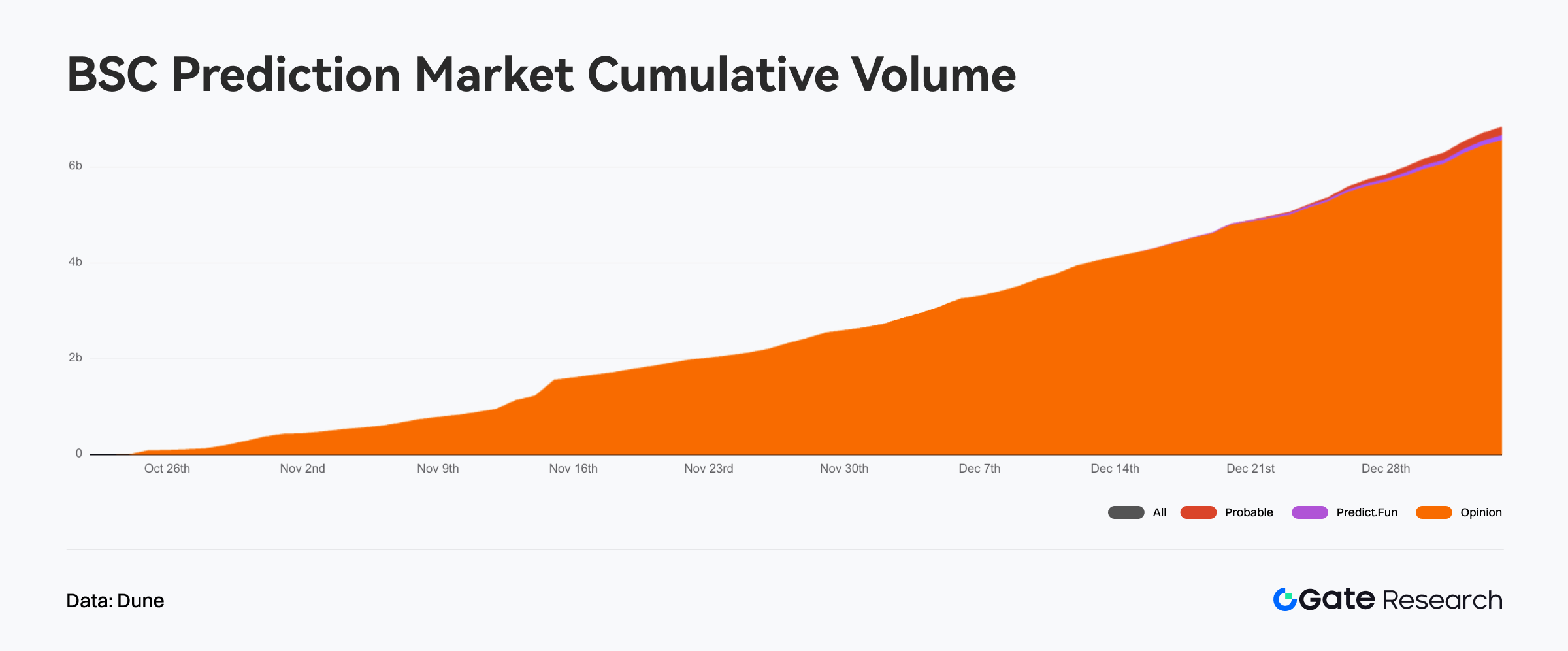

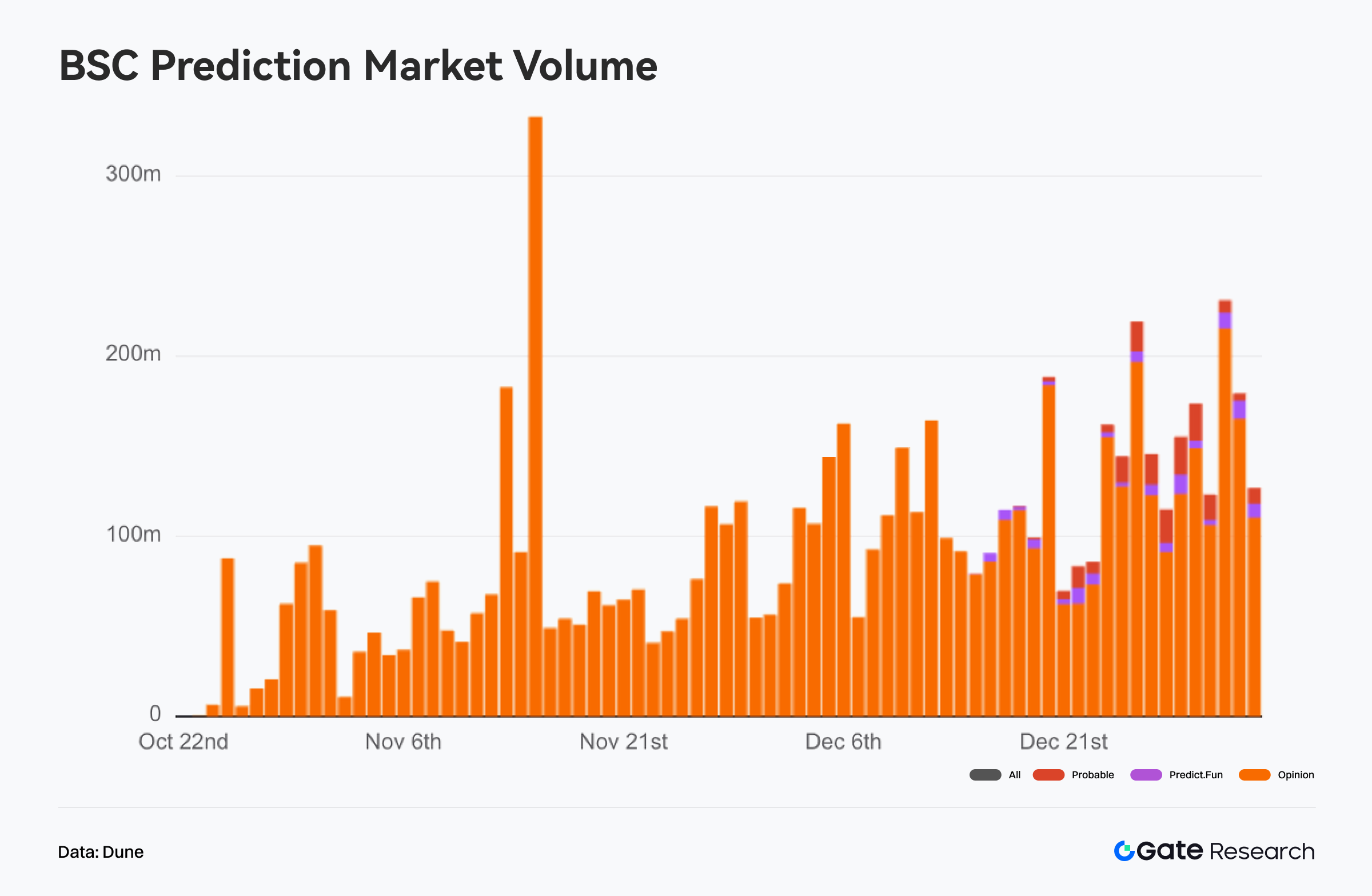

With the successive launches of Predict Fun and Probable, the BSC network has formed a prediction market landscape comprising three platforms, including Opinion. All three operate within broadly similar capital and resource frameworks. At this stage, competition in the BSC prediction market is better characterized as parallel experimentation within the same ecosystem rather than the displacement or consolidation of a single dominant platform. Each project has adopted differentiated approaches in terms of fee structures, incentive mechanisms, and user positioning. 【8】

From an overall scale perspective, since the BSC prediction market began gaining traction in late October, cumulative notional trading volume has continued to rise, approaching $6.5 billion by the end of December. This trajectory suggests that the sector has gradually established sustained trading demand within the BSC ecosystem, rather than relying on one-off, event-driven bursts of activity.

From the perspective of volume contribution, the market is highly concentrated in Opinion. Both in cumulative volume and daily trading volume, Opinion has consistently accounted for more than 95% of total market activity, making it the core engine driving overall scale expansion. Daily volume data show that Opinion has repeatedly recorded active trading days in the range of $100–300 million. By contrast, Predict Fun and Probable only began to register activity from mid to late December, and their trading volumes remain relatively small, contributing marginally to overall market growth.

In terms of competitive structure, the current BSC prediction market more closely resembles a “single dominant platform operating at scale, with other platforms in the stage of mechanism validation and user testing.” Opinion has established a high-turnover, high-stickiness trading loop through low fees and relatively mature liquidity. Predict Fun has entered the market with more aggressive mechanism design, but still lags significantly in both trading volume and user expansion. Probable, meanwhile, has adopted a zero-fee and points-based incentive strategy; at present, it primarily reflects characteristics of early participation and trial operation.

