Claude and I Analyzed 6,723 Crypto Funding Rounds. This is What VC's Are Funding

Crypto funding rebounded like a prime Dennis Rodman in 2025.

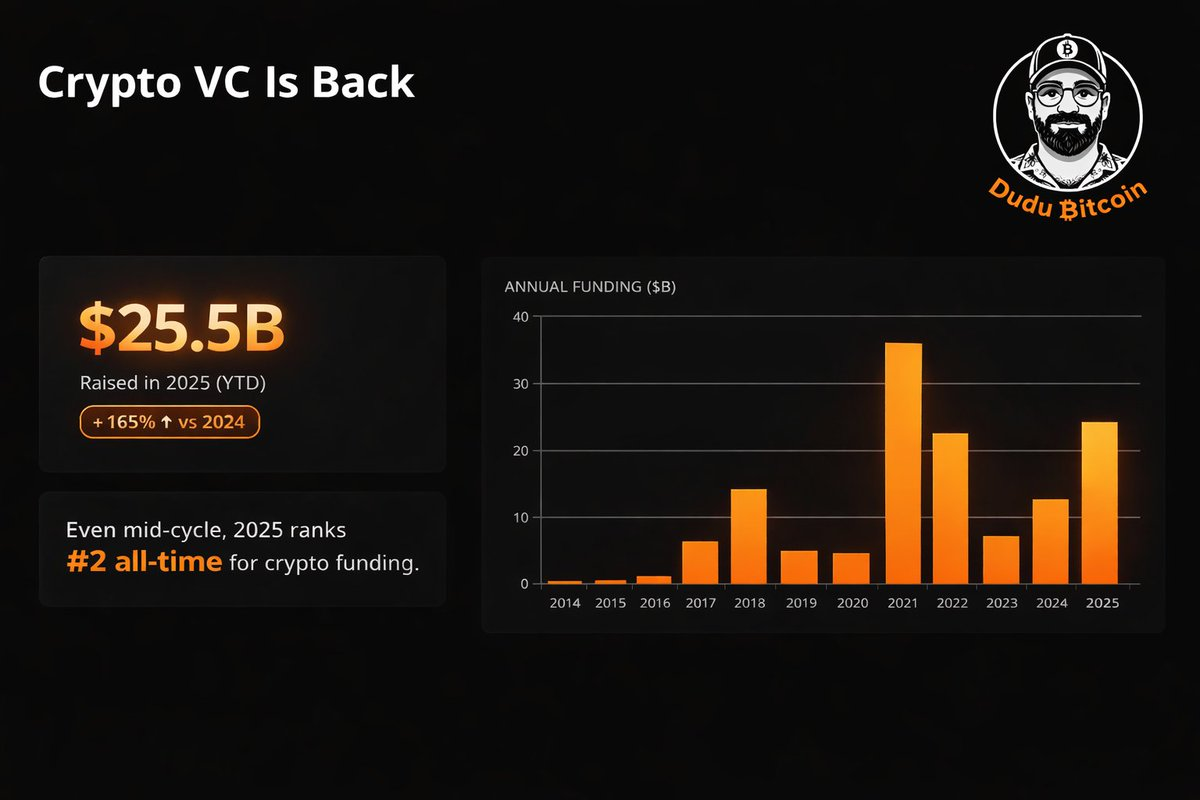

$25 billion raised. The second-biggest year on record, trailing only the 2021 frenzy.

But here’s what’s different:

This year actually feels sustainable.

I spent weeks days analyzing 6,700+ funding rounds to understand where the money went.