It is important to emphasize that this internal structure does not imply a fully fixed competitive landscape. On the one hand, the newer platforms are still in the early stages of deployment, with trading depth and product functionality yet to be fully developed. On the other hand, the BSC prediction market as a whole remains in an expansion phase. Current data are therefore more indicative of concentration effects during the scale-formation period rather than mature-stage competition. Future shifts in the landscape will depend on how new platforms execute on liquidity incentives, user retention, and product differentiation in practice.

Overview of Trending Token

$BEAT

Audiera (BEAT) is the Web3 extension of the classic music and dance game IP Audition, targeting a global user base of over 600 million. By integrating AI and blockchain technologies, the project aims to build an immersive entertainment ecosystem centered on music creation, AI idol interaction, NFT minting, and motion-based fitness. Its product lineup spans mobile games, mini-applications, and AI-driven creative studios, positioning BEAT as a Web3 entertainment project characterized by high interactivity and strong content creation attributes.

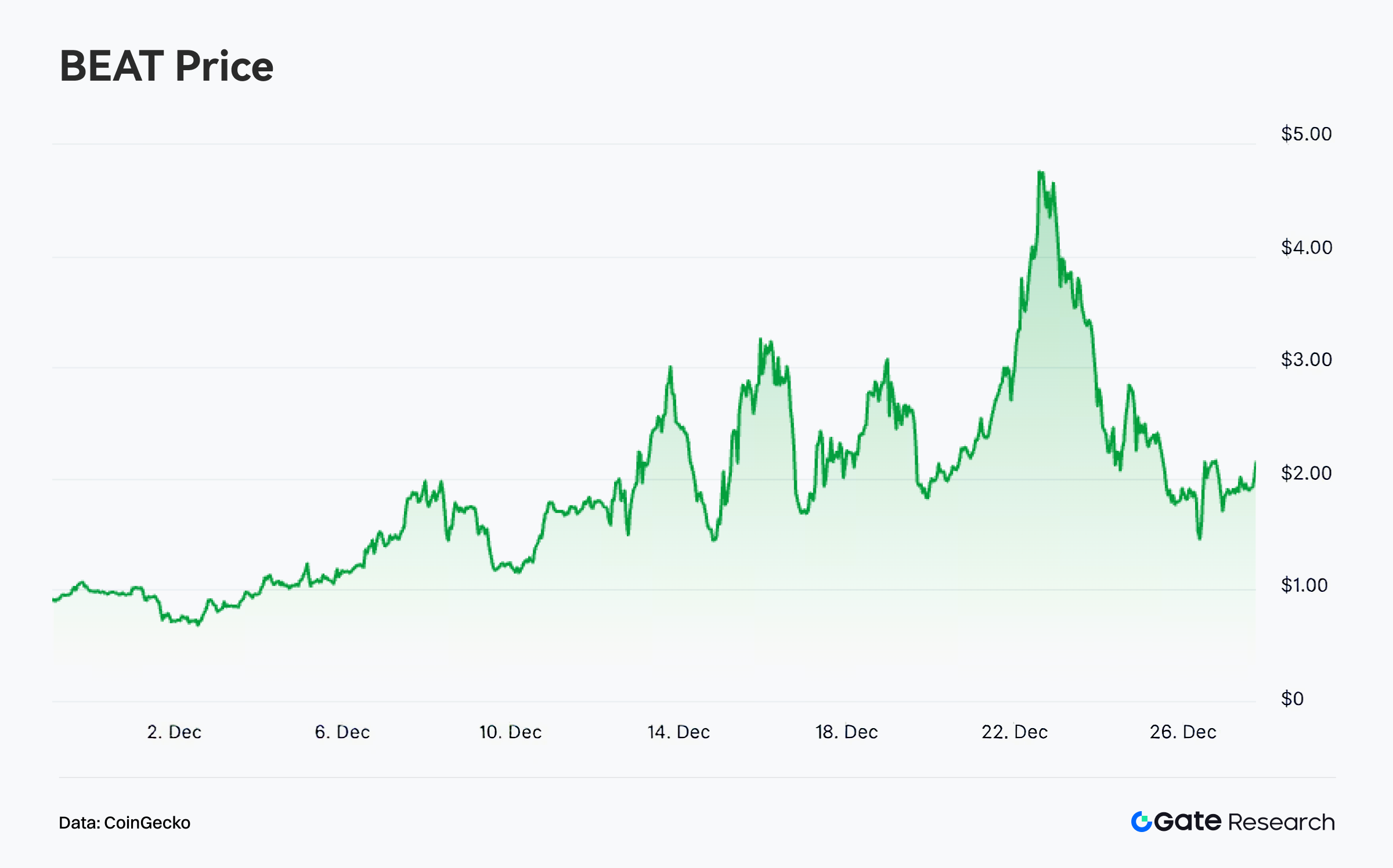

According to CoinGecko data, $BEAT recorded a peak gain of over 300% in December. This rally was not driven by a single fundamental catalyst, but rather occurred in a range-bound market environment where capital rotated out of low-volatility large-cap assets into mid- and small-cap, high-beta tokens. Prior to the rally, BEAT’s supply structure was relatively healthy, with no prolonged heavy selling pressure. Improvements in liquidity and order book depth occurred in tandem, providing favorable conditions for trend-following capital to participate. 【9】

At the project level, BEAT has not experienced any notable negative events or signs of fundamental deterioration in recent periods. Market pricing has therefore been driven primarily by its trading characteristics and short-term elasticity expectations. The combination of “no obvious fundamental drag” and “improving trading structure” made BEAT more likely to be selected by short-term and momentum-driven capital during a choppy market phase, resulting in a stage-based rally. On the community and media front, as prices rose rapidly, discussion intensity around BEAT increased significantly within the crypto community. Attention focused on the magnitude of the rally, short-term liquidity improvements, and divergent views on whether a second leg of upside could emerge. Social media sentiment acted as an amplifier after core capital entered, accelerating both price volatility and high-level turnover.

Overall, the recent performance of $BEAT represents a typical case of a rally driven by capital rotation, improved trading structure, and amplified community sentiment. Its strength has been more a function of market environment and trading dynamics than of a fundamental transformation, meaning that future price action will remain highly dependent on volume trends and the defense or loss of key price levels.

Conclusion