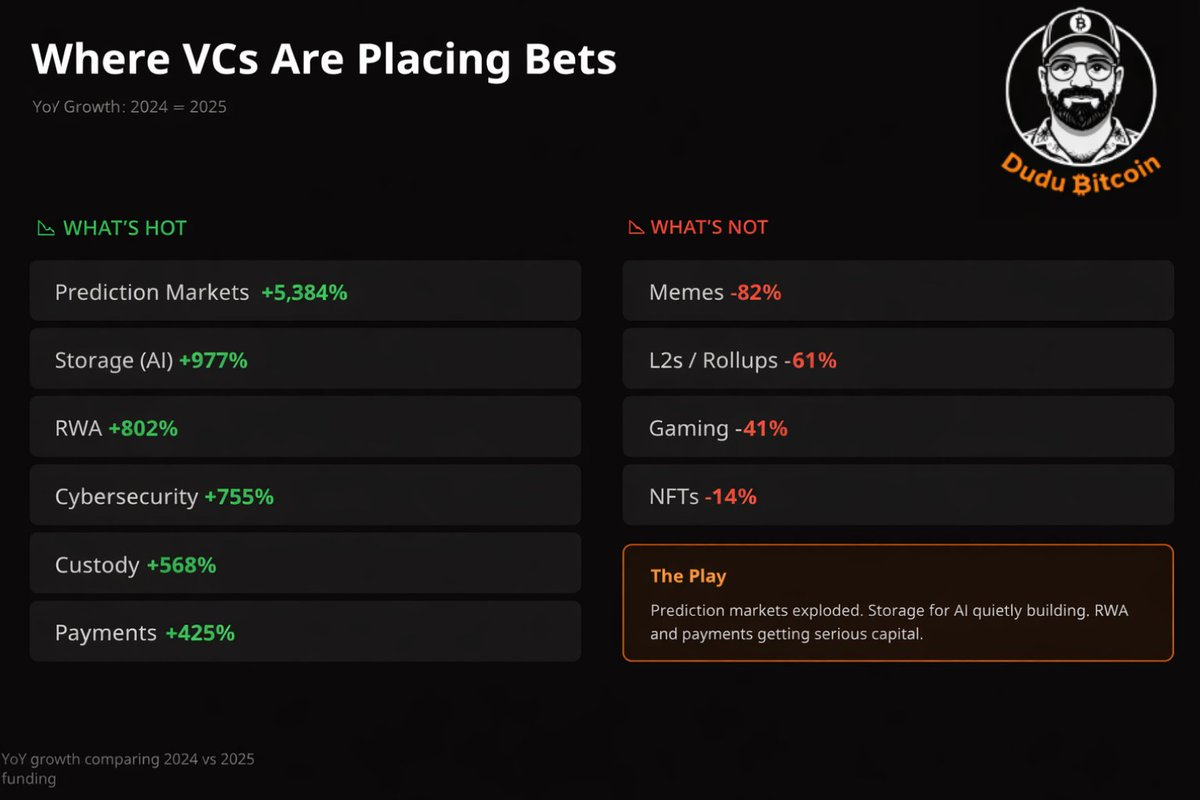

WINNING SECTORS: PREDICTION MARKETS, AI STORAGE AND RWA

Prediction markets were the big winners, and there’s no surprise there.

It’s been a bumper year for prediction markets, the one true narrative from Web3 to capture a mainstream consumer base.

Polymarket and Kalshi have been in a grudge match contest to rack up as many tier-1 partnerships.

Today, prediction markets are embedded in Google Search and large media outlets.

Seeing RWA and cybersecurity at the top also drives home the main point -> crypto is growing up and becoming more entrenched as part of the financial system.

RIP to founders building NFTs though.