In December 2025, the public blockchain ecosystem as a whole exhibited a pattern of “activity stabilizing at a slower pace, with deepening structural divergence.” Core high-performance chains and settlement layers maintained stable fundamentals: Solana continued to dominate in terms of transaction frequency and user activity, while Ethereum remained the central settlement hub in fee generation and capital allocation. By contrast, divergence within the Layer 2 segment became more pronounced. Base retained relatively stable capacity to absorb activity, whereas Arbitrum faced clear pressure across multiple dimensions, including transaction activity, fee revenue, and capital flows. Overall, the year-end market did not enter a broad expansion phase; capital and user behavior became more rational, and competition among public chains increasingly shifted away from narrative-driven momentum toward longer-term evaluation of functional positioning, capital efficiency, and real-world usage.

At the Bitcoin level, the price pullback over the past month has pushed high-level supply into a phase of loosening and rotation, forming a consolidation structure above dense cost zones. Short-term price action has shifted from strength to pressure. Although unrealized losses have increased, they are concentrated primarily among short-term holders, while long-term supply remains profit-dominant. As a result, the medium-term bull market framework has not been invalidated. The market currently sits in a transitional zone characterized by “pullback, rotation, and rebalancing,” with future direction hinging on the strength of support at lower cost levels and whether upside momentum can be rebuilt after sentiment cools.

At the project and token level, the BSC prediction market entered a phase of internal experimentation following the parallel launch of multiple platforms. Aggregate notional volume continued to expand and approached USD 6.5 billion, but liquidity remained highly concentrated in Opinion. New platforms are still in the stages of mechanism validation and user cultivation, leaving the competitive landscape unsettled. On the token side, $BEAT benefited from capital rotation and improved trading structure in a range-bound market, with stage-based gains approaching 300%. This rally was driven primarily by high-beta trading characteristics and sentiment amplification. Taken together, the current market remains defined by structural expansion and trading-led dynamics, while a sustained trend-driven phase awaits confirmation from new macro or on-chain catalysts.

References:

- Artemis, https://app.artemisanalytics.com/chains

- Artemis, https://app.artemisanalytics.com/chains

- Artemis, https://app.artemisanalytics.com/chains

- Artemis, https://app.artemisanalytics.com/flows

- Glassnode, https://studio.glassnode.com/charts/indicators.CostBasisDistributionHeatmap?a=BTC&period=5y

- Glassnode, https://studio.glassnode.com/charts/supply.LossSum?a=BTC&chartStyle=column&s=1485388800&u=1765929600&zoom=

- Glassnode, https://studio.glassnode.com/charts/supply.LthSthProfitLossRelative?a=BTC&mAvg=7&s=1472860800&u=1765929600&zoom=

- Dune, https://dune.com/defioasis/prediction-market-wars-on-bsc

- CoinGecko, https://www.coingecko.com/coins/audiera

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market