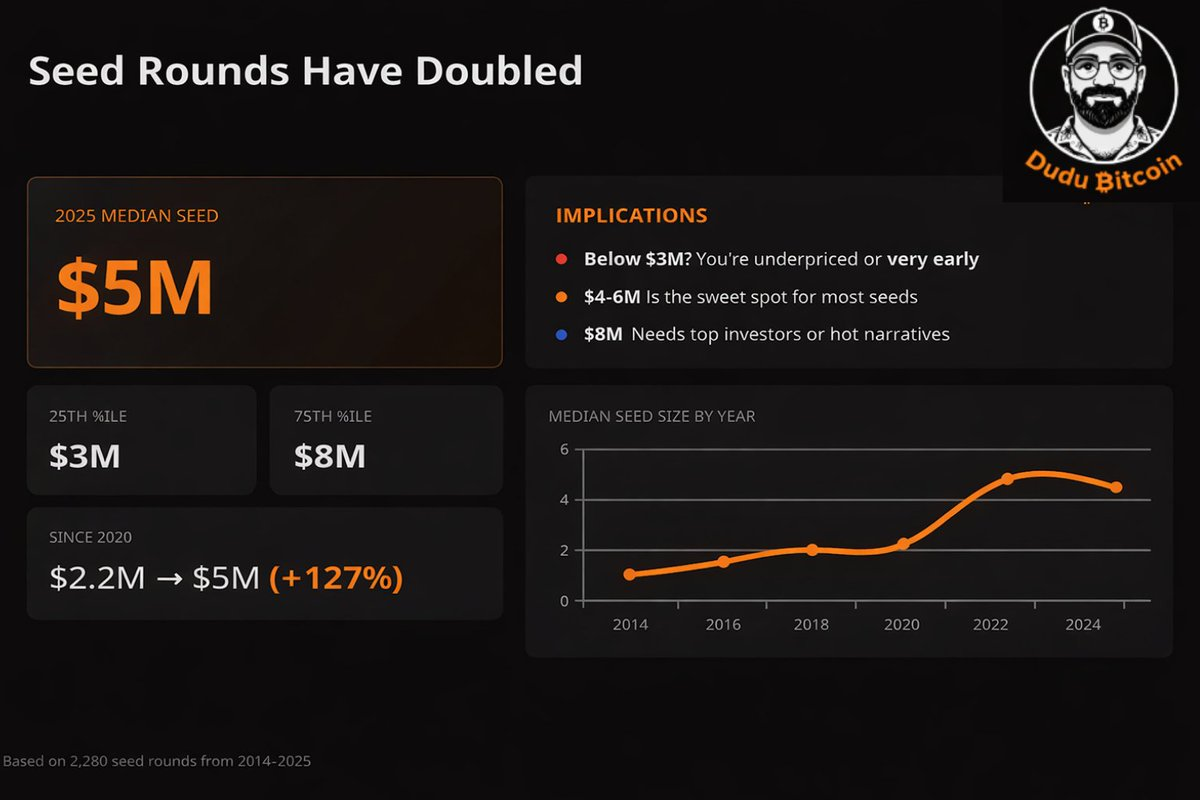

SEED ROUNDS ARE MATURING

Gone are the days of raising small seeds to get a project off the ground. In the age of AI, you need a lot fewer resources to build a product people use. That means you can bootstrap for longer and only go to the funding market when you have something to real to share.

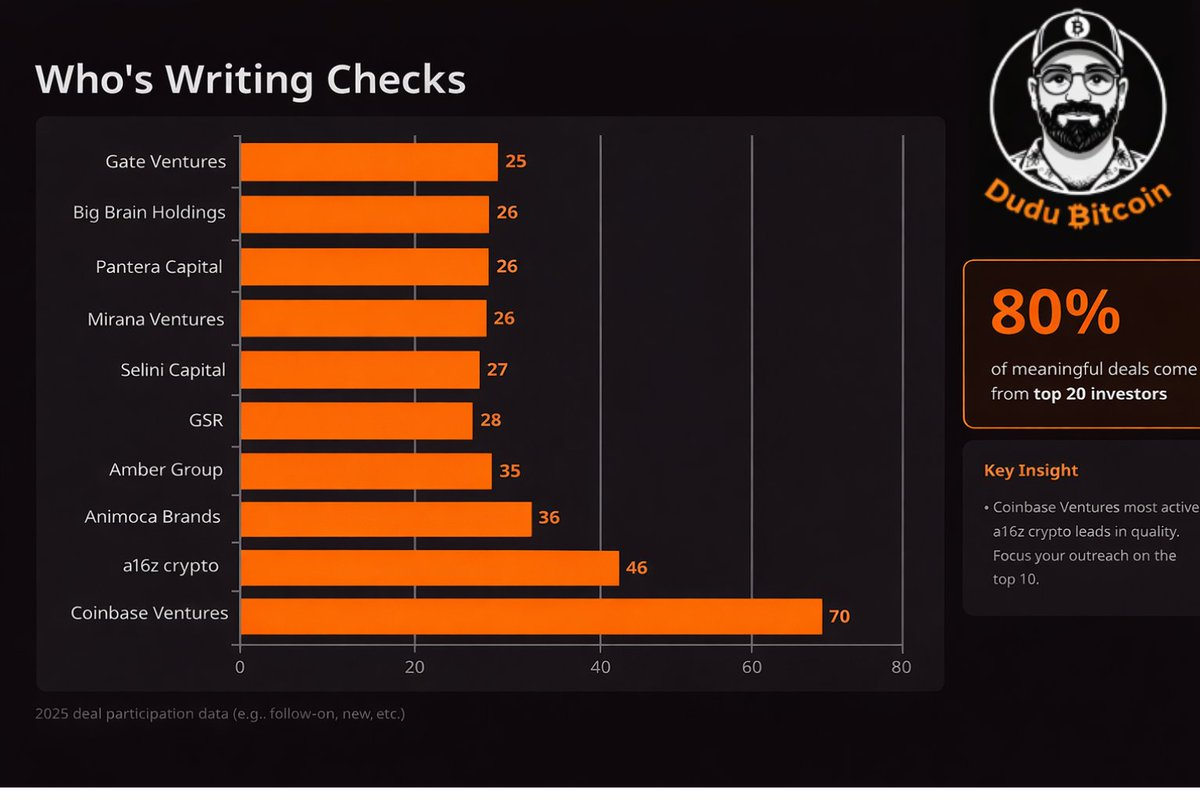

TRY GET IN WITH COINBASE VENTURES

I’ve seen too many ‘VC connectors’ that take a cut for introducing founders to investors. Most of these connectors only know 3rd-tier investors, which makes it not worth a founder’s time. Find someone who can intro you to Coinbase Ventures, not Soulja Boy’s fund.

CRYPTO IS GROWING UP

Look at the biggest raises this year and the pattern is obvious.

Yes, there’s still some degen energy:

@ binance got a large check from the Emiratis to build out the #1 altcoin casino.

@ Pumpfun broke records for number of memecoins launched per second.

@ ton_blockchain gained some traction on the back of Telegram’s ubiquity in crypto.

@ monad ‘s L1 got the community before a disappointing TGE

Every cycle needs its adrenaline.

But zoom out, and you’ll see the maturity staring you in the face.

Two prediction markets in the top raises, Polymarket and Kalshi.

It’s been a bumper year for prediction markets, the one true narrative from Web3 to capture a mainstream consumer base.

Polymarket and Kalshi have been in a grudge match contest to rack up as many tier-1 partnerships.

Today, prediction markets are embedded in Google Search and large media outlets.

Stablecoins also cooked in 2025.

@ Bullish , co-founded by Brendan Blumer of EOS shame, pulled in $1b at IPO.

Remember @ Ripple ? They attracted Wall Street money to build stablecoins.

@ circle raised a cool billion through an IPO before going on an insane rally.

@ stripe ‘s L1 called @ tempo , proves that fintechs also want in on the action.

@ Figure was another 9-figure IPO and another stablecoin play.

Finally, @ krakenfx & @ Gemini both raised what could be the last round before their IPOs.

The 4 ‘degen’ projects raised ~$3.27B in total.

Prediction markets brought in $3bn.

And the more mature side of Web3 brought in $3.4B in total.

Crypto isn’t choosing one identity anymore.

It’s splitting into three parallel tracks:

Speculation & culture

Markets for information and truth

Financial infrastructure for the real economy

PS I’ve got the full 6,723 rounds and I want to share it with

Disclaimer:

- This article is reprinted from [dudu_bitcoin]. All copyrights belong to the original author [dudu_bitcoin]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

The Impact of Token Unlocking on Prices

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

Gate Research: Web3 Industry Funding Report - November 2024